Title: Dallas, Texas: A Comprehensive Overview of the Proposal to Amend Certificate of Incorporation to Authorize Preferred Stock Introduction: The city of Dallas, Texas is known for its vibrant business environment and strong economy. As part of its continuous growth, corporations often propose amendments to their certificate of incorporation. In this article, we will provide a detailed description of the proposal to amend the certificate of incorporation in Dallas, Texas, specifically focusing on authorizing a preferred stock. We will explore the various types of preferred stocks that can be authorized, outlining their key features and benefits. 1. Dallas, Texas: A Thriving Business Hub 2. Understanding Certificate of Incorporation Amendments 3. Proposal to Authorize Preferred Stock in the Certificate of Incorporation 4. Benefits of Preferred Stock Authorization 5. Types of Preferred Stocks: a. Cumulative Preferred Stock b. Non-Cumulative Preferred Stock c. Convertible Preferred Stock d. Participating Preferred Stock e. Redeemable Preferred Stock f. Adjustable Rate Preferred Stock (ARMS) g. Callable Preferred Stock Section 1: Dallas, Texas: A Thriving Business Hub In this section, we will provide an overview of the remarkable business ecosystem and economic conditions of Dallas, showcasing its attractiveness for corporations looking to amend their certificate of incorporation. Section 2: Understanding Certificate of Incorporation Amendments This section will elucidate the purpose and significance of certificate of incorporation amendments, highlighting their legal and regulatory implications. A concise explanation of the governing bodies and legislation involved will also be provided. Section 3: Proposal to Authorize Preferred Stock in the Certificate of Incorporation Delving into the heart of the matter, this section will outline the specific proposal to authorize preferred stock in the certificate of incorporation. It will elaborate on the motivations, requirements, and procedures associated with this amendment, focusing on the Dallas, Texas context. Section 4: Benefits of Preferred Stock Authorization Highlighting the advantages for both corporations and shareholders, this section will discuss the potential benefits of authorizing preferred stock. It will encompass aspects such as enhanced capital structure flexibility, increased liquidity, and potential tax advantages. Section 5: Types of Preferred Stocks Presenting an array of preferred stock types, this section will provide a comprehensive overview of their distinctive characteristics, benefits, and potential applications. Each type will be thoroughly explained, covering aspects such as dividend preferences, conversion rights, and redemption features. Conclusion: In conclusion, this article has provided a detailed description of the proposal to amend the certificate of incorporation in Dallas, Texas, specifically relating to the authorization of preferred stock. By exploring the various types of preferred stocks, we have shed light on the potential benefits and implications for corporations considering this amendment. As businesses continue to thrive in Dallas, such amendments contribute to the city's dynamic growth and economic prosperity.

Dallas Texas Proposal to amend certificate of incorporation to authorize a preferred stock

Description

How to fill out Dallas Texas Proposal To Amend Certificate Of Incorporation To Authorize A Preferred Stock?

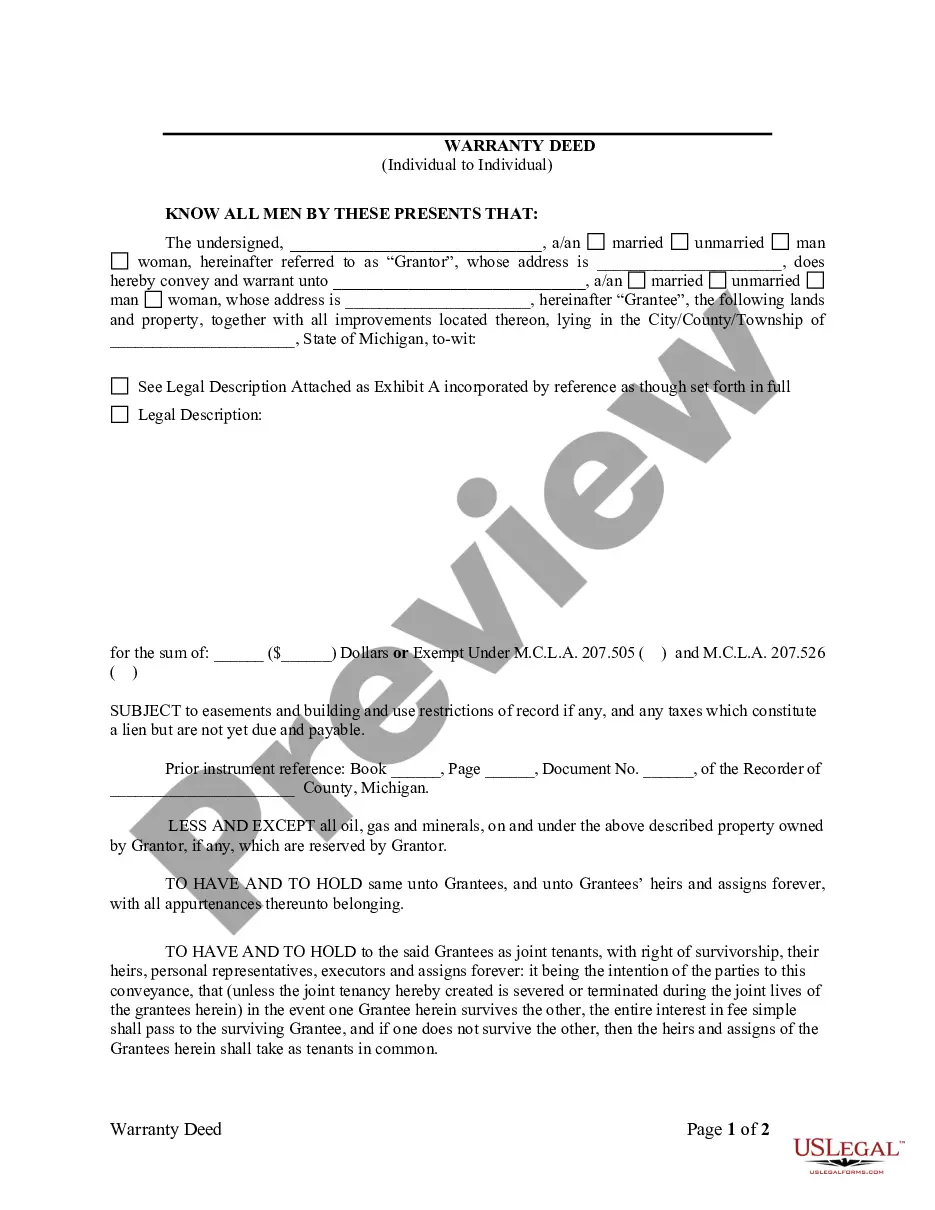

Draftwing forms, like Dallas Proposal to amend certificate of incorporation to authorize a preferred stock, to manage your legal matters is a tough and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents intended for various scenarios and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Dallas Proposal to amend certificate of incorporation to authorize a preferred stock template. Simply log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before getting Dallas Proposal to amend certificate of incorporation to authorize a preferred stock:

- Ensure that your template is compliant with your state/county since the rules for writing legal papers may differ from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Dallas Proposal to amend certificate of incorporation to authorize a preferred stock isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to begin utilizing our service and get the form.

- Everything looks good on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!