Title: Exploring Alameda, California's Proposal to Amend Certificate of Incorporation to Authorize Preferred Stock Keywords: Alameda California, Proposal, Amend Certificate of Incorporation, Preferred Stock, Types Introduction: Alameda, California, is contemplating an important proposal to amend its certificate of incorporation. This proposed amendment aims to authorize the issuance of preferred stock within the organization. In this article, we will delve into the significance of this proposal, its potential impact, and the different types of preferred stock that may be considered in the amendment. 1. Understanding the Proposal: The proposal entails making changes to Alameda, California's certificate of incorporation to permit the introduction of a preferred stock option within the organization. This preferred stock offering will enable the company to raise capital through a new class of shares. 2. Significance of the Amendment: The authorization of preferred stock can provide several benefits to Alameda, California, and its shareholders. First, it offers flexibility in fundraising by providing an alternative to traditional equity and debt financing. Second, it allows for different classes of stock with unique rights and preferences, tailored to specific investor needs. Finally, it offers potential tax advantages for both the company and investors. 3. Potential Types of Preferred Stock: a. Cumulative Preferred Stock: Cumulative preferred stock guarantees that any missed or unpaid dividends will accumulate over time and must be paid before any future dividends can be distributed to common stockholders. b. Convertible Preferred Stock: Convertible preferred stock provides the option to convert these shares into common stock based on predetermined terms and conditions. This feature allows shareholders to benefit from potential future growth and higher returns. c. Participating Preferred Stock: With participating preferred stock, holders receive preferential treatment during dividend distributions. In addition, they also have the opportunity to participate alongside common stockholders in any remaining company profits after the dividends have been paid. d. Non-Cumulative Preferred Stock: Non-cumulative preferred stock does not accumulate unpaid dividends. If a dividend is missed, it will not be carried forward, and common stockholders will receive dividends before preferred stockholders. e. Redeemable Preferred Stock: This type of preferred stock includes a provision that allows the company to repurchase shares at a specific price after a predetermined period. The redemption price and conditions are outlined at the time of issuance. Conclusion: Alameda, California's proposal to amend its certificate of incorporation to authorize preferred stock represents an important step in expanding the organization's fundraising capabilities and enhancing shareholder flexibility. By introducing various types of preferred stock, the company can tailor their offering to meet specific investor requirements, ensuring growth opportunities and potential financial benefits for all stakeholders involved.

Alameda California Proposal to amend certificate of incorporation to authorize a preferred stock

Description

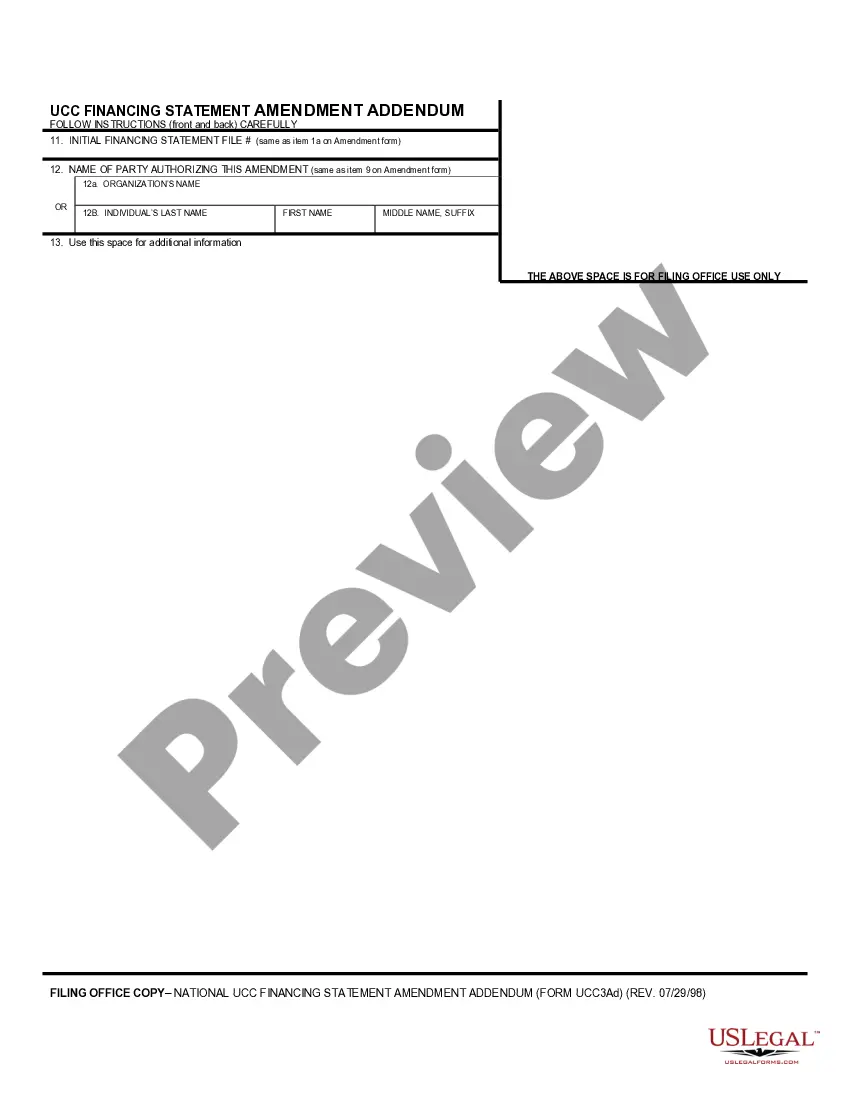

How to fill out Alameda California Proposal To Amend Certificate Of Incorporation To Authorize A Preferred Stock?

Whether you intend to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Alameda Proposal to amend certificate of incorporation to authorize a preferred stock is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to get the Alameda Proposal to amend certificate of incorporation to authorize a preferred stock. Adhere to the guide below:

- Make sure the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to get the file when you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Alameda Proposal to amend certificate of incorporation to authorize a preferred stock in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

The vote usually takes place at a formal meeting of the corporation (annual meeting or other) and shareholders must be advised of the proposed change before the meeting. If the shareholders approve the change to the articles of incorporation, the amended document must be attested to by the corporate secretary.

A certificate may not be amended against the will of the board of directors. Second, any amendments recommended by the board of directors must be approved by a vote of a majority of the outstanding shares of the corporation. A certificate may not be amended against the will of the majority of the stockholders.

SEC. The articles of incorporation of a nonstock corporation may be amended by the vote or written assent of majority of the trustees and at least two-thirds (2/3) of the members. The original and amended articles together shall contain all provisions required by law to be set out in the articles of incorporation.

How to Amend Articles of Incorporation Review the bylaws of the corporation.A board of directors meeting must be scheduled.Write the proposed changes.Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

To make amendments your New York Corporation, you must provide the completed Certificate of Amendment of the Certificate of Incorporation form to the new York Department of State by mail, fax or in person, along with the filing fee.

Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split).

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

A stock amendment is an economical way to increase the share structure. We can help. Simply call 800-345-2677, Ext. 6911 or email us. Please be advised we will need to know the total number of shares authorized along with the new par value.