The San Diego California Elimination of the Class A Preferred Stock refers to a specific corporate action taken by a company operating in San Diego, California, to remove or eliminate its Class A Preferred Stock from its capital structure. This action may occur for various reasons and can have significant implications for both the company and its shareholders. Class A Preferred Stock is a type of ownership stake in a company that typically carries preferential rights and privileges compared to common stock. It offers shareholders priority in terms of dividend payments and liquidation proceeds, while often lacking voting rights. However, there might be different variations or subclasses of Class A Preferred Stock, depending on the specific terms and characteristics attached to the shares. When a company decides to eliminate its Class A Preferred Stock, it usually means that the company wants to streamline its capital structure, simplify its ownership classes, or potentially reduce its debt burden. By eliminating this specific class of stock, the company aims to consolidate its ownership structure and provide greater clarity for investors and potential stakeholders. This action may involve multiple steps, including obtaining board or shareholder approval, conducting legal and regulatory filings, and executing the necessary corporate documents. Once the elimination is complete, the company's capital structure will no longer include Class A Preferred Stock, which might lead to changes in the company's financial reporting and governance structure. It is important to note that the elimination of Class A Preferred Stock may not always be applicable to every company in San Diego, California. Each company's decision to eliminate this type of stock will depend on factors such as its financial goals, existing shareholder agreements, and the overall state of the business. In summary, the San Diego California Elimination of the Class A Preferred Stock refers to the process by which a company in San Diego, California, removes its Class A Preferred Stock from its capital structure. This action aims to simplify ownership classes, streamline operations, and potentially restructure the company's financial position. However, it is crucial to understand the specific circumstances and implications associated with each company's decision to eliminate its Class A Preferred Stock, as they can vary case by case.

San Diego California Elimination of the Class A Preferred Stock

Description

How to fill out San Diego California Elimination Of The Class A Preferred Stock?

Whether you plan to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like San Diego Elimination of the Class A Preferred Stock is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to get the San Diego Elimination of the Class A Preferred Stock. Adhere to the instructions below:

- Make sure the sample meets your individual needs and state law requirements.

