Phoenix, Arizona Proposal to Amend Articles of Incorporation: Increasing Authorized Common Stock and Eliminating Par Value In Phoenix, Arizona, a proposal has been put forth to amend the articles of incorporation for businesses operating within the city. This proposed amendment aims to increase the authorized common stock and eliminate the par value requirement, thus presenting significant opportunities and benefits for companies and investors. To begin with, the primary objective of this proposal is to increase the authorized common stock of businesses operating in Phoenix. This would allow companies to issue a higher number of shares to raise capital and pursue growth opportunities. By increasing the authorized common stock, businesses will have greater flexibility in financing their operations, expanding their reach, and attracting potential investors. Simultaneously, the proposal seeks to eliminate the par value requirement in the articles of incorporation. Par value is the nominal value assigned to each share of stock, often set at a very low amount such as $0.01. Removing the par value offers companies more freedom and flexibility in assigning a market value to their shares, based on their actual worth or perceived market demand. This adjustment eliminates the potential constraint that a fixed par value may impose on companies and shareholders. The rationale behind eliminating the par value lies in the fact that par value no longer serves a significant purpose in modern corporate finance practices. Instead, valuation of shares in the market is determined by factors such as investor sentiment, perceived potential, and company performance. By allowing shares to trade without a predetermined par value, businesses can better adapt to dynamic market conditions and take advantage of the prevailing valuation trends. Additionally, the proposed amendment would align Phoenix-based companies with the prevailing trend in many states that have already eliminated the par value requirement. This ensures consistency in business practices and fosters a favorable investment climate both within Phoenix and across state borders. Investors tend to favor jurisdictions that have implemented such amendments as it provides greater transparency and reduces potential legal complexities. Furthermore, the elimination of par value can also benefit small businesses, as they often have difficulty generating sufficient funds due to limited resources and access to capital. With the amendment, these companies will have greater opportunities to issue shares at a value more reflective of their business potential, making it easier to raise capital and expand their operations. To summarize, the proposed amendment to the articles of incorporation in Phoenix, Arizona seeks to increase the authorized common stock and eliminate the par value requirement. This amendment aims to enhance the financing options for businesses, attract investors, align with prevailing market practices, and create a favorable investment climate in the city. By embracing this proposal, companies operating in Phoenix will be better equipped to seize growth opportunities, attract investment, and contribute to the overall economic development of the region.

