Title: Clark Nevada Proposal to Amend Articles of Incorporation: Increase Authorized Common Stock and Eliminate Par Value Description: The Clark Nevada Proposal aims to introduce vital amendments to the company's articles of incorporation. This proposed amendment seeks to increase the authorized common stock and eliminate the concept of par value. These changes are designed to provide the company with more flexibility and potential for growth. By increasing the authorized common stock, Clark Nevada aims to ensure that the company has enough shares available to accommodate potential future expansions, capital raises, or mergers and acquisitions. This expansion of shares can be instrumental in attracting investors and partners, as it demonstrates the company's confidence in its growth prospects. It also allows for potential dilution of equity, which can give the company more leverage when negotiating strategic deals. Additionally, with the elimination of par value, Clark Nevada aims to remove the fixed minimum value assigned to each share. Par value restrictions can often limit a company's ability to issue shares below a specific price or create high-value shares, restricting its financial flexibility. By eliminating par value, the company gains the freedom to issue shares at any price, giving them more control over their capital structure and potential for strategic financial planning. Benefits of the proposed amendments include: 1. Enhanced Growth Prospects: By increasing authorized common stock, the company can easily respond to future growth opportunities, such as expansions or partnerships, without being restricted by issues of insufficient authorized shares. 2. Attraction of Investors and Partners: Increasing authorized shares demonstrates a company's commitment to growth, making it more appealing to potential investors and partners seeking long-term prospects. 3. Increased Financial Flexibility: Eliminating par value removes the restrictions on share pricing, allowing the company to adjust its capital structure efficiently to meet changing market conditions or financial requirements. Different Types of Clark Nevada Proposals to Amend Articles of Incorporation: 1. Proposal to Increase Authorized Common Stock Only: This type of amendment focuses solely on expanding the number of authorized common shares without eliminating the par value. It can be suitable for companies seeking greater flexibility for future capital raises, expansions, or M&A activities. 2. Proposal to Eliminate Par Value Only: In this scenario, the company solely aims to remove the restriction of a fixed minimum value assigned to each share without increasing the authorized shares. This type of amendment may align with companies aiming to provide more financial flexibility while avoiding potential dilution. 3. Proposal to Amend Both Authorized Common Stock and Eliminate Par Value: This comprehensive amendment encompasses both expanding the authorized common shares and eliminating the concept of par value. Such a proposal is suitable for companies looking to maximize their growth potential and have complete control over their capital structure. In conclusion, the Clark Nevada Proposal seeks to amend the articles of incorporation by increasing authorized common stock and eliminating par value. By doing so, the company aims to position itself for enhanced growth opportunities, attract investors and partners, and gain increased financial flexibility for strategic decision-making.

Clark Nevada Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment

Description

How to fill out Clark Nevada Proposal To Amend The Articles Of Incorporation To Increase Authorized Common Stock And Eliminate Par Value With Amendment?

