Nassau, New York Approval of Authorization of Preferred Stock Nassau, New York is a town located in Rensselaer County, New York. As part of its financial planning and management, the town has recently approved the authorization of preferred stock. This move allows the town to raise capital through the issuance of preferred stock, which provides certain advantages over common stock. The authorization of preferred stock means that the town government can now sell shares of preferred stock to investors, who will become shareholders and receive certain benefits. Preferred stockholders have a higher claim on the town's assets, earnings, and dividends than common stockholders. This means that if the town were to face financial difficulties or liquidation, preferred stockholders would be prioritized in terms of repayment. The authorization of preferred stock also gives the town the flexibility to offer different classes or types of preferred stock. These different classes may vary in terms of dividend rates, voting rights, conversion options, redemption provisions, or other specific features that cater to the needs of different investors. Some types or classes of preferred stock that Nassau, New York may consider issuing could include: 1. Cumulative Preferred Stock: This type of preferred stock guarantees that if any dividends are missed, they will accumulate and must be paid in the future before any dividends can be paid to common shareholders. 2. Non-Cumulative Preferred Stock: Unlike cumulative preferred stock, non-cumulative preferred stock does not accumulate unpaid dividends. If the town is unable to pay dividends for a certain period, it does not owe any unpaid dividends in the future. 3. Convertible Preferred Stock: With this type of preferred stock, shareholders have the option to convert their preferred shares into a predetermined number of common shares at a specified conversion ratio. This allows investors to benefit from any potential increase in common stock value. 4. Participating Preferred Stock: Participating preferred stockholders have the right to receive additional dividends beyond the fixed dividend rate. If the town performs well and distributes dividends to common stockholders, participating preferred stockholders may receive additional dividends based on a predetermined formula. By authorizing preferred stock and potentially offering various classes, Nassau, New York aims to attract investors, raise capital, and strengthen its financial position. This move provides the town with additional funding options and the ability to tailor stock offerings to meet the specific needs and preferences of different investors.

