Orange, California is a vibrant city located in Orange County. Known for its rich history, diverse culture, and beautiful architecture, Orange offers residents and visitors alike a unique and charming experience. With its convenient location and proximity to major attractions, Orange is a popular destination for both business and leisure travelers. Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock splits is a financial initiative being considered by companies in Orange, California. A reverse stock split is a corporate action that reduces the number of outstanding shares of a company, while increasing the share price proportionally. This proposal aims to consolidate the company's shares, which can potentially enhance its market appeal and trading liquidity. It is important to note that there may be variations or additional types of reverse stock splits, such as a one for five or one for twenty, depending on the company's specific needs and objectives. The proposed amendment to the certificate of incorporation in Orange, California would necessitate the approval of the company's board of directors and shareholders. It would require a detailed implementation plan outlining the timeline, procedures, and potential impact on stakeholders. By addressing the reverse stock split through this formal proposal, the company aims to streamline its capital structure, improve market perception, and potentially attract new investors. The one for ten reverse stock split proposal holds several potential benefits for the company and its shareholders. Firstly, it can increase the share price, making it more attractive to institutional investors and potentially boosting investor confidence. Additionally, a reduced number of outstanding shares can enhance the company's financial ratios, making it more favorable for potential mergers or acquisitions. Moreover, a reverse stock split can help create a perception of stability and improved market value, potentially attracting a wider range of investors. In summary, the proposal to amend certificate of incorporation in Orange, California to effectuate a one for ten reverse stock splits is a financial strategy being considered by companies. The aim is to consolidate shares, potentially increase share price, boost market appeal, and improve liquidity. Although there may be variations such as a one for five or one for twenty reverse stock splits, the ultimate goal would be to enhance the company's overall performance and attract investors.

Orange California Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split

Description

How to fill out Orange California Proposal To Amend Certificate Of Incorporation To Effectuate A One For Ten Reverse Stock Split?

Drafting documents for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to draft Orange Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split without professional help.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Orange Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, follow the step-by-step guideline below to get the Orange Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split:

