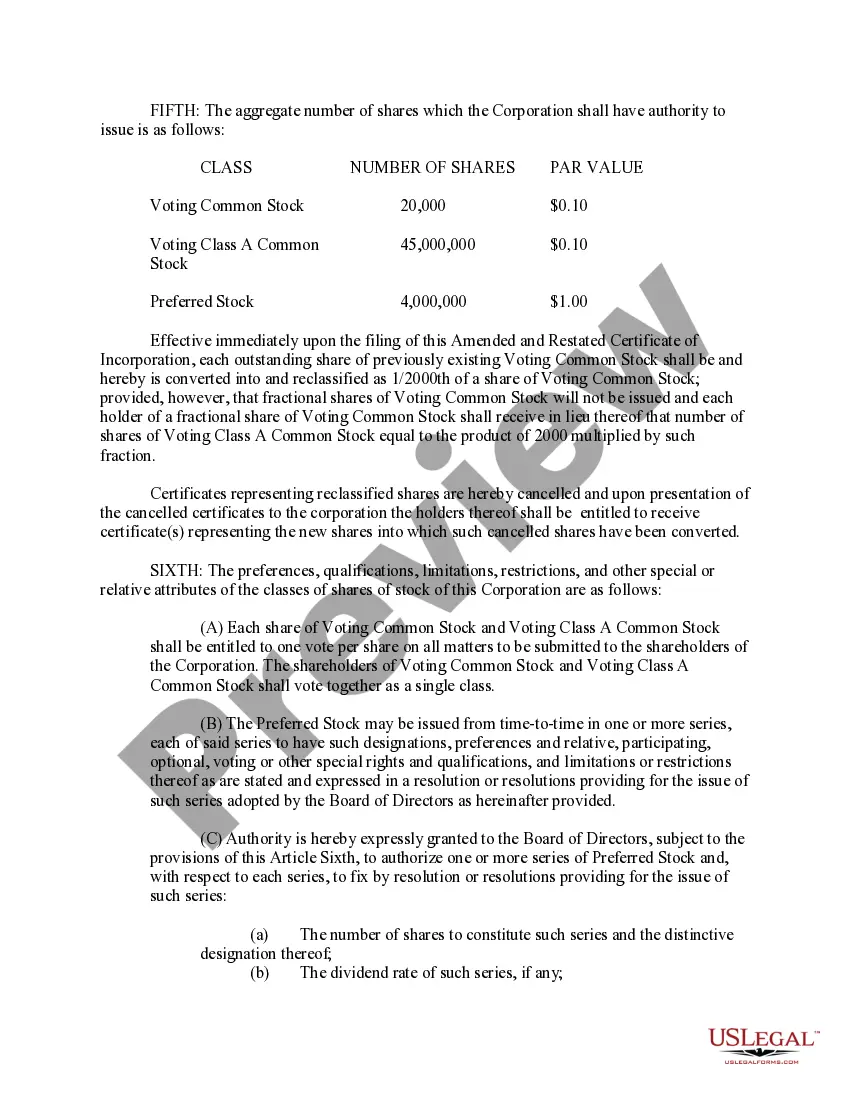

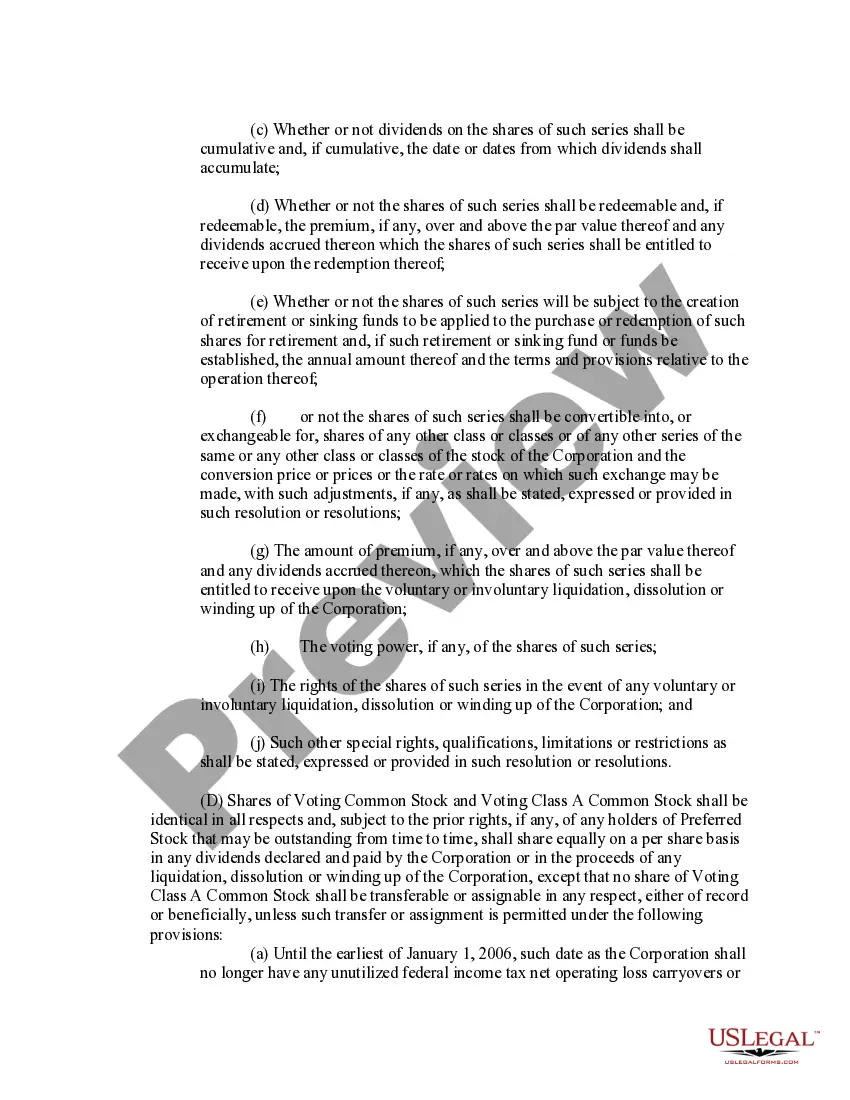

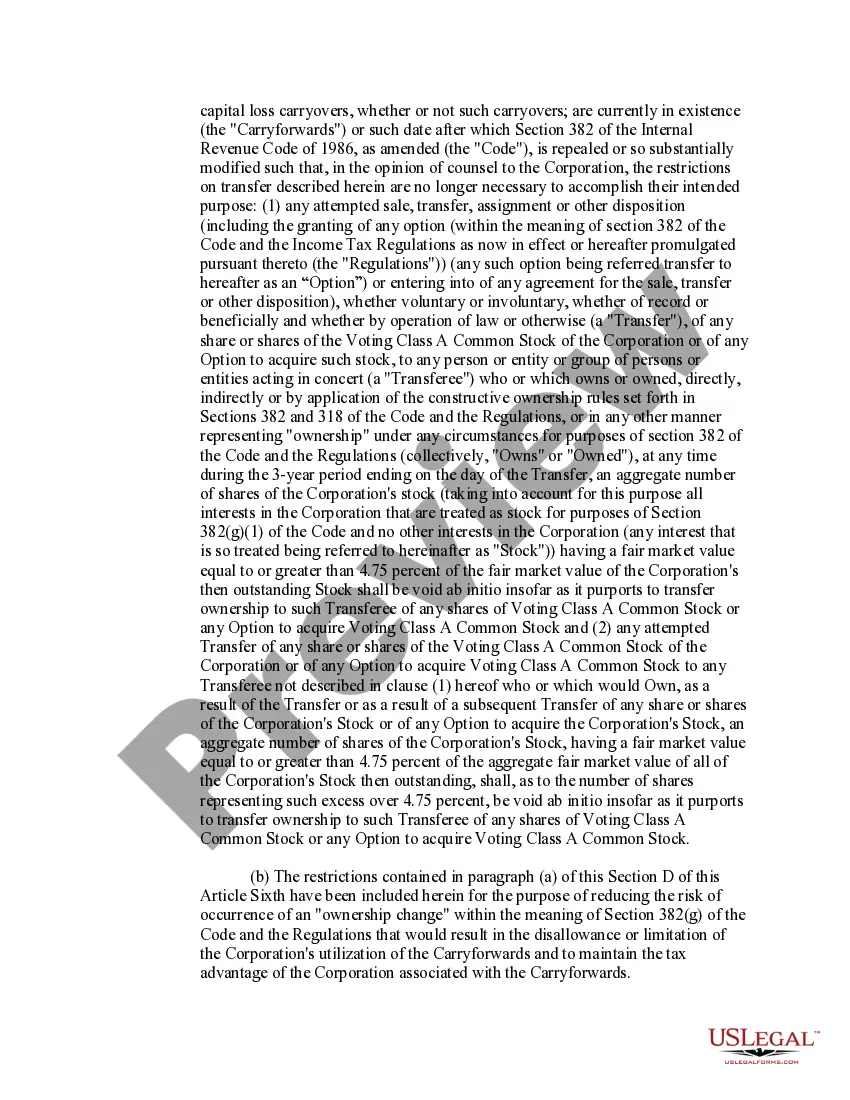

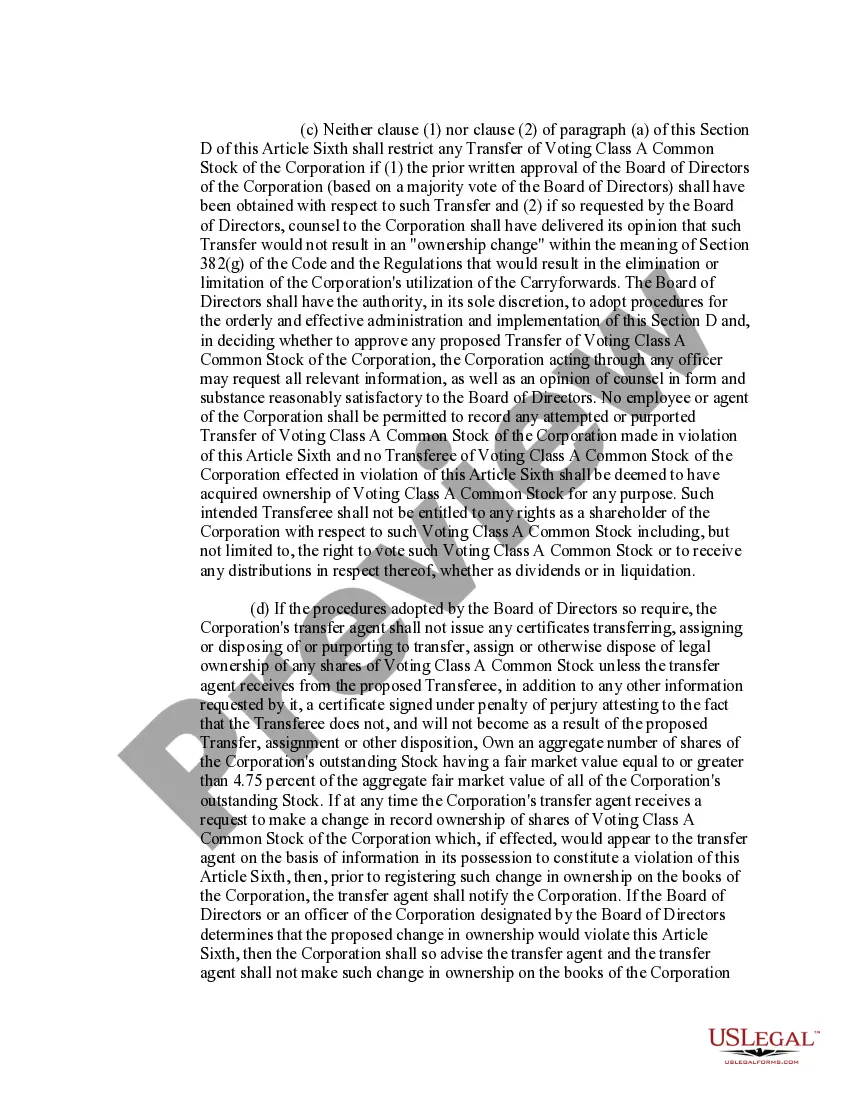

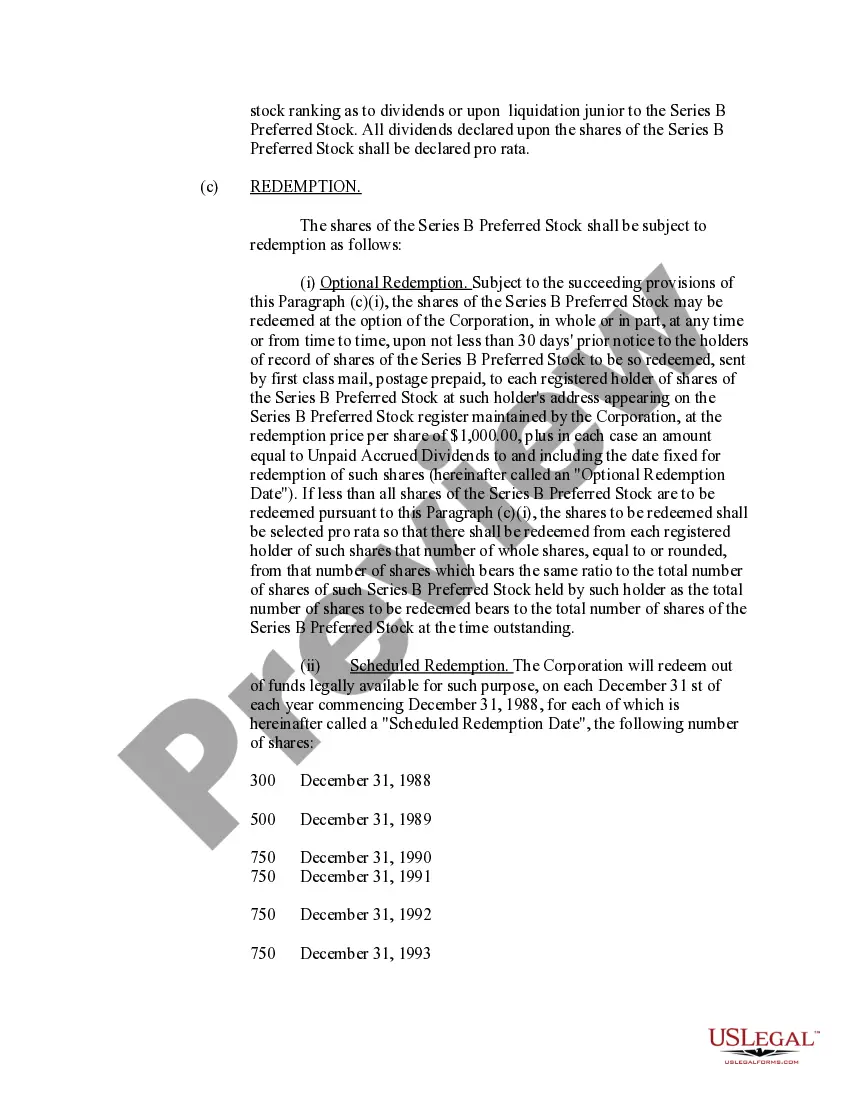

Cook Illinois Amended and Restated Certificate of Incorporation is a legal document that outlines the fundamental details of CMI Corporation, an Illinois-based company. This document serves as the foundation of the company's existence and defines various aspects of its operations. Here is a detailed description of the Cook Illinois Amended and Restated Certificate of Incorporation of CMI Corporation, including its various types: 1. Purpose: The Cook Illinois Amended and Restated Certificate of Incorporation of CMI Corporation specifies the primary purpose for which the company was formed. This may include engaging in business activities related to manufacturing, distribution, or providing services, among others. The purpose is essential for identifying the company's core operations. 2. Name and Location: The certificate outlines the legal name of the company, which in this case is CMI Corporation. It also specifies the location where the company is incorporated or formed, usually within the state of Illinois in this instance. The name and location details are crucial for identification and legal purposes. 3. Incorporation Details: This section of the certificate provides information regarding the original incorporation of CMI Corporation, including the date and place of incorporation. It details the amendments made to the original certificate and the subsequent restatement to ensure compliance with current laws and regulations. This demonstrates the company's commitment to maintaining transparency and legal compliance. 