Houston Texas Amendment of Restated Certificate of Incorporation to Change Dividend Rate on $10.50 Cumulative Second Preferred Convertible Stock is a legal process undertaken by a corporation in Houston, Texas, to modify the terms of the dividend payment on their $10.50 cumulative second preferred convertible stock. This amendment is aimed at altering the rate at which dividends are distributed to shareholders holding this specific type of stock. The $10.50 cumulative second preferred convertible stock is a unique security that combines features of both preferred and convertible stocks. It carries a fixed dividend rate of $10.50 per share annually, which is paid to shareholders on a cumulative basis. This means that if the corporation fails to pay dividends in a particular year, the outstanding amount accumulates and must be paid before any distribution is made to common stockholders. The convertible aspect of this stock allows shareholders to convert their preferred stock into a predetermined number of common shares. This conversion option provides shareholders with the potential of benefiting from the growth of the company, as common shares are generally more valuable in terms of appreciation. In cases where a Houston corporation realizes the need to revise the dividend rate on their $10.50 cumulative second preferred convertible stock, an Amendment of Restated Certificate of Incorporation must be filed. This legal document acknowledges the intention to modify the terms of the stock, including the dividend payment rate. It is important to note that there may be different variations or types of Houston Texas Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock, depending on the specific circumstances of each corporation. Some potential variations could include: 1. Amendment to Increase Dividend Rate: This type of amendment is sought when a corporation intends to raise the annual dividend payment on their $10.50 cumulative second preferred convertible stock. Shareholders holding this stock will be entitled to a higher dividend payment per share annually. 2. Amendment to Decrease Dividend Rate: This variation comes into play when a corporation wishes to reduce the annual dividend rate for their $10.50 cumulative second preferred convertible stock. This amendment could be prompted by various factors like financial constraints, a change in the company's overall dividend distribution strategy, or a desire to reallocate funds towards other corporate initiatives. 3. Amendment to Adjust Conversion Ratio: In certain circumstances, a corporation may want to modify the conversion ratio attached to the $10.50 cumulative second preferred convertible stock. This amendment aims to alter the number of common shares that preferred shareholders will receive upon conversion, potentially adjusting the conversion rate to reflect changes in the company's financial performance or market conditions. By utilizing appropriate keywords like Houston, Texas, Amendment of Restated Certificate of Incorporation, dividend rate, $10.50 cumulative second preferred convertible stock, and variations such as increase, decrease, and adjustment, corporations can accurately communicate their desired modifications and ensure compliance with legal requirements.