Nassau New York Approval of authorization of preferred stock

Description

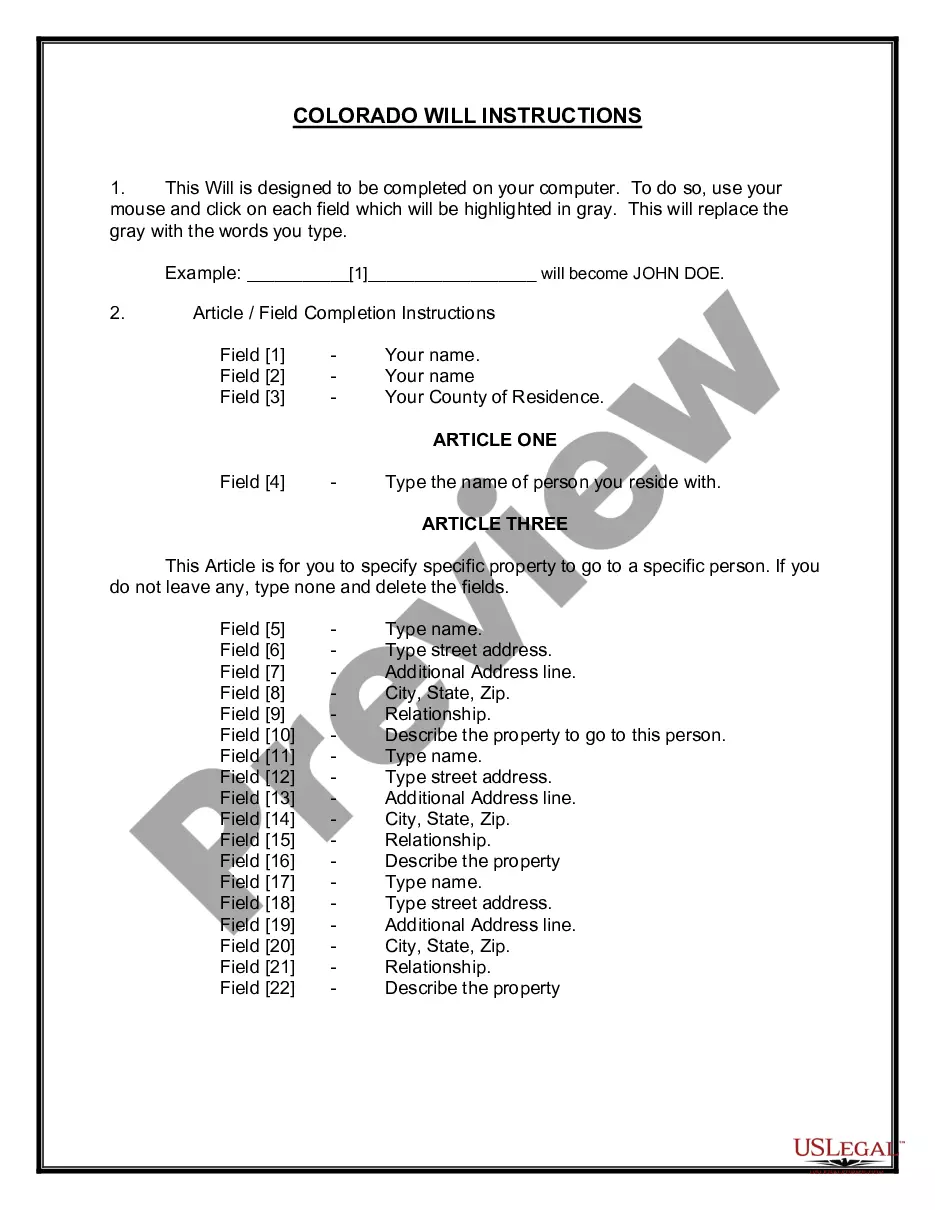

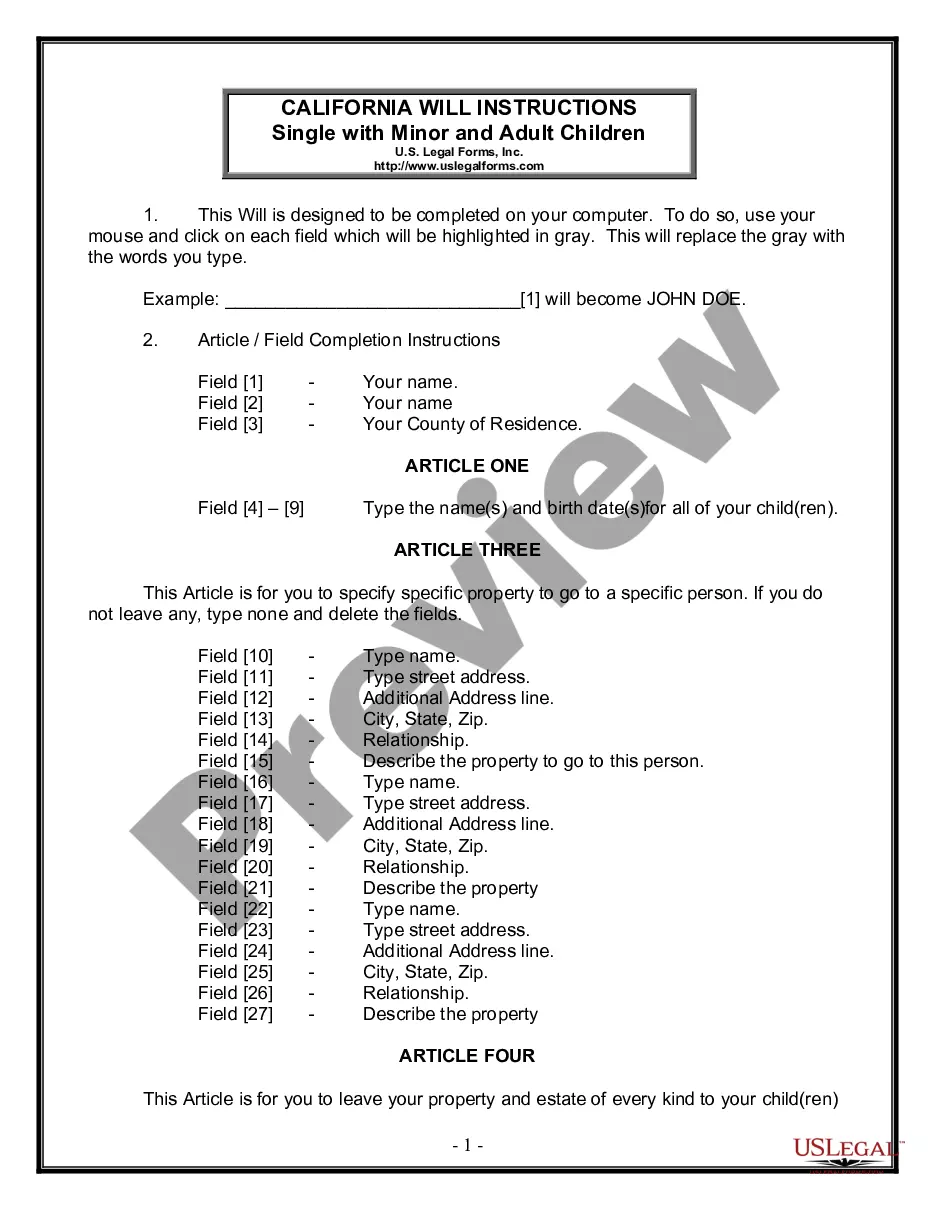

