Title: Understanding Oakland, Michigan's Proposal to Amend Articles of Incorporation — Increasing Authorized Common Stock and Eliminating Par Value Introduction: The city of Oakland, Michigan is considering a significant change to its articles of incorporation. This proposal aims to amend existing regulations and enhance the business environment within the city. Among the proposed amendments, two notable changes stand out: increasing authorized common stock and eliminating par value. In this article, we will delve into the specifics of this proposal, its benefits, and how it may impact businesses in Oakland. 1. What is the Proposal? The proposed amendment to the articles of incorporation revolves around increasing the authorized common stock and eliminating par value. Currently, the maximum amount of authorized common stock is limited, thus restricting the growth potential of businesses. The proposed change seeks to remove this limitation, allowing companies to issue a greater number of shares to raise capital and expand their operations. Additionally, the elimination of par value will provide greater flexibility in determining the initial value of shares and, consequently, their market price. 2. Benefits of Increasing Authorized Common Stock: a. Enhanced Capital Generation: By increasing authorized common stock, businesses can easily raise additional capital by issuing new shares. This increased funding can be utilized for research and development, infrastructure development, market expansion, and acquisitions, among others. b. Improved Investment Potential: A higher number of authorized shares can attract potential investors, as it showcases greater liquidity and growth potential for the company. This may result in increased funding opportunities through offerings such as initial public offerings (IPOs), follow-on offerings, or private placements. 3. Impact of Eliminating Par Value: a. Greater Market Flexibility: Eliminating par value allows companies to set the market price of their shares based on market demand and other considerations, rather than being limited by an arbitrary face value. This flexibility aligns better with market trends and enables companies to respond to changing market conditions promptly. b. Increased Transaction Efficiency: Without a par value, subsequent stock transactions can be streamlined, as the need for adjusting share prices to accommodate par value is eliminated. This results in improved efficiency in trading shares and reduces administrative complexities. Conclusion: Oakland, Michigan's proposal to amend the articles of incorporation and increase authorized common stock while eliminating par value demonstrates the city's commitment to fostering a business-friendly environment. By allowing companies to issue more shares and determining share value based on market dynamics, businesses can achieve improved funding potential and adaptability to ever-changing market conditions. This proposal holds promise for expediting business growth within Oakland, ultimately benefiting both local companies and the overall economy.

Oakland Michigan Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment

Description

How to fill out Oakland Michigan Proposal To Amend The Articles Of Incorporation To Increase Authorized Common Stock And Eliminate Par Value With Amendment?