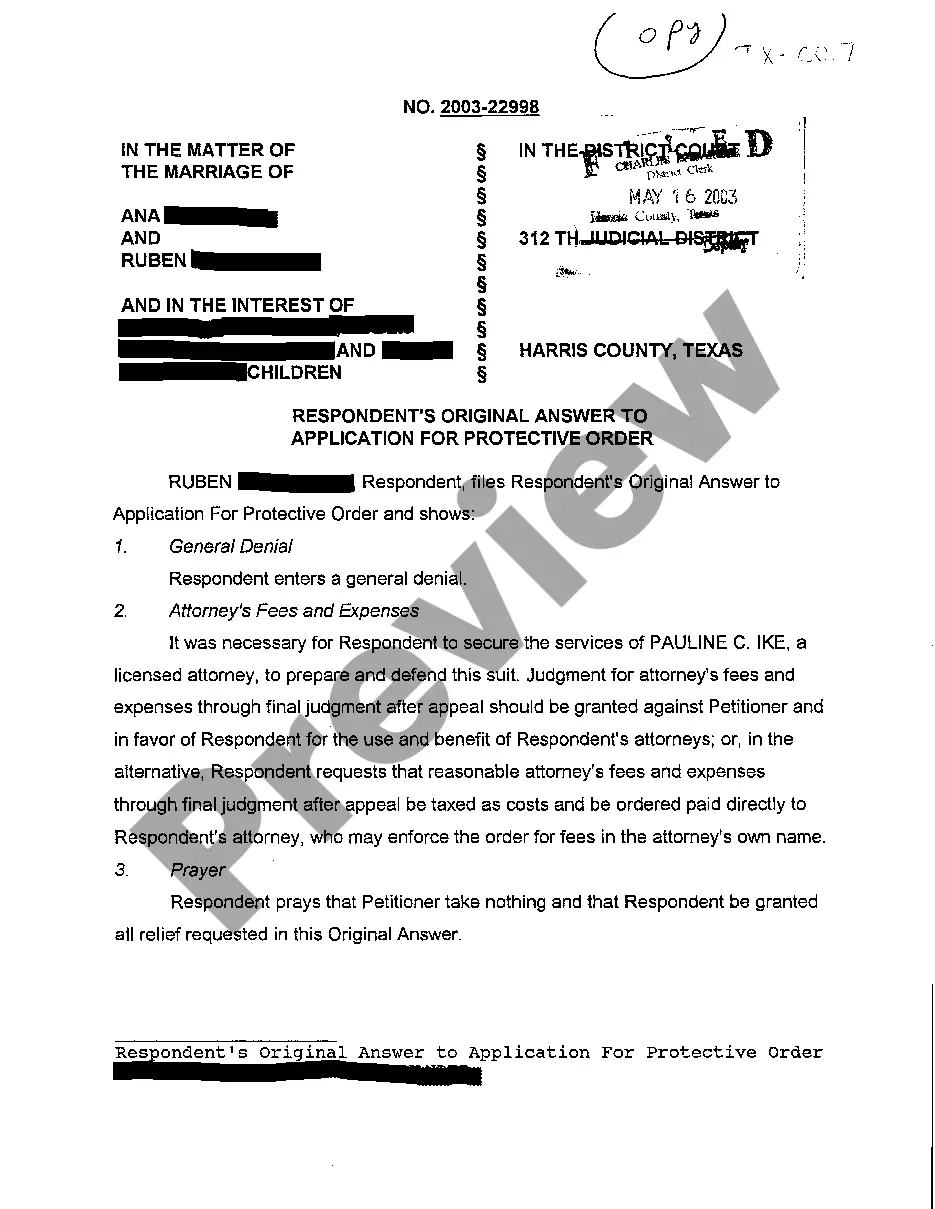

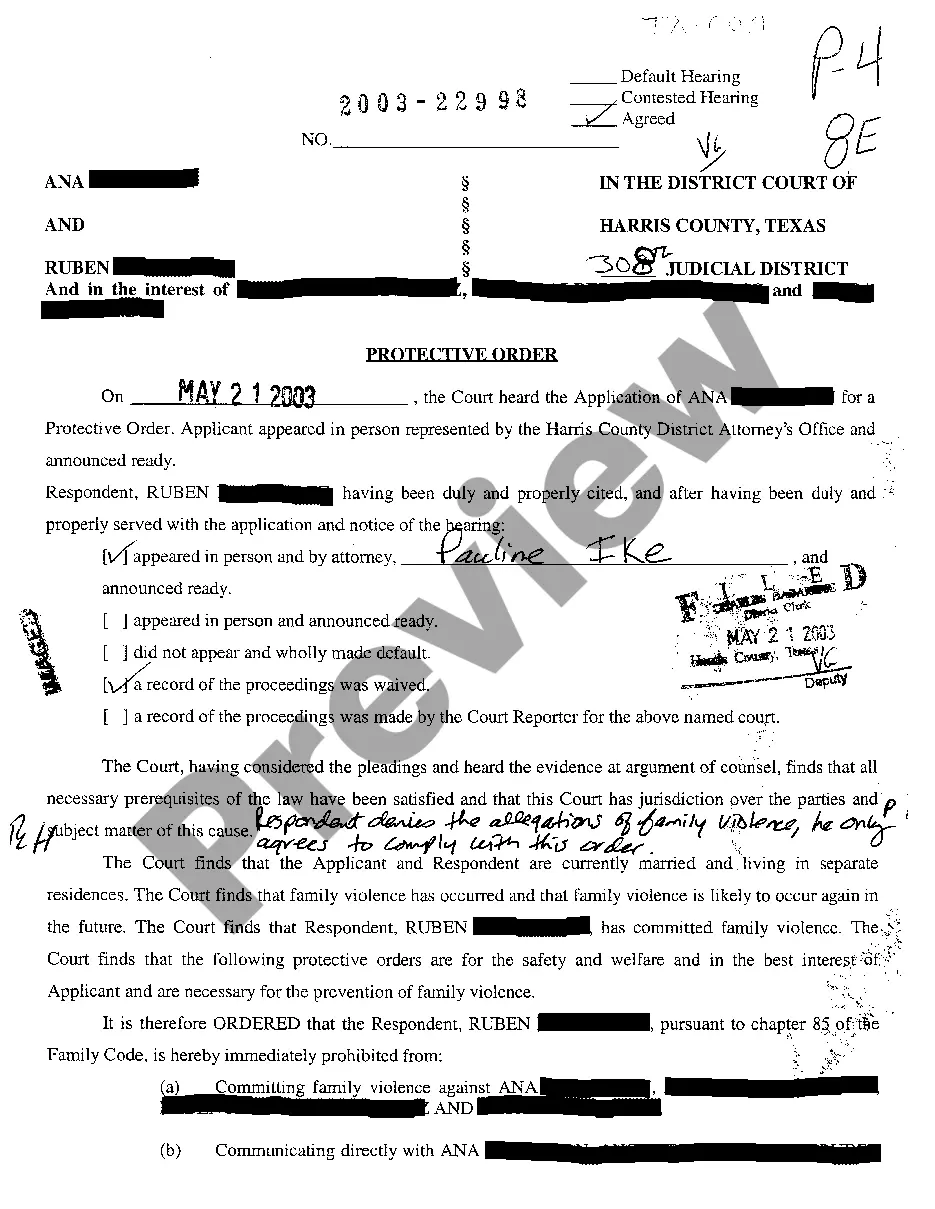

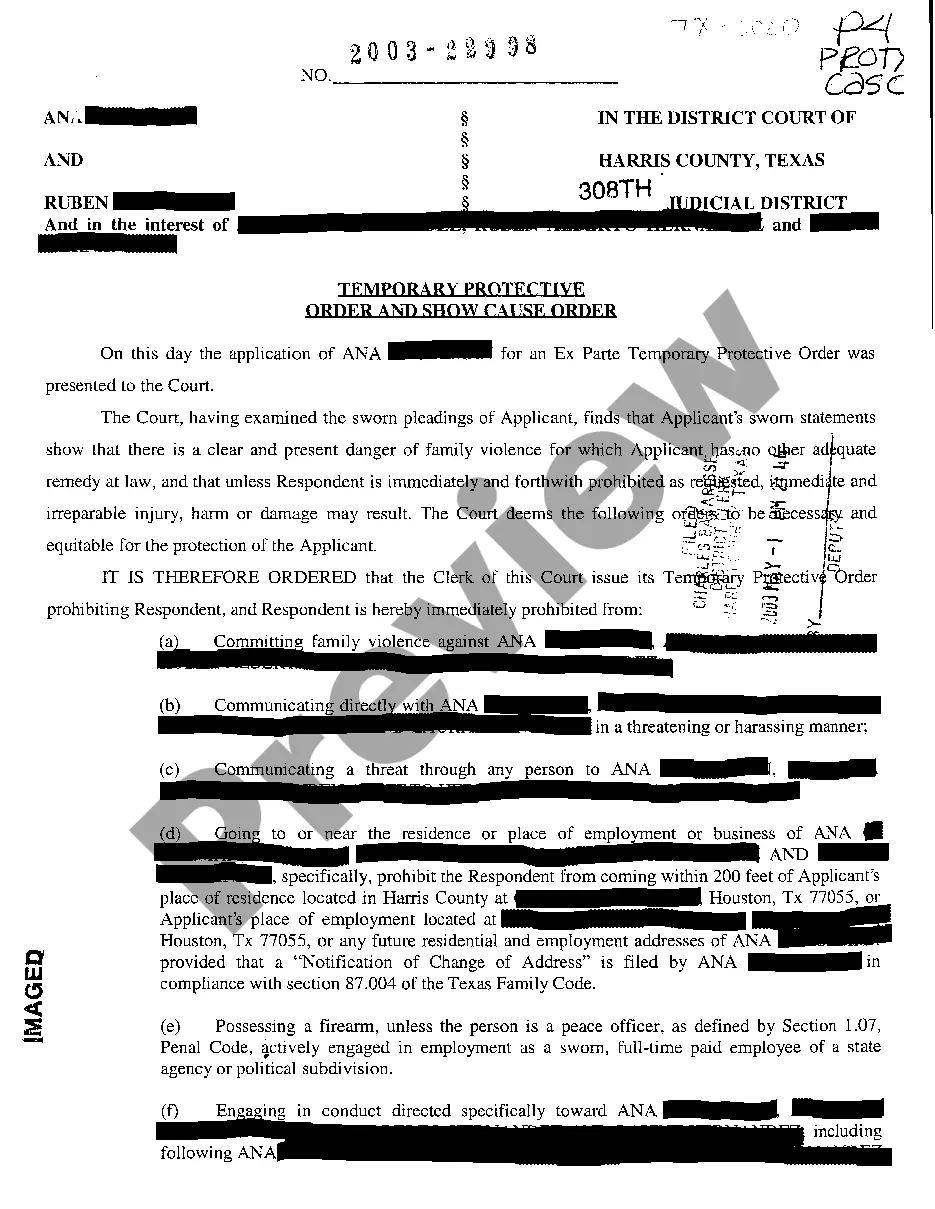