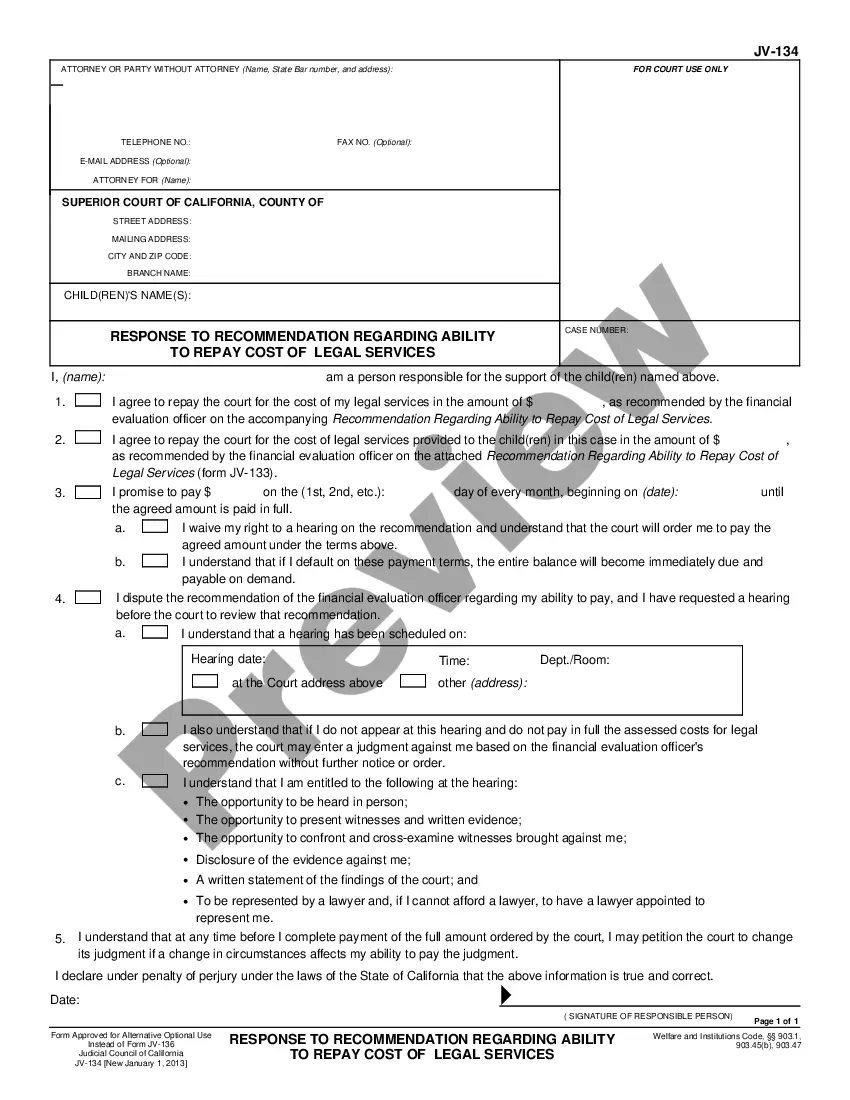

Phoenix Arizona Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment

Description

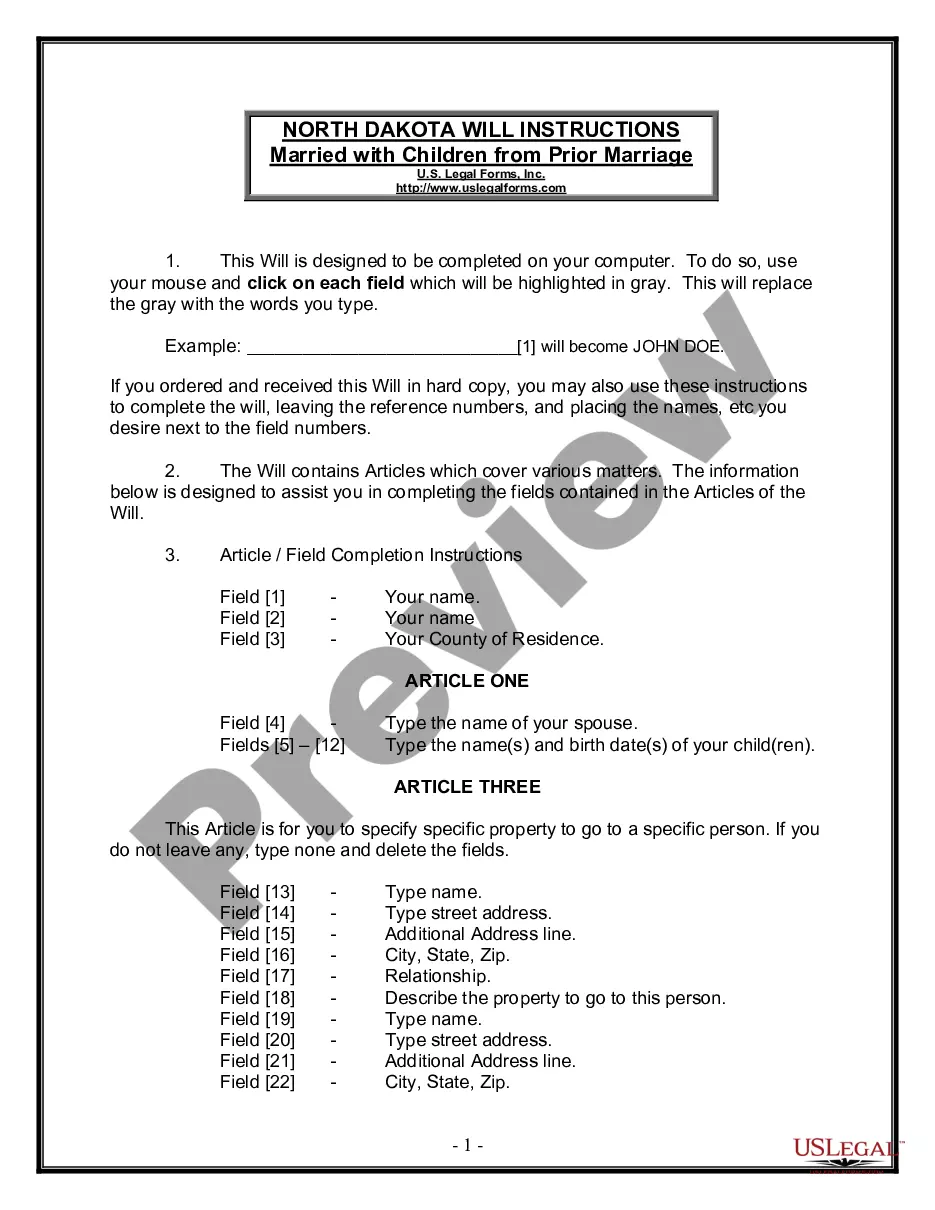

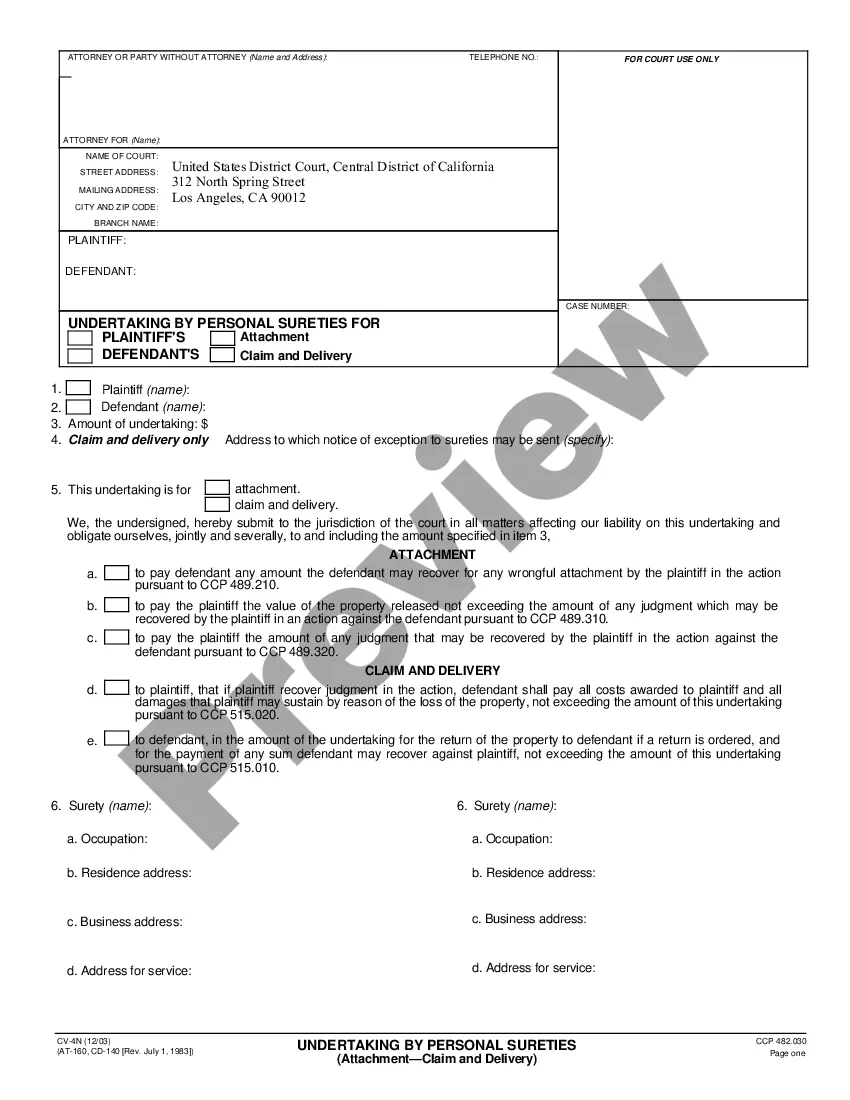

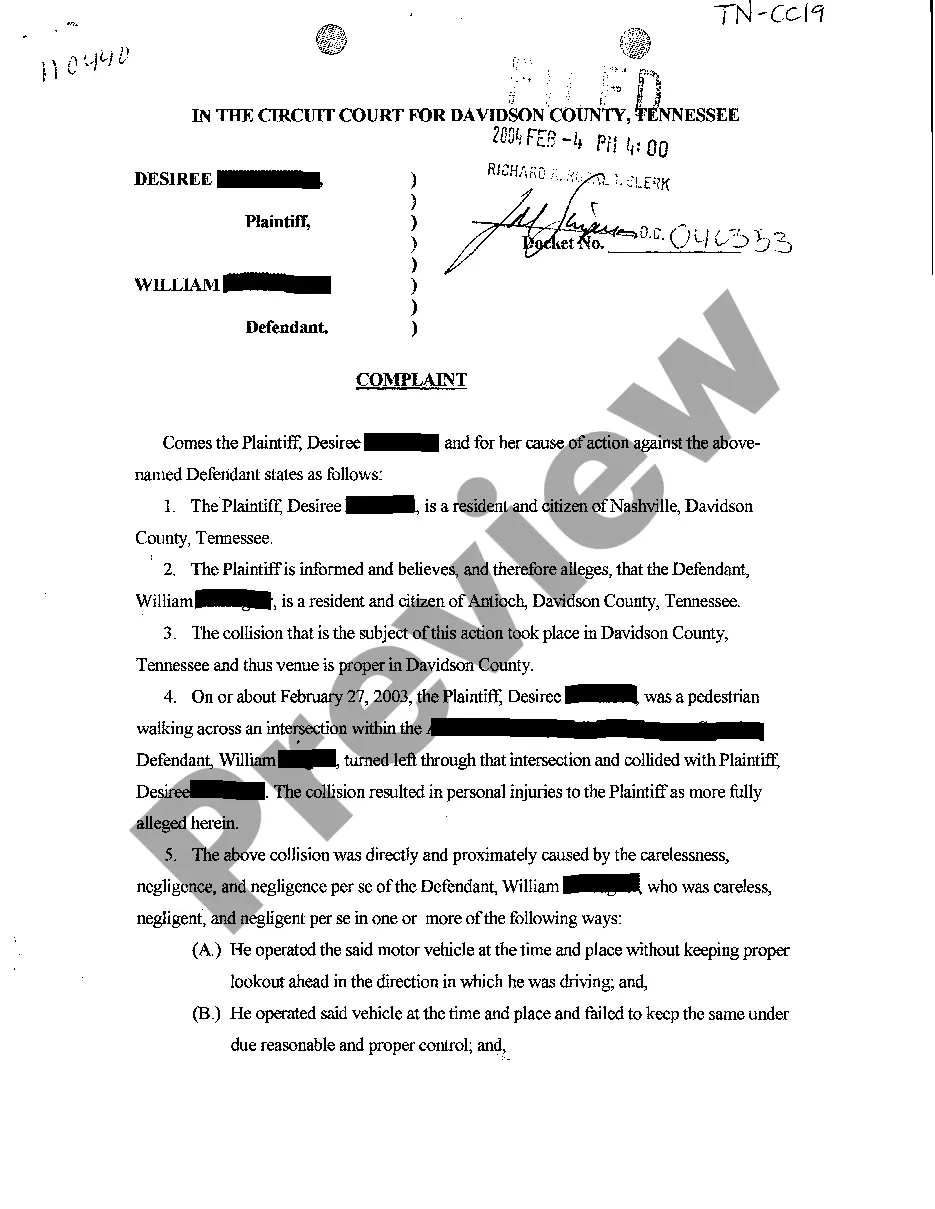

How to fill out Phoenix Arizona Proposal To Amend The Articles Of Incorporation To Increase Authorized Common Stock And Eliminate Par Value With Amendment?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Phoenix Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you pick a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Phoenix Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Phoenix Proposal to amend the articles of incorporation to increase authorized common stock and eliminate par value with amendment:

- Examine the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document once you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

To amend your domestic corporation's Articles of Incorporation, file Form CF: 0040, Articles of Amendment and one exact copy with the Arizona Corporations Commission. You can submit the amendment by mail, fax, or in person. Include the Arizona Corporation filing cover sheet.

