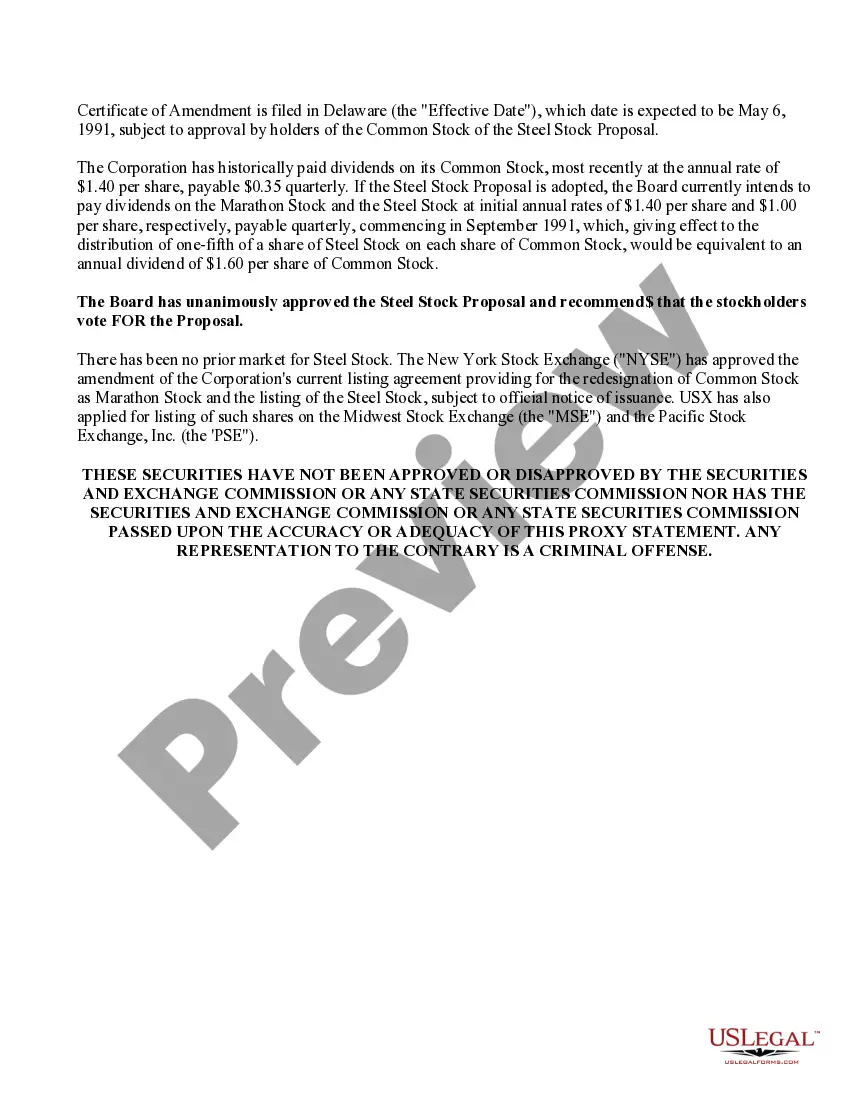

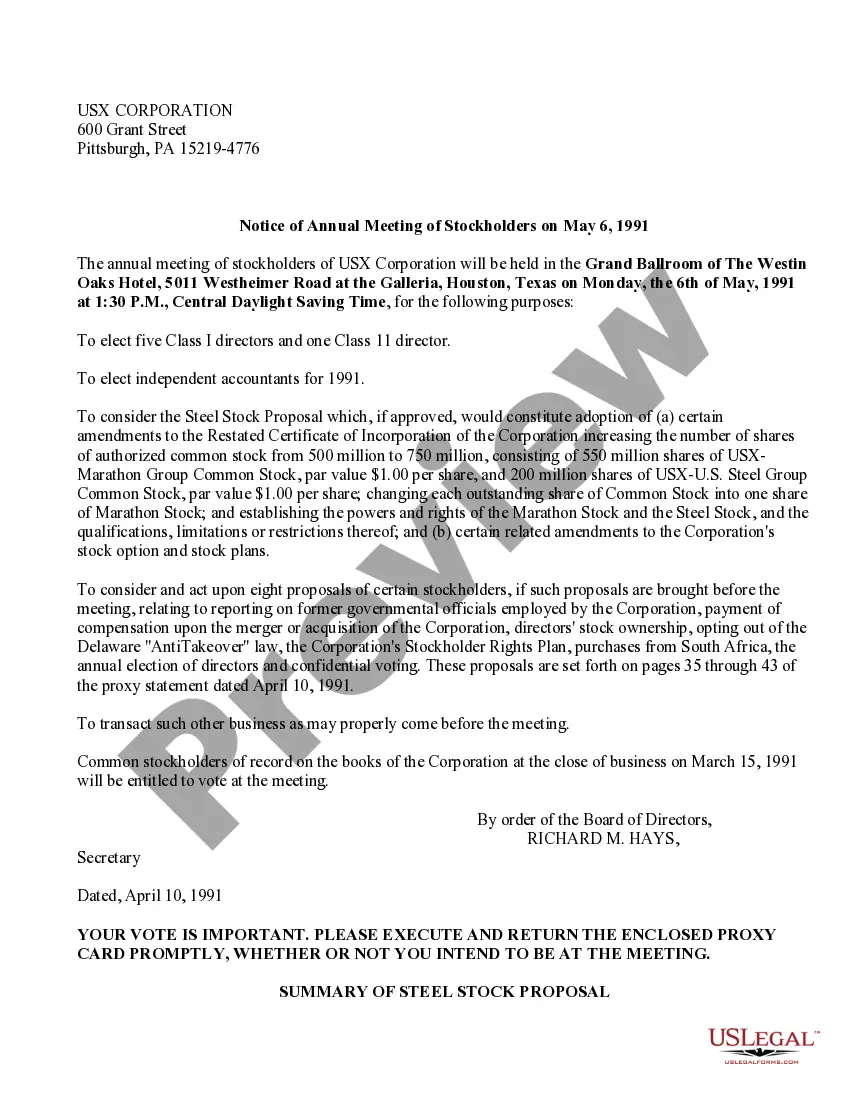

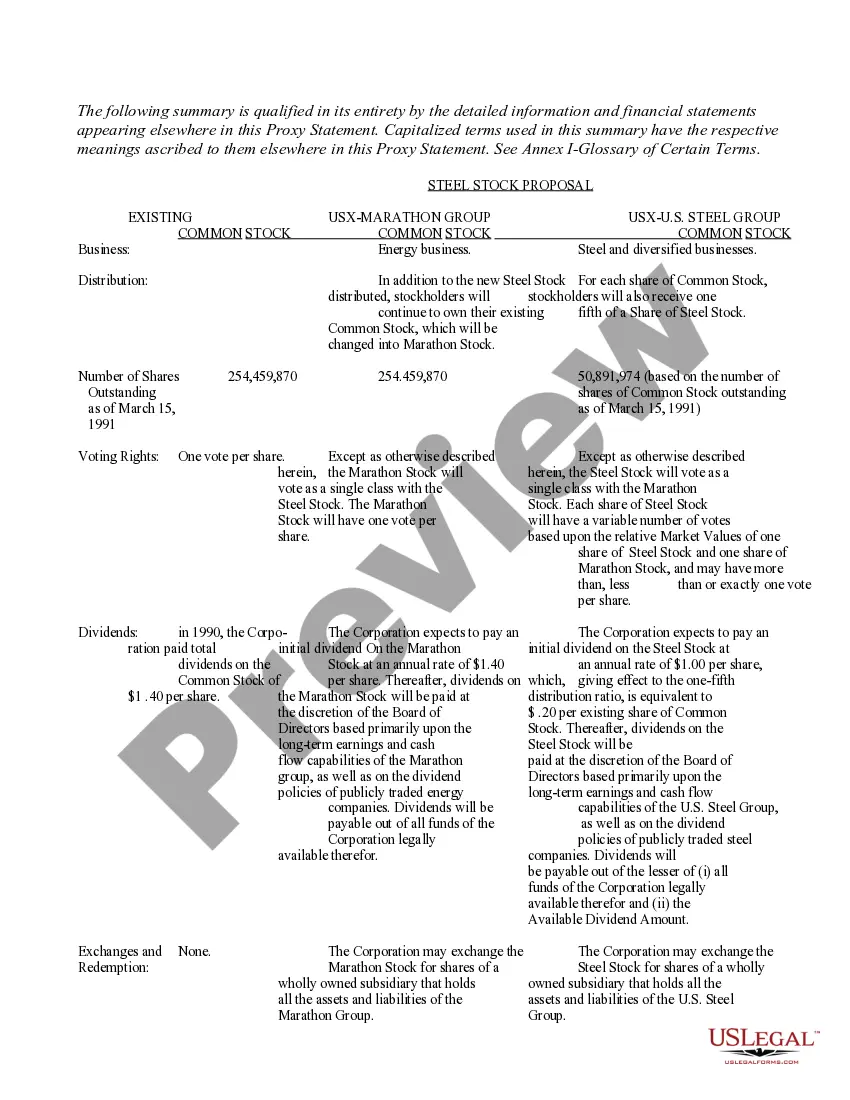

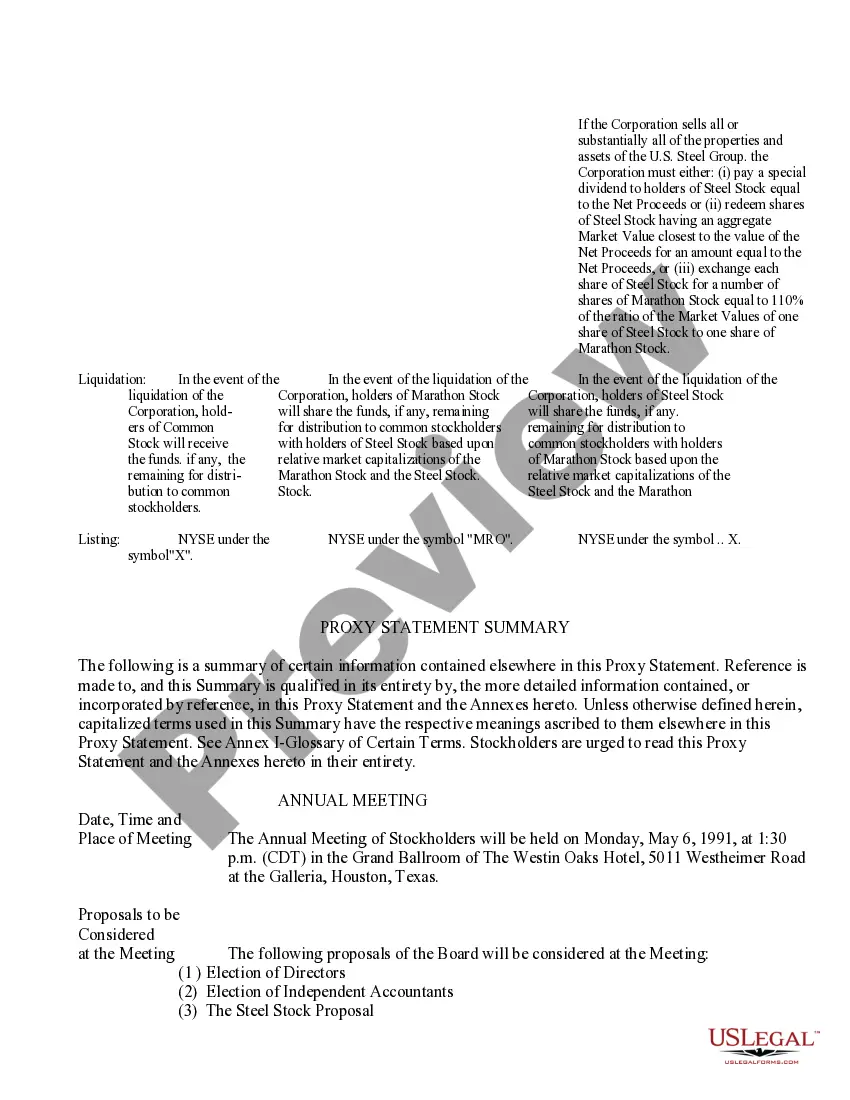

Harris Texas Proxy Statement and Prospectus of US Corporation serve as crucial documents in corporate governance and financial disclosure for interested stakeholders. These documents provide detailed information about the operations, financial performance, and future plans of US Corporation. The Harris Texas Proxy Statement is a comprehensive document prepared by US Corporation to provide important information to shareholders regarding upcoming corporate events and proposals, including the election of directors, executive compensation, and corporate governance matters. It enables shareholders to make informed decisions by outlining the background, qualifications, and accomplishments of board candidates and management. The Harris Texas Proxy Statement includes details about the company's strategic goals, performance metrics, and other matters that may lead to shareholder voting decisions. On the other hand, the Prospectus of US Corporation is an important disclosure document that is provided to