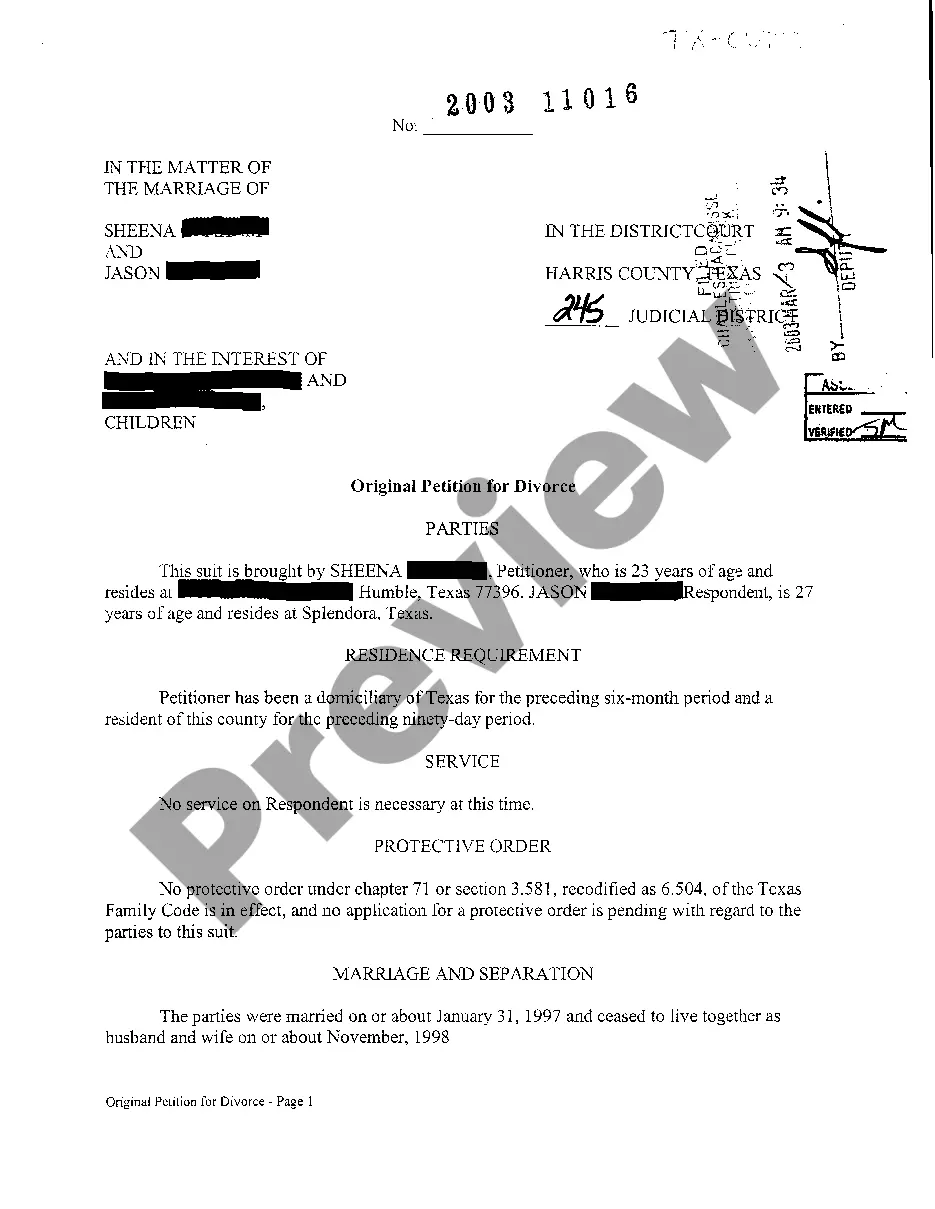

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Elimination of the Class A Preferred Stock in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!