As can be gleaned from the foregoing, there are three (3) basic requirements for amending the Articles of Incorporation, namely: Majority vote of the board of directors. Written assent of the stockholders representing at least 2/3 of the outstanding capital stock. Approval by the Securities and Exchange Commission.

The most common reason that businesses change the articles of incorporation is to change members' information. It is important to amend the articles of incorporation for any major changes to avoid legal consequences.

Any corporation may for legitimate corporate purpose or purposes amend its articles of incorporation by a majority vote of its board of directors or trustees and the vote or written assent of two-thirds of its members if it be a non-stock corporation, or if it be a stock corporation, by the vote or written assent of

When must you amend your entity's formation documents? Changes to the entity's name. Changes in the entity's purpose. Changes in the number of authorized shares of a corporation. Changes in the type/class/series of authorized shares of a corporation.

Articles of Amendment are filed when your business needs to add to, change or otherwise update the information you originally provided in your Articles of Incorporation or Articles of Organization.

The most common reason that businesses change the articles of incorporation is to change members' information. It is important to amend the articles of incorporation for any major changes to avoid legal consequences.

To make amendments to your Delaware Stock Corporation, you submit the completed State of Delaware Certificate of Amendment of Certificate of Incorporation form to the Department of State by mail, fax or in person, along with the filing fee and the Filing Cover Memo. Non-stock corporations use a separate amendment form.

Depending on the state in which the business is incorporated, unanimous agreement from all the shareholders may be required to change the articles of incorporation. Most states have changed this older, common law rule, and now only require a majority of shareholders to agree to change the articles of incorporation.

How to Amend Articles of Incorporation Review the bylaws of the corporation.A board of directors meeting must be scheduled.Write the proposed changes.Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.