Wayne, Michigan is a city located in Wayne County, Michigan. It is known for its rich history and vibrant community. In terms of financial matters, the Wayne Michigan Approval of authorization of preferred stock plays a crucial role. Preferred stock refers to a type of stock that entitles shareholders to certain privileges and preferences over common stockholders. This is often a popular form of investment for individuals and businesses looking for stability and regular income. The approval of authorization of preferred stock in Wayne, Michigan signifies an important decision made by a company's board of directors and shareholders. There are different types of Wayne Michigan Approval of authorization of preferred stock that can be considered. Firstly, one type is convertible preferred stock which allows shareholders the option to convert their shares into common stock at a predetermined ratio. This type of preferred stock provides investors with the potential for capital appreciation. Another type is cumulative preferred stock which guarantees shareholders a fixed dividend payment, even if the company temporarily suspends or lowers dividend distributions. This type of preferred stock usually accumulates unpaid dividends and must be paid out before any common stock dividends are distributed. Furthermore, participating preferred stock is another type that allows shareholders to receive additional dividends based on a predetermined formula if the company achieves a certain level of profitability. This type of preferred stock offers the potential for higher returns if the company performs well. Lastly, callable preferred stock gives the company the right to redeem the shares at a specified price after a predetermined call date. This allows companies the flexibility to buy back shares and adjust their capital structure as needed. In summary, the Wayne Michigan Approval of authorization of preferred stock is a significant decision made by companies in Wayne, Michigan. There are various types of preferred stock that can be authorized, including convertible, cumulative, participating, and callable preferred stock. Each type offers different benefits and considerations for shareholders, providing them with opportunities for stable income, potential capital appreciation, and additional dividends.

