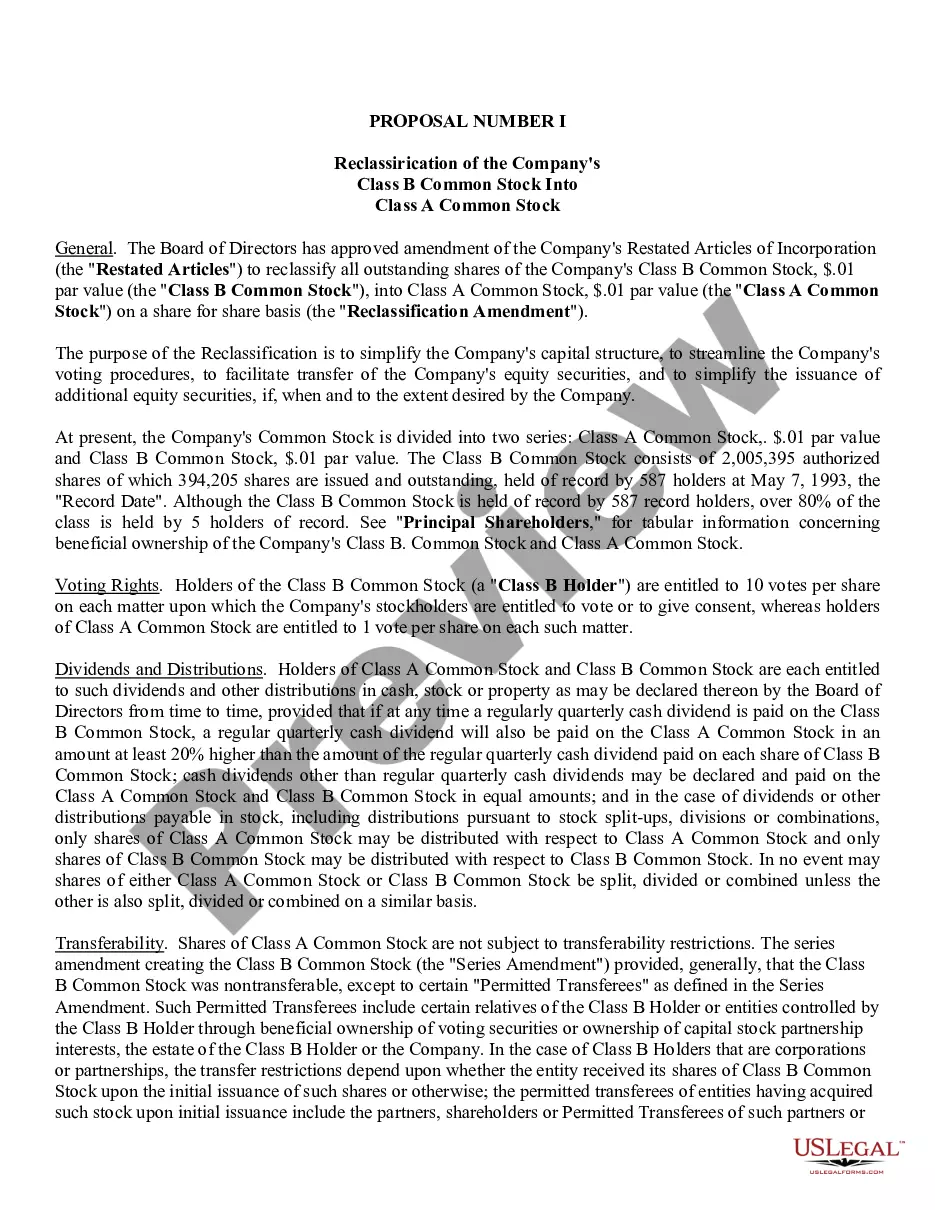

Houston, Texas Reclassification of Class B common stock into Class A common stock is a significant financial event that occurs when a company decides to convert its existing Class B common stock into Class A common stock. This reclassification process is often initiated to provide enhanced voting rights and economic benefits to the shareholders. During this reclassification, the company may introduce various types of Houston, Texas Reclassification of Class B common stock into Class A common stock, including: 1. Voting Rights Enriched Reclassification: In this type, the primary motive is to grant enhanced voting power to the shareholders. The company aims to consolidate the ownership and decision-making authority into the hands of a select group of Class A stockholders, which might include company executives, founders, or strategic partners. The reclassification boosts their voting influence while potentially limiting the voting rights of existing Class B stockholders. 2. Economic Privileges Advancement Reclassification: This type of reclassification seeks to offer increased economic benefits to Class A stockholders. The company may intend to differentiate the rights associated with each class of stock, such as dividend distribution or access to certain company assets. By reclassifying, the company aims to reward Class A stockholders with enhanced economic privileges. 3. Capital Structure Simplification Reclassification: Sometimes, a company may opt to reclassify its Class B common stock into Class A common stock to streamline its capital structure. By consolidating the two classes, the company simplifies its allocation of resources, thereby reducing complexities and potential conflicts arising from differential rights and obligations associated with different classes of stock. 4. Regulatory Compliance-Driven Reclassification: Occasionally, reclassification may be triggered by regulatory requirements. Regulatory bodies might impose conditions or restrictions on a company's capital structure, necessitating reclassification to meet compliance obligations. This type of reclassification aims to align the company's stock structure with legal or regulatory requirements applicable in Houston, Texas. The Houston, Texas Reclassification of Class B common stock into Class A common stock involves meticulous planning and execution, which typically includes shareholder voting, amendments to the company's articles of incorporation or bylaws, and compliance with applicable legal procedures. This financial event requires careful consideration of the shareholders' interests, corporate governance principles, and any potential impact on the company's stock market performance. By utilizing the appropriate Houston, Texas Reclassification of Class B common stock into Class A common stock, a company can strategically benefit its shareholders, enhance its governance structure, and potentially unlock value in the stock market.

Houston Texas Reclassification of Class B common stock into Class A common stock

