Tarrant Texas Elimination of the Class A Preferred Stock: An Overview The Tarrant County in Texas has recently witnessed a significant development in relation to financial securities, specifically regarding the elimination of the Class A Preferred Stock. This decision holds substantial implications for shareholders, company governance, and financial markets. In this article, we will delve into the various aspects of the Tarrant Texas Elimination of the Class A Preferred Stock, outlining the reasons behind this move, its potential consequences, and identifying any nuanced types that may exist. Preferred stocks are a type of financial instrument often issued by companies, providing shareholders with certain advantages over common stockholders. These benefits typically include priority dividend payments, greater claim on company assets during liquidation, and sometimes even conversion into common shares. However, in some cases, companies may decide to eliminate specific classes of preferred stock such as Class A Preferred Stock. Tarrant County, Texas, has recently experienced such changes that have drawn attention from investors and financial experts alike. The decision to eliminate Class A Preferred Stock in Tarrant Texas could stem from various factors. It might reflect a company's desire to streamline their capital structure, simplifying the financial instruments and classes of shares offered. This consolidation can help reduce administrative complexity and costs associated with managing multiple classes of preferred shares. Additionally, the elimination of Class A Preferred Stock could be prompted by a strategic realignment to meet changing market dynamics, investor preferences, or corporate objectives. Such a decision might result from a company's need to raise additional capital without complicating its existing shareholder structure or negatively impacting current shareholders. However, it's essential to note that specific types of Class A Preferred Stock elimination might exist within Tarrant Texas, depending on the unique circumstances of each company. These differences often arise from variations in terms and conditions, redemption provisions, conversion rights, and overall shareholder agreements associated with specific classes of preferred stock. For instance, a company might eliminate Class A-1 Preferred Stock, which offers higher dividend rates but lacks conversion rights, while retaining Class A-2 Preferred Stock, which provides investors with greater flexibility to convert preferred shares into common shares. These nuanced types of Class A Preferred Stock eliminations introduce complexities that must be thoroughly analyzed by investors and legal professionals to understand the impact on shareholder rights, dividends, and liquidity. The elimination of Class A Preferred Stock in Tarrant Texas holds implications for both the company and its stakeholders. Shareholders who hold Class A Preferred Stock may experience changes to their investment, including potential loss of priority dividend payments or different conversion options. On the other hand, the company can benefit from a simplified capital structure, reduced administrative burdens, and potential cost savings. In summary, the Tarrant Texas Elimination of the Class A Preferred Stock marks a noteworthy event in the corporate landscape of the region. By eliminating specific classes of preferred stock, companies aim to optimize their capital structure, align with evolving market conditions, and potentially improve shareholder value. Investors and stakeholders must carefully examine the precise terms of each preferred stock class affected by this elimination to understand the ramifications and adapt their investment strategies accordingly.

Tarrant Texas Elimination of the Class A Preferred Stock

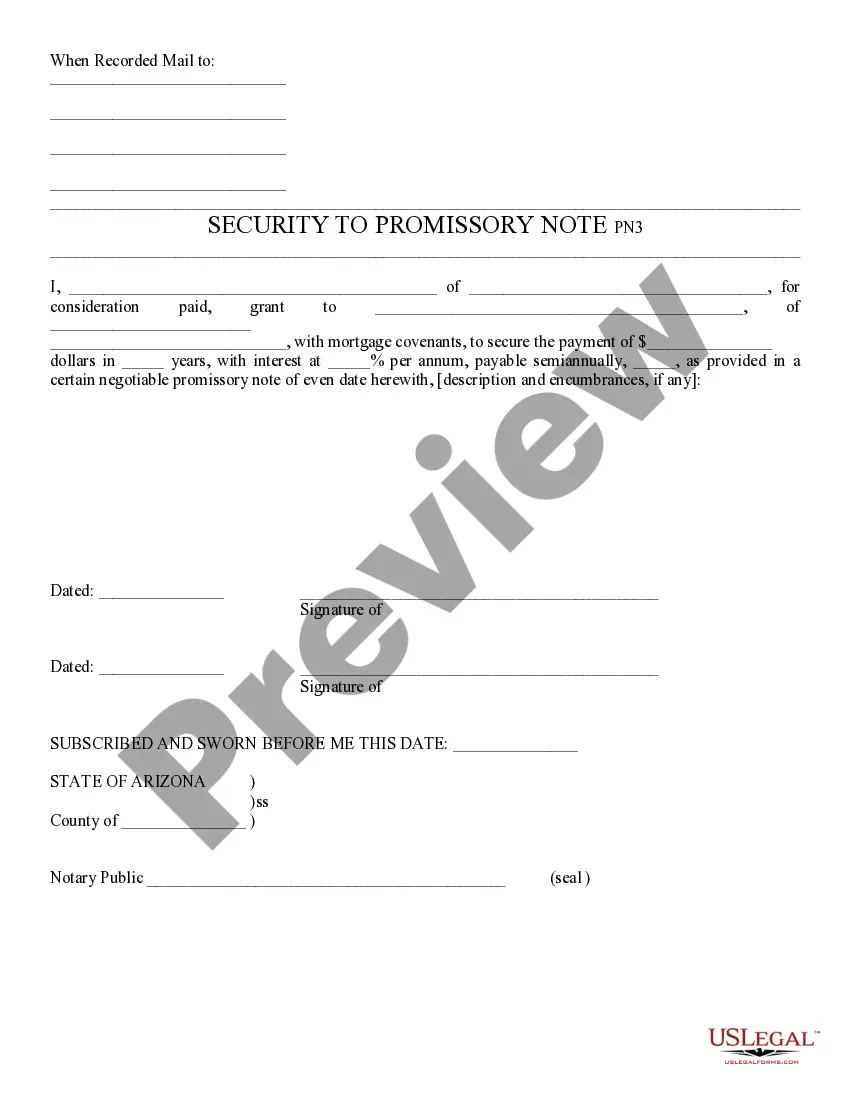

Description

How to fill out Tarrant Texas Elimination Of The Class A Preferred Stock?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business objective utilized in your region, including the Tarrant Elimination of the Class A Preferred Stock.

Locating forms on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Tarrant Elimination of the Class A Preferred Stock will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to get the Tarrant Elimination of the Class A Preferred Stock:

- Make sure you have opened the correct page with your local form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Tarrant Elimination of the Class A Preferred Stock on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!