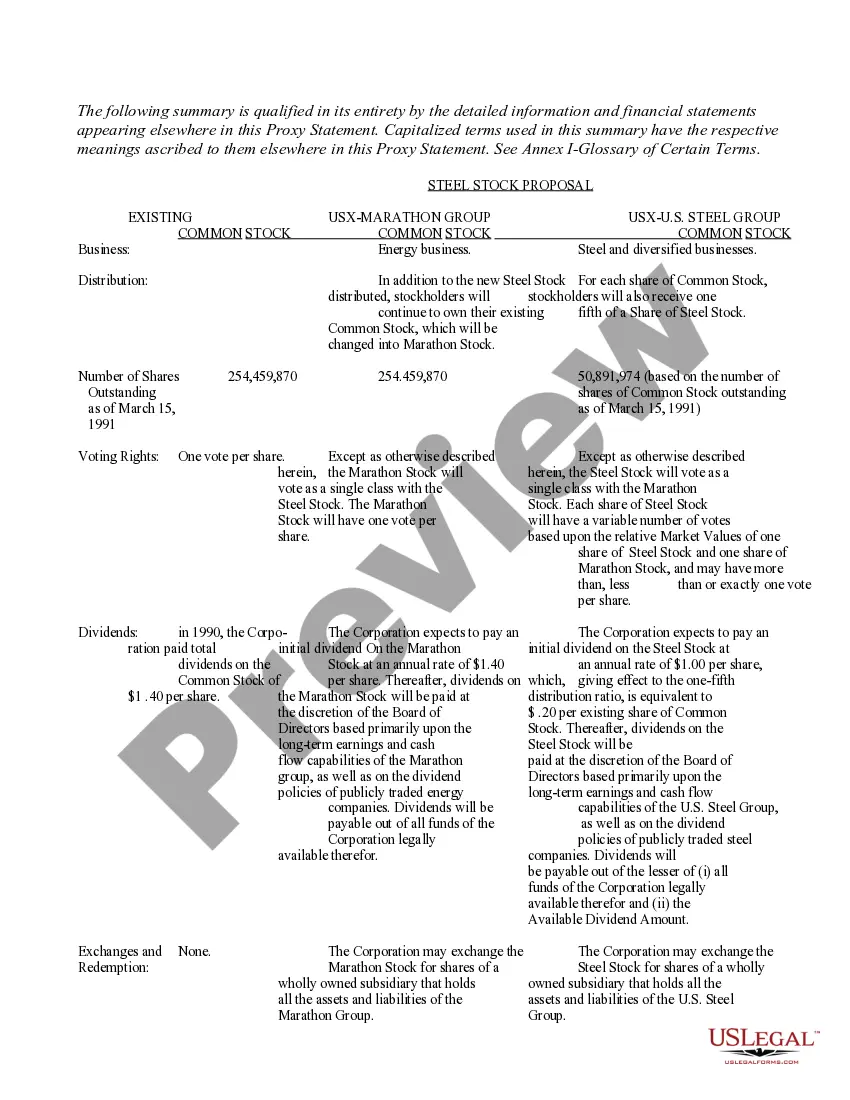

The Phoenix Arizona Proxy Statement and Prospectus play crucial roles in the financial landscape of US Corporation. These documents contain comprehensive information about the corporation, providing valuable insights to its shareholders and potential investors. Let's explore the components of these statements and prospectuses, while incorporating relevant keywords. 1. Phoenix Arizona Proxy Statement: The Phoenix Arizona Proxy Statement of US Corporation serves as a medium of communication between the company's board and its shareholders. It is a legally required document, produced annually or when significant corporate actions arise. Key components: a) Corporate Governance: The proxy statement outlines the structure of US Corporation's board of directors, their qualifications, and responsibilities. It also discusses the board's committee composition, executive compensation, and potential conflicts of interest. Keywords: corporate governance, board of directors, committee composition, executive compensation, conflicts of interest. b) Meeting Information: This section details essential details about the company's annual shareholders' meeting, including the date, time, location, and purpose of the meeting. It also mentions the items to be voted upon, such as election of directors, approval of financial statements, and proposed changes to bylaws or articles of incorporation. Keywords: annual shareholders' meeting, voting, election of directors, financial statements, bylaws, articles of incorporation. c) Shareholder Proposals: If shareholders wish to present proposals for voting, this section outlines the submission process, deadlines, and criteria for eligibility. It explains how shareholders can raise their concerns and have a real impact on the company's decision-making. Keywords: shareholder proposals, submission process, deadlines, eligibility, decision-making. 2. Phoenix Arizona Prospectus of US Corporation: The Phoenix Arizona Prospectus provides detailed information about US Corporation's financial position, operations, and future prospects. It is typically issued when the corporation intends to offer securities to potential investors, such as during initial public offerings (IPOs) or secondary stock offerings. Key components: a) Company Overview: The prospectus begins by introducing US Corporation, including its history, business model, industry position, and competitive advantages. It provides details about the company's subsidiaries, products or services offered, and target markets. Keywords: company overview, history, business model, industry position, competitive advantages, subsidiaries, products, services, target markets. b) Financial Information: This segment presents comprehensive financial data, including audited financial statements, balance sheets, income statements, and cash flow information. It may also include information on historical financial performance over several years, key ratios, and trends. Keywords: financial information, audited financial statements, balance sheets, income statements, cash flow, historical financial performance, key ratios, trends. c) Risk Factors: This crucial section discloses various potential risks that could affect US Corporation's operations or financial performance. It provides an overview of industry-specific risks, regulatory risks, competition, market volatility, and other factors that investors should consider. Keywords: risk factors, operational risks, financial risks, industry-specific risks, regulatory risks, competition, market volatility. d) Offering Details: In case of a securities offering, this part details the terms of the offering, such as the type of securities being offered, the price, underwriting information, and any special considerations. Keywords: offering details, securities offering, underwriting, price, special considerations. By addressing the content of the Phoenix Arizona Proxy Statement and Prospectus of US Corporation, this description sheds light on the comprehensive information provided to shareholders and potential investors, enabling them to make informed decisions about the company's governance, financial standing, and investment opportunities.

