The Nassau New York Amendment of Restated Certificate of Incorporation is a legal document that outlines changes to the dividend rate on the $10.50 cumulative second preferred convertible stock for a company incorporated in Nassau, New York. This amendment is an important aspect of corporate governance, as it affects the rights and benefits associated with this specific class of stock. The purpose of this amendment is to modify the existing dividend rate on the $10.50 cumulative second preferred convertible stock. By changing the dividend rate, the company aims to either increase or decrease the amount of money distributed to the holders of this stock class. This can have significant implications for shareholders, as it directly impacts their potential returns on investment. Keywords: Nassau New York, Amendment of Restated Certificate of Incorporation, dividend rate, $10.50 cumulative second preferred convertible stock, corporate governance, shareholders. Different types or classifications of the Nassau New York Amendment of Restated Certificate of Incorporation to change the dividend rate on $10.50 cumulative second preferred convertible stock may include: 1. Initial Amendment: This refers to the first modification made to the original Restated Certificate of Incorporation to change the dividend rate on the $10.50 cumulative second preferred convertible stock. 2. Subsequent Amendments: These are subsequent changes made to the Restated Certificate of Incorporation that further modify the dividend rate on the $10.50 cumulative second preferred convertible stock. They may be passed at different points in time, addressing evolving needs and market conditions. 3. Supplemental Amendments: These amendments might be made to address specific additional considerations regarding the dividend rate change on the $10.50 cumulative second preferred convertible stock. They are intended to provide further clarification or adjustments to the original or amended terms. 4. Amended and Restated Amendment: This type of amendment occurs when the original amendment to change the dividend rate on the $10.50 cumulative second preferred convertible stock is further modified or consolidated with other changes in a comprehensive manner. It creates a new version of the amendment that incorporates all previous modifications. Keywords: Initial Amendment, Subsequent Amendments, Supplemental Amendments, Amended and Restated Amendment, dividend rate, $10.50 cumulative second preferred convertible stock. By utilizing the relevant keywords throughout the content, this description effectively addresses the topic of the Nassau New York Amendment of Restated Certificate of Incorporation to change the dividend rate on $10.50 cumulative second preferred convertible stock and highlights potential variations or classifications of the amendment.

Nassau New York Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock

Description

How to fill out Nassau New York Amendment Of Restated Certificate Of Incorporation To Change Dividend Rate On $10.50 Cumulative Second Preferred Convertible Stock?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Nassau Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Nassau Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock from the My Forms tab.

For new users, it's necessary to make some more steps to get the Nassau Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock:

