The proposed amendment to the certificate of incorporation in Lima, Arizona aims to authorize up to 10,000,000 shares of preferred stock with certain amendments. This amendment grants the company flexibility in terms of equity financing, providing additional opportunities for investment, expansion, and growth. Preferred stock refers to a class of shares that possess certain benefits, rights, or privileges compared to common stockholders. These preferred shares often receive a fixed dividend payment before common shareholders receive any dividends. Additionally, in the event of liquidation or bankruptcy, preferred stockholders are typically given priority over common stockholders in receiving their investment back. There are various types of preferred stock that can be authorized with this proposed amendment. These may include: 1. Cumulative Preferred Stock: This type of preferred stock accumulates unpaid dividends and must be paid out to the shareholders before dividends can be paid to common stockholders. If the company doesn't pay dividends in a particular year, these unpaid dividends will continue to accumulate until they are settled. 2. Convertible Preferred Stock: Convertible preferred stock provides the option for shareholders to convert their preferred stock into a predetermined number of common shares at a specified conversion ratio. This allows preferred stockholders to benefit from potential capital appreciation of the common stock. 3. Participating Preferred Stock: This type of preferred stock gives shareholders the right to receive extra dividends in addition to the fixed dividend payment if the company exceeds a certain profitability threshold. Participating preferred stockholders share the excess profits with common stockholders. 4. Non-Cumulative Preferred Stock: Unlike cumulative preferred stock, non-cumulative preferred stock does not accumulate unpaid dividends. If the company fails to pay dividends in a particular year, the shareholders have no claim to dividends for that period. 5. Redeemable Preferred Stock: Redeemable preferred stock can be repurchased by the company at a predetermined price after a specified date. This provides the company with the flexibility to retire or repurchase the preferred stock in the future. By amending the certificate of incorporation, Lima, Arizona aims to enhance its financial flexibility, attract potential investors, and empower the company to access additional capital through the issuance of preferred stock. These amendments ensure that the company can adapt to changing financial requirements and pave the way for future growth and success.

