Mecklenburg North Carolina Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock

Description

How to fill out Mecklenburg North Carolina Notice And Proxy Statement To Effect A 2-for-1 Split Of Outstanding Common Stock?

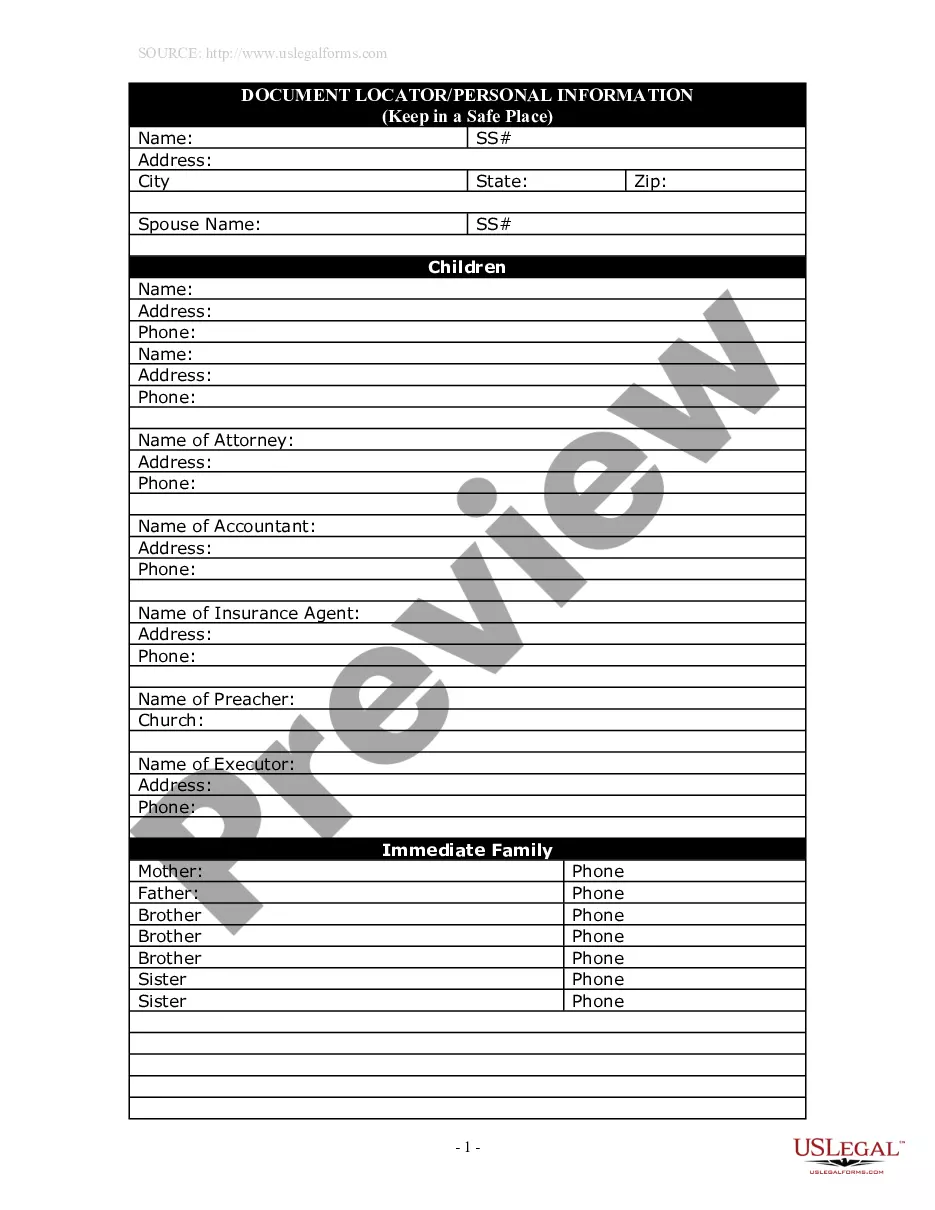

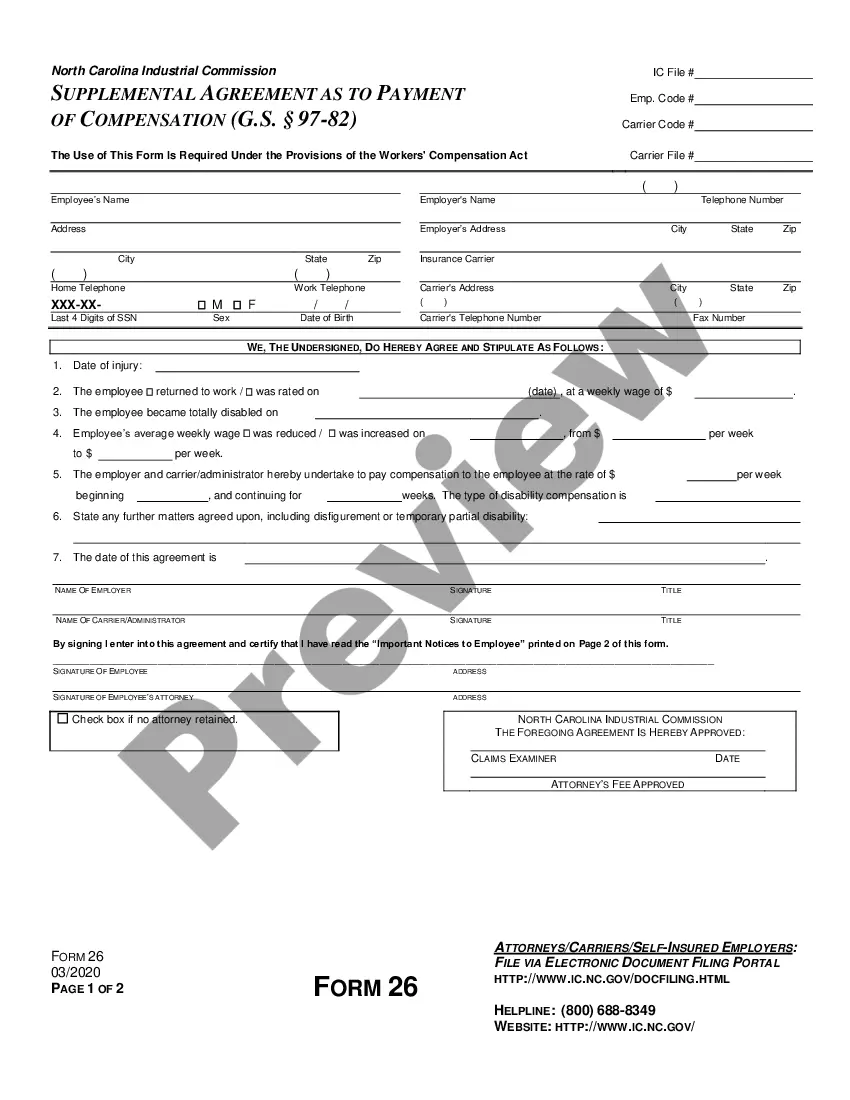

Preparing legal documentation can be burdensome. In addition, if you decide to ask an attorney to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Mecklenburg Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Therefore, if you need the current version of the Mecklenburg Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Mecklenburg Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Mecklenburg Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock and save it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

A 10 for 1 stock split means that for each share an investor has, there will now be ten. This overall value of the company will still be the same due to market capitalization. This can be figured out by multiplying the total shares by the price each share is worth.

Should you buy before or after a stock split? Theoretically, stock splits by themselves shouldn't influence share prices after they take effect since they're essentially just cosmetic changes.

A 2-for-1 stock split grants you two shares for every one share of a company you own. If you had 100 shares of a company that has decided to split its stock, you'd end up with 200 shares after the split. A 2 for 1 stock split doubles the number of shares you own instantly.

For example, a 2-for-1 stock split would reduce the par value of each share of stock by 50 percent. No account is debited, but a memo entry should be made on the company's balance sheet indicating the change in the company's per share par value.

What is a 20-for-1 stock split? A 20-for-1 split means that Amazon shareholders got 19 additional shares for every one they owned before Monday. Since Amazon shares closed at $2,447 on Friday, before markets opened Monday, the price of shares after the split went to about $122, or $2,447 divided by 20.

