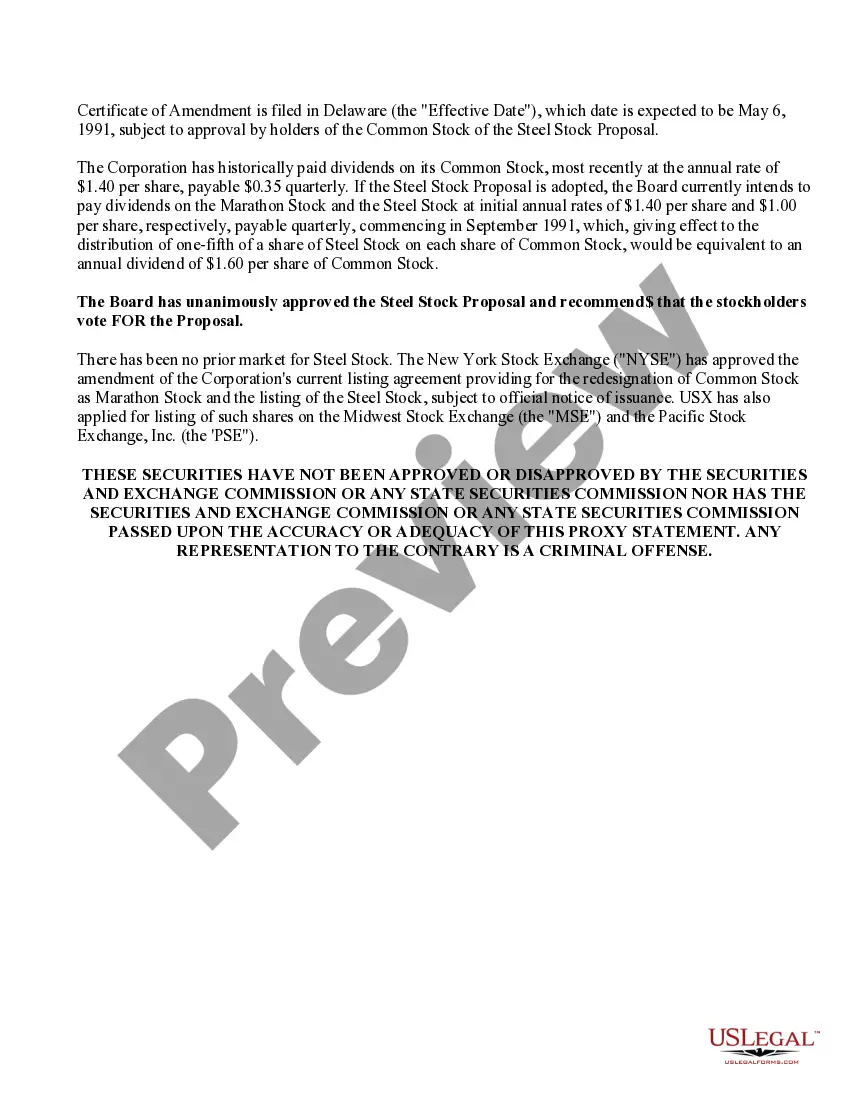

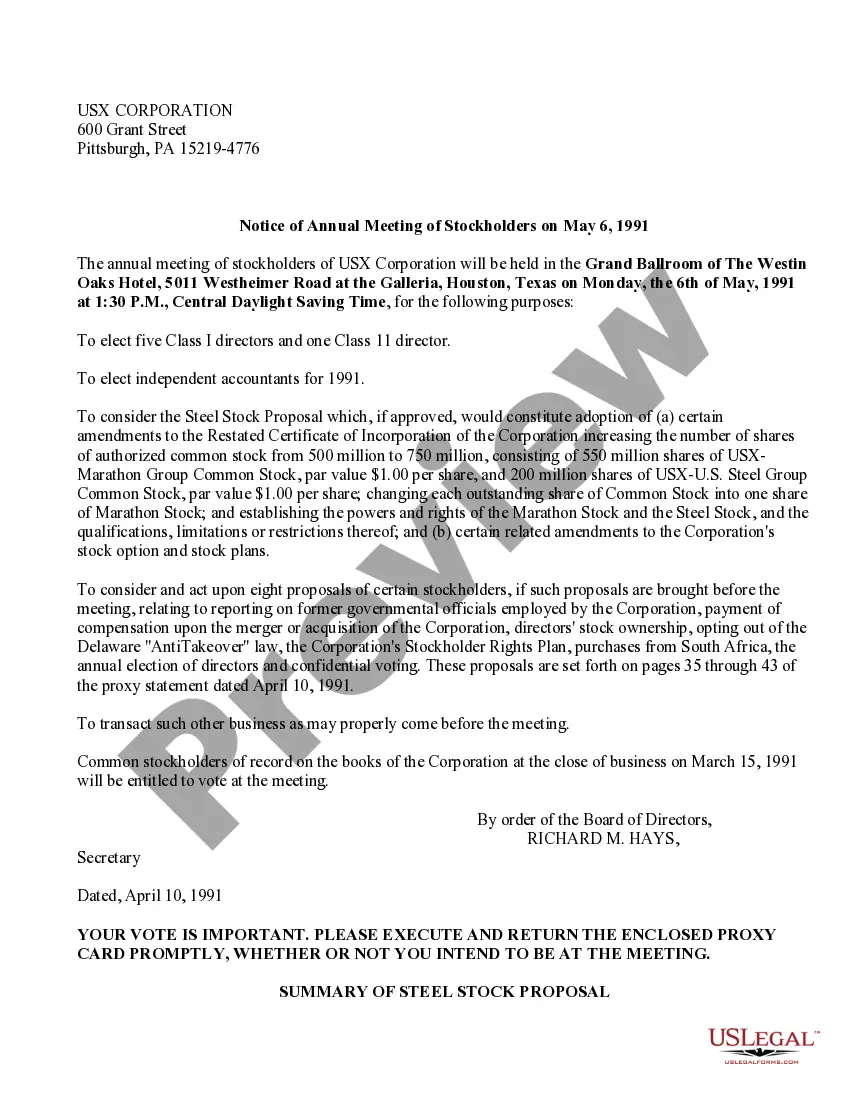

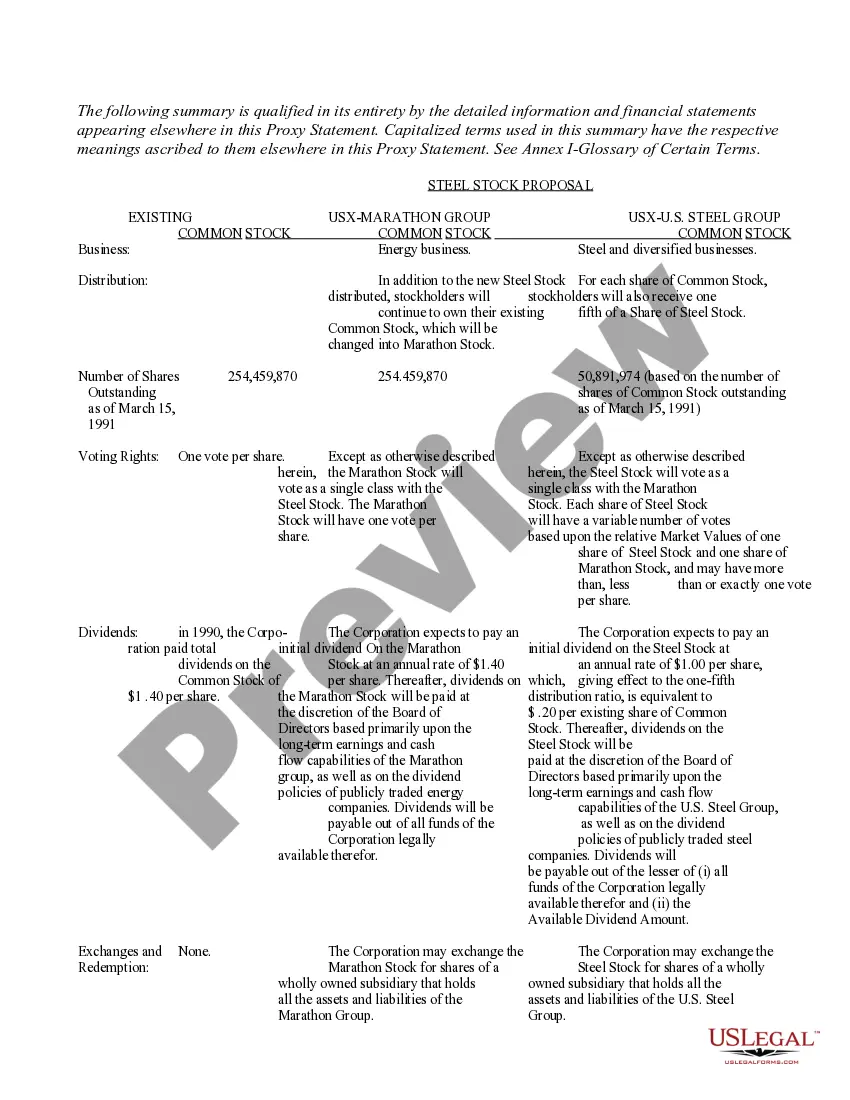

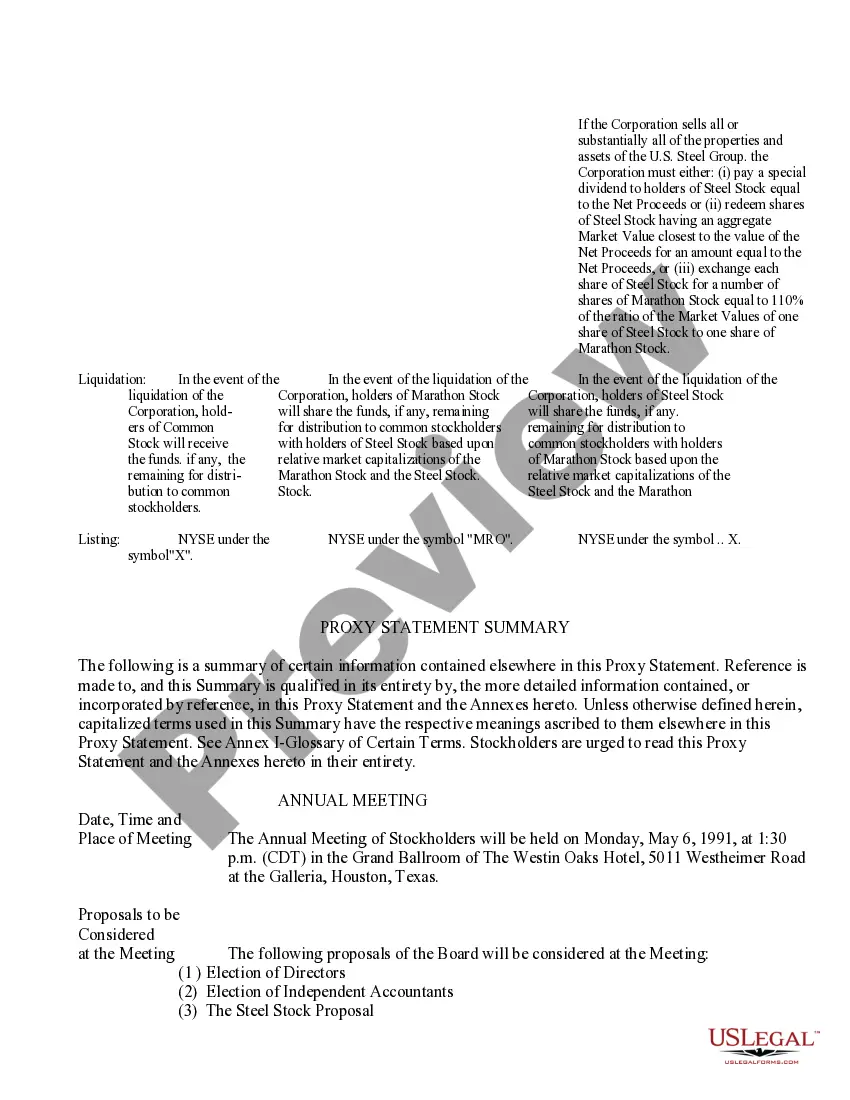

The Franklin Ohio Proxy Statement and Prospectus of US Corporation is an essential document that provides potential investors and shareholders with in-depth information about the company's operations, financial performance, and corporate governance practices. This comprehensive disclosure is crucial for individuals looking to make informed investment decisions and understand the potential risks and rewards associated with investing in US Corporation. The Franklin Ohio Proxy Statement serves as a crucial communication tool, enabling shareholders to vote on important matters, such as electing board members, approving executive compensation, or making significant corporate decisions. It also details the rights and responsibilities of shareholders, providing them with a platform to voice their concerns and propose resolutions during annual or special meetings. Meanwhile, the Franklin Ohio Prospectus outlines US Corporation's investment offering in detail. This comprehensive document sheds light on the