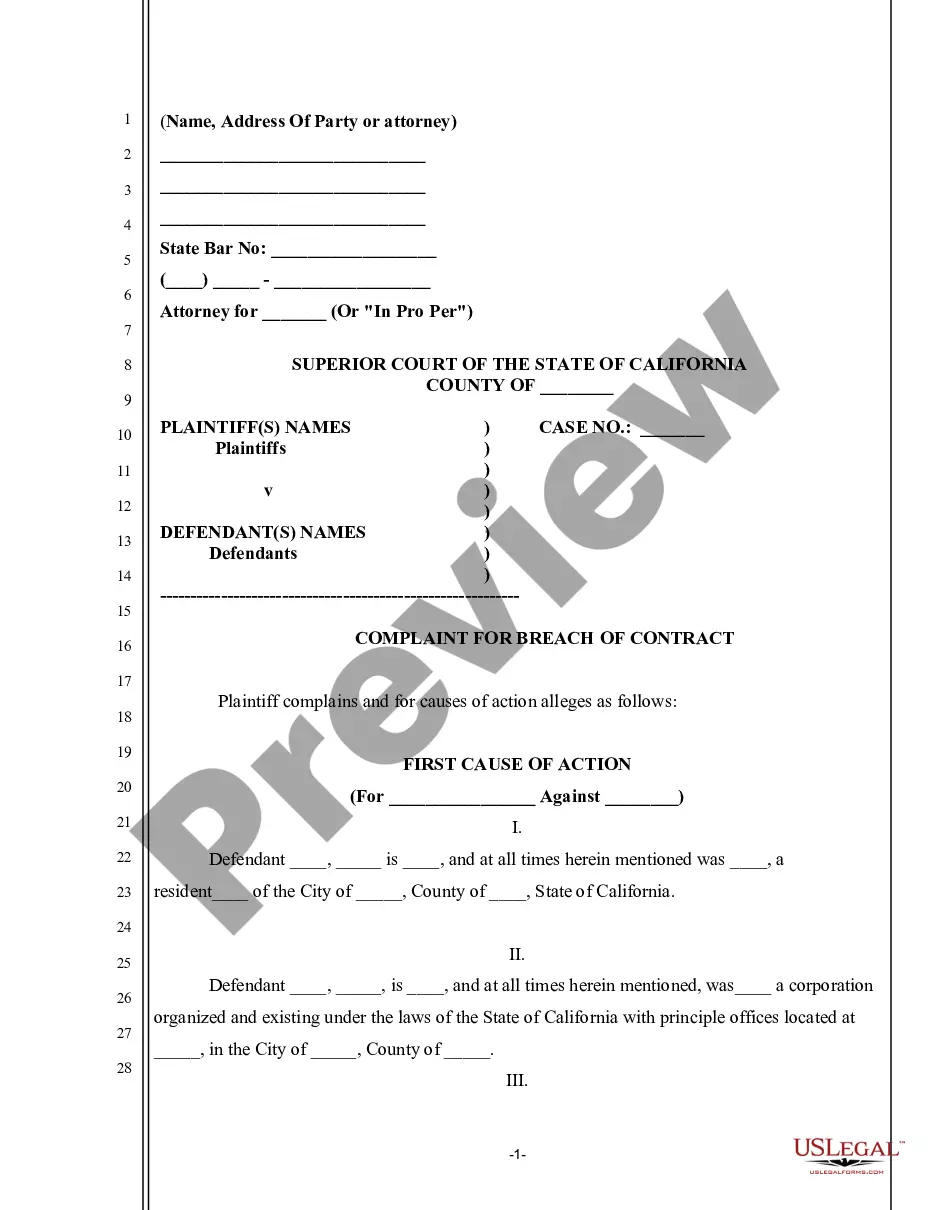

Do you need to quickly draft a legally-binding Oakland Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment or maybe any other form to manage your own or business matters? You can select one of the two options: contact a professional to draft a legal paper for you or create it completely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get professionally written legal paperwork without paying sky-high prices for legal services.

US Legal Forms offers a huge collection of over 85,000 state-specific form templates, including Oakland Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed document without extra hassles.

- To start with, double-check if the Oakland Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment is tailored to your state's or county's regulations.

- In case the form has a desciption, make sure to check what it's suitable for.

- Start the search again if the document isn’t what you were seeking by utilizing the search bar in the header.

- Choose the plan that is best suited for your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Oakland Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the templates we provide are reviewed by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Articles of incorporation are important documents because they serve as legal proof that your company is established in your state, and provide the state government with information about the main aspects of your business.

The vote usually takes place at a formal meeting of the corporation (annual meeting or other) and shareholders must be advised of the proposed change before the meeting. If the shareholders approve the change to the articles of incorporation, the amended document must be attested to by the corporate secretary.

How to Amend Articles of Incorporation Review the bylaws of the corporation.A board of directors meeting must be scheduled.Write the proposed changes.Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

Articles of Amendment are filed when your business needs to add to, change or otherwise update the information you originally provided in your Articles of Incorporation or Articles of Organization.

You may submit the monitoring and the amendment requirements through crmdamendforeign@sec.gov.ph .

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

Changing articles of incorporation often means changing things like agent names, the businesses operating name, addresses, and stock information. The most common reason that businesses change the articles of incorporation is to change members' information.

- A private corporation may extend or shorten its term as stated in the articles of incorporation when approved by a majority vote of the board of directors or trustees and ratified at a meeting by the stockholders representing at least two-thirds (2/3) of the outstanding capital stock or by at least two-thirds (2/3)

SEC. The articles of incorporation of a nonstock corporation may be amended by the vote or written assent of majority of the trustees and at least two-thirds (2/3) of the members. The original and amended articles together shall contain all provisions required by law to be set out in the articles of incorporation.