Description

How to fill out Houston Texas Reclassification Of Class B Common Stock Into Class A Common Stock?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Houston Reclassification of Class B common stock into Class A common stock, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Houston Reclassification of Class B common stock into Class A common stock from the My Forms tab.

For new users, it's necessary to make some more steps to get the Houston Reclassification of Class B common stock into Class A common stock:

- Analyze the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Reclassification occurs when a mutual fund company changes the share class of certain issues. This may be done to add or remove a sales load from fund shares, or to require larger minimum investments for purchase.

Class A shares are common stocks, as are the vast majority of shares issued by a public company. Common shares are an ownership interest in a company and entitle purchasers to a portion of the profits earned. Investors in common shares are usually given at least one vote for each share they hold.

Explanation of income reclassification Income reclassification refers to changes that companies make to all or part of previously reported dividend (or interest) income to some other tax classification.

The process of converting issued shares from one class or group into another is called re-designation, re-classification, re-naming or converting of shares. It is referred to as share re-designation in the Companies Act 2006, however the process is more usually referred to as share re-classification.

Class C shares give stockholders an ownership stake in the company, just like Class A shares, but unlike common shares, they do not confer voting rights on shareholders. As a result, these shares tend to trade at a modest discount to Class A shares.

The amount reclassified into earnings from accumulated other comprehensive income is the portion of the swap's net gain or loss equivalent to the present value of the cash flows from the swap intended to offset the changes in the first forecasted transaction that is probable not to occur.

What Are Class B Shares? Class B shares are a classification of common stock that may be accompanied by more or fewer voting rights than Class A shares. Class B shares may also have lower repayment priority in the event of a bankruptcy.

Share reclassification is where a company limited by shares converts its shares from one class to another.

When more than one class of stock is offered, companies traditionally designate them as Class A and Class B, with Class A carrying more voting rights than Class B shares. Class A shares may offer 10 voting rights per stock held, while class B shares offer only one.

Some companies may refer to their Class B shares as preferred stock. These stocks are described as a hybrid between bonds and common stock as it has features of both securities. These dividends which come with these shares are paid to shareholders before common shareholders when a company goes bankrupt.