Title: San Antonio, Texas Reclassification of Class B Common Stock into Class A Common Stock: A Comprehensive Overview Introduction: The San Antonio, Texas reclassification of Class B common stock into Class A common stock is an essential process undertaken by companies to redefine their stock structure. This detailed description will provide an insightful overview of this reclassification, highlighting its significance, reasons behind its implementation, potential benefits, and key considerations. Additionally, we will explore any variations or types of this stock reclassification within the San Antonio area. 1. Understanding Reclassification of Class B Common Stock into Class A Common Stock: Reclassification refers to the redistribution or reclassification of an existing class of common stock by a company, altering its rights, privileges, or characteristics. In the case of San Antonio, Texas, this process centers around reclassifying Class B common stock into Class A common stock. 2. Significance and Objectives of Reclassification: The reclassification process serves multiple purposes: a. Enhanced Voting Power: Reclassification aims to concentrate voting power through Class A common stock, ensuring decision-making control predominantly rests with a specific group of stockholders. b. Improved Ownership Structure: It allows companies to establish a clear distinction between insider shareholders and public shareholders, reflecting a more defined ownership structure. 3. Reasons for Reclassifying Class B Common Stock into Class A Common Stock: Common motivations for the reclassification process include: a. Streamlining Governance: The reclassification provides companies with a more straightforward governance structure, establishing a class of shares that aligns with the interests of the company's management or founders. b. Long-Term Planning: Reclassification helps facilitate long-term planning by ensuring decision-making power remains concentrated with specific shareholders or management, who possess in-depth knowledge of the company's vision and goals. 4. Potential Benefits of Reclassification: The reclassification of Class B common stock into Class A common stock brings various advantages: a. Increased Flexibility: Reclassification enables companies to adapt to changing market conditions and raise capital quicker with greater flexibility. b. Enhanced Investor Confidence: Clearer ownership structure and concentrated voting power often lead to increased investor confidence, potentially attracting new investors. c. Strategic Alliances and Mergers: The reclassification process may make the company more appealing for potential strategic alliances, partnerships, or mergers where clear ownership structures are highly desirable. 5. Variations of Reclassification within San Antonio, Texas: While the process of reclassification itself remains consistent, variations may exist in terms of the reasoning or specific provisions implemented by different entities within the San Antonio area. These variations may arise based on the individual company's objectives or industry-specific requirements. a. Founder Control: Some reclassification may emphasize empowering founders or management teams, ensuring their sustained control over strategic decision-making. b. Voting Power Distribution: Companies may reclassify stocks to achieve a balanced voting power distribution among various stakeholders or investor classes. c. Industry-specific Restrictions: Certain industries, such as regulated utilities or financial institutions, may have distinct reclassification guidelines to comply with specific regulations governing their operations. Conclusion: The reclassification of Class B common stock into Class A common stock within San Antonio, Texas, is a strategic process undertaken by companies to redefine their ownership structure, voting rights, and decision-making capabilities. This comprehensive overview has shed light on the significance of this reclassification, its objectives, potential benefits, and even variations that may exist within the San Antonio area. Understanding these nuances is crucial for both companies and investors involved to make informed decisions and navigate the stock market effectively.

San Antonio Texas Reclassification of Class B common stock into Class A common stock

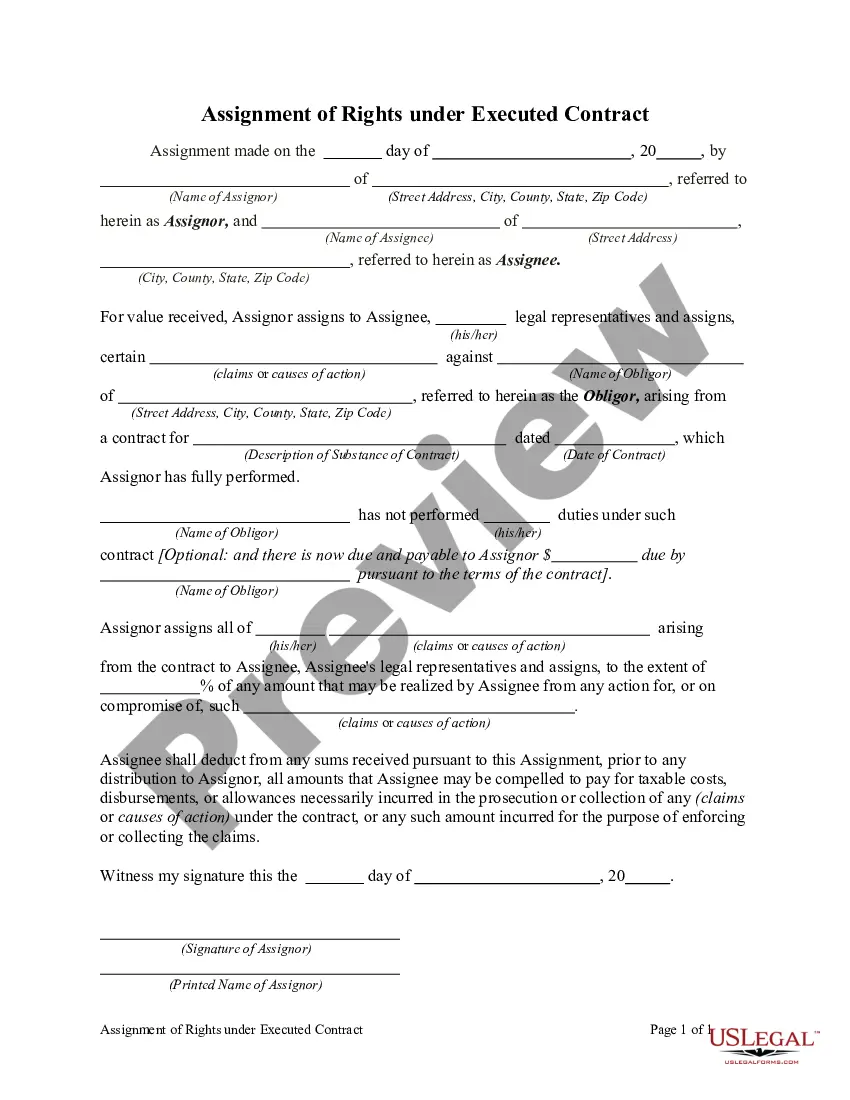

Description

How to fill out San Antonio Texas Reclassification Of Class B Common Stock Into Class A Common Stock?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the San Antonio Reclassification of Class B common stock into Class A common stock, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario collected all in one place. Therefore, if you need the latest version of the San Antonio Reclassification of Class B common stock into Class A common stock, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the San Antonio Reclassification of Class B common stock into Class A common stock:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your San Antonio Reclassification of Class B common stock into Class A common stock and save it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!