Nassau County, located in the state of New York, has proposed an amendment to its certificate of incorporation to authorize the issuance of preferred stock. This proposal aims to provide the county with additional flexibility in managing its financial affairs and pursuing growth opportunities. Preferred stock is a type of ownership interest in a corporation that typically comes with certain preferential rights and conditions. By authorizing the issuance of preferred stock, Nassau County would gain the ability to tap into alternative sources of funding, allowing for greater flexibility in addressing financial needs and investing in infrastructure projects. As for the different types of preferred stock, there can be several variations based on the specific terms and features offered to investors. Some common types include: 1. Cumulative preferred stock: This type of preferred stock entitles shareholders to receive unpaid dividends, which accumulate over time and must be paid before any dividends are distributed to common stockholders. 2. Convertible preferred stock: Convertible preferred stock grants shareholders the option to convert their ownership into a predetermined number of common shares at a specified conversion ratio. This gives investors the opportunity to benefit from potential appreciation in the company's stock value. 3. Participating preferred stock: Participating preferred stock allows holders to receive both their preferential dividends and additional dividends on an equal basis with common stockholders. This additional participation feature provides investors with the opportunity for increased returns. 4. Non-cumulative preferred stock: Unlike cumulative preferred stock, non-cumulative preferred stock does not accumulate unpaid dividends. If the company cannot pay dividends in a particular period, the shareholders of non-cumulative preferred stock do not have the right to claim those dividends in the future. It is important to note that the specific types of preferred stock that Nassau County proposes to authorize may differ from these examples. The proposal will outline the specific terms and conditions, including dividend rates, redemption rights, and voting rights, associated with the preferred stock to be issued by Nassau County. Overall, the proposed amendment to authorize preferred stock in Nassau County's certificate of incorporation is a strategic move that can expand the county's financial capabilities and enhance its ability to fund important initiatives and projects.

Nassau New York Proposal to amend certificate of incorporation to authorize a preferred stock

Description

How to fill out Nassau New York Proposal To Amend Certificate Of Incorporation To Authorize A Preferred Stock?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Nassau Proposal to amend certificate of incorporation to authorize a preferred stock.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Nassau Proposal to amend certificate of incorporation to authorize a preferred stock will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the Nassau Proposal to amend certificate of incorporation to authorize a preferred stock:

- Ensure you have opened the correct page with your localised form.

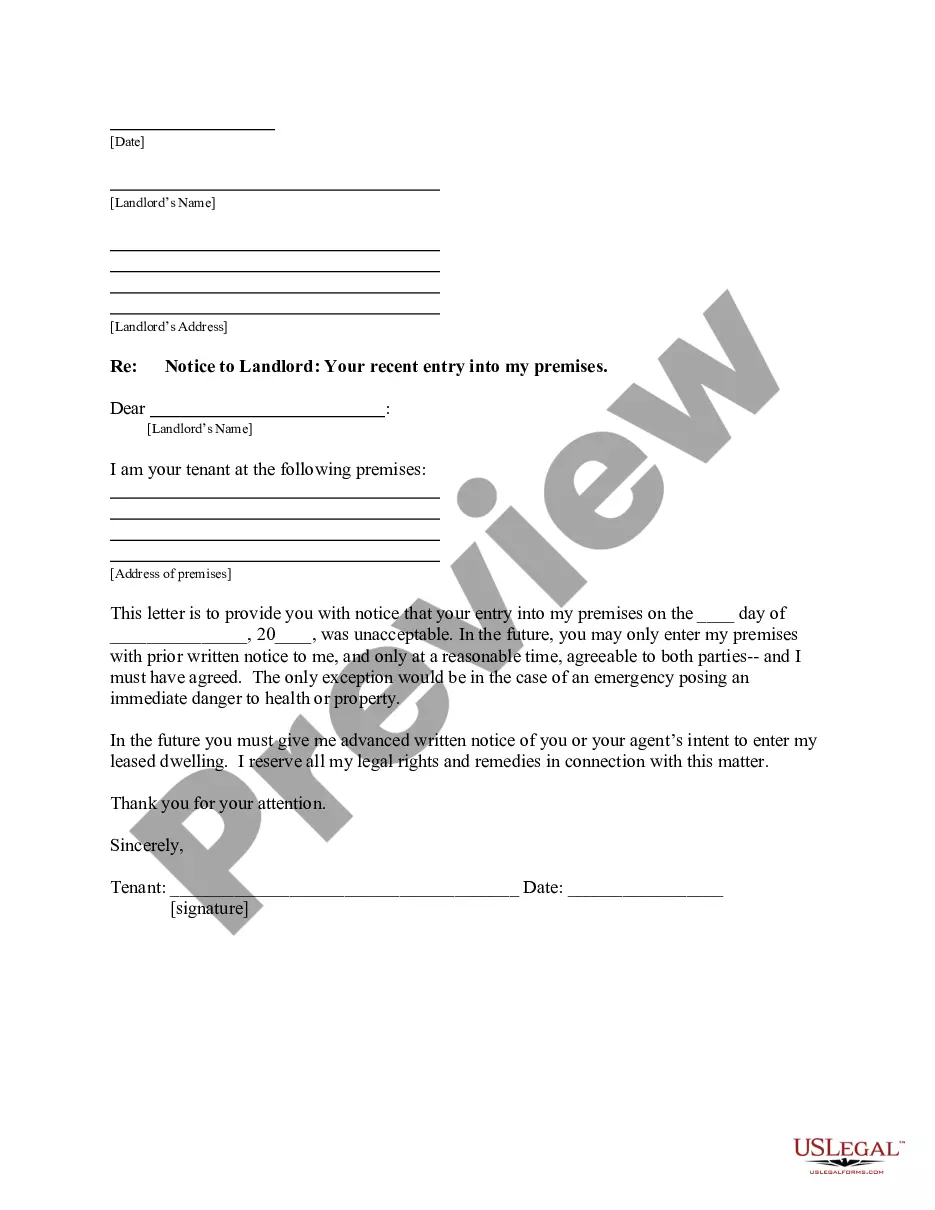

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your needs.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Nassau Proposal to amend certificate of incorporation to authorize a preferred stock on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!