Kings New York Amendment of Restated Certificate of Incorporation is a legal document filed by Kings New York, a company incorporated in the state of New York, to modify the terms and conditions related to the dividend rate on its $10.50 cumulative second preferred convertible stock. In this amendment, Kings New York seeks to revise the existing dividend rate on its $10.50 cumulative second preferred convertible stock, which is a preferred stock that entitles its holders to receive a fixed dividend payment before any dividends are paid to common stockholders. The purpose of this amendment is to make changes in the rate at which these dividends are paid to the holders of the $10.50 cumulative second preferred convertible stock. By filing this amendment, Kings New York indicates its intention to adjust the dividend rate to better align with its financial goals and market conditions. The amendment will outline the new dividend rate, which is likely to be expressed as a percentage or a fixed amount per share. It is important to note that there may be different types or variations of this specific amendment relating to the dividend rate on the $10.50 cumulative second preferred convertible stock. These variations could include amendments that propose to increase or decrease the dividend rate, or even amendments that seek to eliminate or replace the $10.50 cumulative second preferred convertible stock altogether. Each specific amendment will have a unique name or identifier to distinguish it from others. For example, if a certain amendment proposes to increase the dividend rate, it could be named "Kings New York Amendment of Restated Certificate of Incorporation to Increase Dividend Rate on $10.50 Cumulative Second Preferred Convertible Stock." Similarly, if an amendment seeks to replace the stock with a new preferred stock, it may be named "Kings New York Amendment of Restated Certificate of Incorporation to Replace $10.50 Cumulative Second Preferred Convertible Stock." In conclusion, Kings New York Amendment of Restated Certificate of Incorporation is a legally binding document that outlines the changes made to the dividend rate on the $10.50 cumulative second preferred convertible stock. Different variations of this amendment may exist to address specific modifications concerning the dividend rate or even the replacement of the stock itself.