Pima Arizona Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment

Description

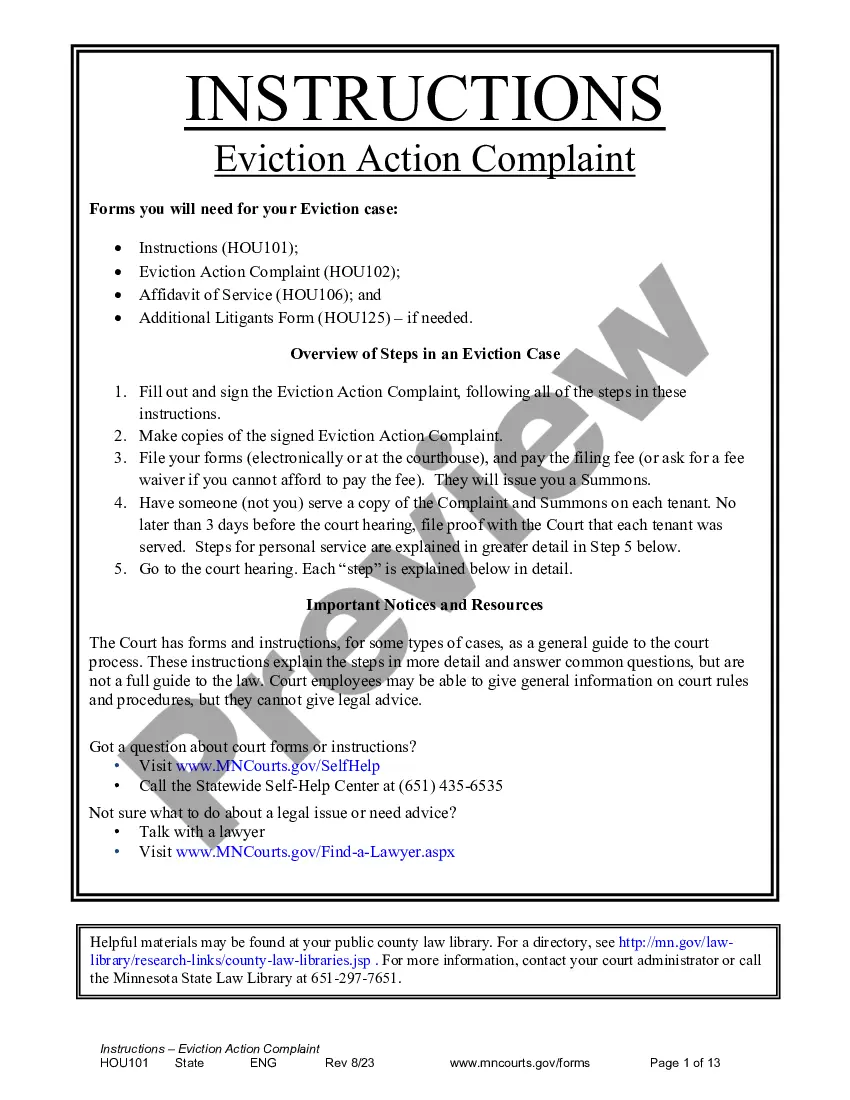

How to fill out Pima Arizona Proposed Amendment To The Certificate Of Incorporation To Authorize Up To 10,000,000 Shares Of Preferred Stock With Amendment?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Pima Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in various types varying from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less frustrating. You can also find information materials and tutorials on the website to make any tasks related to paperwork execution simple.

Here's how you can purchase and download Pima Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment.

- Go over the document's preview and description (if provided) to get a basic information on what you’ll get after getting the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the validity of some records.

- Check the related forms or start the search over to locate the appropriate document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment method, and buy Pima Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Pima Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment, log in to your account, and download it. Of course, our platform can’t replace a lawyer entirely. If you have to deal with an exceptionally complicated case, we recommend getting an attorney to check your document before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-specific paperwork effortlessly!

Form popularity

FAQ

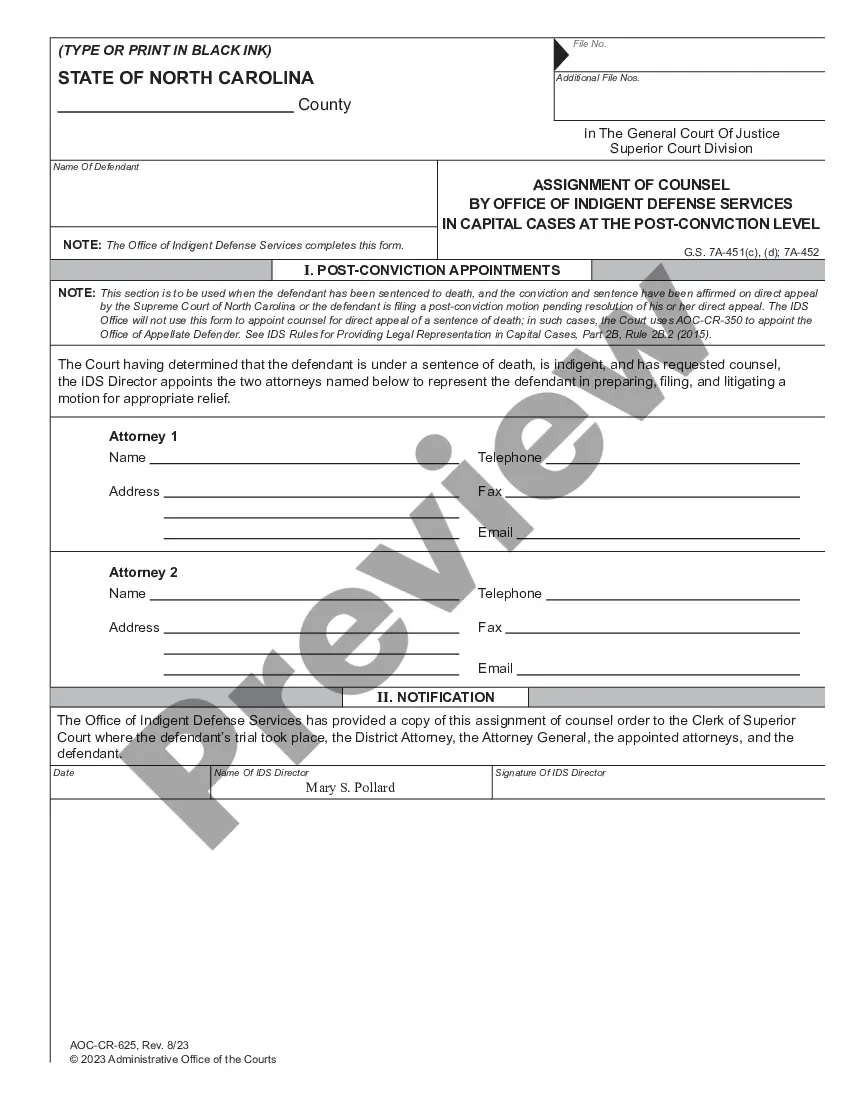

(Certificate of Amendment) The attached form is drafted to meet minimal statutory filing requirements pursuant to the relevant code. provisions. This form and the information provided are not substitutes for the advice and services of an attorney and tax specialist.

