The Franklin Ohio Amendment of Restated Certificate of Incorporation is a legal document that outlines the changes made to the dividend rate of the $10.50 cumulative second preferred convertible stock for a company based in Franklin, Ohio. This amendment alters the original terms of the stock agreement and adjusts the rate at which dividends will be paid out to shareholders. Keywords: Franklin Ohio, Amendment of Restated Certificate of Incorporation, dividend rate, $10.50 cumulative second preferred convertible stock. Different types of Franklin Ohio Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock: 1. Franklin Ohio Amendment of Restated Certificate of Incorporation — Increase Dividend Rate: This type of amendment raises the dividend rate on the $10.50 cumulative second preferred convertible stock. The change is meant to provide increased returns to shareholders and reflect the company's improved financial performance. 2. Franklin Ohio Amendment of Restated Certificate of Incorporation — Decrease Dividend Rate: In this case, the amendment lowers the dividend rate on the $10.50 cumulative second preferred convertible stock. This adjustment might be necessary to align with the company's current financial situation or to allocate funds towards other business priorities. 3. Franklin Ohio Amendment of Restated Certificate of Incorporation — Suspension of Dividends: This category of amendment temporarily suspends the payment of dividends on the $10.50 cumulative second preferred convertible stock. It may be implemented during periods of financial hardship or to conserve capital for strategic investments and operational requirements. 4. Franklin Ohio Amendment of Restated Certificate of Incorporation — Resetting Dividend Rate: This type of amendment revises the dividend rate on the $10.50 cumulative second preferred convertible stock to a new fixed or variable rate. The reset allows for a more appropriate distribution of profits based on prevailing market conditions or changes in the company's financial health. 5. Franklin Ohio Amendment of Restated Certificate of Incorporation — Convertible Stock Conversion Ratio Adjustment: This amendment modifies the conversion ratio for the $10.50 cumulative second preferred convertible stock. The adjustment changes the number of common shares an investor will receive upon conversion, which could impact the overall value and attractiveness of the stock. It is essential to consult legal experts or the specific amendment document to determine the exact nature and terms of the Franklin Ohio Amendment of Restated Certificate of Incorporation for changing the dividend rate on the $10.50 cumulative second preferred convertible stock.

Franklin Ohio Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock

Description

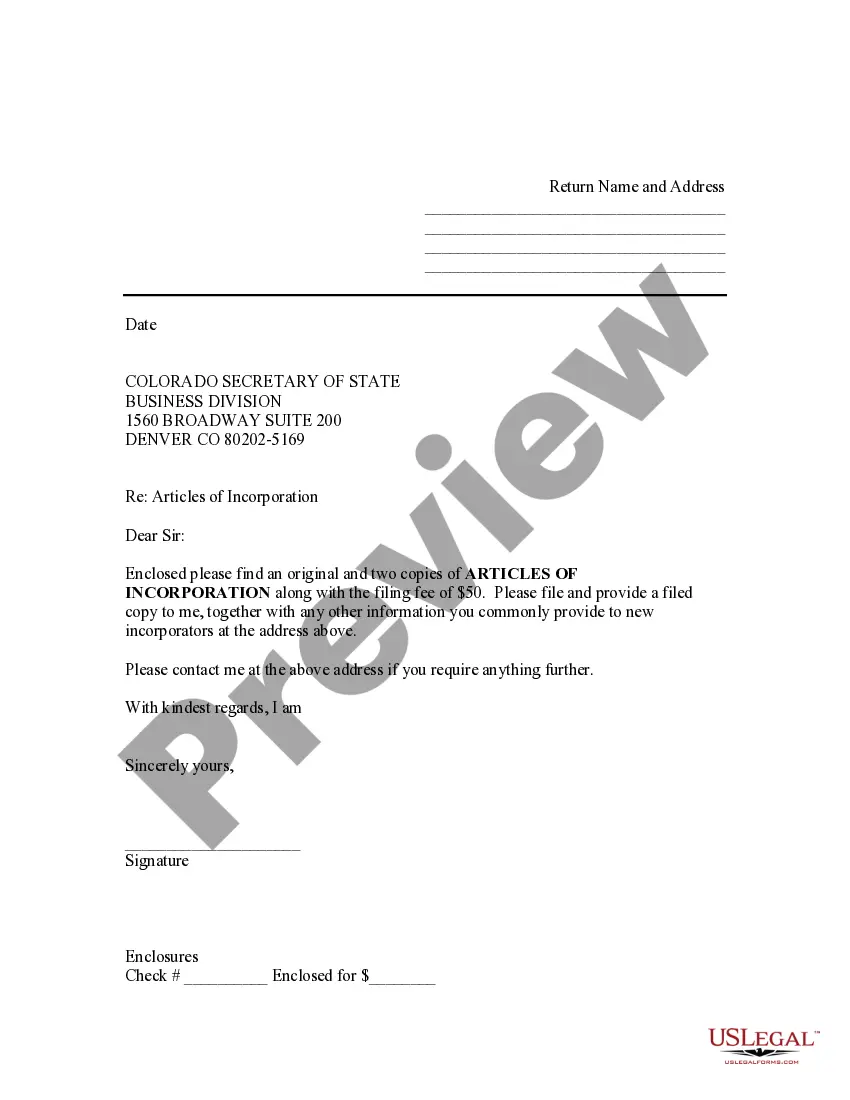

How to fill out Franklin Ohio Amendment Of Restated Certificate Of Incorporation To Change Dividend Rate On $10.50 Cumulative Second Preferred Convertible Stock?

Whether you plan to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business case. All files are grouped by state and area of use, so picking a copy like Franklin Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Franklin Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock. Adhere to the guidelines below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the right one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Franklin Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!