4. Duration: The certificate states the duration of the company's existence, which could be perpetual or for a specific period. This component clarifies how long the corporation can operate and helps potential stakeholders understand its longevity. 5. Authorized Capital Stock: This section specifies the maximum number of shares of stock that the company is authorized to issue. It may additionally outline the different classes of stock, such as common stock, preferred stock, or voting and non-voting stock. The authorized capital stock provides information regarding the ownership structure and potential investment opportunities within the company. 6. Board of Directors: The Cook Illinois Amended and Restated Certificate of Incorporation details the composition and responsibilities of the board of directors. It may outline the number of directors, their qualifications, and the terms of their office. This ensures that the company operates under effective leadership and governance. 7. Indemnification: This segment of the certificate addresses the indemnification of directors and officers against liabilities arising from their positions. It lays out the company's commitment to protecting its directors and officers and provides clarity regarding the extent of their liability protection. 8. Amendments: The certificate may include provisions regarding the amendment or alteration of its terms. It outlines the procedures and requirements for making changes to the certificate itself—a critical aspect for adapting to evolving business needs. Types of Cook Illinois Amended and Restated Certificate of Incorporation of CMI Corporation: 1. Original Certificate of Incorporation: This is the initial legal document that establishes the formation of CMI Corporation and outlines its primary details. 2. Amended Certificate of Incorporation: This type of Certificate is created when changes or updates are made to the original Certificate of Incorporation. These changes may include updates to the purpose, authorized capital stock, or board composition, among other essential components. 3. Restated Certificate of Incorporation: A restated certificate consolidates all the previous changes made to the original certificate, creating a new, comprehensive document. It ensures that the company's founding principles and amendments are accurately reflected in a single authoritative document. In conclusion, the Cook Illinois Amended and Restated Certificate of Incorporation is a vital legal document that establishes the core details of CMI Corporation. It encompasses various aspects, such as purpose, location, authorized capital stock, board structure, indemnification, and amendment procedures. Understanding the different types, including the original, amended, and restated certificates, provides a comprehensive understanding of CMI Corporation's history and ongoing compliance with legal requirements.

Cook Illinois Amended and Restated Certificate of Incorporation of CMI Corporation

Description