Houston Texas Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock

Description

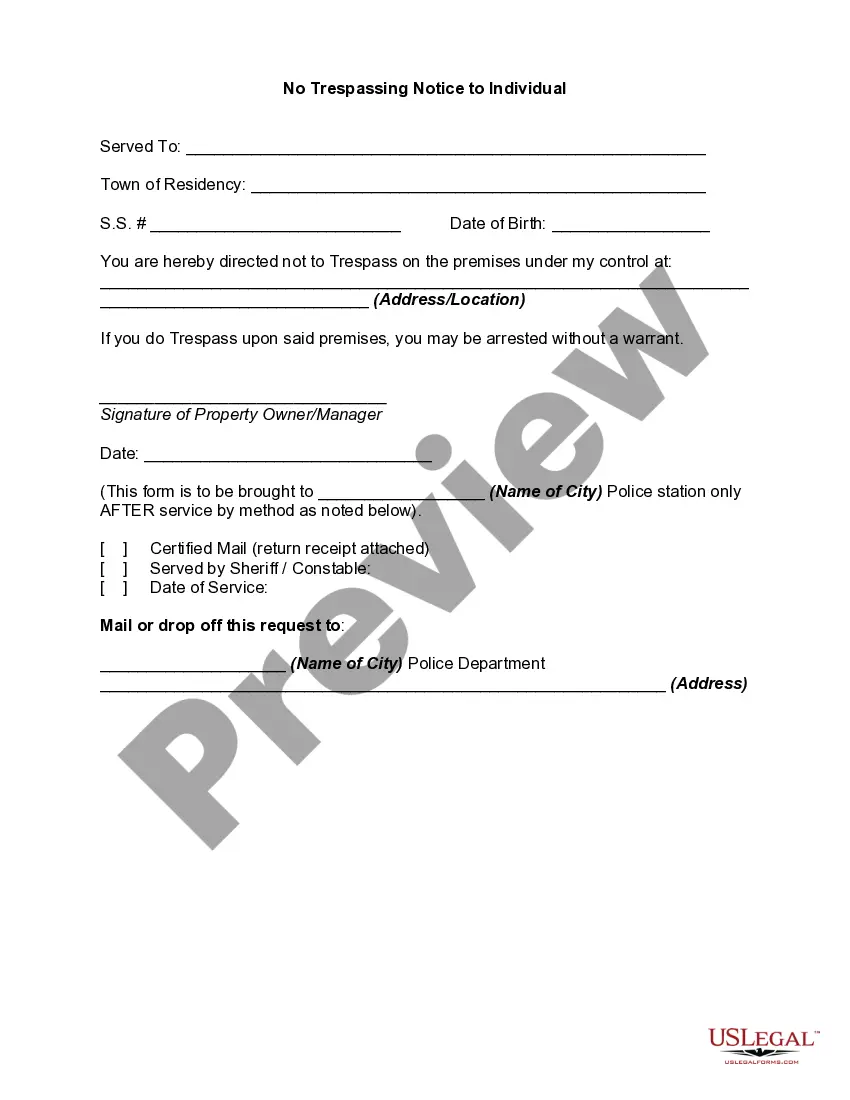

How to fill out Houston Texas Amendment Of Restated Certificate Of Incorporation To Change Dividend Rate On $10.50 Cumulative Second Preferred Convertible Stock?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare official documentation that varies throughout the country. That's why having it all collected in one place is so helpful.