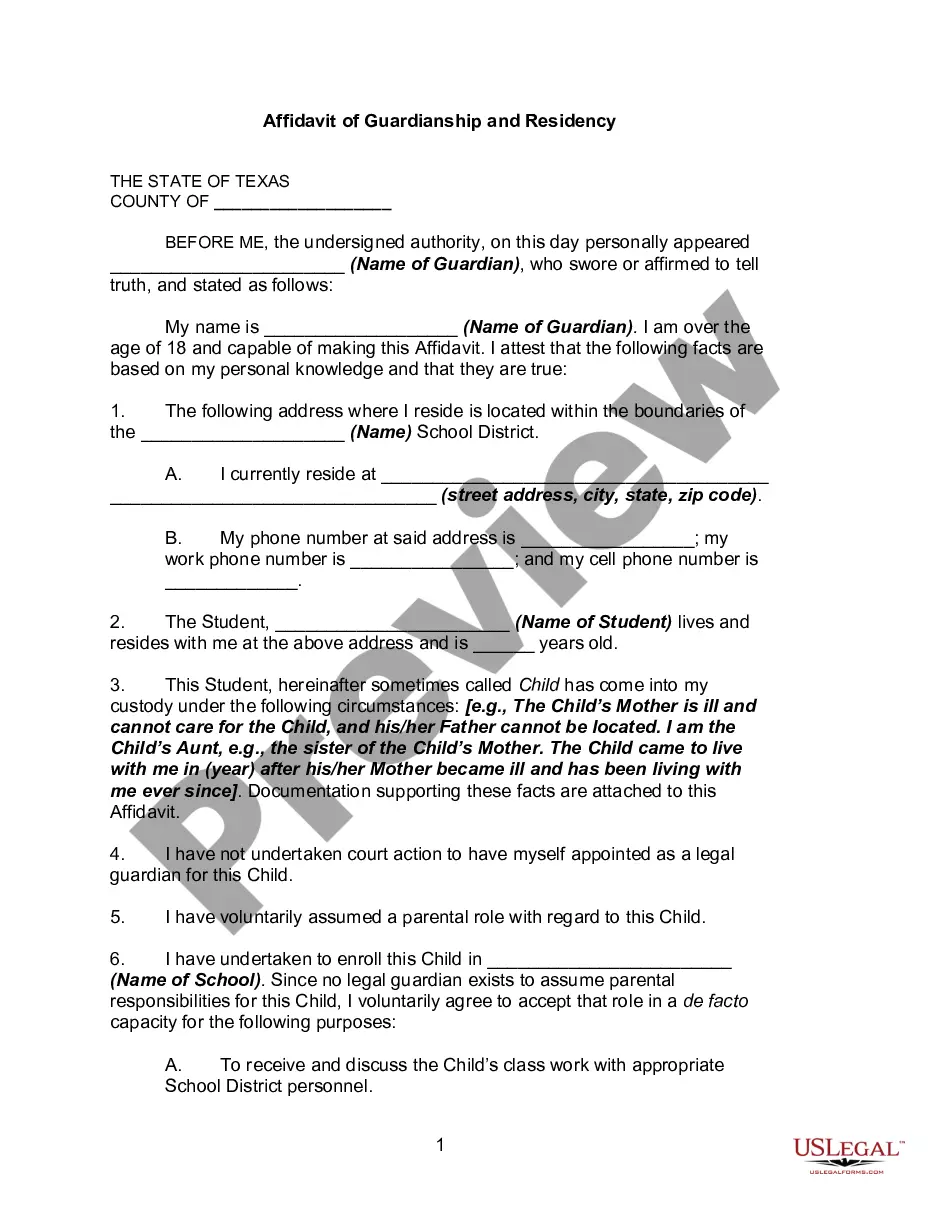

- Examine the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Dividends on common shares are payable only if and when declared by a corporation's board of directors. Any unpaid cumulative dividends must be paid before any dividends on common shares (or a class of lower-ranking preferred shares) are paid.

A certificate may not be amended against the will of the board of directors. Second, any amendments recommended by the board of directors must be approved by a vote of a majority of the outstanding shares of the corporation. A certificate may not be amended against the will of the majority of the stockholders.

When preferred stock is cumulative, preferred dividends not declared in a given period are called dividends in arrears. Dividends may be declared and paid in cash or stock. A debit balance in the Retained Earnings account is identified as a deficit. 11.

Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed in the past, the dividends owed must be paid out to cumulative preferred shareholders first.

A stock amendment is an economical way to increase the share structure. We can help. Simply call 800-345-2677, Ext. 6911 or email us. Please be advised we will need to know the total number of shares authorized along with the new par value.

Restated Charter means the amended and restated certificate or articles of incorporation of the Company, as in effect at the time of determination, including any certificates of designation or articles of amendment.

An Amended and Restated Certificate of Incorporation is a legal document filed with the Secretary of State that restates, integrates, and adjusts the startup's initial Articles of Incorporation (i.e. the company's Charter).

Amended means changed, i.e., that someone has revised the document. Restated means presented in its entirety, i.e., as a single, complete document. Accordingly, amended and restated means a complete document into which one or more changes have been incorporated.

Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split).

Corporations that, in separate filings, have amended sections of the original Articles of Incorporation, can use the Restated Articles of Incorporation (Form DC-4) to restate the entire articles of incorporation so that there is only one document to reference in the future.