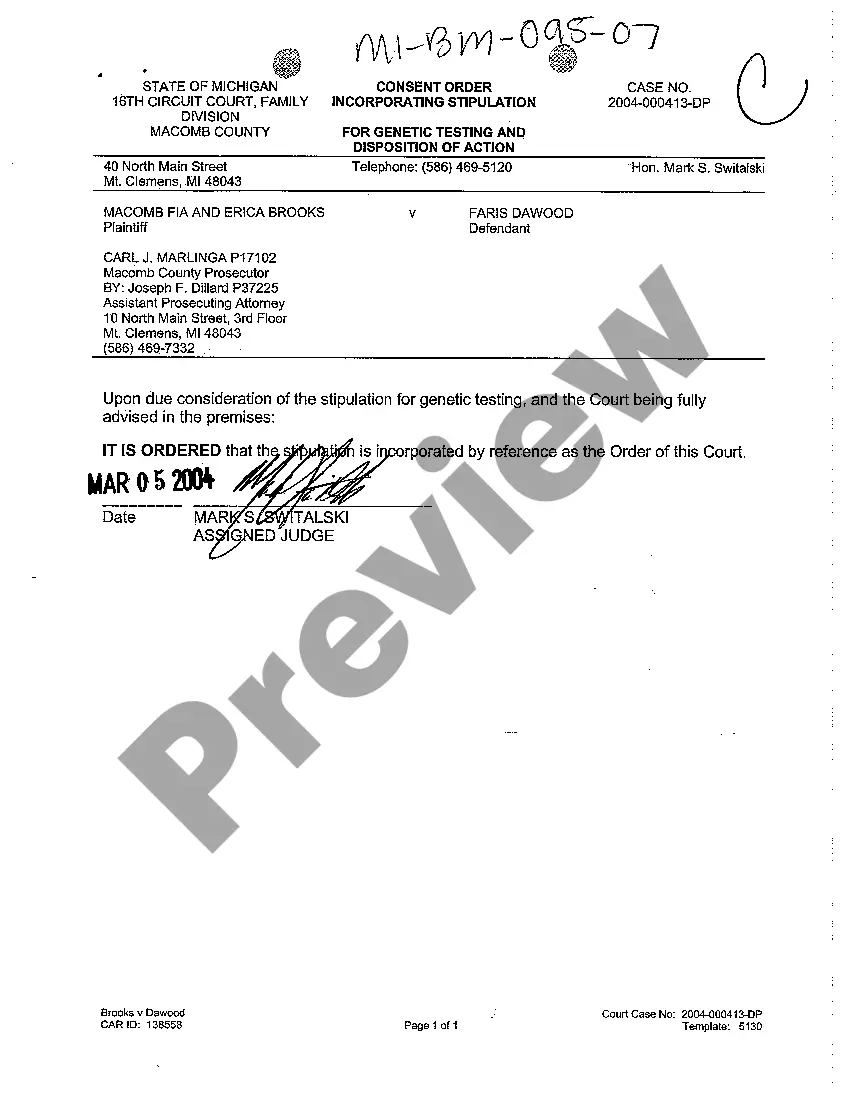

To make amendments your New York Corporation, you must provide the completed Certificate of Amendment of the Certificate of Incorporation form to the new York Department of State by mail, fax or in person, along with the filing fee.

Texas allows corporations to file Texas Certificate of Formation amendments online using the SOSDirect website for corporate filings. Alternatively, you can mail a completed Certificate of Amendment form to their office in Austin, Texas, or you can deliver the form in person.

Key Takeaways. An amendment is a change or addition to the terms of a contract or document. An amendment is often an addition or correction that leaves the original document substantially intact.

A certificate of amendment is a legal document that amends the articles of incorporation. It can amend anything from the name and address to the number of shares available for issuance and voting rights.

The filing fee for a certificate of amendment for a nonprofit corporation or a cooperative association is $25. Fees may be paid by personal checks, money orders, LegalEase debit cards, or American Express, Discover, MasterCard, and Visa credit cards.

The vote usually takes place at a formal meeting of the corporation (annual meeting or other) and shareholders must be advised of the proposed change before the meeting. If the shareholders approve the change to the articles of incorporation, the amended document must be attested to by the corporate secretary.

Articles of Amendment are filed when your business needs to add to, change or otherwise update the information you originally provided in your Articles of Incorporation or Articles of Organization.

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

How to Amend Articles of Incorporation Review the bylaws of the corporation.A board of directors meeting must be scheduled.Write the proposed changes.Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.