Dallas Texas Amendment to Articles of Incorporation allows a corporation incorporated in Dallas, Texas, to modify the terms of their authorized preferred stock. This amendment is crucial as it gives a corporation the flexibility to adapt to changing market conditions, financial needs, or strategic goals. There are various types of Dallas Texas Amendments to Articles of Incorporation that can be used to change the terms of authorized preferred stock. These include: 1. Amendment to Terms of Preferred Stock: A corporation may choose to modify certain provisions of its preferred stock, such as dividend rates, conversion rights, or liquidation preferences. This amendment enables the corporation to tailor the preferred stock terms to align with its specific requirements or to attract potential investors. 2. Amendment to Increase Authorized Preferred Stock: If a corporation anticipates a need for additional capital or wants to strengthen its financial position, it can amend its articles to increase the number of authorized preferred stock shares. This amendment expands the corporation's ability to issue more preferred stock to investors in the future. 3. Amendment to Convert Preferred Stock into Common Stock: In some cases, a corporation may decide to convert its authorized preferred stock into common stock, which has different voting rights and privileges. This amendment simplifies the capital structure, potentially increasing the marketability or flexibility of the corporation's stock. 4. Amendment to Add New Classes or Series of Preferred Stock: A corporation may also choose to amend its articles of incorporation to create new classes or series of preferred stock. This amendment allows the corporation to diversify its capital structure and potentially offer different terms for various categories of preferred stock. 5. Amendment to Remove Existing Classes or Series of Preferred Stock: Conversely, a corporation may decide to eliminate certain classes or series of preferred stock from its authorized capital. This amendment streamlines the capital structure, reduces complexity, or aligns with changes in business strategies. In conclusion, a Dallas Texas Amendment to Articles of Incorporation is a powerful tool that allows a corporation to modify the terms of its authorized preferred stock. Whether it is adjusting existing preferences, increasing authorized shares, converting preferred stock, adding new classes, or removing existing ones, these amendments help corporations shape their capital structure to meet their evolving needs.

Dallas Texas Amendment to Articles of Incorporation to change the terms of the authorized preferred stock

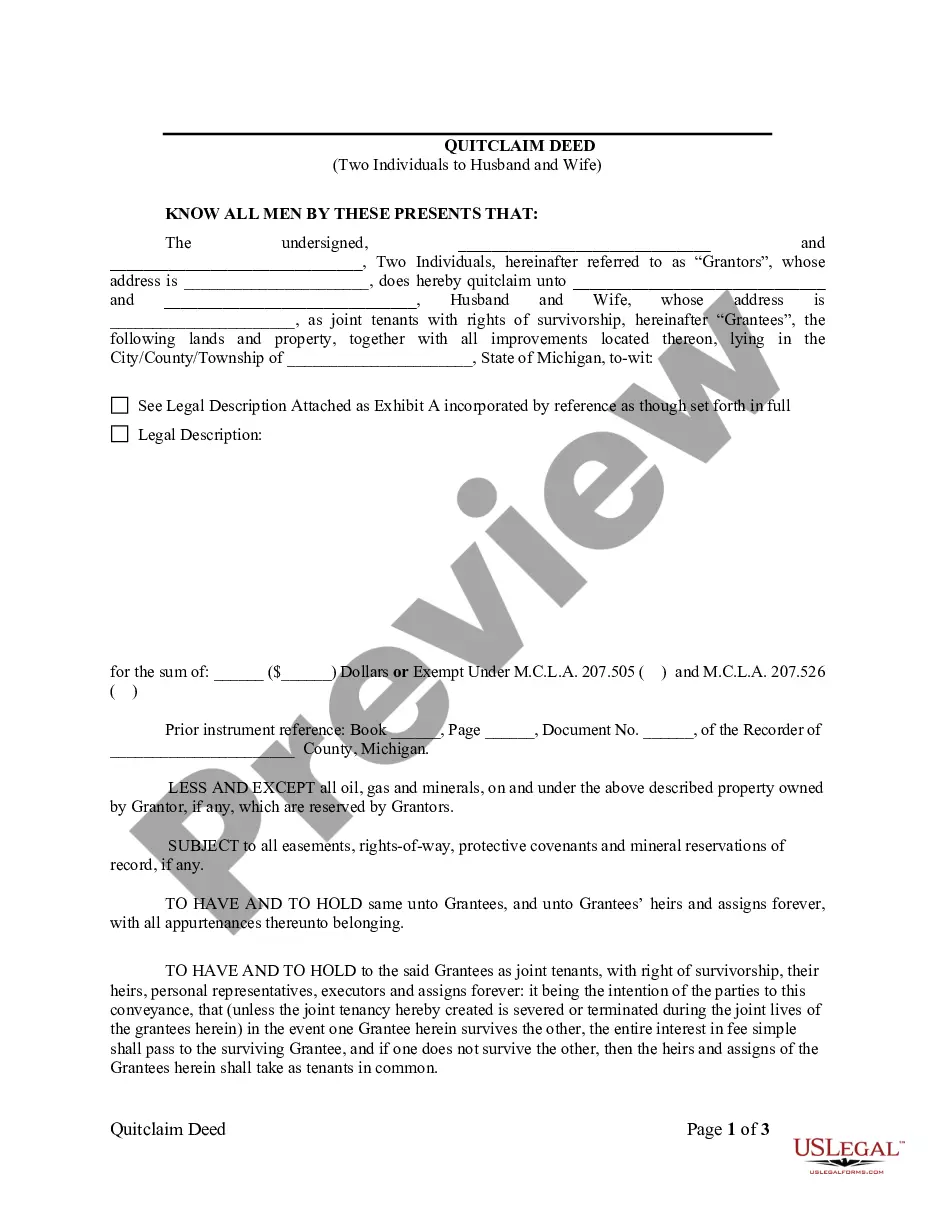

Description

How to fill out Dallas Texas Amendment To Articles Of Incorporation To Change The Terms Of The Authorized Preferred Stock?

Preparing papers for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create Dallas Amendment to Articles of Incorporation to change the terms of the authorized preferred stock without professional help.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Dallas Amendment to Articles of Incorporation to change the terms of the authorized preferred stock by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Dallas Amendment to Articles of Incorporation to change the terms of the authorized preferred stock:

- Examine the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that fits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any scenario with just a few clicks!