The Contra Costa California Elimination of the Class A Preferred Stock refers to a significant financial decision taken by a company or organization operating in Contra Costa County, California, to terminate or remove the Class A Preferred Stock from their capital structure. This action is usually undertaken to simplify the company's equity structure, align it with industry standards, or enhance corporate governance. The Class A Preferred Stock is a type of equity security offered by companies to shareholders that grants them preferential rights over common stockholders in terms of dividends, liquidation preference, or voting power. By eliminating this class of stock, the company restructures its ownership hierarchy and streamlines the allocation of rights and privileges among its shareholders. There can be various reasons for a Contra Costa California company to eliminate the Class A Preferred Stock. One reason could be a desire to consolidate ownership and reduce complexity within the capital structure. By removing different classes of stock, such as Class A Preferred Stock, the company aims to simplify decision-making processes, enhance efficiency, and facilitate future financial transactions. Another motivation could be to align the capital structure with industry standards. Over time, market dynamics and industry practices change, and a company may find it necessary to eliminate certain classes of stock to remain competitive and attract investors. This alignment ensures that the company's capital structure remains consistent with prevailing market norms, allowing it to access capital more easily and potentially improve its valuation. Enhancing corporate governance is another objective that may drive the elimination of Class A Preferred Stock in Contra Costa California or elsewhere. By reducing the number of stock classes, a company can potentially improve transparency, accountability, and reporting requirements. This can lead to better shareholder relations and a more favorable investment climate for potential stakeholders. While the concept of eliminating Class A Preferred Stock is generally applicable, it's important to note that there may be variations or specific types of this decision in different contexts. Some potential variations may include eliminating multiple classes of preferred stock, such as Class B or Class C, or targeting a specific class based on certain criteria, such as redeeming a convertible preferred stock or retiring non-voting preferred shares. Overall, the elimination of Class A Preferred Stock by a Contra Costa California company represents a strategic decision to optimize the company's capital structure, improve corporate governance, and align itself with industry standards. This action can have significant implications for shareholders, potential investors, and the overall financial well-being of the organization.

Contra Costa California Elimination of the Class A Preferred Stock

Description

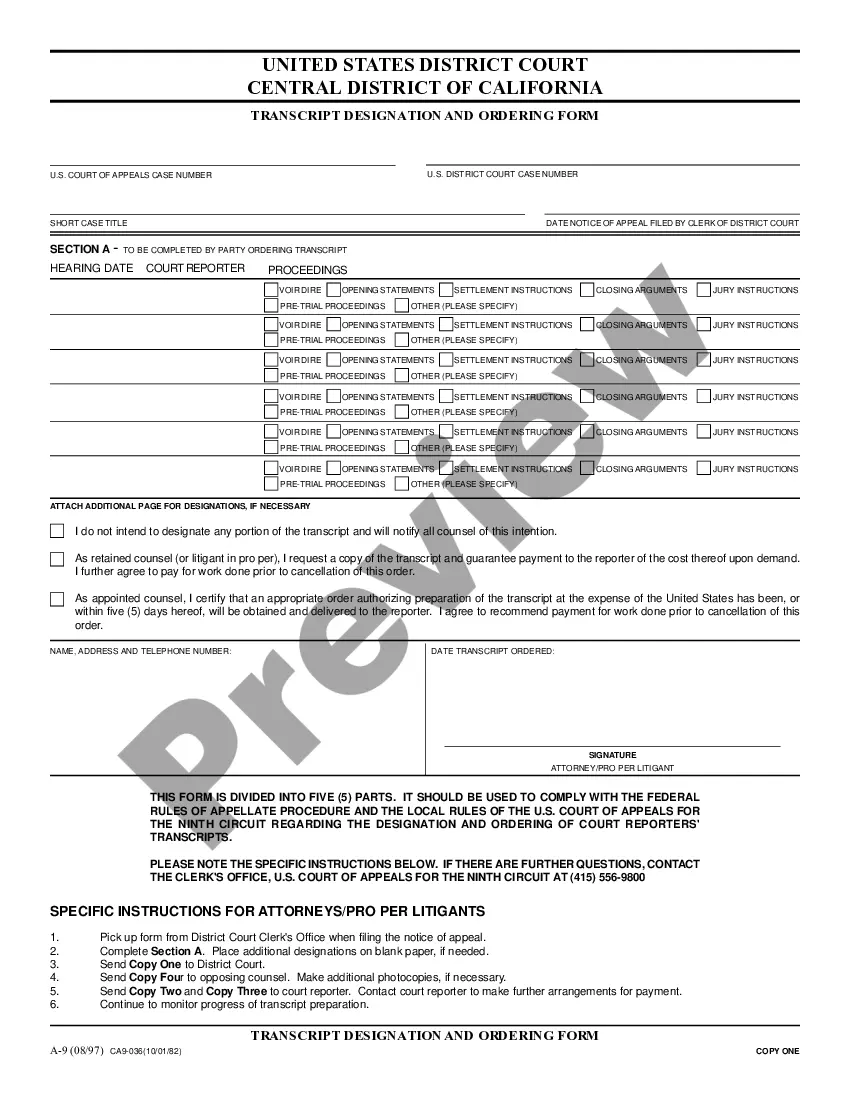

How to fill out Contra Costa California Elimination Of The Class A Preferred Stock?

Draftwing forms, like Contra Costa Elimination of the Class A Preferred Stock, to manage your legal affairs is a tough and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents crafted for different scenarios and life circumstances. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Contra Costa Elimination of the Class A Preferred Stock form. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before getting Contra Costa Elimination of the Class A Preferred Stock:

- Ensure that your template is compliant with your state/county since the rules for creating legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or reading a quick intro. If the Contra Costa Elimination of the Class A Preferred Stock isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to start using our service and download the document.

- Everything looks good on your side? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is all set. You can go ahead and download it.

It’s easy to find and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!