Nassau New York Proposal to Amend Certificate of Incorporation to Effectuate a One for Ten Reverse Stock Split In the bustling financial hub of Nassau, New York, a noteworthy proposal has emerged in the corporate landscape. This proposal aims to amend the certificate of incorporation of a prominent company to effectuate a one for ten reverse stock splits. Through this detailed description, we will explore the significance of this proposal, shed light on the intended outcomes, and touch upon examples of different types of amendments similar to this in Nassau, New York. A reverse stock split is a strategic maneuver often undertaken by companies to consolidate their outstanding shares, reducing the number of shares while increasing their value proportionally. In the case of the Nassau New York proposal, the stock split ratio stands at one for ten. This means that for every ten existing shares owned by an individual, they would receive one new share with ten times the value of the original shares. The purpose behind implementing a reverse stock split can vary based on the specific circumstances of the company. It may aim to increase the stock price, thereby potentially attracting new investors and improving the company's market perception. Through this consolidation, companies also seek to enhance their stock's liquidity, making it more appealing to traders. In Nassau, New York, several variations of reverse stock splits have been observed, with each designed to meet particular corporate objectives. Some notable types include: 1. Fractional Reverse Stock Split: This type occurs when the reverse split results in fractional shares. To address this, the company may compensate shareholders through cash payments or offer alternatives to acquire whole shares. 2. Reverse Stock Split with Proportional Adjustment: Here, the reverse stock split is accompanied by a proportional adjustment to options, warrants, or any other derivative securities held by shareholders. This ensures that existing stakeholders retain their relative ownership interests in the company. 3. Reverse Stock Split with Additional Capital Raise: In certain cases, a company may combine the reverse stock split with a simultaneous capital raise. By issuing additional shares, the company can generate funds for expansion, acquisitions, or debt repayment. It is crucial to recognize that while a reverse stock split may present potential benefits to a company, it also carries inherent risks and uncertainties. Investors should thoroughly analyze the proposed amendments and understand the implications before making any financial decisions. In conclusion, the Nassau New York Proposal to amend the certificate of incorporation to effectuate a one for ten reverse stock splits holds significant implications for the concerned company and its shareholders. By consolidating shares, the proposal aims to increase the stock price and enhance market perception. Different types of amendments including fractional splits, proportional adjustments, and those combined with additional capital raises have been witnessed in Nassau, New York. It is essential for stakeholders to carefully evaluate the potential impact and make informed decisions to ensure their interests are safeguarded in this pivotal moment.