potential investors before they make investment decisions. It contains detailed information about US Corporation's business model, operations, financial statements, risk factors, and other relevant information. The Prospectus aims to provide potential investors with an understanding of US Corporation's business potential, competitive advantages, and key risk factors. It helps investors assess the suitability of an investment in the company by evaluating its financial health, growth prospects, and market position. The different types of Harris Texas Proxy Statement and Prospectus of US Corporation include: 1. Annual Proxy Statement: This document is prepared each year and provides shareholders with information related to the company's annual general meeting, including election of directors, executive compensation, and any shareholder proposals. 2. Special Proxy Statement: This type of Proxy Statement is issued when special circumstances require shareholder approval, such as a merger, acquisition, or major corporate restructuring. 3. Preliminary Prospectus: This document is released prior to an initial public offering (IPO) or a significant securities' issuance. It presents a preliminary version of the Prospectus and provides potential investors with a preliminary overview of the offering. 4. Final Prospectus: The Final Prospectus is the final version of the disclosure document and is issued before or on the effective date of an IPO or securities issuance. It includes all relevant details required for investors to make an informed investment decision in US Corporation. In summary, the Harris Texas Proxy Statement and Prospectus of US Corporation are vital documents that provide detailed information about the company's corporate governance practices, financial performance, and investment potential. The various types of these documents cater to specific corporate events and investor needs, ensuring transparency and compliance in communication between US Corporation and its shareholders and potential investors.

Harris Texas Proxy Statement and Prospectus of USX Corporation

Description

How to fill out Harris Texas Proxy Statement And Prospectus Of USX Corporation?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Harris Proxy Statement and Prospectus of USX Corporation, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various types varying from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information materials and tutorials on the website to make any activities associated with paperwork completion straightforward.

Here's how to find and download Harris Proxy Statement and Prospectus of USX Corporation.

- Take a look at the document's preview and description (if available) to get a general information on what you’ll get after getting the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the validity of some documents.

- Examine the related document templates or start the search over to locate the correct document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and purchase Harris Proxy Statement and Prospectus of USX Corporation.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Harris Proxy Statement and Prospectus of USX Corporation, log in to your account, and download it. Needless to say, our website can’t take the place of an attorney completely. If you need to cope with an extremely difficult case, we recommend using the services of a lawyer to examine your document before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-compliant documents effortlessly!