Palm Beach, Florida, is an affluent town located in Palm Beach County, Florida, known for its stunning beaches, upscale lifestyle, and luxurious amenities. This charming tourist destination offers a unique blend of natural beauty, cultural attractions, and historical richness. When it comes to financial matters, Palm Beach has also witnessed significant developments, including the reclassification of Class B common stock into Class A common stock. This reclassification is a restructuring of shares that can have several implications for both the company and its shareholders. In the case of Palm Beach, there are a few variations when it comes to the reclassification of Class B common stock into Class A common stock. These types may include: 1. Voluntary Reclassification: This type occurs when a company, usually for strategic purposes or to simplify its capital structure, decides to convert its Class B common stock into Class A common stock. By doing so, the company aims to streamline its governance and eliminate any potential disparities between different classes of shareholders. 2. Involuntary Reclassification: In certain cases, a reclassification of stock may be enforced by external factors, such as regulatory requirements or legal disputes. This situation may arise due to violations, non-compliance, or other issues that require the reclassification of Class B common stock into Class A common stock. 3. Dual-Class Reclassification: In some scenarios, a company may have multiple classes of common stock, each offering different voting or dividend rights. The reclassification in this case could involve merging the multiple classes into a single, unified class — typically Class A common stock. This consolidation aims to simplify the company's capital structure and promote corporate transparency. The reclassification of Class B common stock into Class A common stock holds significance for various stakeholders, including investors, shareholders, and the company itself. It can impact voting rights, dividend distribution, and influence corporate decision-making processes. Overall, Palm Beach, Florida, is not only renowned for its idyllic beaches and vibrant lifestyle but also serves as a backdrop for financial activities like the reclassification of Class B common stock into Class A common stock. Understanding the different types of reclassification is crucial for individuals interested in the intricate dynamics of this process, allowing them to grasp its implications and potential outcomes.

Palm Beach Florida Reclassification of Class B common stock into Class A common stock