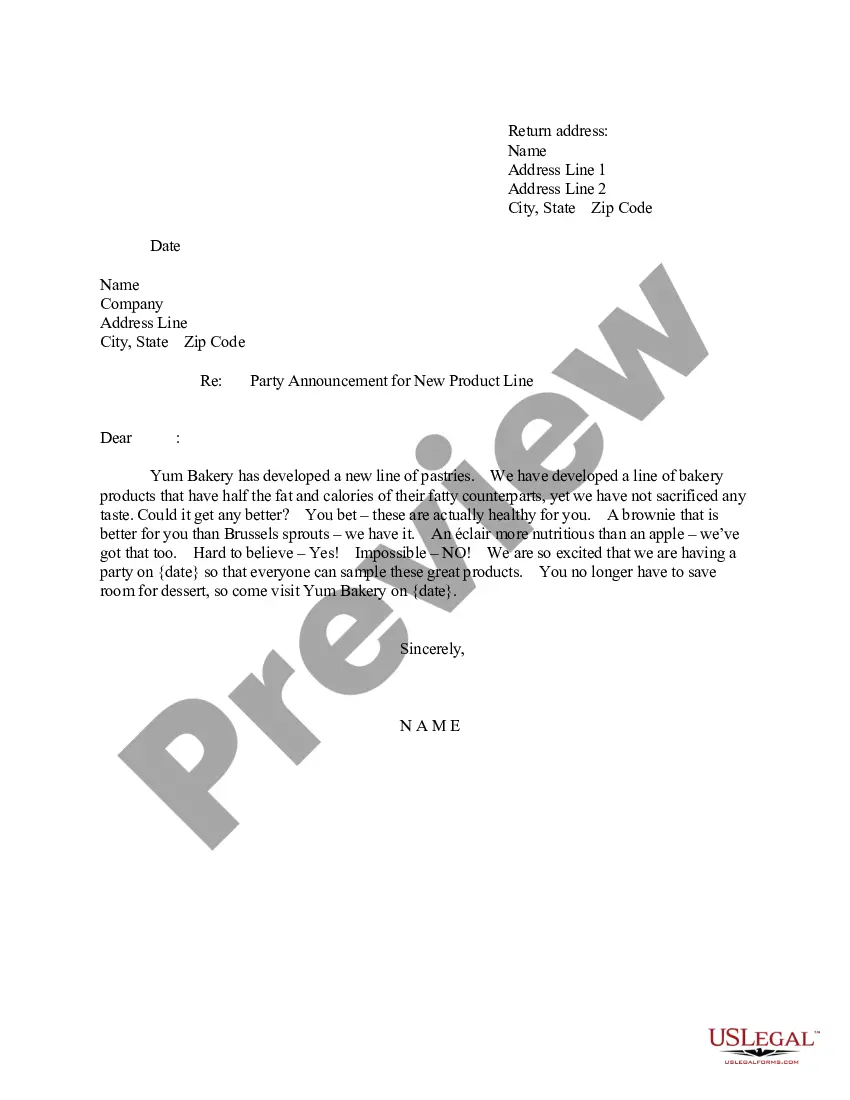

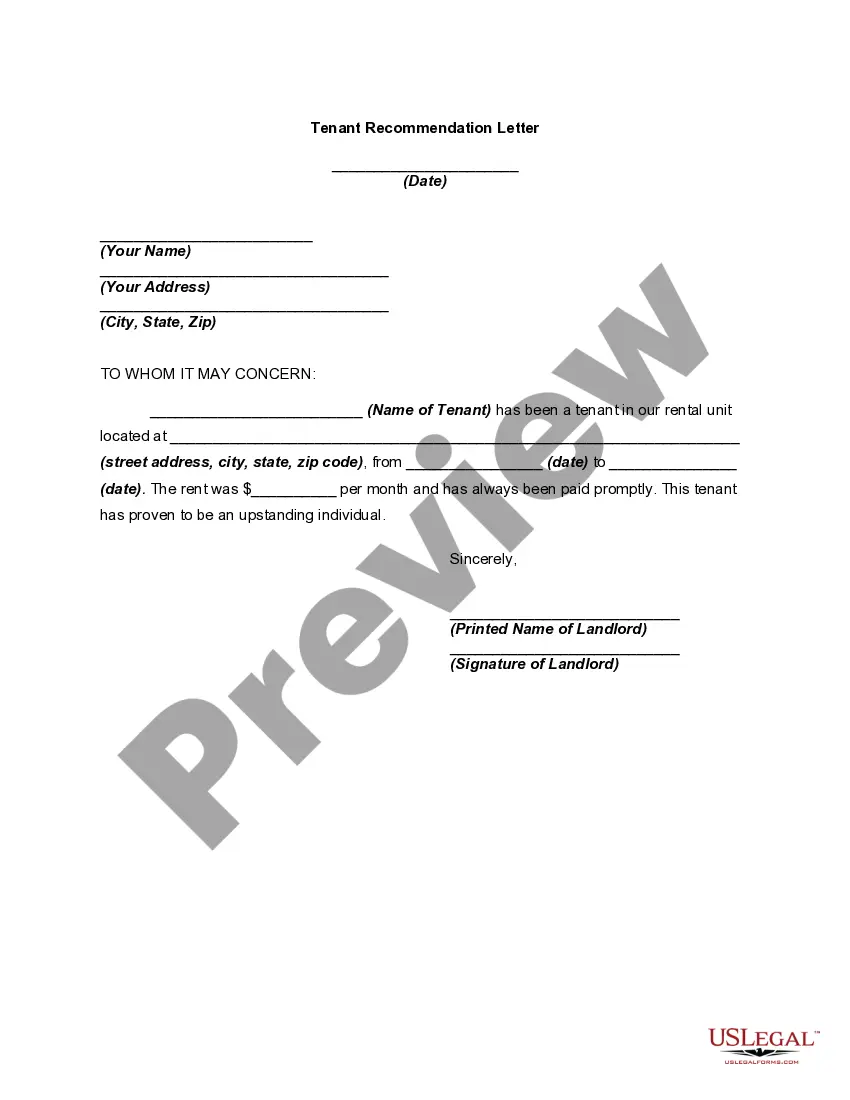

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any personal or business objective utilized in your county, including the Houston Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Houston Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to obtain the Houston Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock:

