King Washington Proposal is a crucial step towards amending the articles of incorporation of a company. This proposal seeks to increase the authorized common stock and eliminate par value with an amendment. By implementing this amendment, the company aims to adapt to the changing market conditions and enhance its financial flexibility. Increasing the authorized common stock is an essential aspect of the proposal. This decision allows the company to have a higher number of shares that can be issued to investors. By doing so, the company can raise additional capital to fund its growth plans, expand operations, invest in research and development, or pursue strategic acquisitions. With a larger authorized common stock, the company can attract more investors and potentially increase shareholder value. Simultaneously, eliminating par value is another critical aspect of the King Washington Proposal. Par value refers to the nominal or face value assigned to each share. By eliminating par value, the company removes any minimum value restriction on the shares. This flexibility enables the company to have greater discretion in determining the price of its shares, facilitating future stock offerings or dividend distributions. Eliminating par value aligns with modern corporate practices and grants the company more versatility in its capital structure. Implementing this proposal requires amending the articles of incorporation, which is the foundational document governing the company's existence and operations. This process involves submitting the proposed amendments to the shareholders for their approval. Shareholders must vote in favor of the amendment before it can be implemented. Once approved, the amended articles of incorporation reflect the increased authorized common stock and the elimination of par value. In summary, the King Washington Proposal to amend the articles of incorporation aims to increase authorized common stock and eliminate par value through an amendment. By doing so, the company seeks to bolster its financial flexibility, attract more investors, and adapt to market dynamics. This proposal reflects the company's commitment to its shareholders and ensuring its long-term growth and success.

King Washington Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment

Description

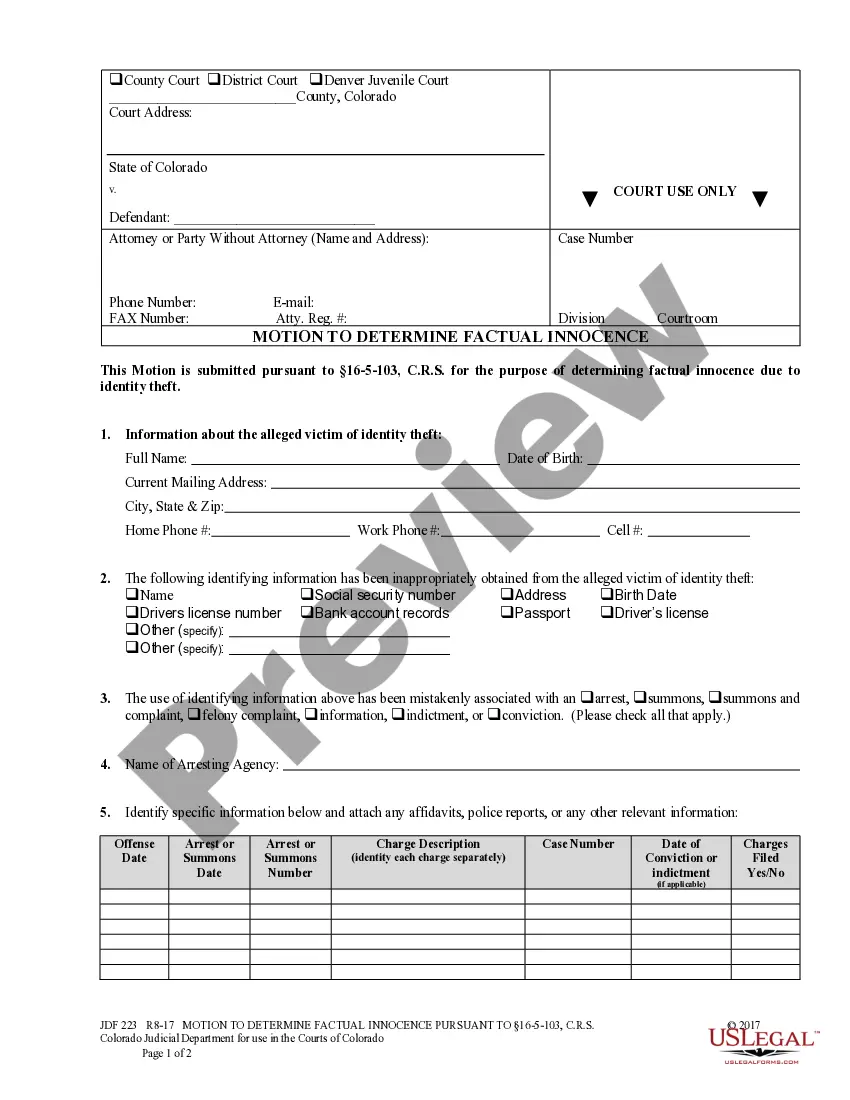

How to fill out King Washington Proposal To Amend The Articles Of Incorporation To Increase Authorized Common Stock And Eliminate Par Value With Amendment?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the King Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you purchase a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the King Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the King Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment:

- Examine the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document once you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

SEC. The articles of incorporation of a nonstock corporation may be amended by the vote or written assent of majority of the trustees and at least two-thirds (2/3) of the members. The original and amended articles together shall contain all provisions required by law to be set out in the articles of incorporation.

The number of authorized shares can be increased by the shareholders of the company at annual shareholder meetings, provided a majority of the current shareholders vote for the change.

SEC. The articles of incorporation of a nonstock corporation may be amended by the vote or written assent of majority of the trustees and at least two-thirds (2/3) of the members. The original and amended articles together shall contain all provisions required by law to be set out in the articles of incorporation.

- A private corporation may extend or shorten its term as stated in the articles of incorporation when approved by a majority vote of the board of directors or trustees and ratified at a meeting by the stockholders representing at least two-thirds (2/3) of the outstanding capital stock or by at least two-thirds (2/3)

The vote usually takes place at a formal meeting of the corporation (annual meeting or other) and shareholders must be advised of the proposed change before the meeting. If the shareholders approve the change to the articles of incorporation, the amended document must be attested to by the corporate secretary.

A certificate may not be amended against the will of the board of directors. Second, any amendments recommended by the board of directors must be approved by a vote of a majority of the outstanding shares of the corporation. A certificate may not be amended against the will of the majority of the stockholders.

Any amendment to the articles of incorporation which seeks to delete or remove any provision required by this Title or to reduce quorum or voting requirement stated in said articles of incorporation shall require the affirmative vote of at least two-thirds (2/3) of the outstanding capital stock, whether with or

How to Amend Articles of Incorporation Review the bylaws of the corporation.A board of directors meeting must be scheduled.Write the proposed changes.Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

The actual wording of Article V is: The Congress, whenever two thirds of both Houses shall deem it necessary, shall propose Amendments to this Constitution, or, on the Application of the Legislatures of two thirds of the several States, shall call a Convention for proposing Amendments, which, in either Case, shall be