Kings New York Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock

Description

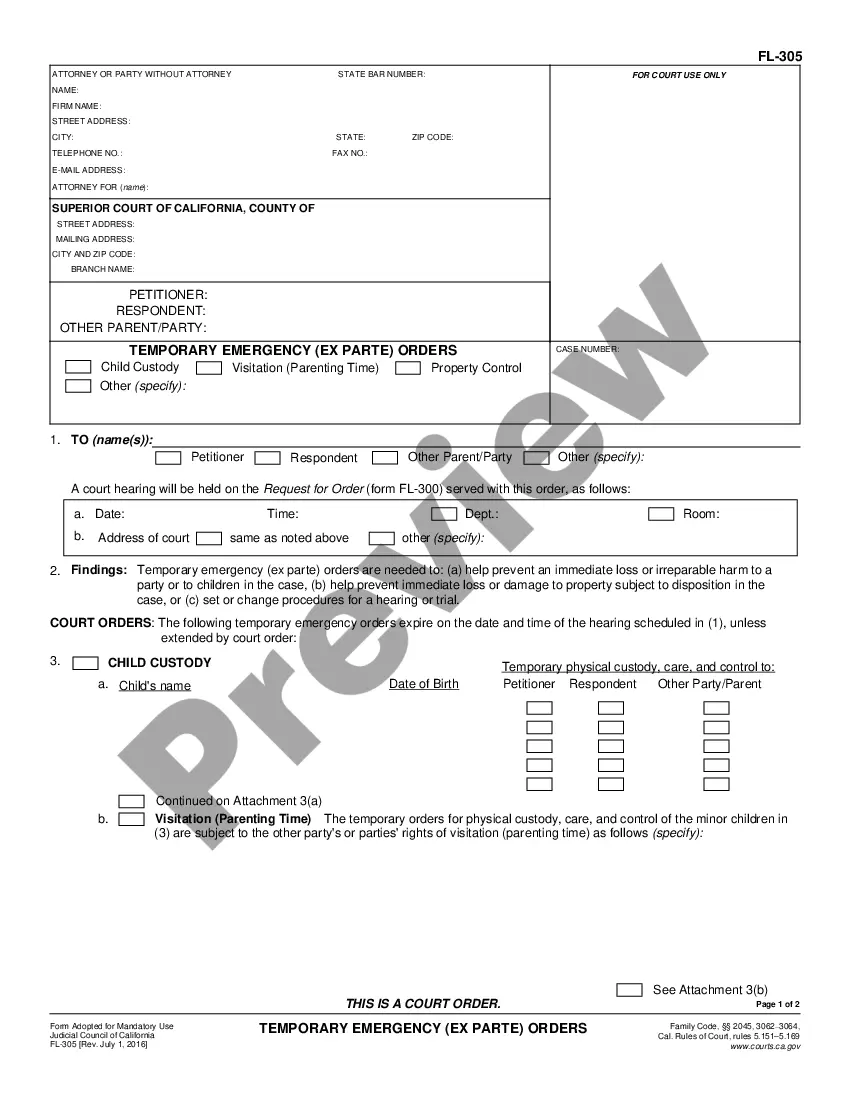

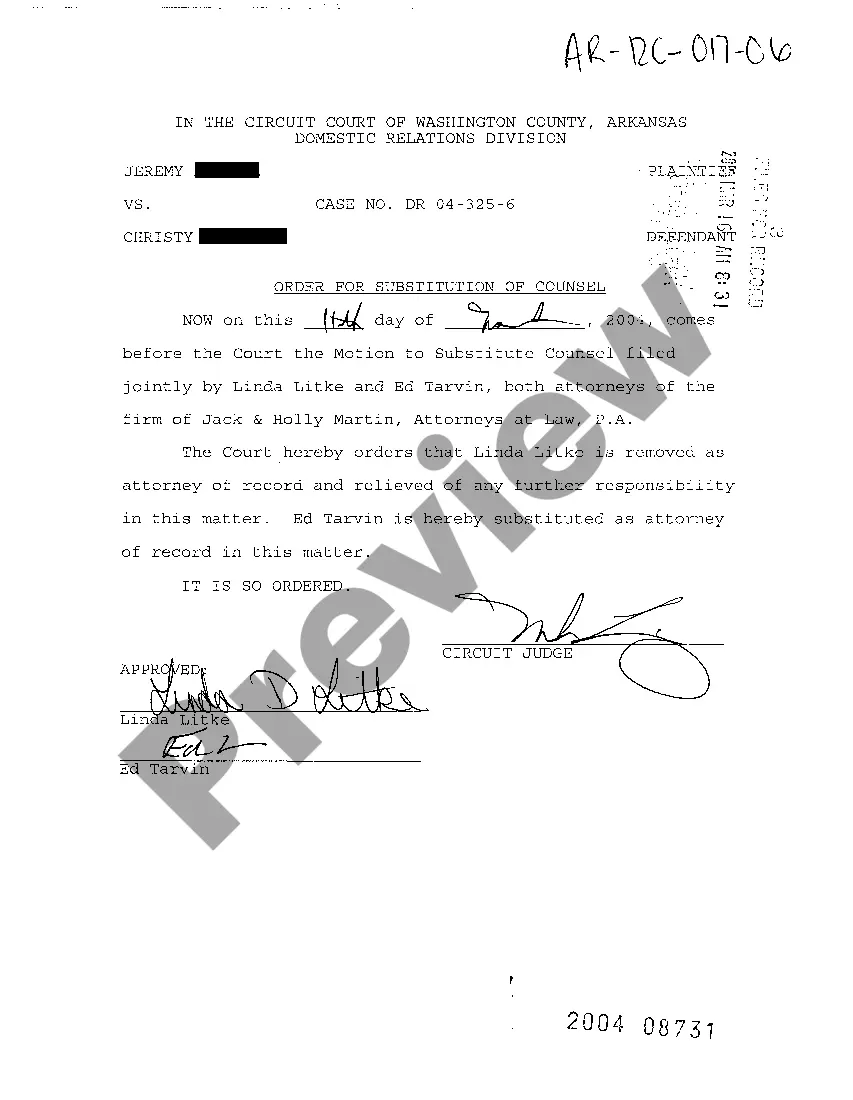

How to fill out Kings New York Amendment Of Restated Certificate Of Incorporation To Change Dividend Rate On $10.50 Cumulative Second Preferred Convertible Stock?

Are you looking to quickly draft a legally-binding Kings Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock or probably any other form to manage your own or corporate matters? You can go with two options: contact a legal advisor to write a legal paper for you or draft it completely on your own. The good news is, there's a third option - US Legal Forms. It will help you get neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-specific form templates, including Kings Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock and form packages. We provide templates for a myriad of life circumstances: from divorce papers to real estate documents. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- First and foremost, double-check if the Kings Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock is tailored to your state's or county's laws.

- If the document has a desciption, make sure to verify what it's suitable for.

- Start the search again if the form isn’t what you were looking for by utilizing the search bar in the header.

- Select the plan that is best suited for your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Kings Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Moreover, the paperwork we offer are reviewed by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!