San Diego California is a vibrant coastal city located in Southern California, known for its beautiful beaches, pleasant weather, and diverse culture. It is home to various industries and is a hub for technology, biotech, defense, and tourism. Reclassification of Class B common stock into Class A common stock refers to a process where a company decides to convert certain shares of its Class B common stock into Class A common stock. This reclassification is often done to consolidate ownership, streamline corporate structure, or enhance the company's transparency and governance. In the context of San Diego California, there are several companies that have undergone or considered reclassification of Class B common stock into Class A common stock. Some prominent examples include: 1. Qualcomm Inc.: A global leader in wireless technology, Qualcomm went through a reclassification process in 2009, converting their dual-class stock structure into a single-class stock structure represented by Class A common stock. 2. Sempra Energy: A major energy infrastructure company, Sempra Energy reclassified its common stock structure in 2018, creating a new class of shares known as Class A common stock. 3. Realty Income Corporation: A real estate investment trust specializing in commercial properties, Realty Income executed a reclassification of its outstanding Class B common stock into Class A common stock in 1985. These examples demonstrate how San Diego-based companies have utilized the reclassification of Class B common stock into Class A common stock to shape their corporate structures, improve corporate governance, or align with market practices. If you are interested in San Diego California or the reclassification of Class B common stock into Class A common stock, it is worth noting that each company's reclassification may have specific terms, conditions, and implications. It is recommended to review the company's official statements, SEC filings, or consult with a financial advisor for accurate and up-to-date information.

San Diego California Reclassification of Class B common stock into Class A common stock