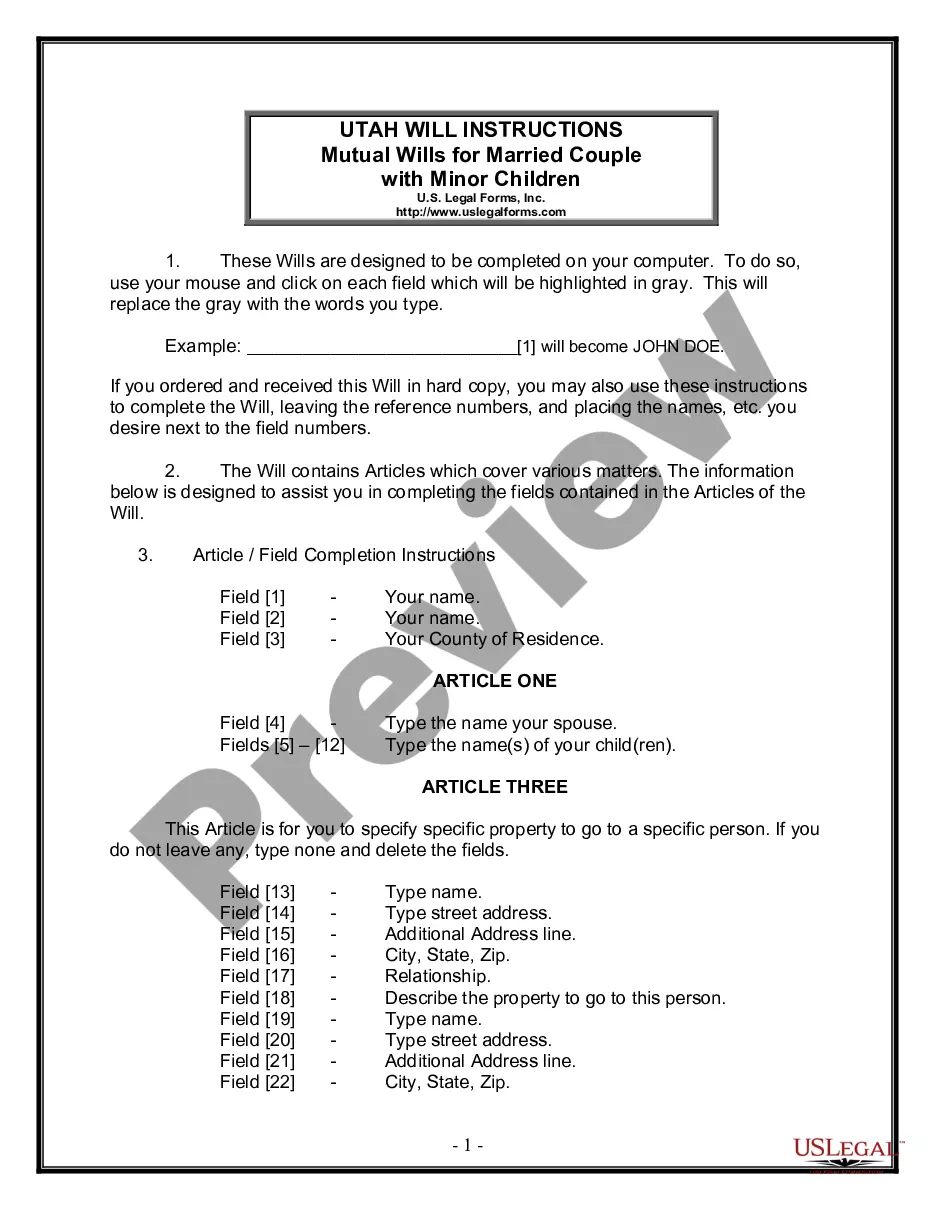

How to fill out Nassau New York Approval Of Authorization Of Preferred Stock?