- Make sure you have opened the correct page with your local form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Houston Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

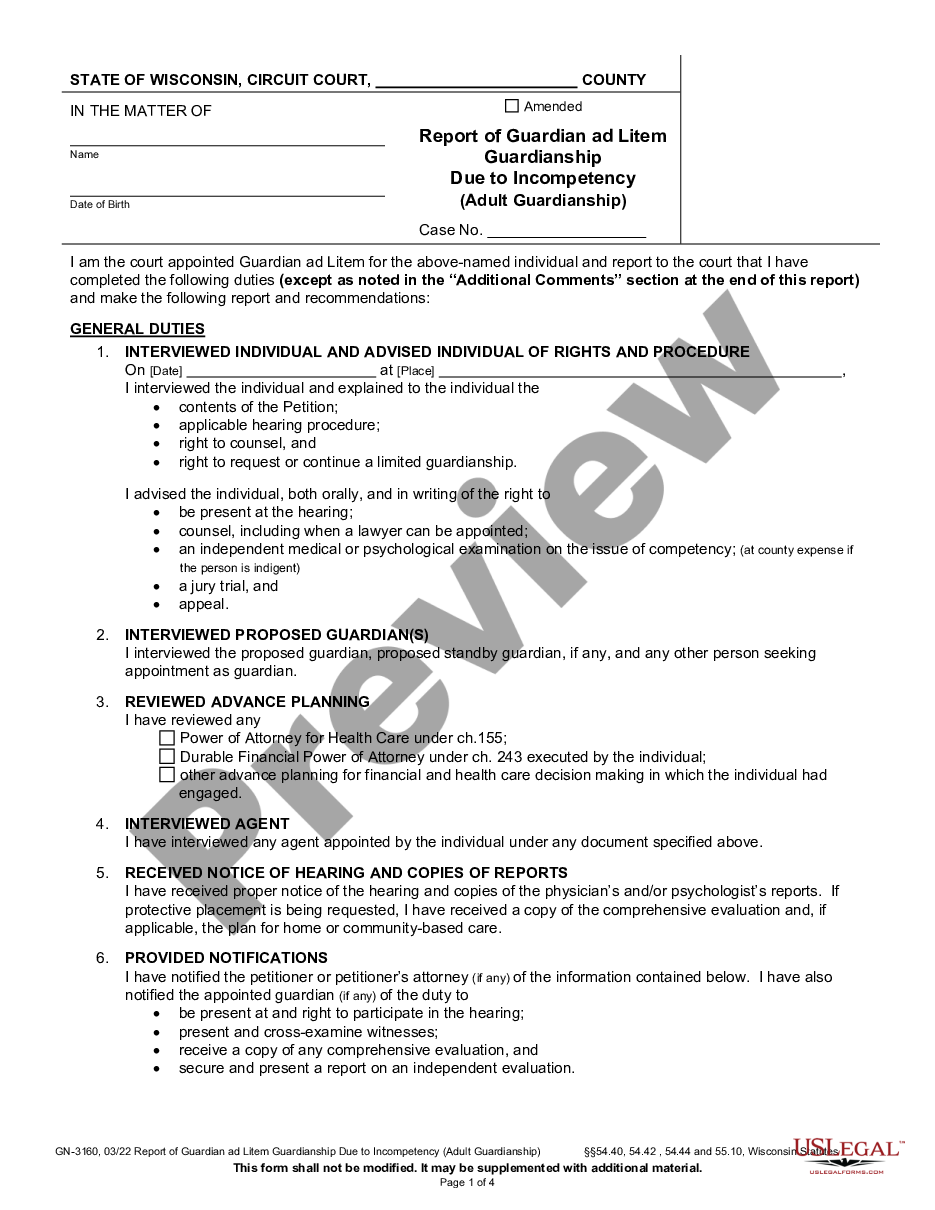

What is Amended and Restated? ?Amended? means that the document has ?changed?? that someone has revised the document. ?Restated? means ?presented in its entirety?, ? as a single, complete document.