A 3-for-1 stock split means that for every one share held by an investor, there will now be three. In other words, the number of outstanding shares in the market will triple. On the other hand, the price per share after the 3-for-1 stock split will be reduced by dividing the old share price by 3.

For example, in a 2-for-1 stock split, a shareholder receives an additional share for each share held. So, if a company had 10 million shares outstanding before the split, it will have 20 million shares outstanding after a 2-for-1 split.

If the event is a stock split, there is no change in either Retained Earnings or Common Stock, only a decrease in par value and an increase in the number of issued and outstanding shares.

Stock splits are generally a sign that a company is doing well, meaning it could be a good investment. Additionally, because the per-share price is lower, they're more affordable and you can potentially buy more shares.

While there are some psychological reasons why companies split their stock, it doesn't change any of the business fundamentals. Remember, the split has no effect on the company's worth as measured by its market cap. In the end, whether you have two $50 bills or single $100, you have the same amount in the bank.

More info

). Do I need a license to rent a car in North Carolina?. See more coverage here. Is there a State law against a “grocery store operator” carrying guns in a grocery store? Or are you protected if a “grocery store operator” does? Here are some of the best stories about how law enforcement officers in North Carolina dealt with situations involving carrying firearms in grocery stores. Do I still need a North Carolina concealed carry permit taking hunting rifles home when I pick them up from the range?. The State of North Carolina concealed carry law allows for the carrying of firearms at licensed shooting facilities while they are being used for lawful purposes. However, under this provision, firearms can not be discharged while in the open presence of others, or while being transported by a person who does not possess a valid concealed carry permit. Can I take my car to get a repair job or get new tires in North Carolina?.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.