Nassau New York Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split

Description

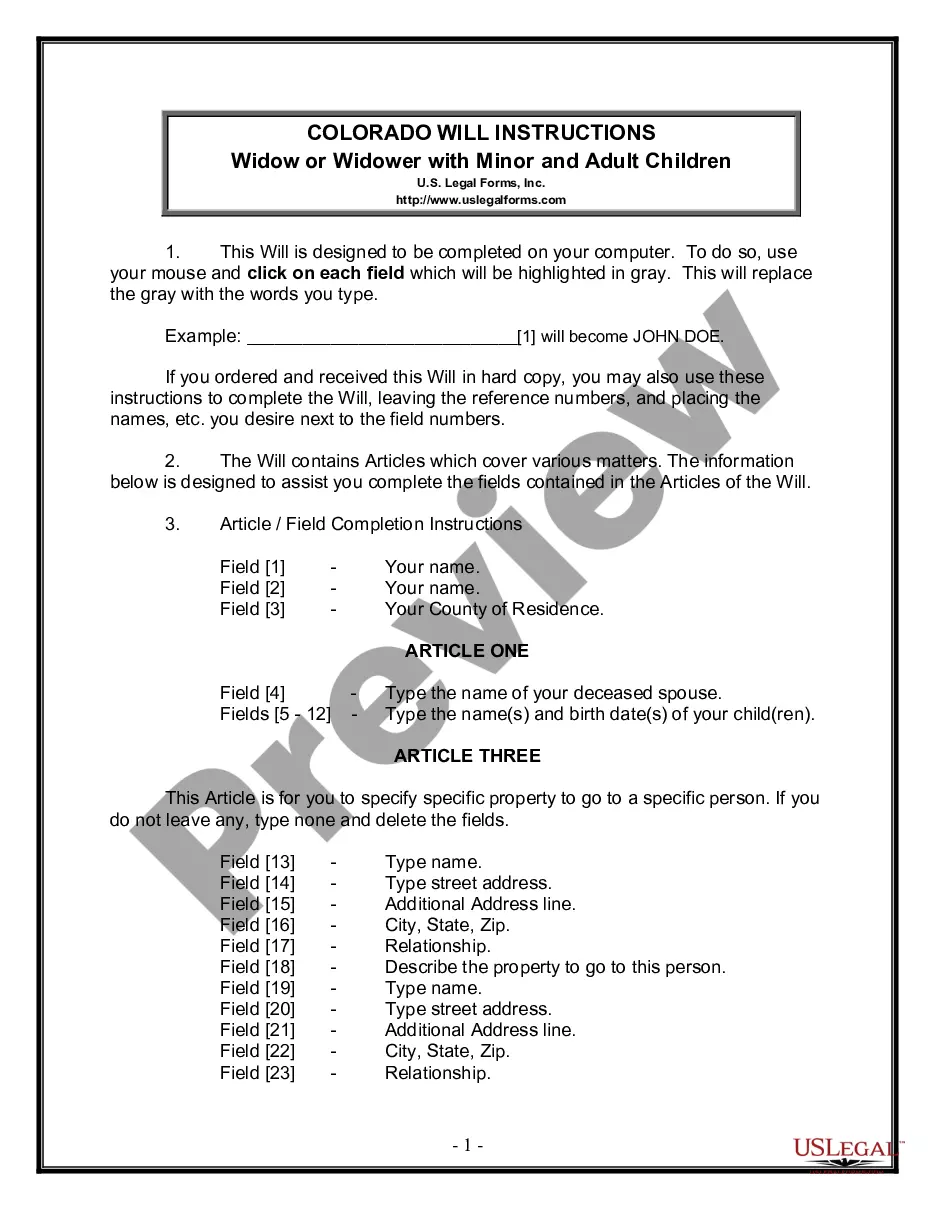

How to fill out Nassau New York Proposal To Amend Certificate Of Incorporation To Effectuate A One For Ten Reverse Stock Split?

If you need to get a reliable legal paperwork provider to find the Nassau Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split, look no further than US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can browse from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of learning resources, and dedicated support make it easy to get and complete various paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply type to look for or browse Nassau Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split, either by a keyword or by the state/county the form is intended for. After locating required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Nassau Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be instantly ready for download once the payment is completed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less costly and more reasonably priced. Set up your first company, arrange your advance care planning, draft a real estate agreement, or execute the Nassau Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split - all from the convenience of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

What is required should an issuer choose to do a reverse stock split? Generally, a public company can declare a reverse split if it obtains the approval of its board of directors. Most often shareholder approval is not required.

A stock split occurs when a Board of Directors authorizes a change in the par or stated value of its stock. This reduction in par value is made to lower the market price of the stock to make the stock more attractive to potential investors.

Although the SEC has authority over a broad range of corporate activity, state corporate law and a company's articles of incorporation and by-laws generally govern the company's ability to declare a reverse stock split and whether shareholder approval is required.

For example: For a 1-for-2 reverse stock split, enter 1 in the New Shares field and 2 in the Old Shares field. Open the account you want to use. Click Enter Transactions. In the Enter Transaction list, select Stock Split. Use this dialog to record the split. Click a link below for more information. Transaction date.

Generally, the split must be approved by either the board of directors or shareholders, depending on the company's bylaws and state corporate law. Public companies that file with the SEC can notify shareholders about an upcoming reverse stock split with a proxy statement on forms 8-K, 10-Q, or 10-K.

A reverse stock split consolidates the number of existing shares of stock held by shareholders into fewer shares. A reverse stock split does not directly impact a company's value (only its stock price). It can signal a company in distress since it raises the value of otherwise low-priced shares.

Will the reverse stock split change the par value of the share? Yes, the par value of each share will be increased proportionally to the exchange ratio, i.e. it will be multiplied by 20.

In a stock split the number of outstanding shares increases and the price per share decreases proportionately, while the market capitalization and the value of the company do not change.

What is FINRA's role? FINRA does not approve reverse splits, but it does process reverse stock splits as part of its functions related to company corporate actions in the OTC market. OTC companies must submit notice to FINRA 10 days prior to the record/effective date of the corporate action.

Reverse stock splits don't affect the number of authorized shares, but a forward stock split issues new stock from the company's authorized shares. When new shares are issued by a company, it adds to the number of outstanding shares and reduces each shareholder's percentage of ownership in the company.