Nassau, New York Elimination of the Class A Preferred Stock The Nassau, New York Elimination of the Class A Preferred Stock refers to the process of removing or cancelling the Class A Preferred Stock of a company registered in Nassau, New York. Class A Preferred Stock is a type of ownership interest in a corporation that typically offers certain advantages to shareholders, such as priority in dividend payments and liquidation preferences. In some cases, a company may decide to eliminate the Class A Preferred Stock for various reasons, such as restructuring its capital structure, reducing debt, or simplifying its shareholder equity. This process requires proper legal and regulatory procedures to ensure fairness to both the company and the Class A Preferred Stockholders. The elimination of the Class A Preferred Stock may involve different types or methods, depending on the specific circumstances and goals of the company. Some possible types or methods are: 1. Full Redemption: This involves the company redeeming all outstanding shares of Class A Preferred Stock from the shareholders at a predetermined price. This provides holders with a cash payout, effectively eliminating their ownership interest. 2. Conversion: Instead of redeeming the Class A Preferred Stock, the company may offer the shareholders the chance to convert their shares into another class of stock, such as common stock. The conversion ratio and terms would be outlined in the company's bylaws or preferred stock agreement. 3. Exchange Offer: In this method, the company may initiate an exchange offer, providing Class A Preferred Stockholders the opportunity to exchange their shares for other types of securities, such as bonds, debentures, or new preferred stock with different terms. 4. Liquidation and Dissolution: If a company decides to undergo liquidation and dissolution, the Class A Preferred Stockholders may receive a preferential treatment in the distribution of assets and funds, ensuring their investment is given priority over other shareholders. 5. Amendment of Articles of Incorporation: The company could propose amending its articles of incorporation to eliminate the Class A Preferred Stock entirely, thus changing the company's authorized capital structure. Shareholder approval and legal documentation would be necessary for this method. Note that the above types or methods are not exhaustive and can vary depending on the specific legal requirements and terms outlined in the company's organizational documents and state regulations. In conclusion, the elimination of the Class A Preferred Stock in Nassau, New York involves the cancellation or removal of this particular class of ownership interest in a company. Different methods, such as full redemption, conversion, exchange offers, liquidation, or amendments to the articles of incorporation, may be utilized depending on the company's goals and circumstances.

Nassau New York Elimination of the Class A Preferred Stock

Description

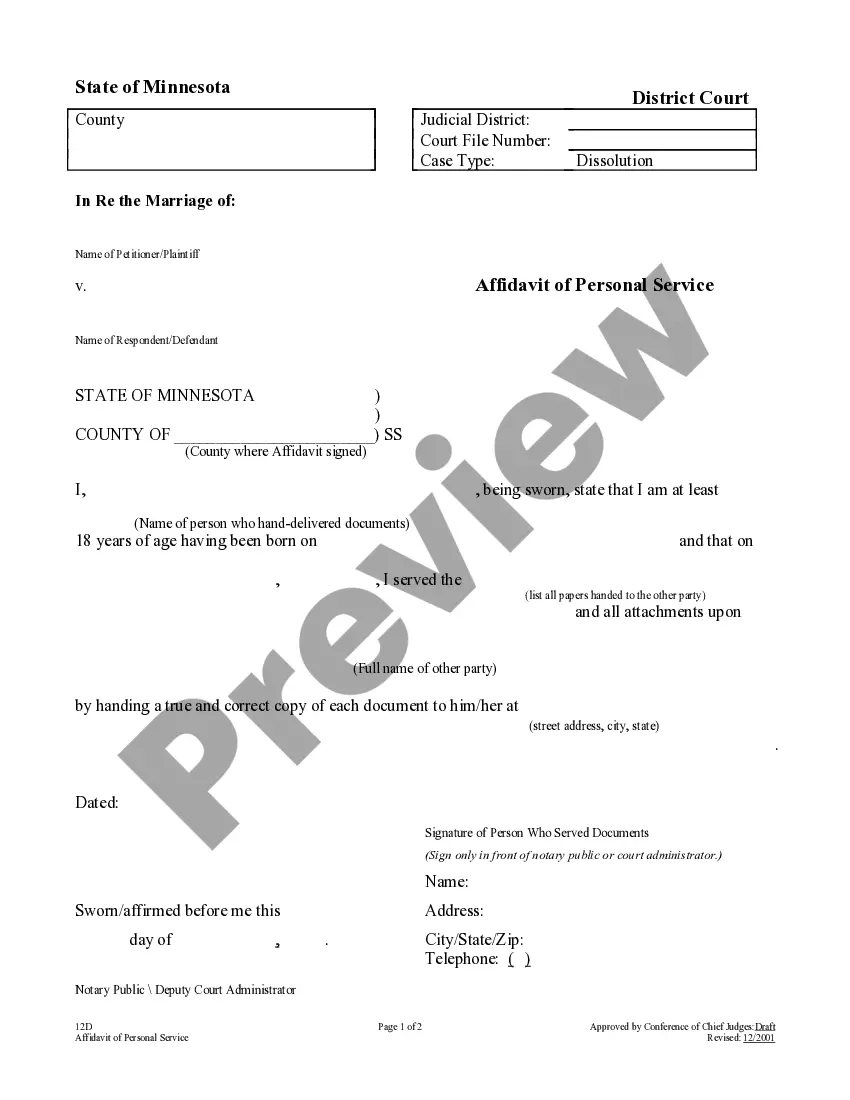

How to fill out Nassau New York Elimination Of The Class A Preferred Stock?

Whether you plan to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business case. All files are collected by state and area of use, so opting for a copy like Nassau Elimination of the Class A Preferred Stock is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several more steps to obtain the Nassau Elimination of the Class A Preferred Stock. Adhere to the guide below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Elimination of the Class A Preferred Stock in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!