How to fill out Cook Illinois Amended And Restated Certificate Of Incorporation Of CMI Corporation?

Drafting documents for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to create Cook Amended and Restated Certificate of Incorporation of CMI Corporation without professional assistance.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Cook Amended and Restated Certificate of Incorporation of CMI Corporation by yourself, using the US Legal Forms online library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Cook Amended and Restated Certificate of Incorporation of CMI Corporation:

- Examine the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that fits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any use case with just a couple of clicks!

Form popularity

FAQ

The Articles of Amendment, also sometimes called a Certificate of Amendment, is a document filed with your state of incorporation (or any states in which your company has foreign qualified to transact business), to enact a specific change to the information included in your company's incorporation or qualification

Amended Birth Certificate definition. An amended birth certificate is a certificate that was officially edited and changed from its original form.

A certificate of amendment is a legal document that amends the articles of incorporation. It can amend anything from the name and address to the number of shares available for issuance and voting rights.

Articles of Amendment are filed when your business needs to add to, change or otherwise update the information you originally provided in your Articles of Incorporation or Articles of Organization.

Restated articles of organization are simply a modified version of the original. Limited liability companies, also known as LLCs, are permitted to make changes to their articles of organization. When such changes are made, they are referred to as amendments.

Amended means changed, i.e., that someone has revised the document. Restated means presented in its entirety, i.e., as a single, complete document. Accordingly, amended and restated means a complete document into which one or more changes have been incorporated.

An Amended and Restated Certificate of Incorporation is a legal document filed with the Secretary of State that restates, integrates, and adjusts the startup's initial Articles of Incorporation (i.e. the company's Charter).

Related Definitions Amended and Restated Charter means the bylaws (estatutos sociales) to be adopted by the combined company in connection with the Closing, attached to this proxy statement/prospectus as Annex E.

Something that's been changed or revised is amended. An amended version of your English paper has been rewritten or edited in some way. An amended piece of writing is fixed, and an amended opinion is improved in some way.

Amended means changed, i.e., that someone has revised the document. Restated means presented in its entirety, i.e., as a single, complete document. Accordingly, amended and restated means a complete document into which one or more changes have been incorporated.

Interesting Questions

More info

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.