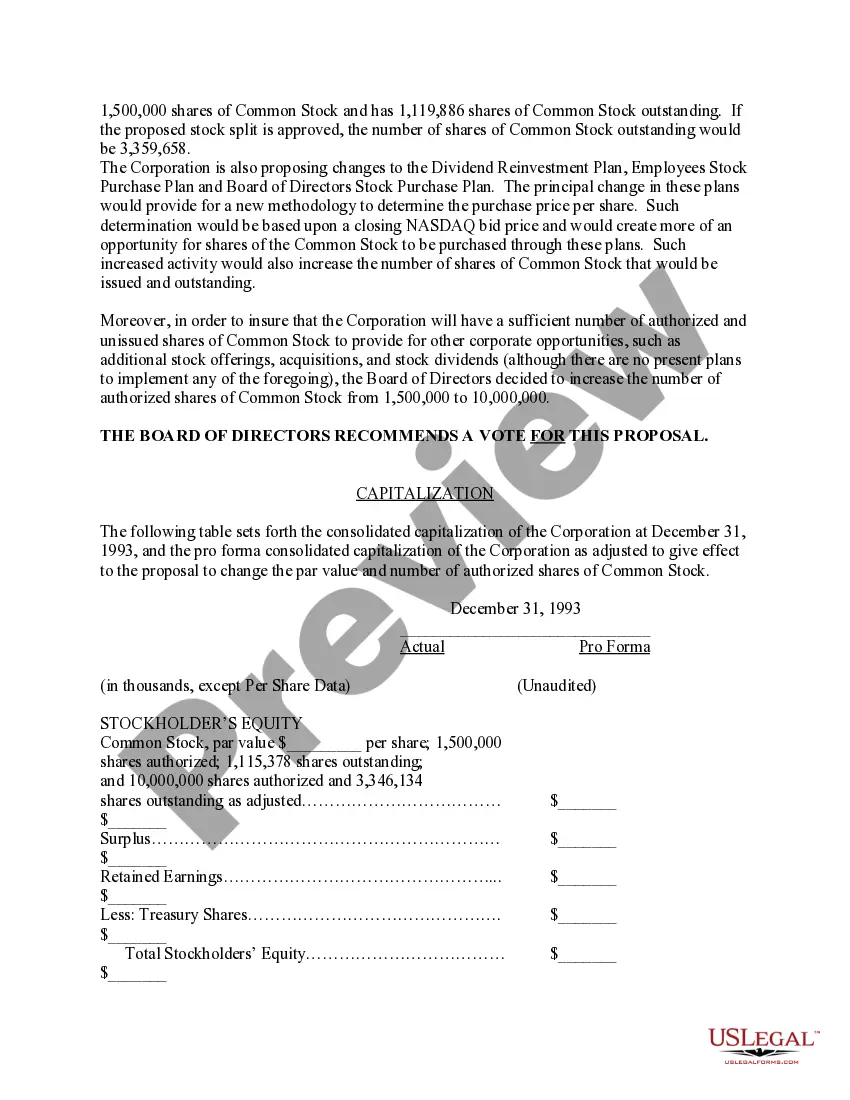

Alameda California Proposal for the Stock Split and Increase in the Authorized Number of Shares: Alameda, a city nestled on the San Francisco Bay, is home to a vibrant business community. With a proposal for a stock split and increase in the authorized number of shares, Alameda California aims to open up new opportunities for growth and attract potential investors. A stock split is a corporate action that involves dividing a company's existing shares into multiple shares. This strategy is often employed to make the stock more accessible and affordable for investors, as well as increase liquidity in the market. Alameda California's proposal for a stock split aims to make their shares more attractive to a wider range of investors, both big and small. By splitting the stock, the price per share becomes more affordable, thus potentially increasing demand and liquidity. This not only creates a broader shareholder base but also enhances the stock's trading and marketability. Alameda California recognizes that a stock split can be an effective tool to drive shareholder value and provide a boost to the company's overall market position. In addition to the stock split, the proposal also includes an increase in the authorized number of shares. This means that the company seeks approval to issue more shares than previously allowed. Increasing the authorized number of shares grants the company flexibility in raising capital for future expansion plans, acquisitions, or other strategic initiatives. It also allows for potential stock-based compensation to attract and retain key talent. Alameda California's proposal for the stock split and increase in the authorized number of shares reflects the company's commitment to capital market efficiency, shareholder value, and long-term growth. By making their shares more accessible and increasing their ability to raise capital, Alameda California aims to position itself strategically and stay ahead in a competitive business landscape. Different types of Alameda California Proposal for the Stock Split and Increase in the Authorized Number of Shares: 1. Traditional Stock Split Proposal: This proposal involves a standard division of existing shares to increase liquidity and make stocks more affordable for investors. 2. Reverse Stock Split Proposal: In contrast to a traditional stock split, a reverse stock split reduces the number of outstanding shares. It is often used to increase the stock price and attract institutional investors or meet exchange requirements. 3. Authorized Shares Increase Proposal: This type of proposal solely focuses on expanding the authorized number of shares that a company can issue, without necessarily splitting the existing shares. It allows the company to have more flexibility in capital raising and stock-based compensation. 4. Combination Proposal: Some companies may choose to combine both a stock split and an increase in the authorized number of shares within a single proposal. This comprehensive approach provides benefits from both strategies, targeting a wider investor base while also enhancing the company's future financial capabilities. In summary, Alameda California's proposal for a stock split and increase in the authorized number of shares aims to bring about positive changes to its market position, shareholder value, and future growth prospects. The different types of proposals available allow for versatility in implementing these strategies, catering to the specific needs and goals of the company.

Alameda California Proposal for the Stock Split and Increase in the Authorized Number of Shares

Description

How to fill out Alameda California Proposal For The Stock Split And Increase In The Authorized Number Of Shares?

Whether you intend to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Alameda Proposal for the Stock Split and Increase in the Authorized Number of Shares is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to obtain the Alameda Proposal for the Stock Split and Increase in the Authorized Number of Shares. Follow the instructions below:

- Make sure the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Alameda Proposal for the Stock Split and Increase in the Authorized Number of Shares in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!