Description

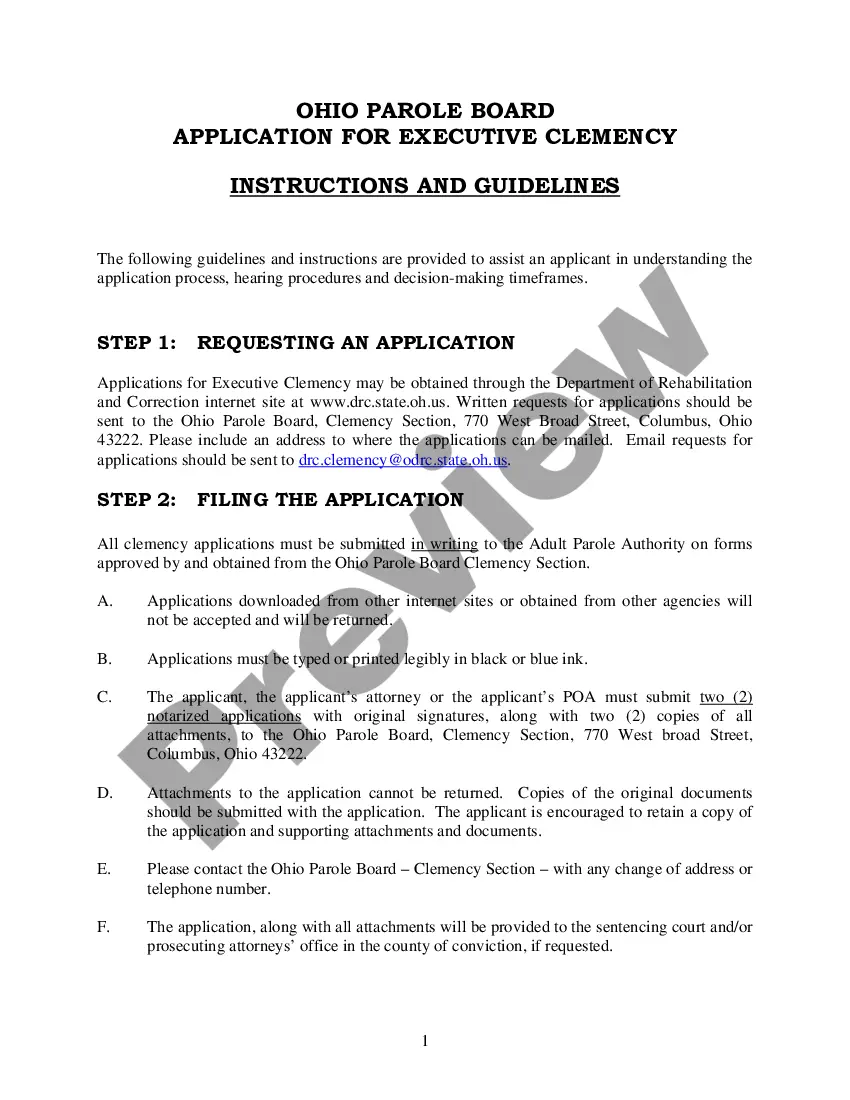

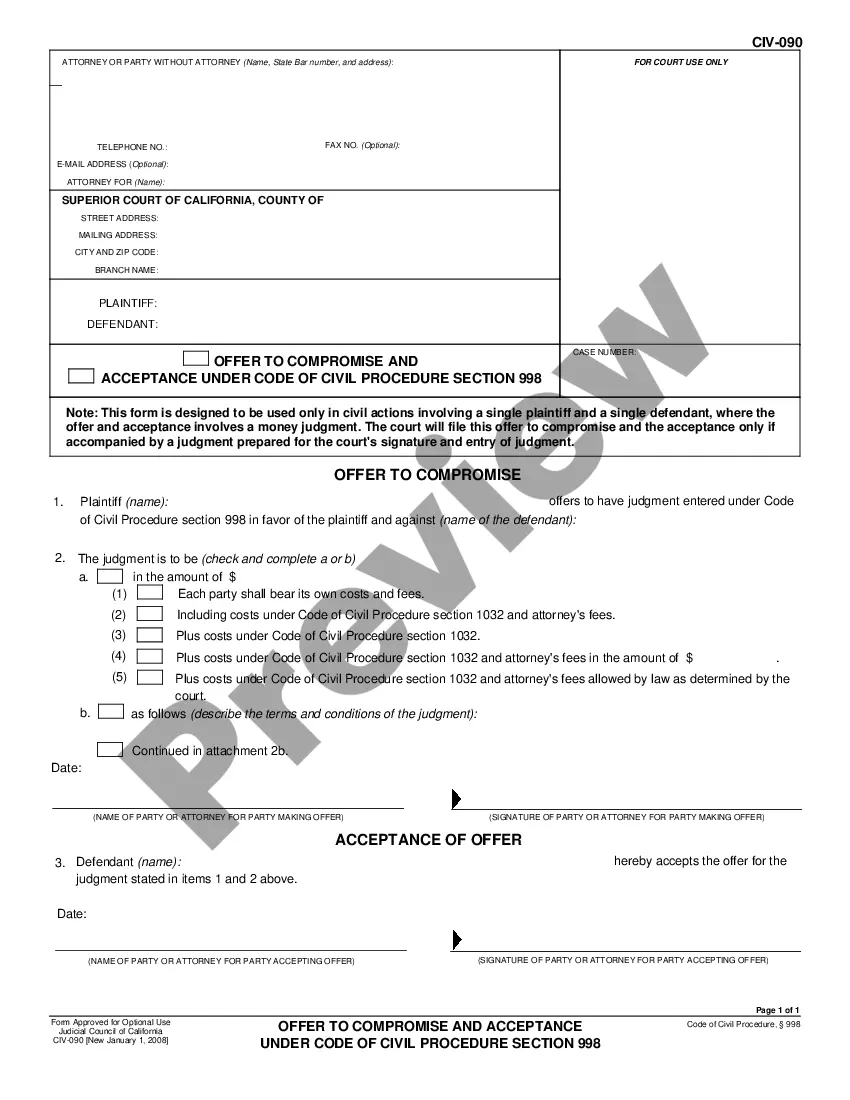

How to fill out San Diego California Reclassification Of Class B Common Stock Into Class A Common Stock?

Drafting papers for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create San Diego Reclassification of Class B common stock into Class A common stock without expert help.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid San Diego Reclassification of Class B common stock into Class A common stock on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the San Diego Reclassification of Class B common stock into Class A common stock:

- Examine the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that meets your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

Shares outstanding refer to a company's stock currently held by all its shareholders. These include share blocks held by institutional investors and restricted shares owned by the company's officers and insiders. A company's number of shares outstanding is not static and may fluctuate wildly over time.

OUTSTANDING CLASS B SHARES means the then-outstanding shares of Class B Common Stock of the Company, taking into account as outstanding for this purpose such Common Stock issuable upon the exercise of Options or warrants, the conversion of convertible stock or debt, and the exercise of any similar right to acquire such

Class B shares typically have lower dividend priority than Class A shares and fewer voting rights. However, different classes do not usually affect an average investor's share of the profits or benefits from the company's overall success.

Class A, common stock: Each share confers one vote and ordinary access to dividends and assets. Class B, preferred stock: Each share confers one vote, but shareholders receive $2 in dividends for every $1 distributed to Class A shareholders. This class of stock has priority distribution for dividends and assets.

Whereas outstanding shares are the shares with the shareholders, i.e., it does not include the shares repurchased by the Company. Thus, subtracting treasury shares from the issued shares will give outstanding shares. Issued shares include shares held in treasury.

Key Takeaways Class A shares charge upfront fees and have lower expense ratios, so they are better for long-term investors. Class A shares also reduce upfront fees for larger investments, so they are a better choice for wealthy investors.

The number of stocks outstanding is equal to the number of issued shares minus the number of shares held in the company's treasury. It's also equal to the float (shares available to the public and excludes any restricted shares, or shares held by company officers or insiders) plus any restricted shares.

Class A shares refer to a classification of common stock that was traditionally accompanied by more voting rights than Class B shares. Traditional Class A shares are not sold to the public and also can't be traded by the holders of the shares.

For example, a public company may offer two classes of common stock outstanding: Class A common stock and Class B common stock.

Understanding Class B Shares Class B shares typically have lower dividend priority than Class A shares and fewer voting rights. However, different classes do not usually affect an average investor's share of the profits or benefits from the company's overall success.