Title: King Washington's Letter to Board of Directors Regarding Recapitalization Proposal Dear esteemed members of the Board of Directors, Subject: Recapitalization Proposal for King Washington I hope this message finds each of you in good health and high spirits. As you are aware, I am writing this letter to provide a detailed description and proposal regarding the recapitalization of King Washington. Our company has reached a pivotal juncture where strategic financial actions are needed to ensure sustainable growth and long-term success. Key Points to Consider: 1. Recapitalization Definition: Recapitalization refers to the restructuring of a company's capital structure, typically involving the adjustment of debt and equity proportions. It aims to optimize financial stability, enhance liquidity, and solidify the company's foundation in light of prevailing market conditions. 2. Recapitalization Strategies: a. Debt-to-Equity Conversion: One form of recapitalization could involve converting a portion of the company's debt into equity. By doing so, the company can reduce its debt burden, improve cash flow, and attract potential investors through an enhanced equity position. b. Equity Infusion: Alternatively, recapitalization may also involve securing additional funding through equity infusion. This strategy can strengthen the company's financial position, support growth initiatives, and augment working capital, ultimately facilitating expansion plans and new ventures. c. Leveraged Recapitalization: Under specific circumstances, a leveraged recapitalization could be considered. It involves using borrowed capital to fund a large-scale repurchase of the company's outstanding shares. While increasing financial leverage, this strategy aims to optimize shareholder value by taking advantage of favorable borrowing conditions. 3. Rationale for Recapitalization: a. Strengthening Balance Sheet: The recapitalization proposal seeks to bolster King Washington's balance sheet by optimizing its mix of debt and equity. This will enhance the company's financial resilience and provide a solid foundation for future growth opportunities. b. Unlocking Value and Attracting Investors: Recapitalizing the company will likely unlock its potential value and make it more attractive to potential investors. By demonstrating a commitment to financial stability and growth, King Washington aims to gain the confidence of stakeholders and expand its shareholder base. c. Addressing Market Volatility and Challenges: The proposed recapitalization is a proactive response to market volatility and challenges faced by King Washington. By aligning the capital structure with current market conditions, the company can better navigate uncertainties and emerge stronger in the ever-changing business environment. In summary, the recapitalization proposal for King Washington intends to optimize the company's financial structure, unlock value, and address market volatility. By implementing appropriate strategies tailored to our specific needs, we aim to fortify King Washington's position in the industry and foster sustainable growth. I kindly request you to carefully evaluate this proposal, conduct due diligence, and engage in comprehensive discussions during upcoming board meetings. Your insights and guidance are immensely valuable as we collectively work towards the long-term success of King Washington. Thank you for your attention to this crucial matter. Yours sincerely, [Your Name] [Your Designation/Title] King Washington.

King Washington Letter to Board of Directors regarding recapitalization proposal

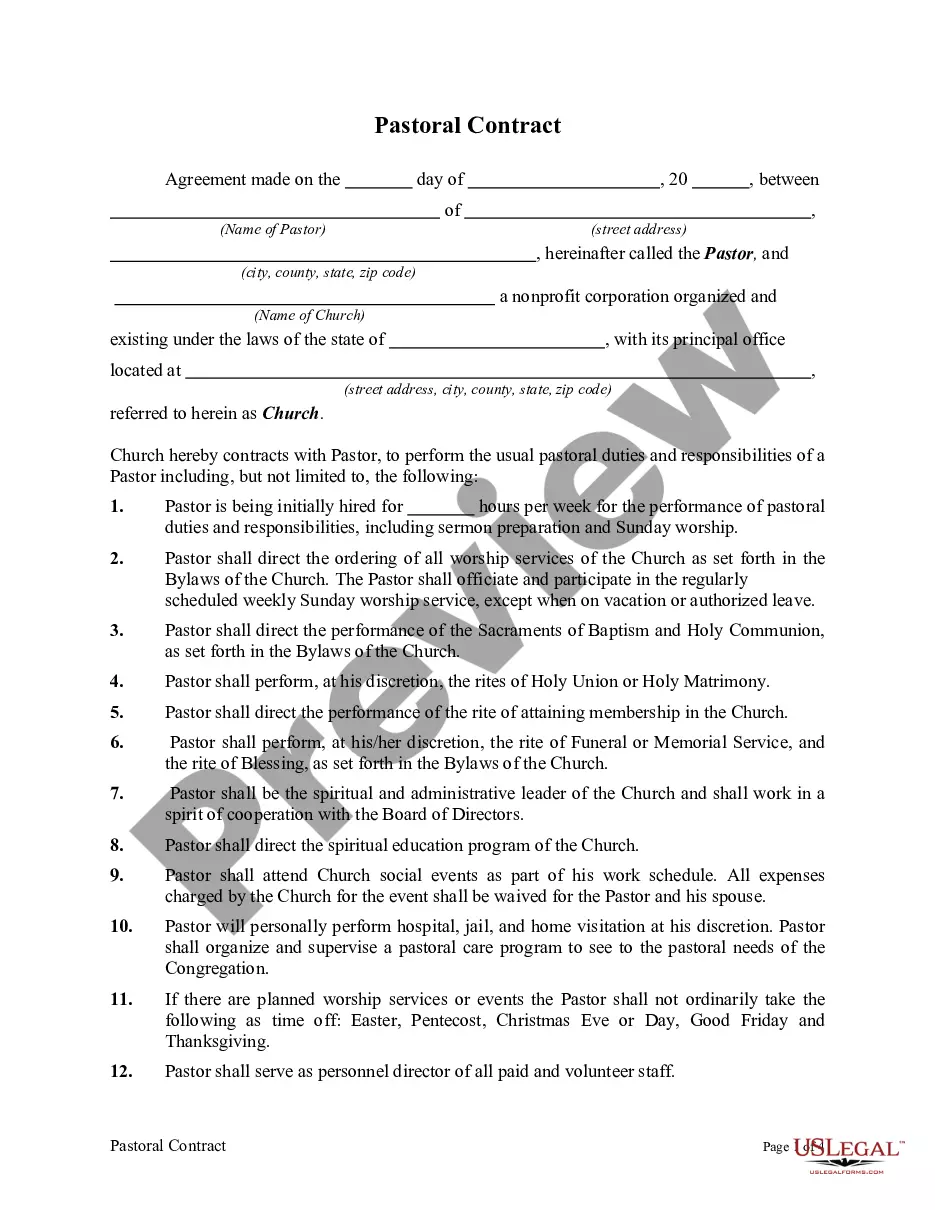

Description

How to fill out King Washington Letter To Board Of Directors Regarding Recapitalization Proposal?

Are you looking to quickly create a legally-binding King Letter to Board of Directors regarding recapitalization proposal or probably any other document to handle your personal or business matters? You can go with two options: contact a legal advisor to draft a valid document for you or draft it completely on your own. Luckily, there's a third solution - US Legal Forms. It will help you receive neatly written legal documents without paying unreasonable prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-compliant document templates, including King Letter to Board of Directors regarding recapitalization proposal and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate documents. We've been on the market for over 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary document without extra troubles.

- First and foremost, carefully verify if the King Letter to Board of Directors regarding recapitalization proposal is tailored to your state's or county's regulations.

- If the document includes a desciption, make sure to check what it's intended for.

- Start the searching process again if the template isn’t what you were looking for by utilizing the search bar in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the King Letter to Board of Directors regarding recapitalization proposal template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. In addition, the documents we provide are reviewed by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!