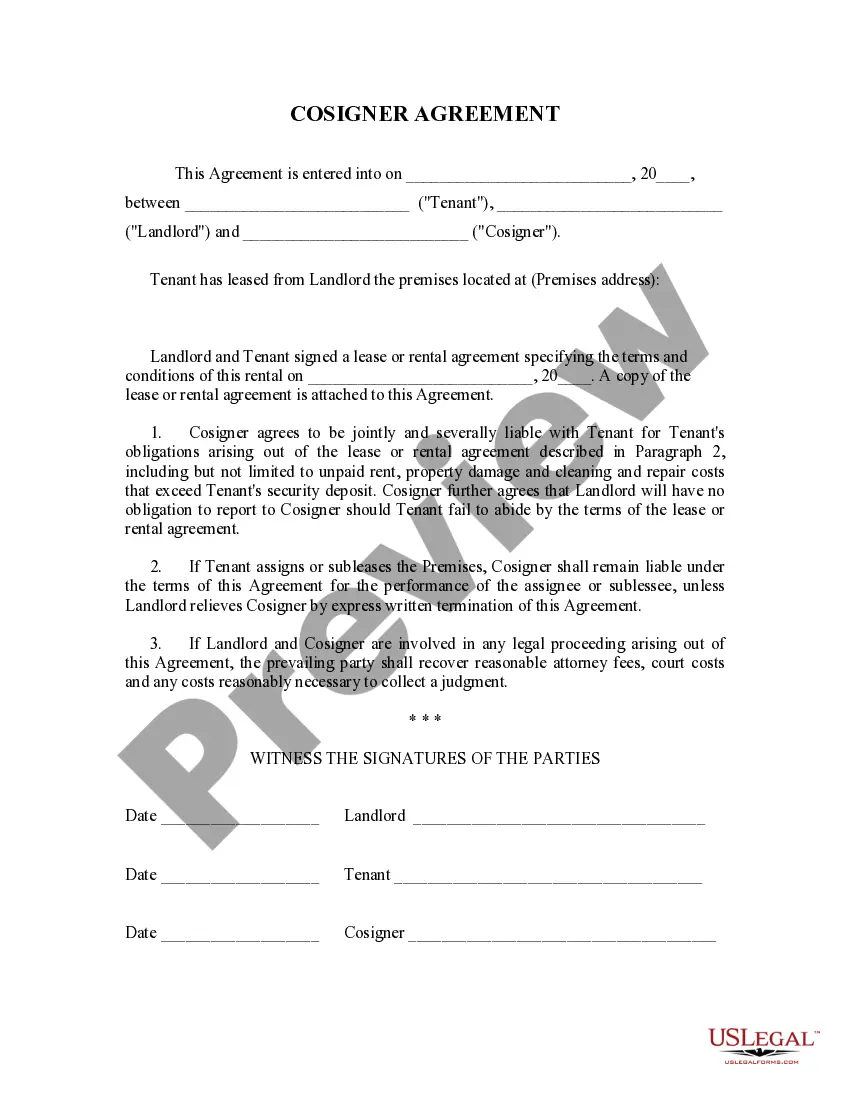

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life scenario, finding a Nassau Approval of authorization of preferred stock meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Apart from the Nassau Approval of authorization of preferred stock, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Professionals verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can pick the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Nassau Approval of authorization of preferred stock:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Nassau Approval of authorization of preferred stock.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

At a minimum, you need to record the sale date, the name and address of the buyer, the number of shares sold and the price per share. Each stock certificate must have preferred written on it, have a unique certificate number and bear the corporate seal on the front.

Stock Designation with respect to a share of Company Common Stock means a designation by the holder of such share, provided by the Company to Parent no later than the Designation Deadline, to the effect that such share is designated to receive the Stock Designation Consideration.

Key Takeaways. Callable preferred stock are preferred shares that may be redeemed by the issuer at a set value before the maturity date. Issuers use this type of preferred stock for financing purposes as they like the flexibility of being able to redeem it.

Preferred shares are issued in a similar manner to common shares. Investors purchase shares at the offering price, and the company receives the funds. The terms of the offer include whether any of the features listed above apply. While preferred stock is outstanding, the company must pay dividends.

Preferred stock is a form of equity, or a stake in the company's ownership. Instead of being a form of debt equity, preferred stock works more like a bond than it does like a share in a company. Companies issue preferred stock as a way to obtain equity financing without sacrificing voting rights.

Companies typically issue preferred stock for one or more of the following reasons: To avoid increasing your debt ratios; preferred shares count as equity on your balance sheet. To pay dividends at your discretion. Because dividend payments are typically smaller than principal plus interest debt payments.

A certificate which contains a copy of the board resolution setting out the powers, designations, preferences or rights of a class or series of a class of stock of a corporation (typically a series of preferred stock) if they are not already contained in the certificate of incorporation of the corporation.

FCA regulation 12 CFR § 615.5230(c) requires that each issuance of preferred stock by a Farm Credit System institution must be approved by a majority of the shares voting of each class of equities adversely affected by the preference, voting by class, whether or not such classes are otherwise authorized to vote.

A preferred stock certificate is a document that identifies the ownership share of an investor in a corporation.

Shareholder approval will only be required for issuances to a related party, and will not be required for issuances to 1) a subsidiary, affiliate, or other closely related person of a related party, or 2) any company or entity in which a related party has a substantial direct or indirect interest.