Description

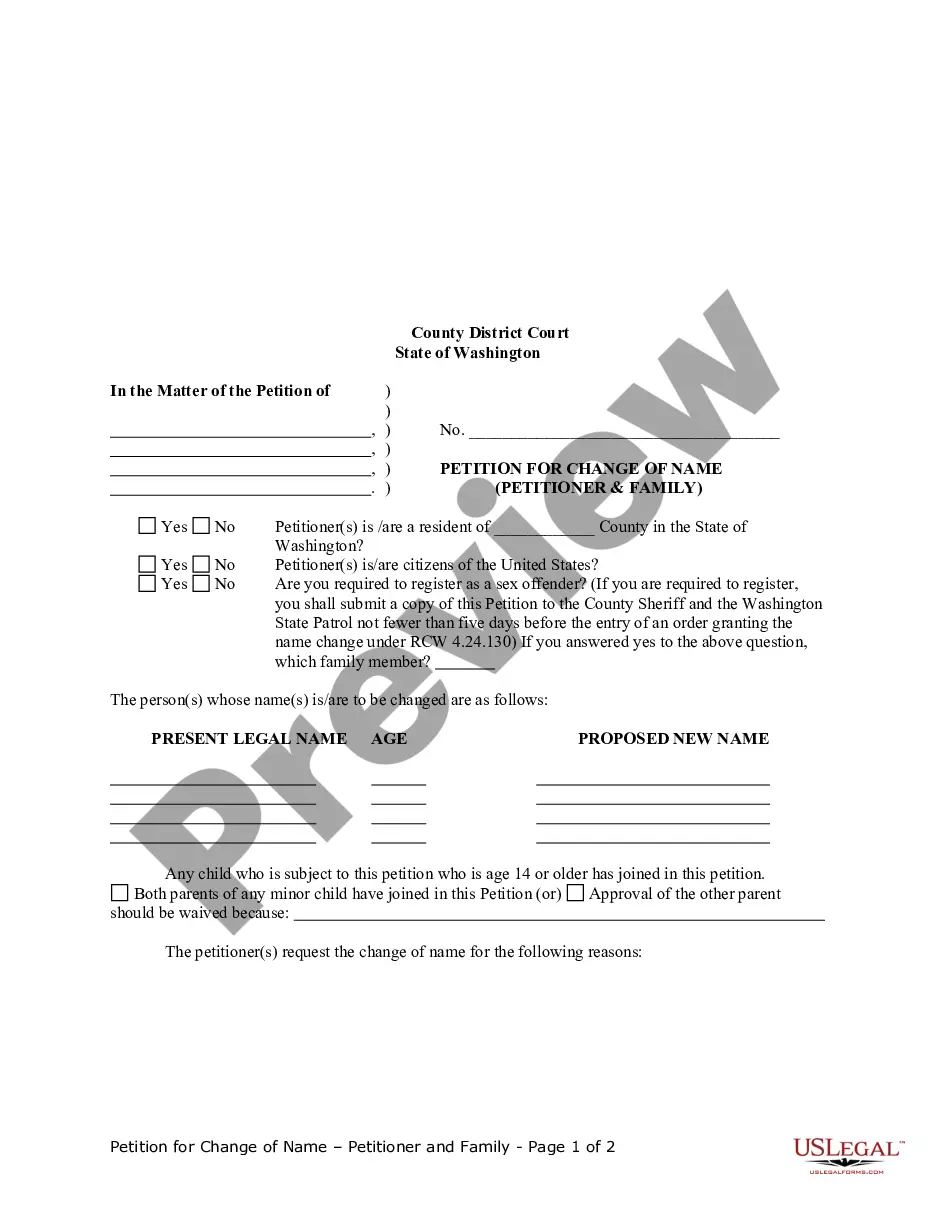

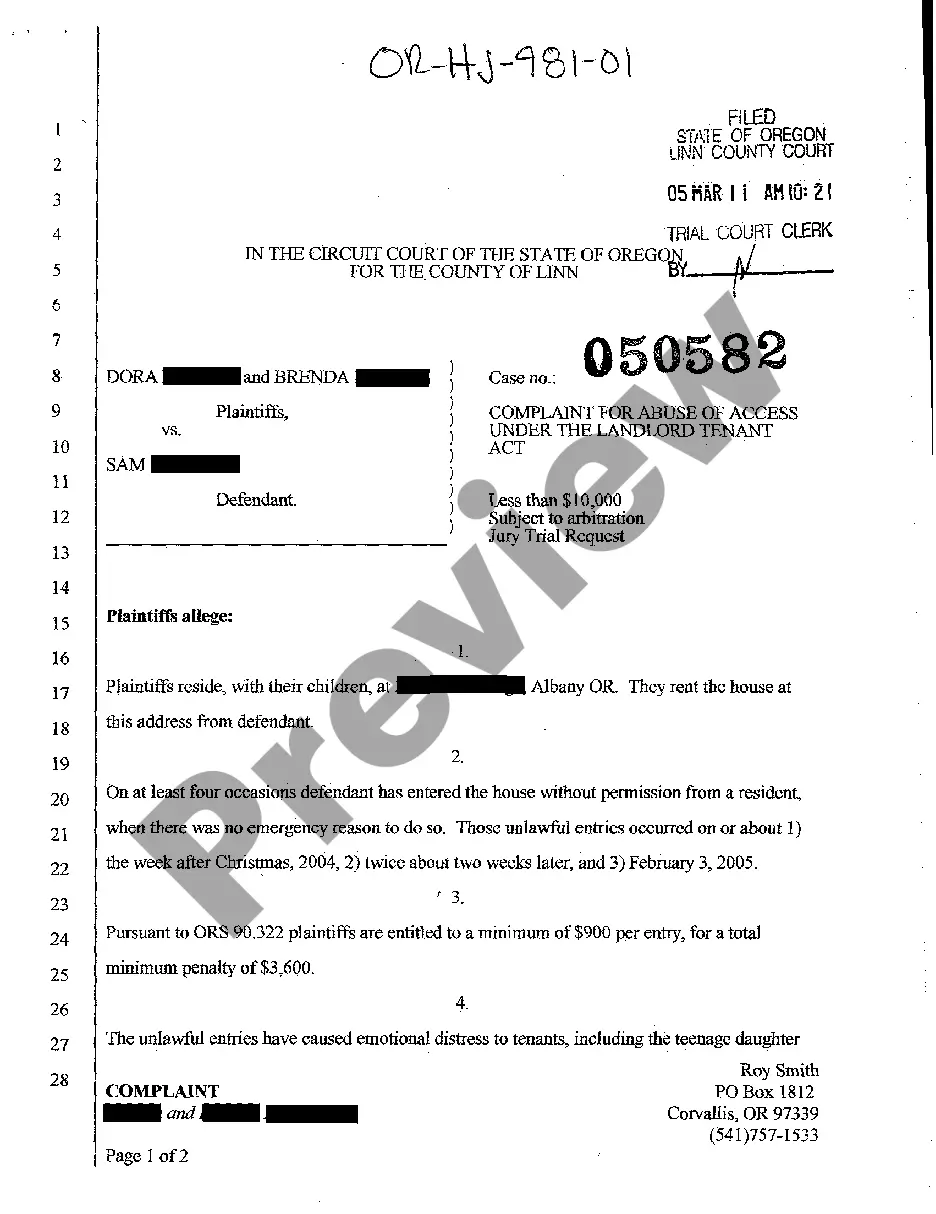

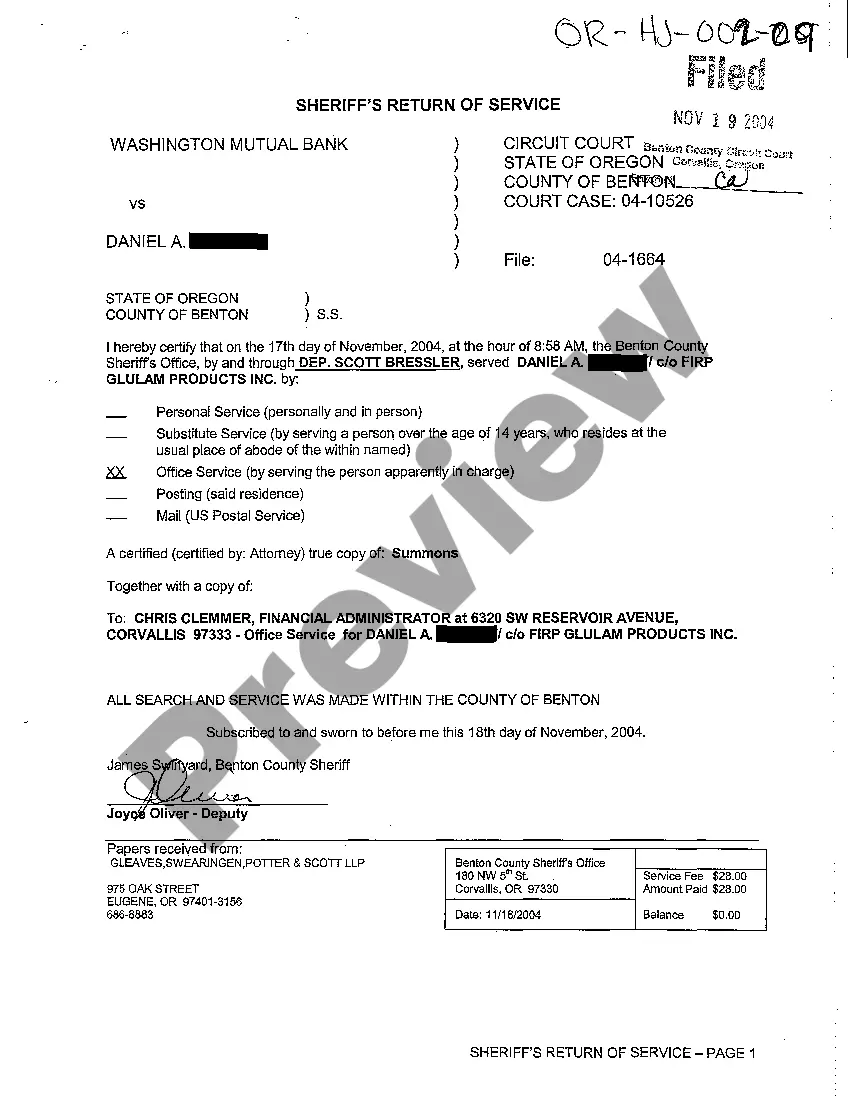

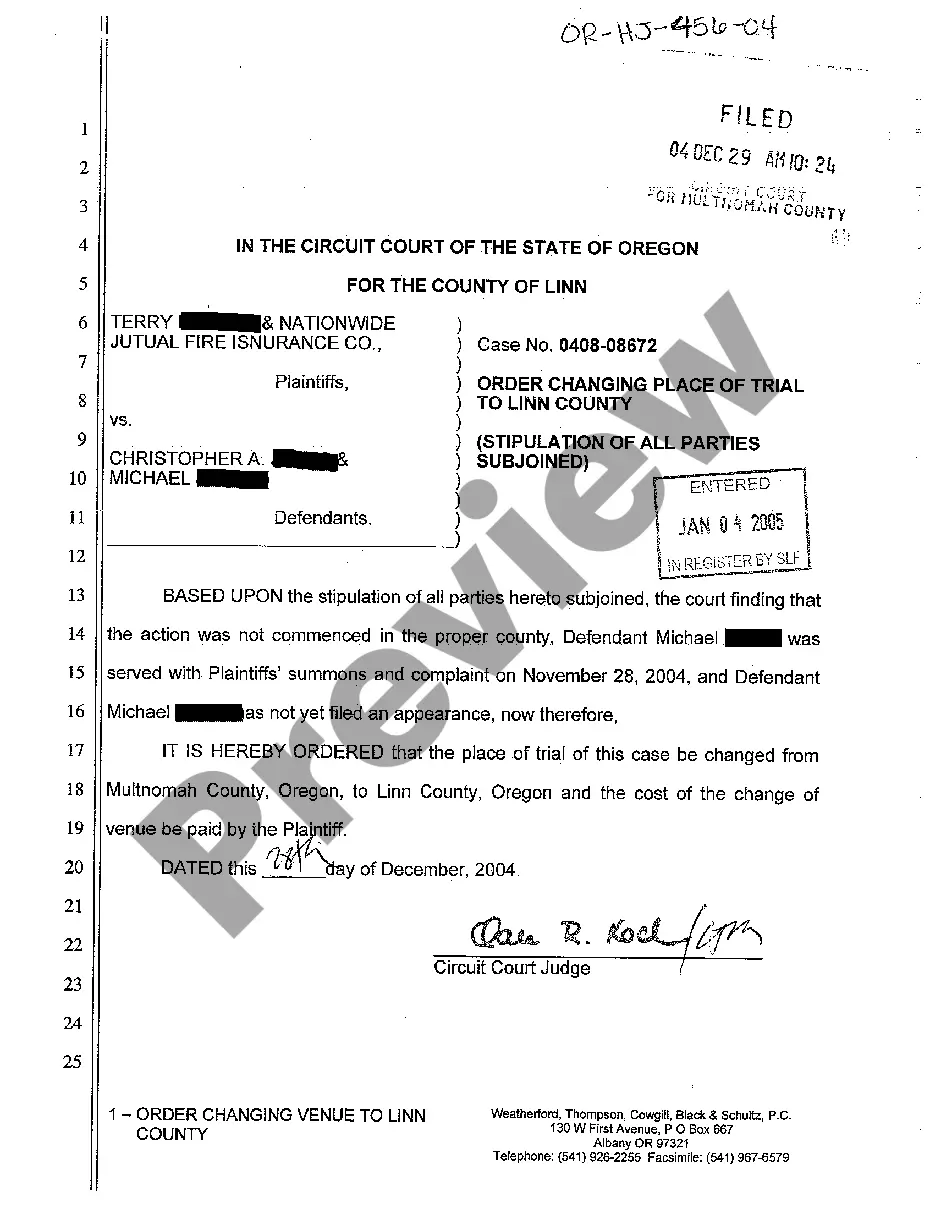

How to fill out Palm Beach Florida Reclassification Of Class B Common Stock Into Class A Common Stock?

Do you need to quickly draft a legally-binding Palm Beach Reclassification of Class B common stock into Class A common stock or maybe any other form to handle your own or corporate matters? You can go with two options: hire a legal advisor to draft a legal paper for you or create it entirely on your own. The good news is, there's another solution - US Legal Forms. It will help you receive professionally written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms provides a rich collection of over 85,000 state-compliant form templates, including Palm Beach Reclassification of Class B common stock into Class A common stock and form packages. We provide documents for an array of life circumstances: from divorce papers to real estate documents. We've been on the market for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra hassles.

