The Maricopa Arizona Certificate of Designation, Preferences and Rights of Series B Junior Cumulative Convertible Preference Stock is a legal document that outlines the specific rights and privileges associated with this particular class of stock in the Onyx Energy Company. This certificate serves as a guide for investors and shareholders, providing a detailed description of the terms and conditions governing the ownership of Series B Junior Cumulative Convertible Preference Stock. The Series B Junior Cumulative Convertible Preference Stock grants holders certain preferences and rights that differ from other classes of stock in the company. These preferences and rights are designed to offer various advantages to the shareholders and ensure their positions are protected. Some key features covered in the Maricopa Arizona Certificate of Designation, Preferences, and Rights of Series B Junior Cumulative Convertible Preference Stock include: 1. Dividend Priority: The holders of Series B Junior Cumulative Convertible Preference Stock are entitled to receive dividends before the holders of common stock. This preference ensures that they receive a consistent stream of income from the company's profits. 2. Cumulative Dividends: If the company fails to pay dividends in any given year, the accumulated unpaid dividends on the Series B Junior Cumulative Convertible Preference Stock will carry forward to the subsequent years. 3. Convertibility: This class of stock is convertible into a predetermined number of common shares at the option of the holder. The conversion ratio outlines the specific terms for the conversion process. 4. Junior Ranking: Series B Junior Cumulative Convertible Preference Stock ranks junior to other classes of preferred stock in the event of liquidation or bankruptcy. This means that holders of this stock have a lower priority in terms of receiving any remaining assets after the payment of debts and obligations to senior stockholders. 5. Anti-Dilution Provisions: The certificate of designation may include provisions to protect Series B Junior Cumulative Convertible Preference Stockholders from dilution in the value of their shares due to future stock issuance or other corporate events. It is important to note that these are general features commonly associated with Series B Junior Cumulative Convertible Preference Stock, and specific details may vary depending on the company and its individual certificate of designation. In addition to the Series B class, Onyx Energy Company may have other series of preferred stock with their own individual certificates of designation, preferences, and rights. These may be designated as Series A, C, D, or any other alphabetical identifier to differentiate between the various classes within the company's capital structure. Each series would have its own set of specific terms and conditions outlined in their respective certificates of designation.

Maricopa Arizona Certificate of designation, preferences and rights of Series B junior cumulative convertible preference stock of Oryx Energy Company

Description

How to fill out Maricopa Arizona Certificate Of Designation, Preferences And Rights Of Series B Junior Cumulative Convertible Preference Stock Of Oryx Energy Company?

