San Diego California Amendment of Restated Certificate of Incorporation is a legal process that involves changing the dividend rate on the $10.50 cumulative second preferred convertible stock of a company incorporated in San Diego, California. This amendment is typically carried out to modify the rate at which dividends are paid to shareholders who hold the aforementioned stock. The purpose of this amendment is to provide flexibility to the company in adjusting the dividend rate to better align with its financial goals and market conditions. By changing the dividend rate, the company can have greater control over the distribution of profits and can potentially enhance shareholder value. The San Diego California Amendment of Restated Certificate of Incorporation allows for amendments to be made to the initial agreement and can provide a mechanism for altering the terms related to the $10.50 cumulative second preferred convertible stock. This change can also be seen as a strategic move to attract more investors and maintain competitiveness in the market. Different types of San Diego California Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock can include: 1. Annual Dividend Rate Adjustment Amendment: This amendment allows for an adjustment of the dividend rate on an annual basis, enabling the company to adapt to changing economic conditions or financial performance. 2. Special Dividend Rate Amendment: This amendment provides for a change in the dividend rate only in certain circumstances, such as during times of substantial growth or when specific financial milestones are achieved. 3. Threshold-Based Dividend Rate Amendment: This type of amendment establishes a threshold, either a minimum or maximum dividend rate, which triggers a change in the dividend rate on the $10.50 cumulative second preferred convertible stock. 4. Market-Driven Dividend Rate Amendment: This amendment enables the company to adjust the dividend rate based on market conditions, such as changes in interest rates or competitor dividend policies. It is important to note that specific terms and types of amendments for the San Diego California Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock may vary depending on the company's individual circumstances and objectives. Consulting with legal professionals familiar with San Diego, California corporate law would be essential in undertaking this amendment process.

San Diego California Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock

Description

How to fill out San Diego California Amendment Of Restated Certificate Of Incorporation To Change Dividend Rate On $10.50 Cumulative Second Preferred Convertible Stock?

Whether you intend to start your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business case. All files are grouped by state and area of use, so opting for a copy like San Diego Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to get the San Diego Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock. Adhere to the guidelines below:

- Make certain the sample fulfills your individual needs and state law regulations.

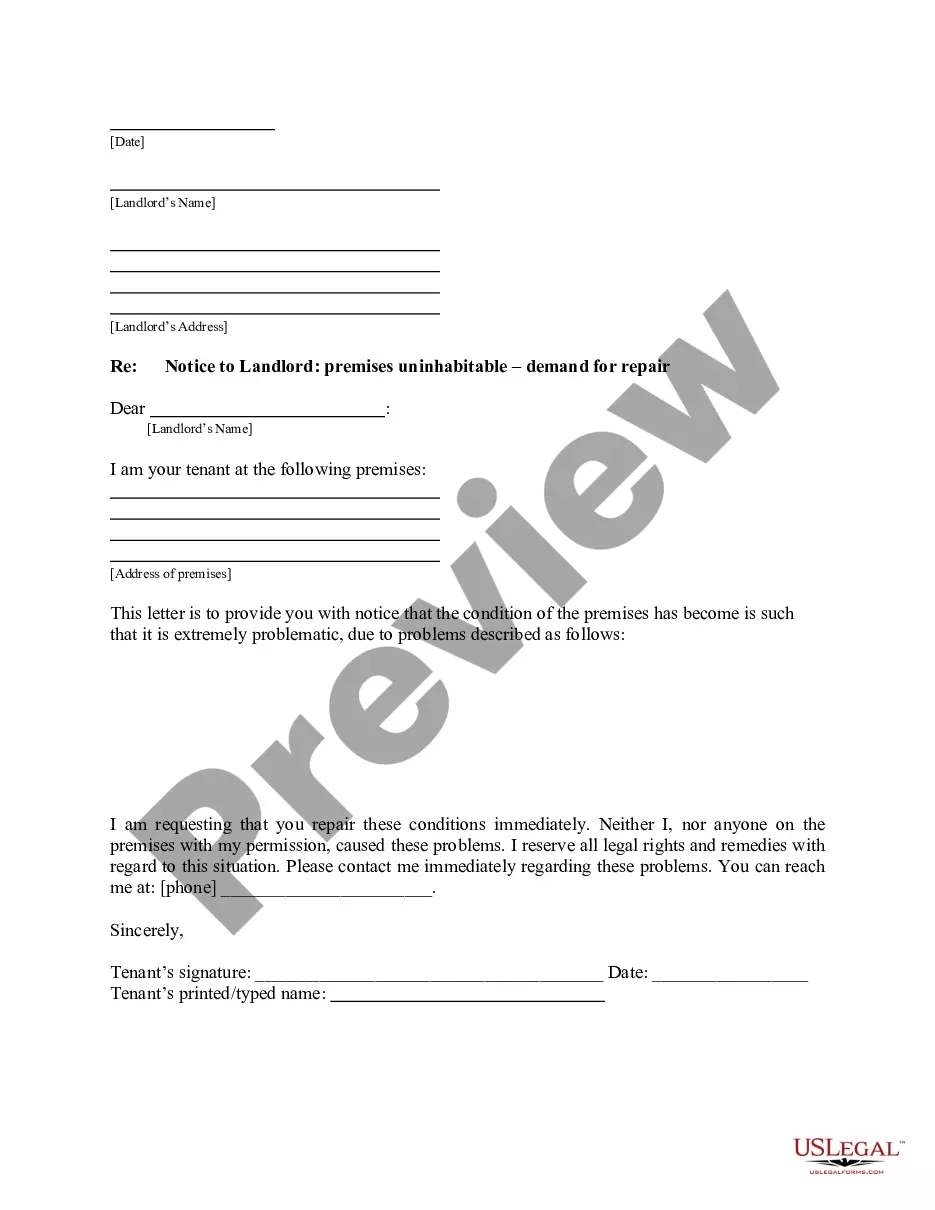

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!