Allegheny Pennsylvania Reclassification of Class B common stock into Class A common stock refers to a corporate action undertaken by a company based in Allegheny, Pennsylvania, aimed at upgrading the rights and privileges associated with its Class B common shares to be on par with those of its Class A common shares. This reclassification essentially merges the two classes of shares by consolidating them into a unified Class A common stock, often resulting in enhanced voting rights and other benefits for the shareholders. The process of Allegheny Pennsylvania Reclassification of Class B common stock into Class A common stock can vary depending on the company's specific circumstances and objectives. However, some common types of reclassification include: 1. Simplification: In this type of reclassification, a company may decide to consolidate its multiple classes of common stock into a single class. By eliminating the distinction between Class A and Class B common shares, shareholders' voting rights are unified and made equal. This process can streamline corporate governance and enhance transparency. 2. Equity Conversion: Companies may opt for reclassification when they wish to convert certain types of equity, such as preferred stock or convertible debt, into common stock. By transforming the Class B common stock into Class A common stock, the company ensures a uniform ownership structure among shareholders. 3. Merger or Acquisition: When a company undergoes a merger or acquisition, reclassification might be necessary to unify the shares of the acquiring and target companies. By reclassifying their respective Class B common stock into Class A common stock, both entities align ownership rights and facilitate the integration process. 4. Capital Restructuring: Reclassification in this context refers to a strategic decision by a company to reorganize and modify its capital structure. It may involve changing the rights and features associated with the company's Class B common shares into Class A common shares to bring about greater flexibility, efficiency, or attract new investors. 5. Compliance Requirements: Reclassification may also be undertaken to meet regulatory or stock exchange listing requirements. By upgrading the Class B common stock into Class A common stock, a company might fulfill the prerequisites necessary for listing on a specific stock exchange or gaining compliance with certain regulations. Companies pursuing the Allegheny Pennsylvania Reclassification of Class B common stock into Class A common stock aim to align shareholder interests, simplify corporate structure, and potentially unlock additional value. This action is often driven by strategic considerations, governance objectives, or external factors influencing the company's desired capital structure.

Allegheny Pennsylvania Reclassification of Class B common stock into Class A common stock

Description

How to fill out Allegheny Pennsylvania Reclassification Of Class B Common Stock Into Class A Common Stock?

How much time does it usually take you to draw up a legal document? Considering that every state has its laws and regulations for every life sphere, finding a Allegheny Reclassification of Class B common stock into Class A common stock meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. In addition to the Allegheny Reclassification of Class B common stock into Class A common stock, here you can find any specific form to run your business or personal deeds, complying with your regional requirements. Professionals verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can pick the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Allegheny Reclassification of Class B common stock into Class A common stock:

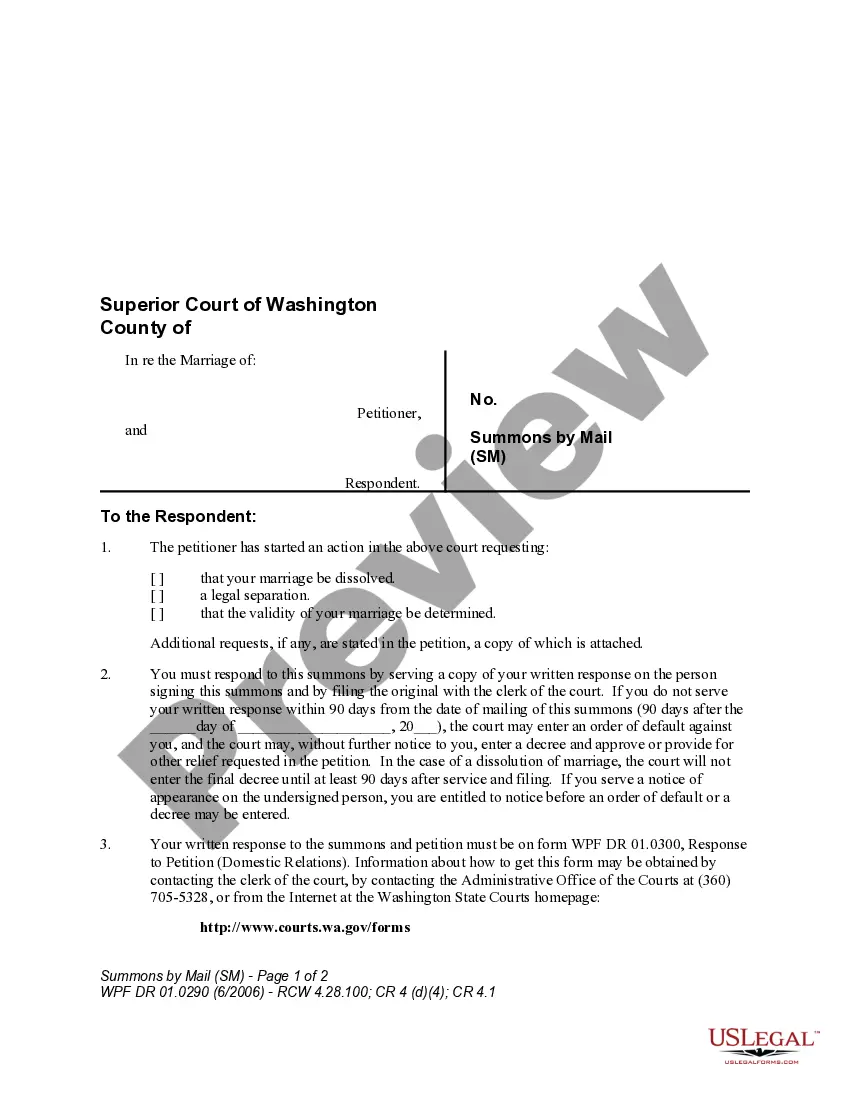

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Allegheny Reclassification of Class B common stock into Class A common stock.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!