Franklin Ohio Approval of Authorization of Preferred Stock: A Comprehensive Guide Preferred stock is a type of stock that grants shareholders certain privileges and preferences over common stockholders. When a company wants to issue preferred stock, it first needs approval from the relevant governing body in the given jurisdiction. In the case of Franklin, Ohio, this authorization process is called the Franklin Ohio Approval of Authorization of Preferred Stock. Preferred stock allows investors to enjoy a fixed dividend payment before common stockholders are paid out. It also offers priority in the event of liquidation, giving preference to preferred shareholders when distributing assets. Franklin, Ohio recognizes the significance of preferred stock in raising capital and attracting potential investors, and therefore mandates the approval process. The approval of authorization of preferred stock in Franklin, Ohio involves a thorough examination of the company's financial stability, capital structure, and management capabilities. The governing body assesses the potential impact of issuing preferred stock on the organization's existing shareholders, ensuring a fair and equitable outcome for all parties involved. Additionally, the Franklin Ohio Approval of Authorization of Preferred Stock may include specific provisions or types of preferred stock options. Here are some common types: 1. Cumulative Preferred Stock: With this type of preferred stock, if the company misses a dividend payment, it accumulates and must be paid at a later date before common stockholders receive any dividends. 2. Non-Cumulative Preferred Stock: Unlike cumulative preferred stock, non-cumulative preferred stockholders do not accumulate unpaid dividends. If a dividend is missed, it is not owed to the shareholders in the future. 3. Convertible Preferred Stock: This type of preferred stock can be converted into a predetermined number of common shares at the shareholders' discretion. This conversion feature provides flexibility and potential upside to preferred shareholders. 4. Participating Preferred Stock: Shareholders of participating preferred stock have the right to receive additional dividends on top of the fixed dividend rate if the company distributes dividends to common stockholders. 5. Callable Preferred Stock: Callable preferred stock allows the issuer to redeem the shares at a predetermined price after a certain date. This provision offers flexibility for the issuing company and may benefit shareholders if the redemption price is favorable. The Franklin Ohio Approval of Authorization of Preferred Stock process ensures that companies comply with all regulatory requirements and provides a thorough evaluation of the preferred stock issuance. It promotes transparency and safeguards the interests of both the company and potential investors. In conclusion, the Franklin Ohio Approval of Authorization of Preferred Stock is a vital step in facilitating the issuance of preferred stock. By undergoing this approval process, companies in Franklin, Ohio can raise capital through various types of preferred stock, offering unique benefits to both the company and its shareholders.

Franklin Ohio Approval of authorization of preferred stock

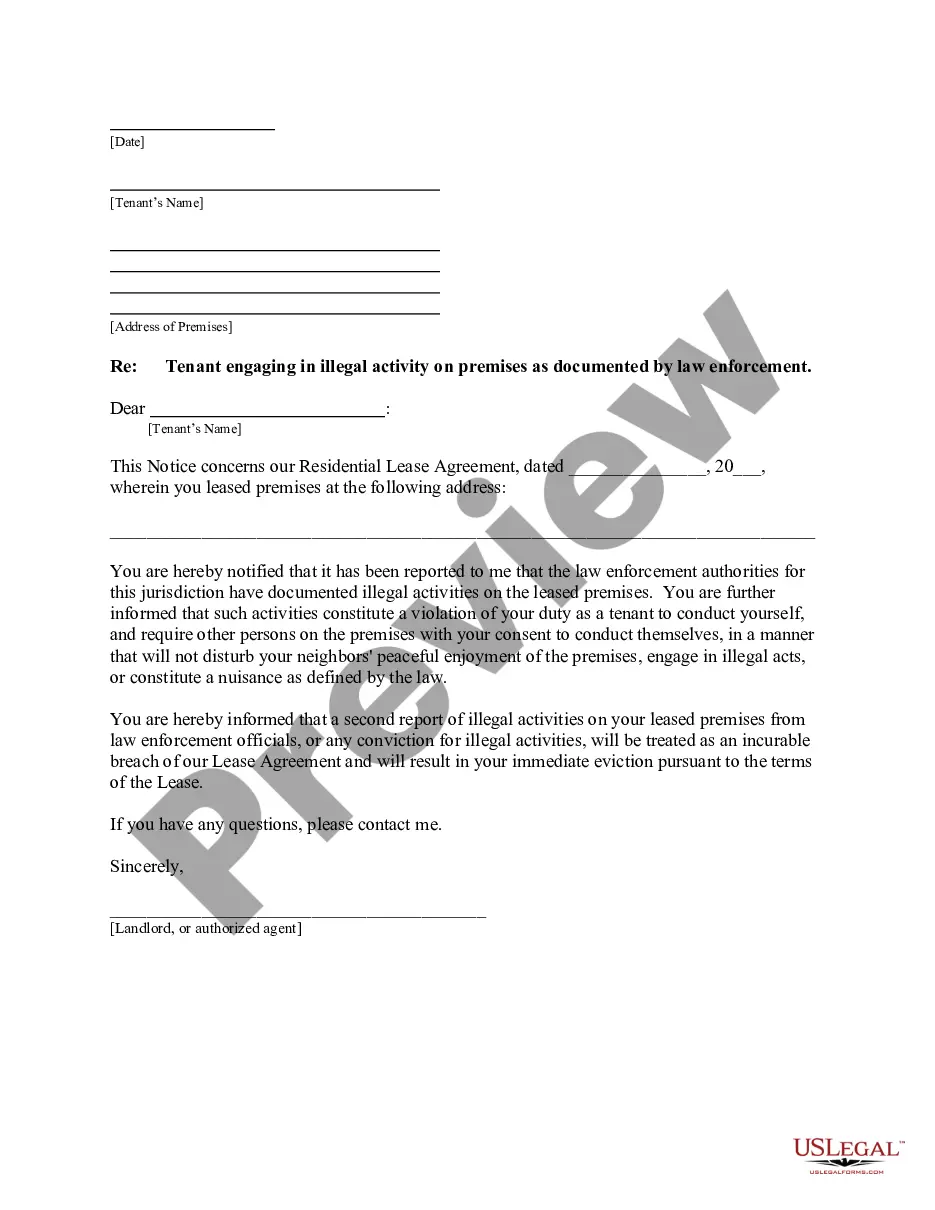

Description

How to fill out Franklin Ohio Approval Of Authorization Of Preferred Stock?

Draftwing paperwork, like Franklin Approval of authorization of preferred stock, to take care of your legal affairs is a difficult and time-consumming task. Many cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can consider your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms created for a variety of cases and life situations. We ensure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Franklin Approval of authorization of preferred stock form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before getting Franklin Approval of authorization of preferred stock:

- Make sure that your template is specific to your state/county since the rules for writing legal papers may vary from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Franklin Approval of authorization of preferred stock isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start using our service and get the document.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s easy to locate and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!