- To start with, double-check if the Palm Beach Reclassification of Class B common stock into Class A common stock is adapted to your state's or county's laws.

- In case the form has a desciption, make sure to check what it's suitable for.

- Start the search again if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the plan that is best suited for your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Palm Beach Reclassification of Class B common stock into Class A common stock template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Moreover, the templates we provide are reviewed by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

After the approval to the resolution, the company needs to submit Form SH08 to notify Companies house about the change of class of shares. After notifying the change of class of shares to Companies house, new share certificates are created and issued to the relevant shareholders mentioning the changed class of share.

Class-A shares are held by regular investors and carry one vote per share. Class-B shares, held primarily by Brin and Page, have 10 votes per share. Class-C shares are typically held by employees and have no voting rights.

Class B shares are a classification of common stock that may be accompanied by more or fewer voting rights than Class A shares. Class B shares may also have lower repayment priority in the event of a bankruptcy.

Class A shares are common stocks, as are the vast majority of shares issued by a public company. Common shares are an ownership interest in a company and entitle purchasers to a portion of the profits earned. Investors in common shares are usually given at least one vote for each share they hold.

To start the conversion process: Click on the Share Classes tab and select the blue 'Share reorganisation' option. This will bring up the below options.Select convert the whole or part of a share class option. Simply add the date of change and which share class is being changed.

Investors purchasing Class B shares may instead pay a fee when selling their shares, but the fee may be waived when holding the shares five years or longer. In addition, Class B shares may convert to Class A shares if held long term.

As an investor, common stock is considered an asset. You own the property; the property has value and can be liquidated for cash. As a business owner, stock is something you use to get an influx of capital.

Class A, common stock: Each share confers one vote and ordinary access to dividends and assets. Class B, preferred stock: Each share confers one vote, but shareholders receive $2 in dividends for every $1 distributed to Class A shareholders. This class of stock has priority distribution for dividends and assets.

Any company can create different classes of shares by setting out those classes and the rights attached to them in the company's articles. If a company has only one class of shares they will be ordinary shares and will carry equal rights.

Class A, common stock: Each share confers one vote and ordinary access to dividends and assets. Class B, preferred stock: Each share confers one vote, but shareholders receive $2 in dividends for every $1 distributed to Class A shareholders. This class of stock has priority distribution for dividends and assets.