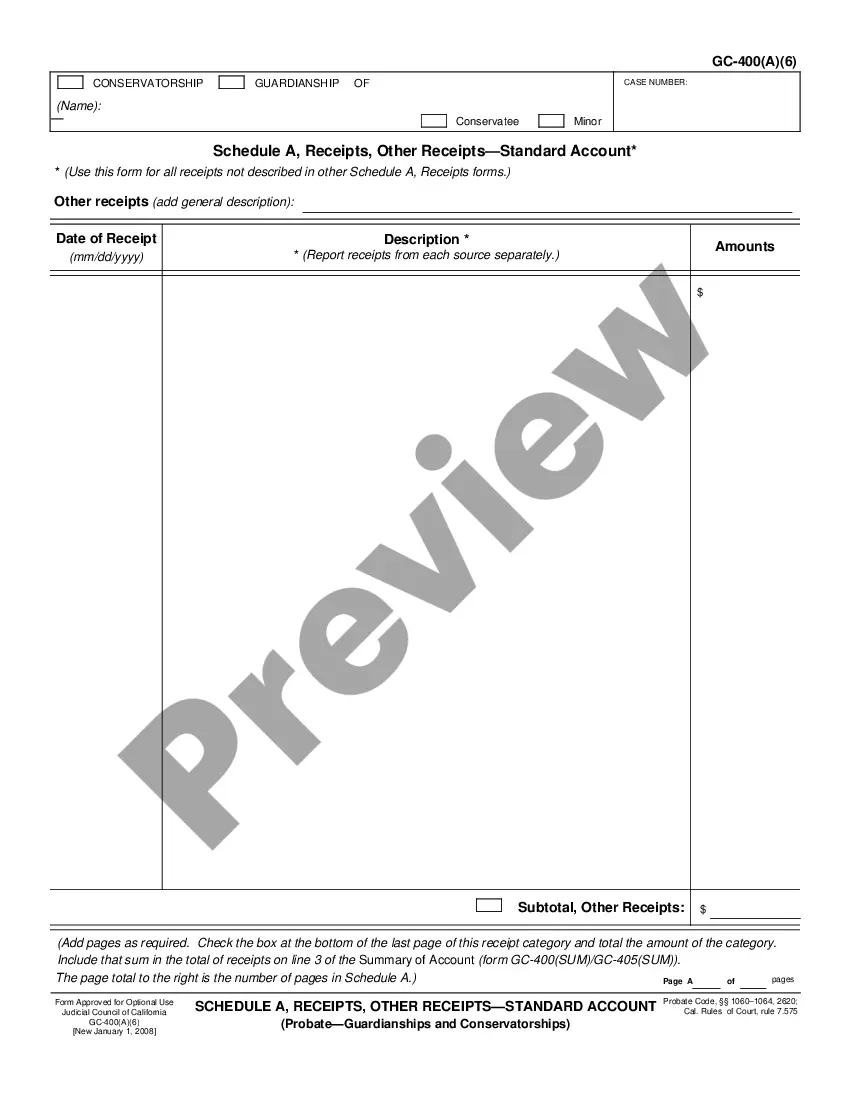

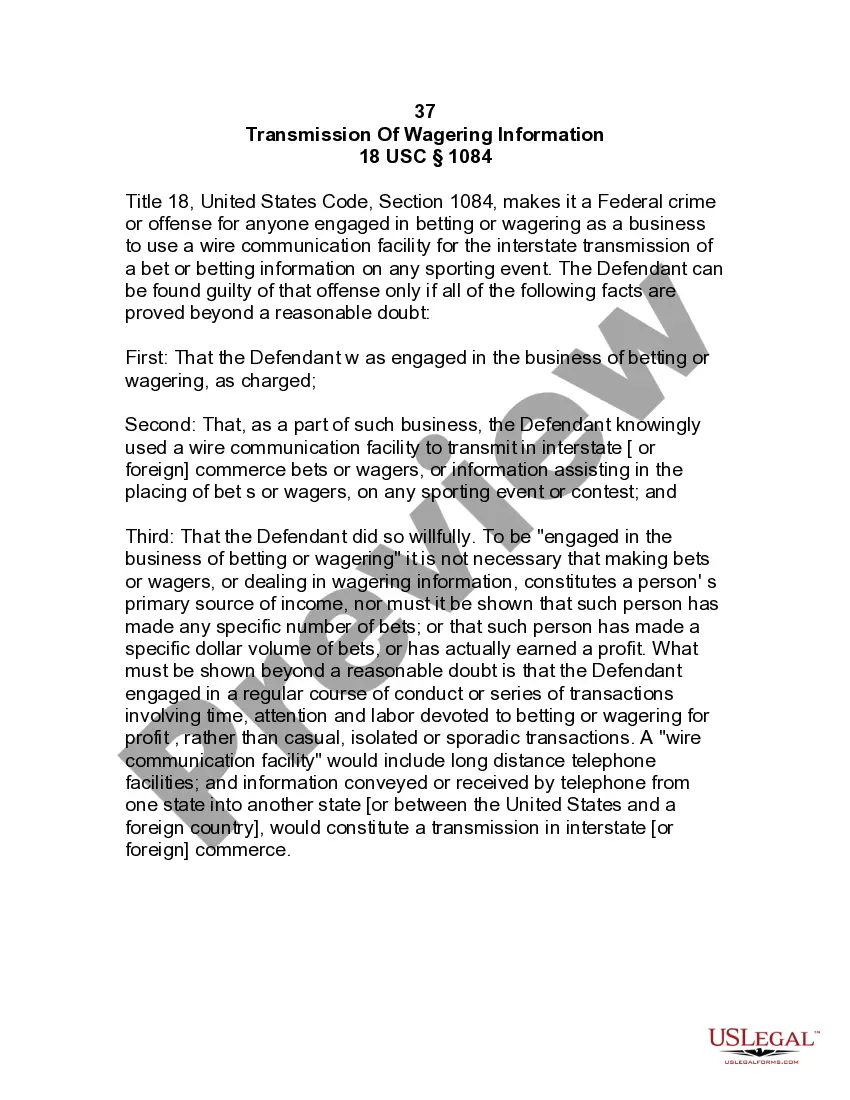

To the extent a dividend is not declared or set aside for a series of Preferred Stock for a designated quarterly dividend period, then the holder of such series of Preferred Stock will have no claim or right to such dividend payment in the future.

