Fairfax Virginia Amendment of Restated Certificate of Incorporation allows for changes to the dividend rate on $10.50 cumulative second preferred convertible stock. This amendment provides flexibility for the company to adjust the dividend payment based on market conditions and the company's financial performance. Key terms related to this topic include: 1. Fairfax Virginia: Refers to the location where the amendment is being made, indicating that it is specific to the laws and regulations in Fairfax, Virginia. 2. Amendment: A modification or alteration made to the existing content of the Restated Certificate of Incorporation. 3. Restated Certificate of Incorporation: The primary document that outlines the legal structure and governing principles of a corporation. 4. Dividend rate: The percentage of the stock's par value that the corporation distributes as dividends to its shareholders. 5. $10.50 cumulative second preferred convertible stock: A specific type of stock that grants certain rights and privileges to shareholders, including a fixed dividend payment of $10.50 annually, cumulative meaning unpaid dividends accumulate, and the ability to convert the stock into common shares at a predetermined rate. Different types of Fairfax Virginia Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock may include: 1. Increase/dividend rate boost amendment: An amendment that raises the dividend rate on the $10.50 cumulative second preferred convertible stock, providing increased returns to shareholders. 2. Decrease/dividend rate reduction amendment: An amendment that lowers the dividend rate on the $10.50 cumulative second preferred convertible stock, adjusting it based on changing market conditions or financial circumstances. 3. Variable/dividend rate adjustment amendment: An amendment that introduces a variable dividend rate structure for the $10.50 cumulative second preferred convertible stock, allowing for adjustments based on specific criteria such as earnings, market conditions, or financial targets. 4. Suspension/dividend halt amendment: An amendment that temporarily suspends dividend payments on the $10.50 cumulative second preferred convertible stock, typically due to financial difficulties or preservation of capital. These different types of amendments provide the company with the necessary tools to adapt the dividend rate on the $10.50 cumulative second preferred convertible stock in response to various factors influencing the business's financial health and market conditions.

Fairfax Virginia Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock

Description

How to fill out Fairfax Virginia Amendment Of Restated Certificate Of Incorporation To Change Dividend Rate On $10.50 Cumulative Second Preferred Convertible Stock?

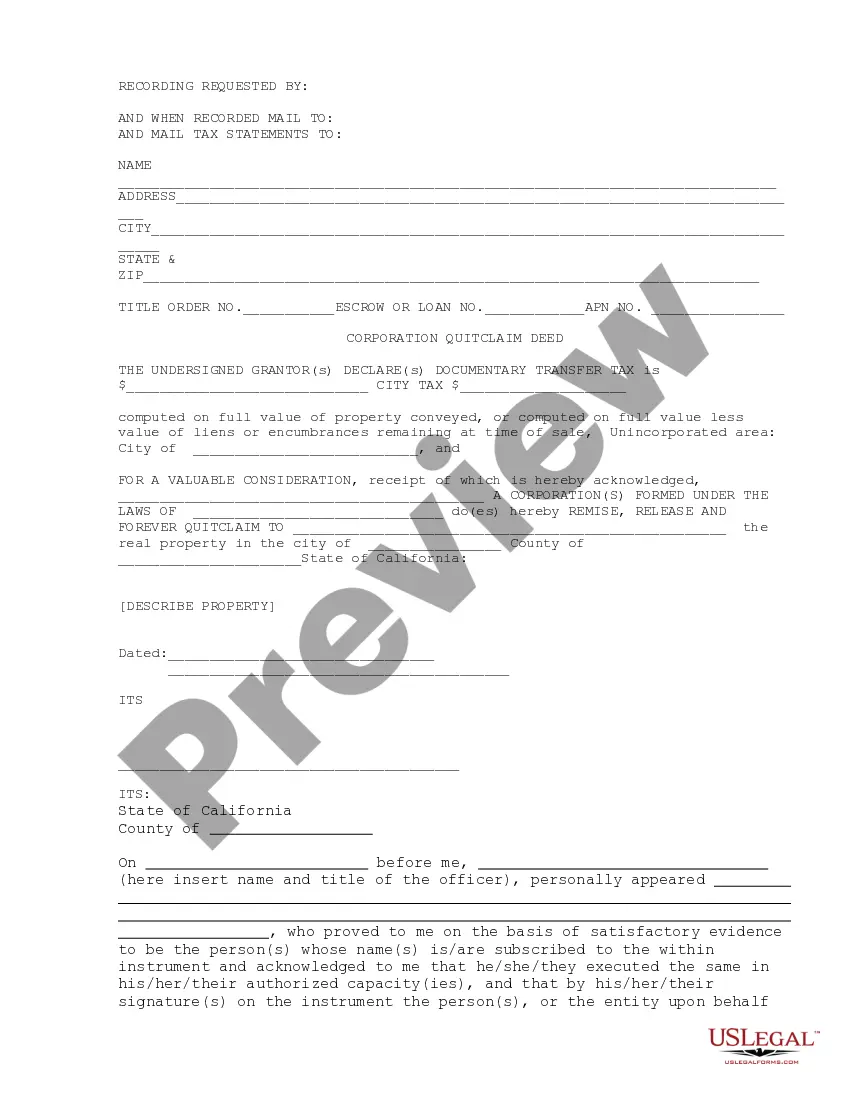

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Fairfax Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Fairfax Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Fairfax Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock:

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Amended means changed, i.e., that someone has revised the document. Restated means presented in its entirety, i.e., as a single, complete document. Accordingly, amended and restated means a complete document into which one or more changes have been incorporated.

An amended agreement or amended means that a contract has been modified, changed or edited. A restated agreement or restated means that the original contract is reproduced in full in one document.

When preferred stock is cumulative, preferred dividends not declared in a given period are called dividends in arrears. Dividends may be declared and paid in cash or stock. A debit balance in the Retained Earnings account is identified as a deficit. 11.

If the preferred shareholders do not receive a dividend (the board of directors does not declare a dividend) in a given period, then the undeclared dividend is accumulated.

Because you must pay the dividends in arrears first, record the cumulative preferred dividend payment by debiting Dividends Payable-Cumulative Preferred Dividend Arrearage for $10,000 and crediting Cash for $10,000.

What Is Convertible Preferred Stock? Convertible preferred stocks are preferred shares that include an option for the holder to convert the shares into a fixed number of common shares after a predetermined date.

Dividends on common shares are payable only if and when declared by a corporation's board of directors. Any unpaid cumulative dividends must be paid before any dividends on common shares (or a class of lower-ranking preferred shares) are paid.

An Amended and Restated Certificate of Incorporation is a legal document filed with the Secretary of State that restates, integrates, and adjusts the startup's initial Articles of Incorporation (i.e. the company's Charter).

Restated Certificate of Incorporation means the certificate of incorporation of the Company, restated and filed pursuant to the Plan and including the Preferred Stock Certificate of Designation.

Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed in the past, the dividends owed must be paid out to cumulative preferred shareholders first.