Phoenix Arizona Proxy Statement and Prospectus of USX Corporation

Description

How to fill out Phoenix Arizona Proxy Statement And Prospectus Of USX Corporation?

If you need to get a reliable legal paperwork provider to get the Phoenix Proxy Statement and Prospectus of USX Corporation, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of learning materials, and dedicated support team make it easy to find and execute various papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply select to search or browse Phoenix Proxy Statement and Prospectus of USX Corporation, either by a keyword or by the state/county the form is intended for. After locating necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Phoenix Proxy Statement and Prospectus of USX Corporation template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and select a subscription option. The template will be instantly ready for download as soon as the payment is processed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes these tasks less expensive and more affordable. Create your first business, organize your advance care planning, draft a real estate contract, or complete the Phoenix Proxy Statement and Prospectus of USX Corporation - all from the comfort of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

This Joint Proxy Statement/Prospectus serves as a prospectus of the Acquiring Fund in connection with the issuance of the Acquiring Fund common shares in the Reorganization.

A reporting company must comply with the SEC's proxy rules whenever its management submits proposals to shareholders that will be subject to a shareholder vote, usually at a shareholders' meeting.

A company is required to file its proxy statements with the SEC no later than the date proxy materials are first sent or given to shareholders. You can see this filing by using the SEC's database, known as EDGAR. Enter the company's name here and select the appropriate company to view its SEC filings.

Public companies are required to file proxy statements with the Securities and Exchange Commission. The proxy statement is filed when a company is seeking shareholder votes and is filed ahead of an annual meeting.

Proxy statements are filed with the SEC as Form DEF 14A, or definitive proxy statement, and can be found using the SEC's database, known as the electronic data gathering, analysis and retrieval system (EDGAR).

A proxy statement is a document provided by public corporations so that their shareholders can understand how to vote at shareholder meetings and make informed decisions about how to delegate their votes to a proxy.

These rules get their name from the common practice of management asking shareholders to provide them with a document called a ?proxy card? granting authority to vote the shareholders' shares at the meeting.

The companies must file the proxy statement with the SEC on Schedule 14A, 17 C.F.R. § 240.14a-101, before any solicitations of securityholder vote on the election of directors or approval of other corporate actions can be made.

Proxy and Registration Statement means Parent's Registration Statement on Form S-4, and all amendments and supplements thereto, to be filed with the SEC containing a proxy statement meeting the requirements of Schedule 14A for the Parent Meeting and a prospectus relating to the Parent Common Stock issuable pursuant to