Wayne Michigan Approval of authorization of preferred stock

Description

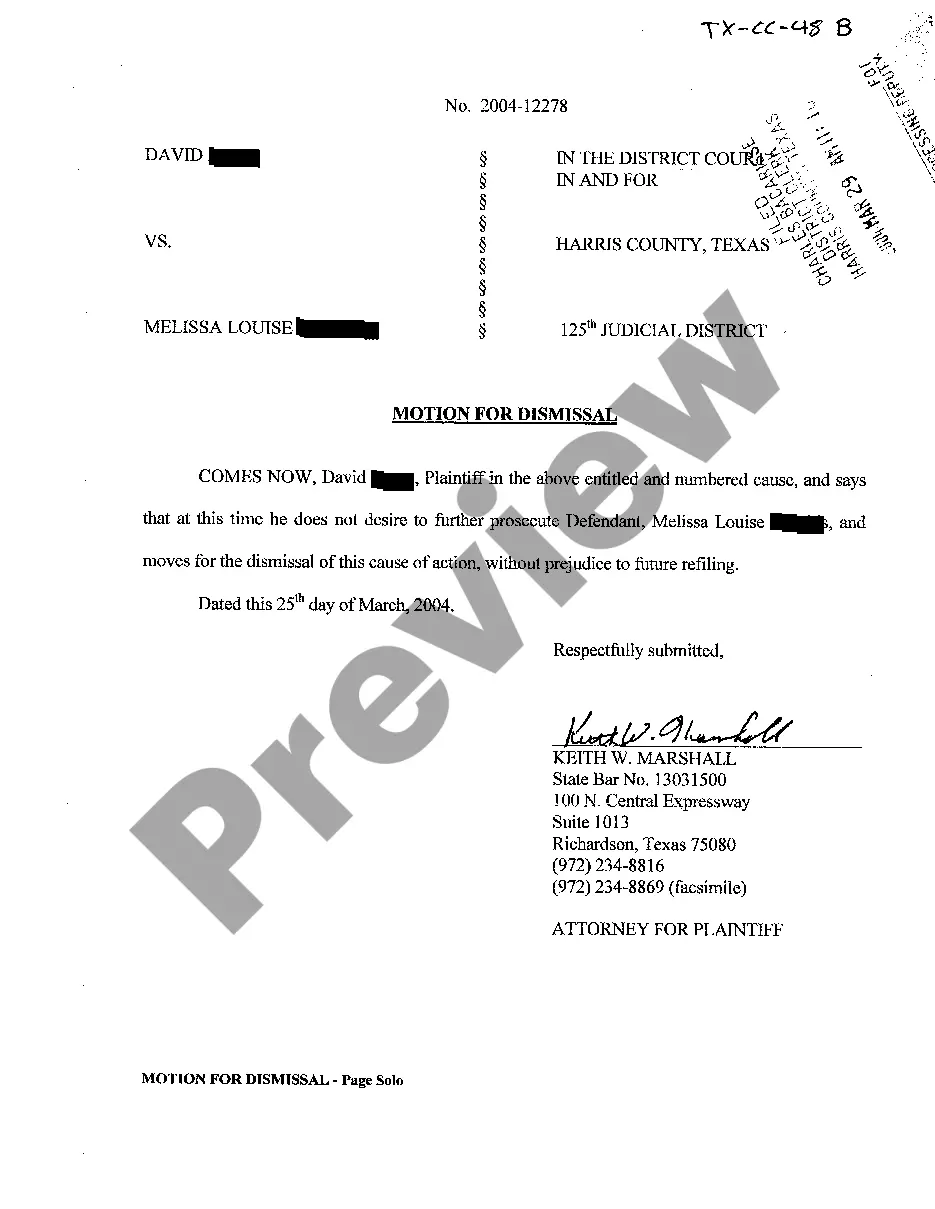

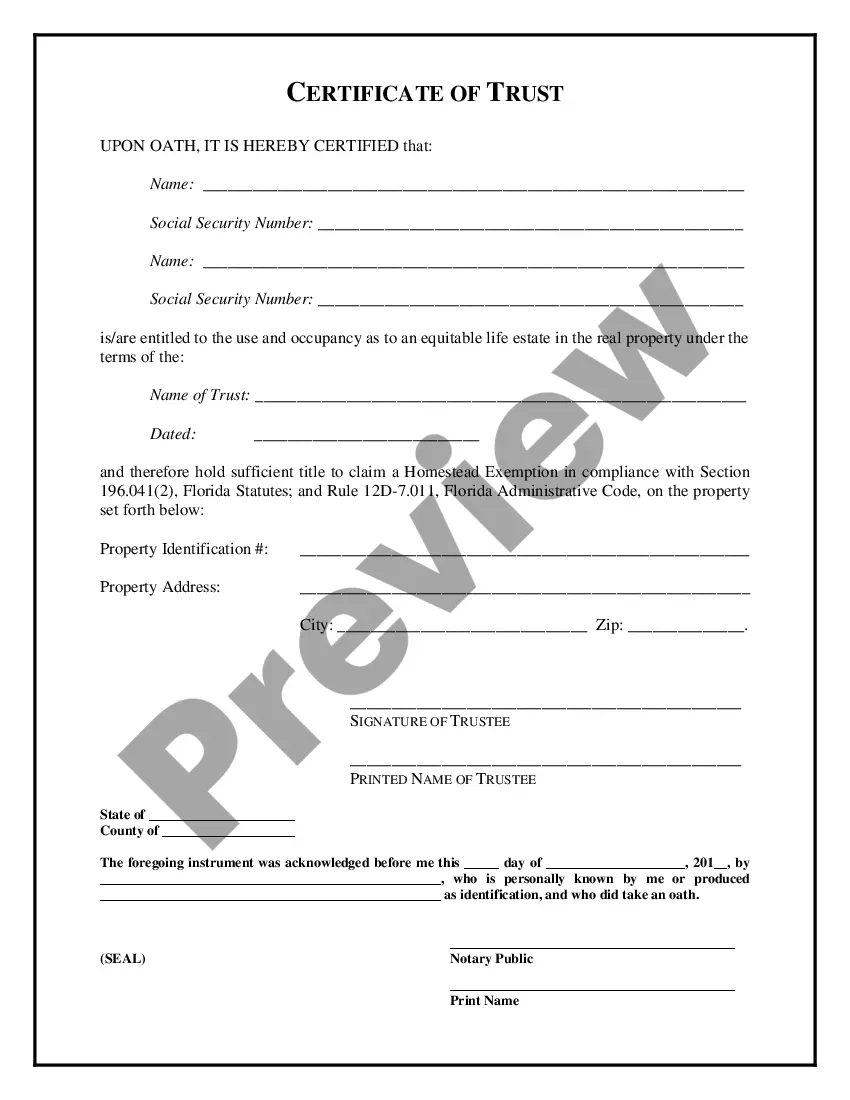

How to fill out Wayne Michigan Approval Of Authorization Of Preferred Stock?

Preparing papers for the business or personal demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to generate Wayne Approval of authorization of preferred stock without professional assistance.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Wayne Approval of authorization of preferred stock by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, adhere to the step-by-step guide below to get the Wayne Approval of authorization of preferred stock:

- Examine the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any situation with just a couple of clicks!

Form popularity

FAQ

Series A Dividends means the cumulative dividends on each share of Series A Preferred Stock equal to the product of the Series A Base Value (as adjusted for stock dividends, stock splits, combinations, recapitalizations or the like) times a rate per annum of 8%.

At a minimum, you need to record the sale date, the name and address of the buyer, the number of shares sold and the price per share. Each stock certificate must have preferred written on it, have a unique certificate number and bear the corporate seal on the front.

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

The four main types of preference shares are callable shares, convertible shares, cumulative shares, and participatory shares. Each type of preferred share has unique features that may benefit either the shareholder or the issuer.

FCA regulation 12 CFR § 615.5230(c) requires that each issuance of preferred stock by a Farm Credit System institution must be approved by a majority of the shares voting of each class of equities adversely affected by the preference, voting by class, whether or not such classes are otherwise authorized to vote.

Most successful, venture-backed startup will have multiple financing rounds. For each round, there will typically be a distinct series of preferred stock tied to the financing series. So, if a startup had raised a Series A and a Series B, then it would likely have Series A Preferred Stock and Series B Preferred Stock.

The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.

Participating preferred stock is a type of preferred stock that gives the holder the right to receive dividends equal to the customarily specified rate that preferred dividends are paid to preferred shareholders, as well as an additional dividend based on some predetermined condition.

Companies typically issue preferred stock for one or more of the following reasons: To avoid increasing your debt ratios; preferred shares count as equity on your balance sheet. To pay dividends at your discretion. Because dividend payments are typically smaller than principal plus interest debt payments.

Authorized stock is the total number of shares you can legally sell. You can authorize preferred stock and common stock shares. The number of shares you authorize depends partly on how much money you may want to raise in the future.