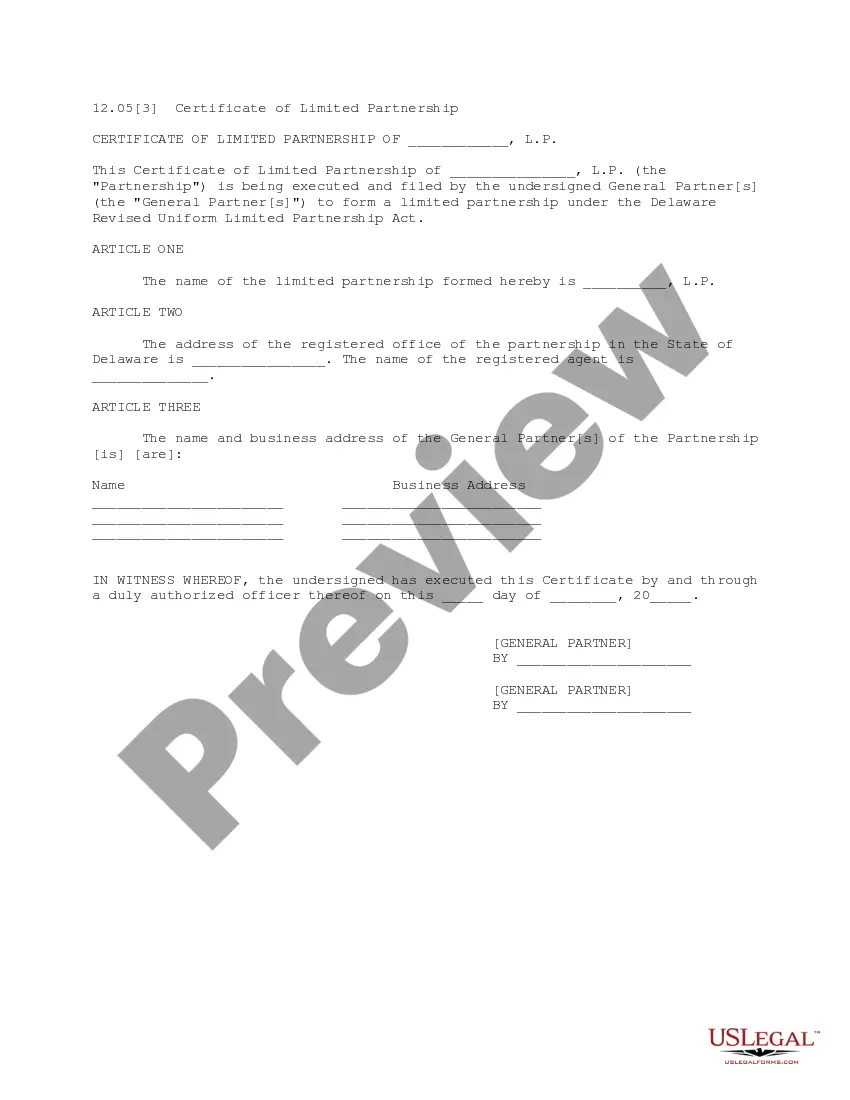

A restated certificate of incorporation may omit (a) such provisions of the original certificate of incorporation which named the incorporator or incorporators, the initial board of directors and the original subscribers for shares, and (b) such provisions contained in any amendment to the certificate of incorporation

When preferred stock is cumulative, preferred dividends not declared in a given period are called dividends in arrears. Dividends may be declared and paid in cash or stock. A debit balance in the Retained Earnings account is identified as a deficit. 11.

Restated Articles of Incorporation can be mailed to Secretary of State, Document Filing Support Unit, 1500 11th Street, 3rd Floor, Sacramento, CA 95814 or delivered in person (drop off) to the Sacramento office. Certificates of Amendment are filed only in the Secretary of State's Sacramento office.

The Articles of Amendment, also sometimes called a Certificate of Amendment, is a document filed with your state of incorporation (or any states in which your company has foreign qualified to transact business), to enact a specific change to the information included in your company's incorporation or qualification

Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed in the past, the dividends owed must be paid out to cumulative preferred shareholders first.

What is Cumulative Preferred Stock? Cumulative preferred stock is a class of shares wherein any unpaid or undeclared dividends for the current year must be accumulated and paid for in the future. However, such stocks are costlier, do not have voting rights, and cannot demand interim dividends.

Preference dividends are cumulative in the sense that if they are not paid in one particular year, they will be carried forward as arrears and must be paid before dividends are given to common stockholders. In noncumulative preference dividends, if dividends are missed they are never paid.

Restated Certificate of Incorporation means the certificate of incorporation of the Company, restated and filed pursuant to the Plan and including the Preferred Stock Certificate of Designation.