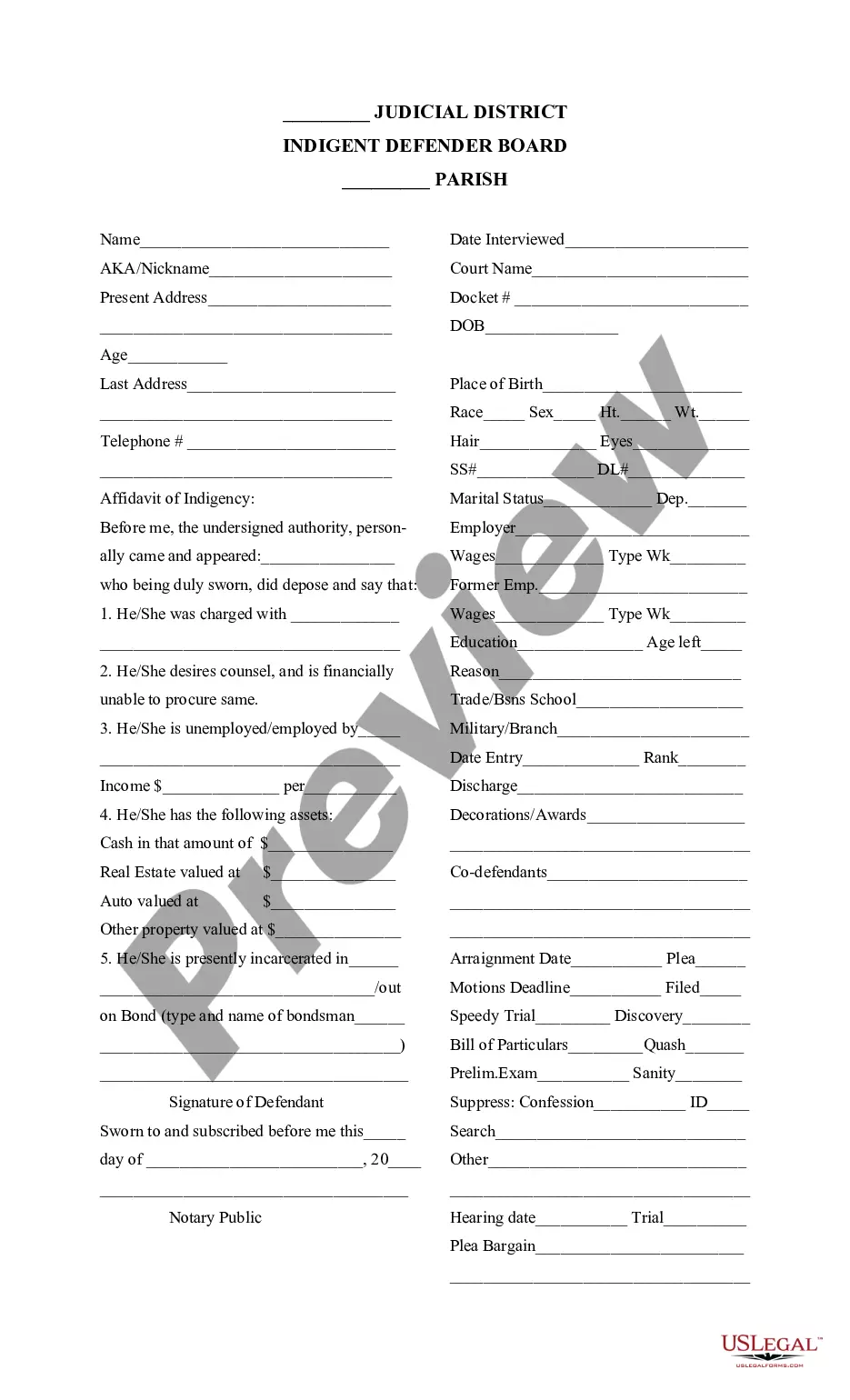

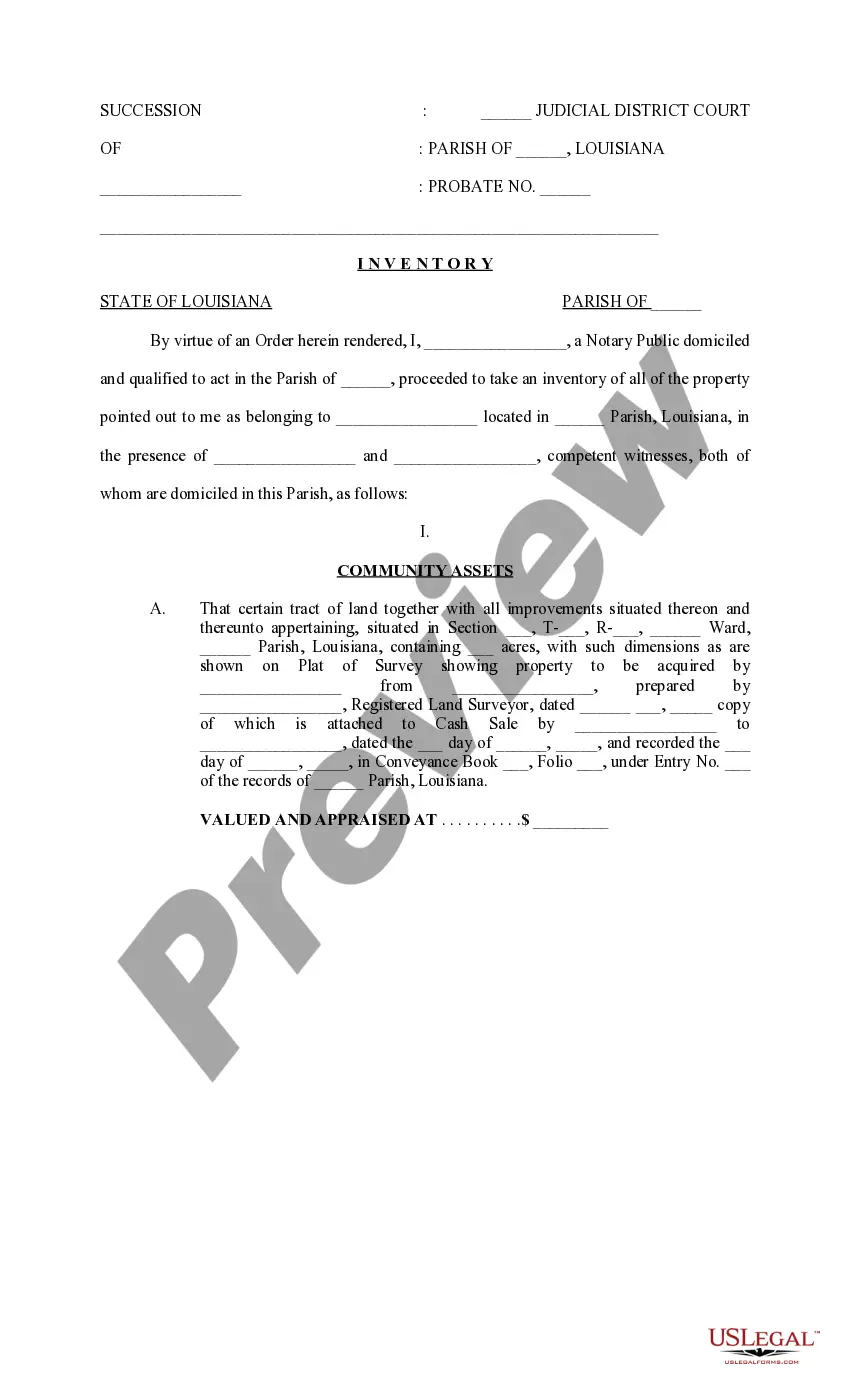

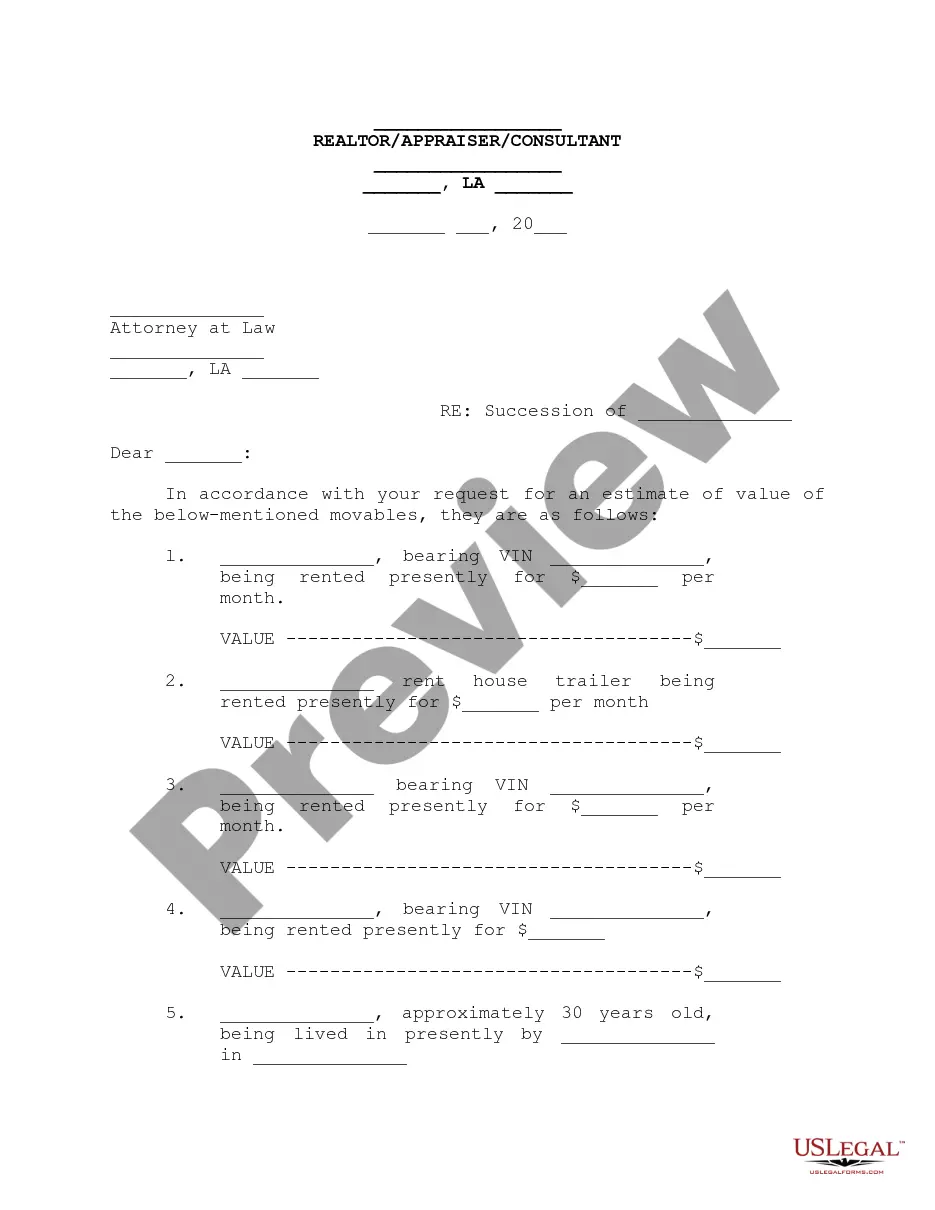

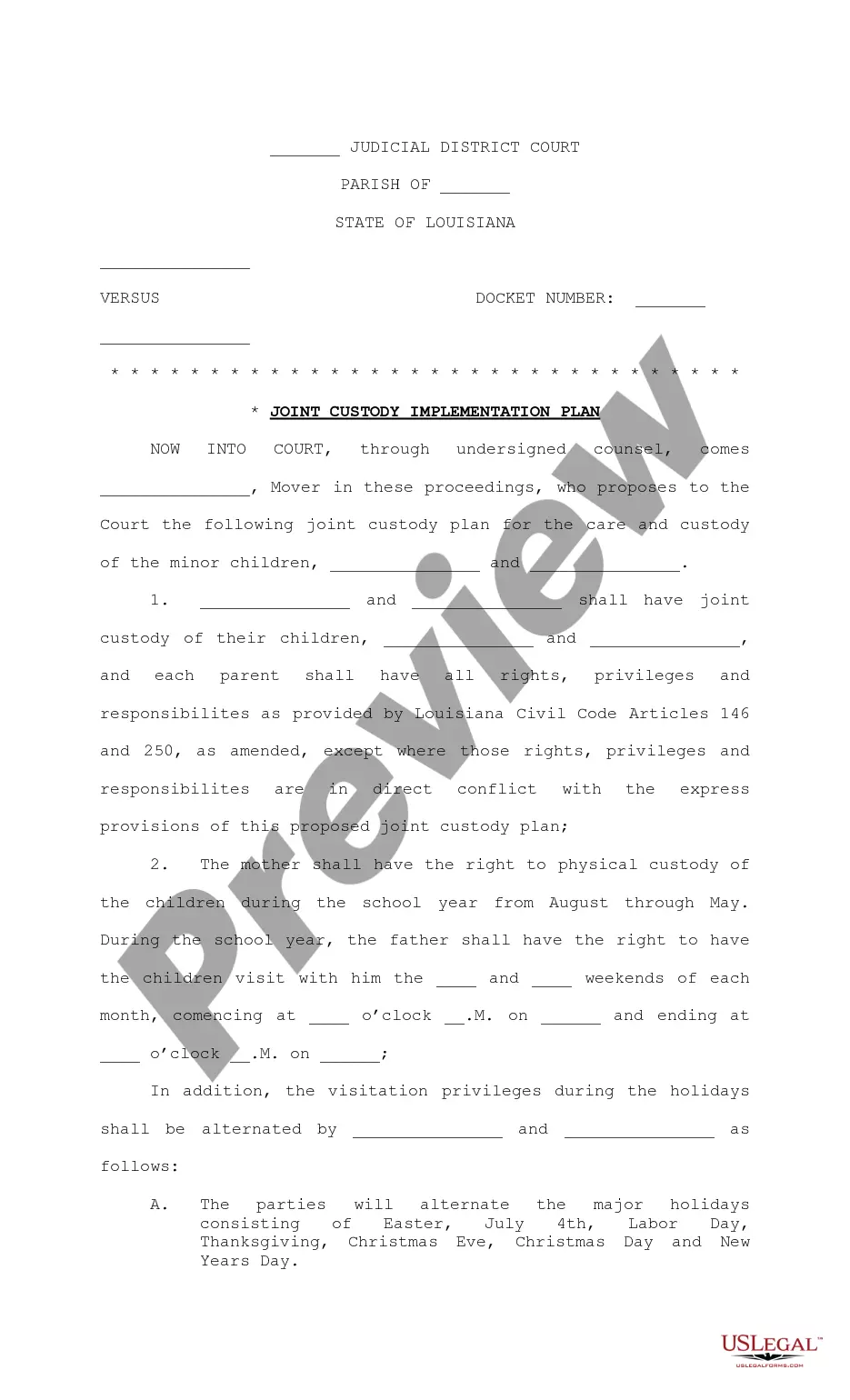

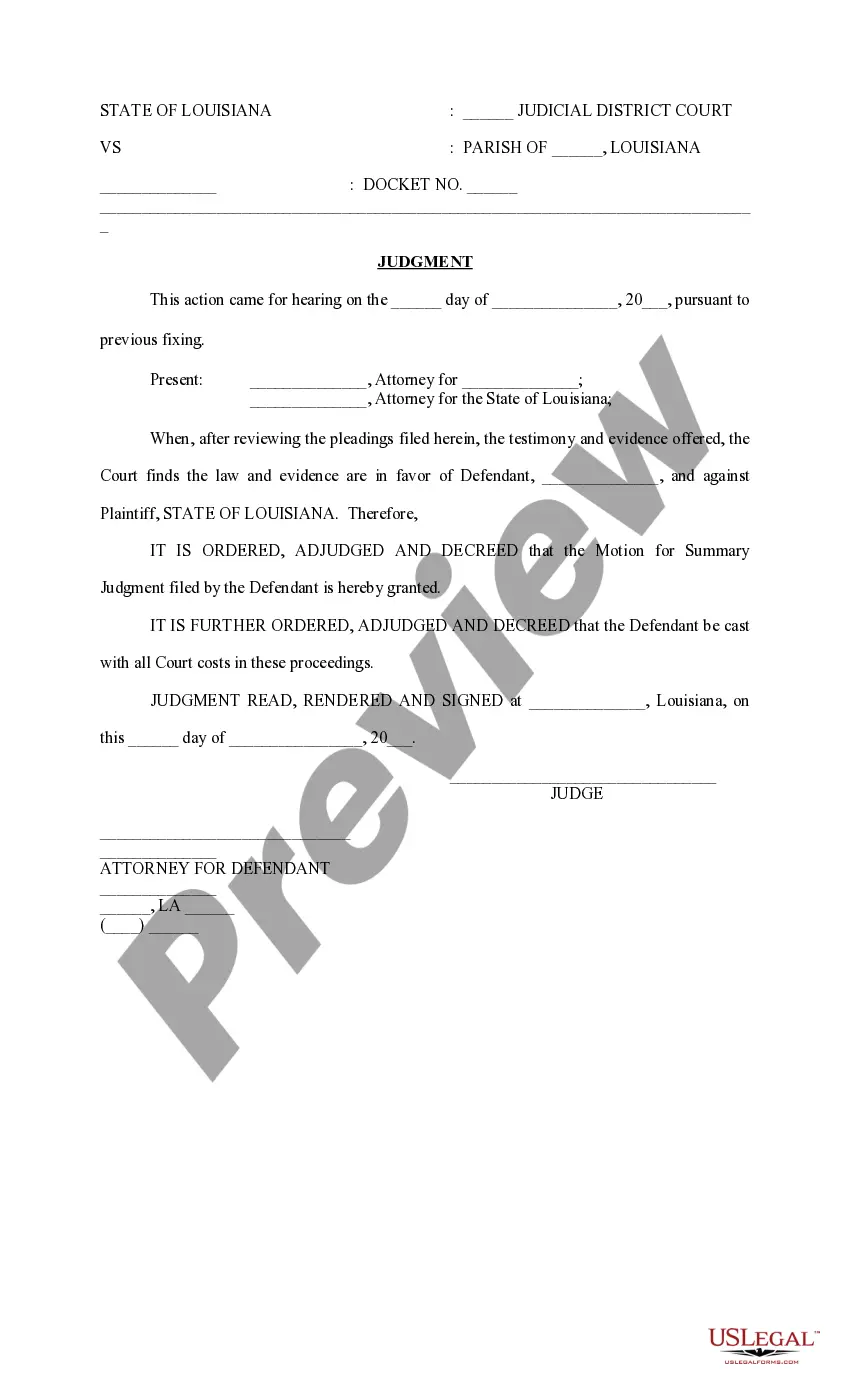

Are you looking to quickly draft a legally-binding Maricopa Certificate of designation, preferences and rights of Series B junior cumulative convertible preference stock of Oryx Energy Company or maybe any other document to handle your personal or corporate matters? You can select one of the two options: contact a professional to write a legal paper for you or create it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you get professionally written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms offers a rich collection of over 85,000 state-specific document templates, including Maricopa Certificate of designation, preferences and rights of Series B junior cumulative convertible preference stock of Oryx Energy Company and form packages. We provide documents for a myriad of life circumstances: from divorce papers to real estate documents. We've been on the market for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the needed document without extra troubles.

- First and foremost, carefully verify if the Maricopa Certificate of designation, preferences and rights of Series B junior cumulative convertible preference stock of Oryx Energy Company is adapted to your state's or county's regulations.

- In case the document comes with a desciption, make sure to check what it's suitable for.

- Start the search again if the document isn’t what you were looking for by using the search box in the header.

- Choose the plan that is best suited for your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Maricopa Certificate of designation, preferences and rights of Series B junior cumulative convertible preference stock of Oryx Energy Company template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. In addition, the paperwork we provide are updated by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!