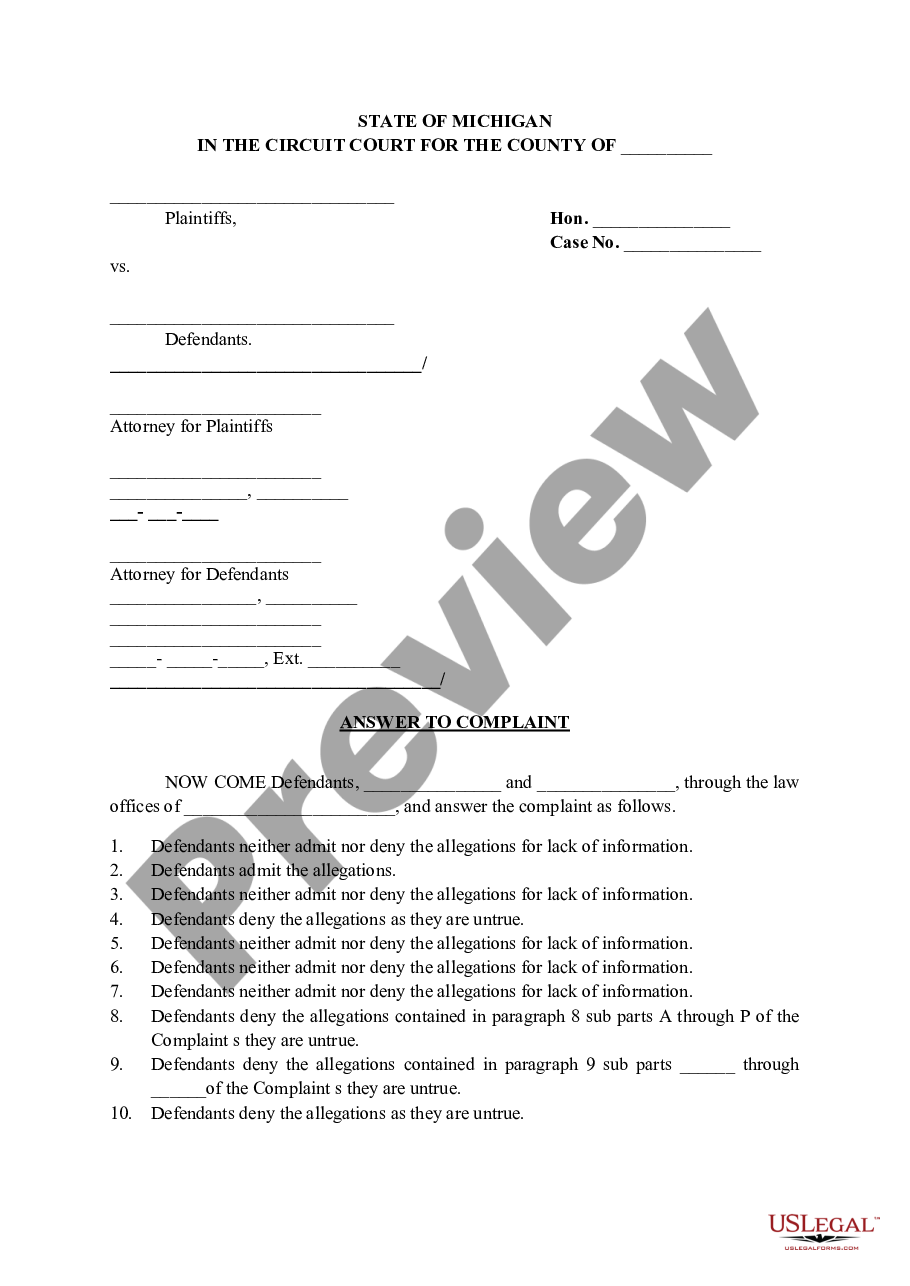

How much time does it usually take you to create a legal document? Given that every state has its laws and regulations for every life scenario, finding a Clark Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment suiting all regional requirements can be exhausting, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Apart from the Clark Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Professionals verify all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Clark Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Clark Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

- A private corporation may extend or shorten its term as stated in the articles of incorporation when approved by a majority vote of the board of directors or trustees and ratified at a meeting by the stockholders representing at least two-thirds (2/3) of the outstanding capital stock or by at least two-thirds (2/3)

How to Amend Articles of Incorporation Review the bylaws of the corporation.A board of directors meeting must be scheduled.Write the proposed changes.Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

The number of authorized shares can be increased by the shareholders of the company at annual shareholder meetings, provided a majority of the current shareholders vote for the change.

A certificate may not be amended against the will of the board of directors. Second, any amendments recommended by the board of directors must be approved by a vote of a majority of the outstanding shares of the corporation. A certificate may not be amended against the will of the majority of the stockholders.

The actual wording of Article V is: The Congress, whenever two thirds of both Houses shall deem it necessary, shall propose Amendments to this Constitution, or, on the Application of the Legislatures of two thirds of the several States, shall call a Convention for proposing Amendments, which, in either Case, shall be

Any amendment to the articles of incorporation which seeks to delete or remove any provision required by this Title or to reduce quorum or voting requirement stated in said articles of incorporation shall require the affirmative vote of at least two-thirds (2/3) of the outstanding capital stock, whether with or

How to Amend Articles of Incorporation Review the bylaws of the corporation.A board of directors meeting must be scheduled.Write the proposed changes.Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

Navigate to Securities > Shares. Click Manage share classes and select Manage authorized. Click on the + to the right of the latest entry, which will duplicate that row. Replace the newest row's filing date and authorized count of each share class with the updated information from the latest incorporation document.

A company may refrain from issuing all of its authorized shares to maintain a controlling interest in the company and therefore prevent a hostile takeover. The number of authorized shares can be changed by shareholder vote.

SEC. The articles of incorporation of a nonstock corporation may be amended by the vote or written assent of majority of the trustees and at least two-thirds (2/3) of the members. The original and amended articles together shall contain all provisions required by law to be set out in the articles of incorporation.