The elimination of Phoenix Arizona Class A Preferred Stock refers to the process of removing or canceling a specific type of stock issued by a company located in Phoenix, Arizona. This preferred stock class, denoted as Class A, typically holds certain rights and privileges that differentiate it from common stock. Companies may choose to eliminate the Class A Preferred Stock for various reasons, including simplification of the capital structure, cost reduction, or to increase flexibility in decision-making. The elimination process involves a series of corporate actions, such as holding a shareholder vote, filing necessary paperwork with relevant regulatory bodies, and ensuring compliance with applicable laws and regulations. There might be different types of elimination scenarios associated with the Phoenix Arizona Class A Preferred Stock, including: 1. Voluntary elimination: This occurs when a company proactively decides to eliminate the Class A Preferred Stock to consolidate its capital structure or align its shareholder base. 2. Conversion to common stock: In certain cases, the Class A Preferred Stock might be converted into common stock. This can happen if the company wants to simplify its stock structure or provide equal equity rights to all shareholders. 3. Mergers and acquisitions: When a company goes through a merger or acquisition, the acquiring company might decide to eliminate the Class A Preferred Stock of the target company to streamline their capital structure and align it with their existing preferred stock class, if any. 4. Redemption or buyback: In some instances, a company might offer to redeem or repurchase the Class A Preferred Stock from its shareholders. This can be done if the company wants to provide an exit opportunity to the preferred stockholders or remove a hindrance to potential financing or strategic decisions. It's important for any company considering the elimination of Class A Preferred Stock in Phoenix, Arizona, to consult with legal and financial professionals to ensure compliance with applicable laws, bylaws, and shareholder agreements. Each situation may have unique considerations, and the process can vary depending on the company's specific circumstances and objectives.

Phoenix Arizona Elimination of the Class A Preferred Stock

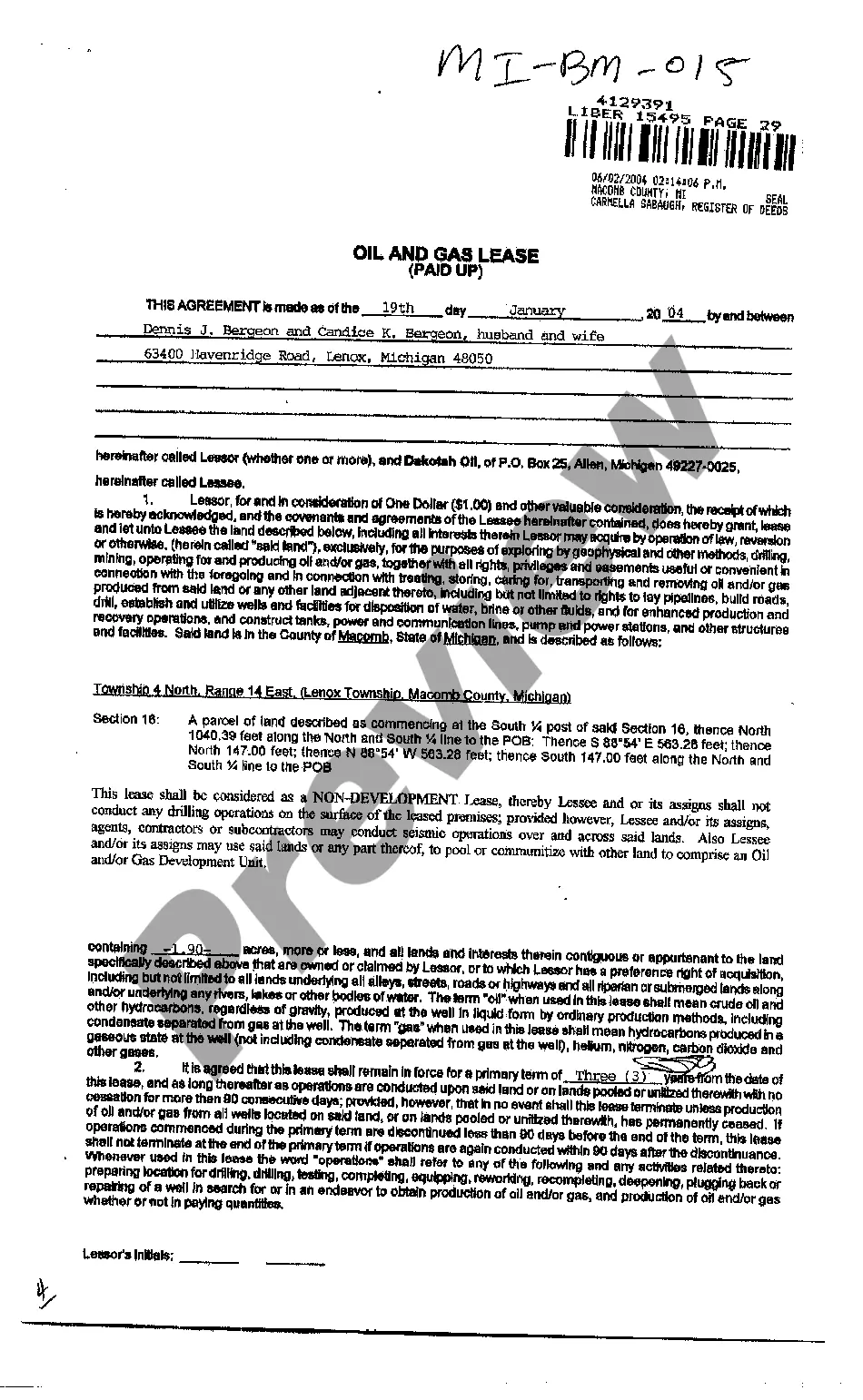

Description

How to fill out Phoenix Arizona Elimination Of The Class A Preferred Stock?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare official documentation that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any individual or business purpose utilized in your region, including the Phoenix Elimination of the Class A Preferred Stock.

Locating samples on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Phoenix Elimination of the Class A Preferred Stock will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to obtain the Phoenix Elimination of the Class A Preferred Stock:

- Ensure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Phoenix Elimination of the Class A Preferred Stock on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!