company's history, business model, products and services, market position, competition, and growth strategy. It also provides crucial financial information, including historical and projected financial statements, management's discussion and analysis, and risk factors that potential investors should consider. The prospectus ensures transparency and enables investors to evaluate the company's prospects and make well-informed investment decisions. Different types of Franklin Ohio Proxy Statements and Prospectuses of US Corporation may include: 1. Annual Proxy Statement: This document is issued once a year, ahead of the annual shareholders' meeting. It provides detailed information about matters to be voted upon and is accompanied by a proxy card enabling shareholders to cast their votes. 2. Special Proxy Statement: As the name suggests, this type of proxy statement pertains to specific events or proposals that require shareholder approval outside the annual meeting. Examples could be a merger, major acquisition, or changes in the company's governance structure. 3. Preliminary Prospectus: This document, also known as a "red herring," is issued at the beginning of an initial public offering (IPO) or other securities offerings. It provides initial details about the offering but is still subject to revision, pending approval by regulatory bodies. 4. Final Prospectus: This version of the prospectus is issued after the regulatory approval process is complete. It contains detailed information about the securities being offered, the offering price, underwriters, and any other relevant information. 5. Combined Proxy Statement and Prospectus: In certain cases, when there is a need to seek shareholder approval for both general matters and securities offerings, a combined document is created. This comprehensive statement/prospectus provides shareholders with all necessary information for voting and making investment decisions simultaneously. Understanding the Franklin Ohio Proxy Statement and Prospectus of US Corporation is integral for investors and shareholders to make informed decisions regarding their investment in the company. These documents serve as valuable sources of information, ensuring transparency and accountability within the corporate landscape.

Franklin Ohio Proxy Statement and Prospectus of USX Corporation

Description

How to fill out Franklin Ohio Proxy Statement And Prospectus Of USX Corporation?

If you need to find a reliable legal form supplier to get the Franklin Proxy Statement and Prospectus of USX Corporation, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support team make it simple to get and complete various documents.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply type to look for or browse Franklin Proxy Statement and Prospectus of USX Corporation, either by a keyword or by the state/county the form is intended for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Franklin Proxy Statement and Prospectus of USX Corporation template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and choose a subscription option. The template will be instantly available for download once the payment is completed. Now you can complete the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes these tasks less costly and more affordable. Set up your first company, arrange your advance care planning, create a real estate agreement, or execute the Franklin Proxy Statement and Prospectus of USX Corporation - all from the convenience of your sofa.

Sign up for US Legal Forms now!