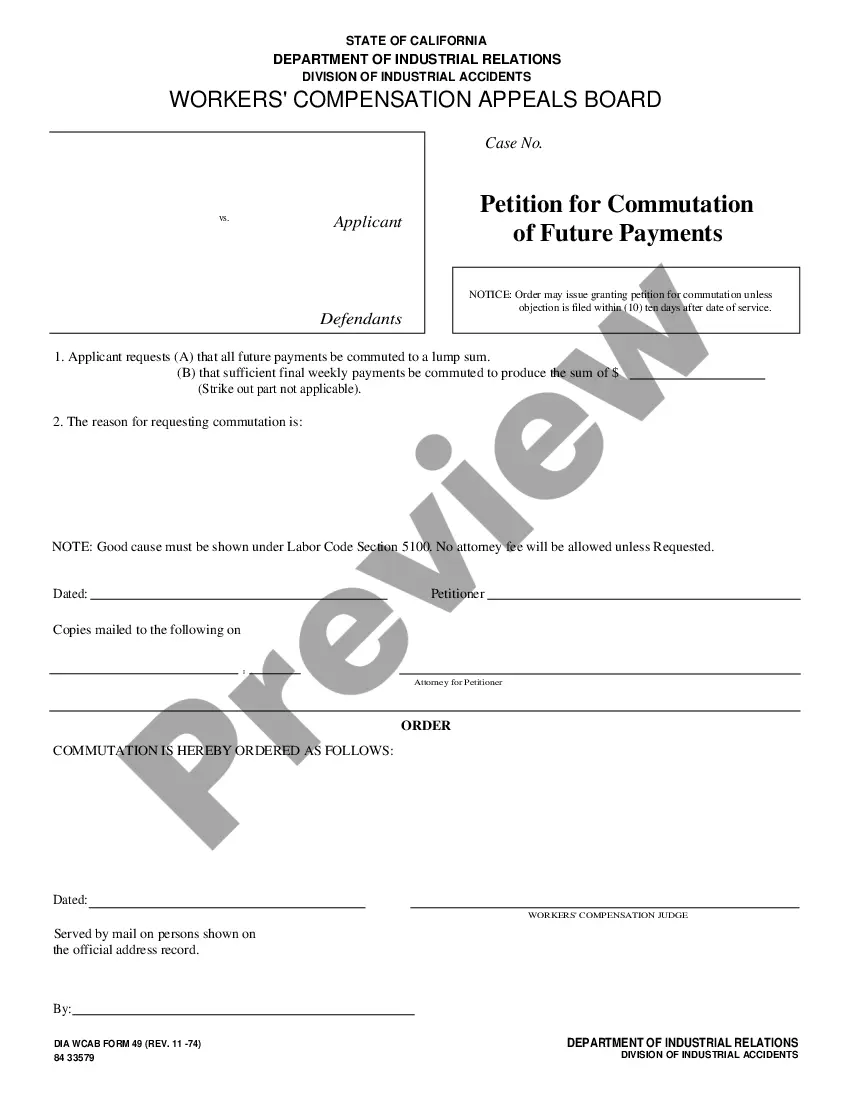

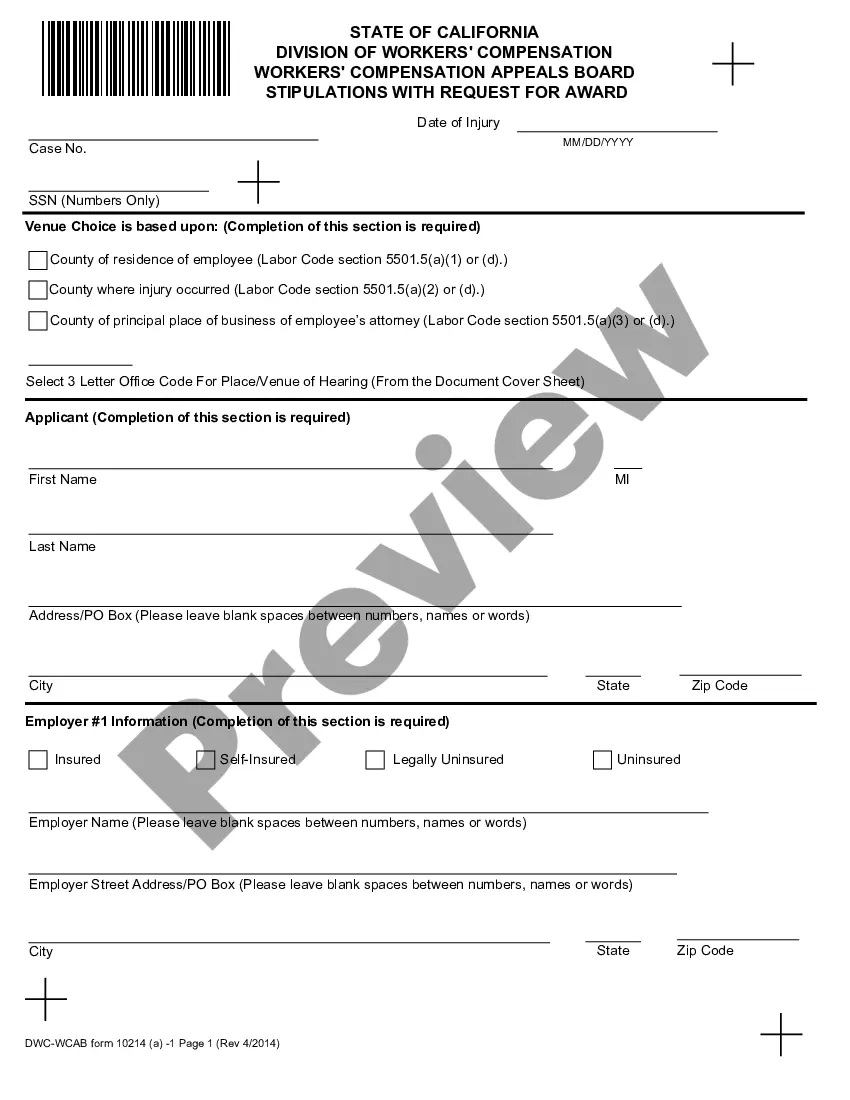

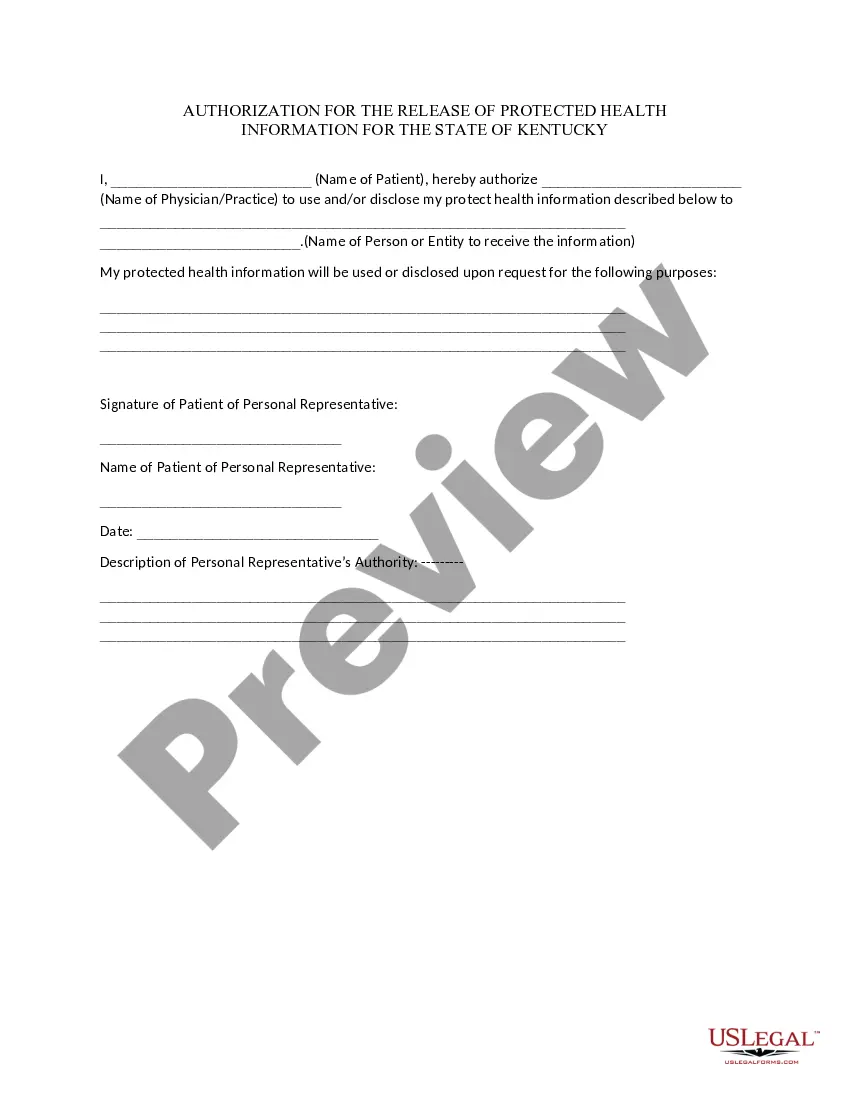

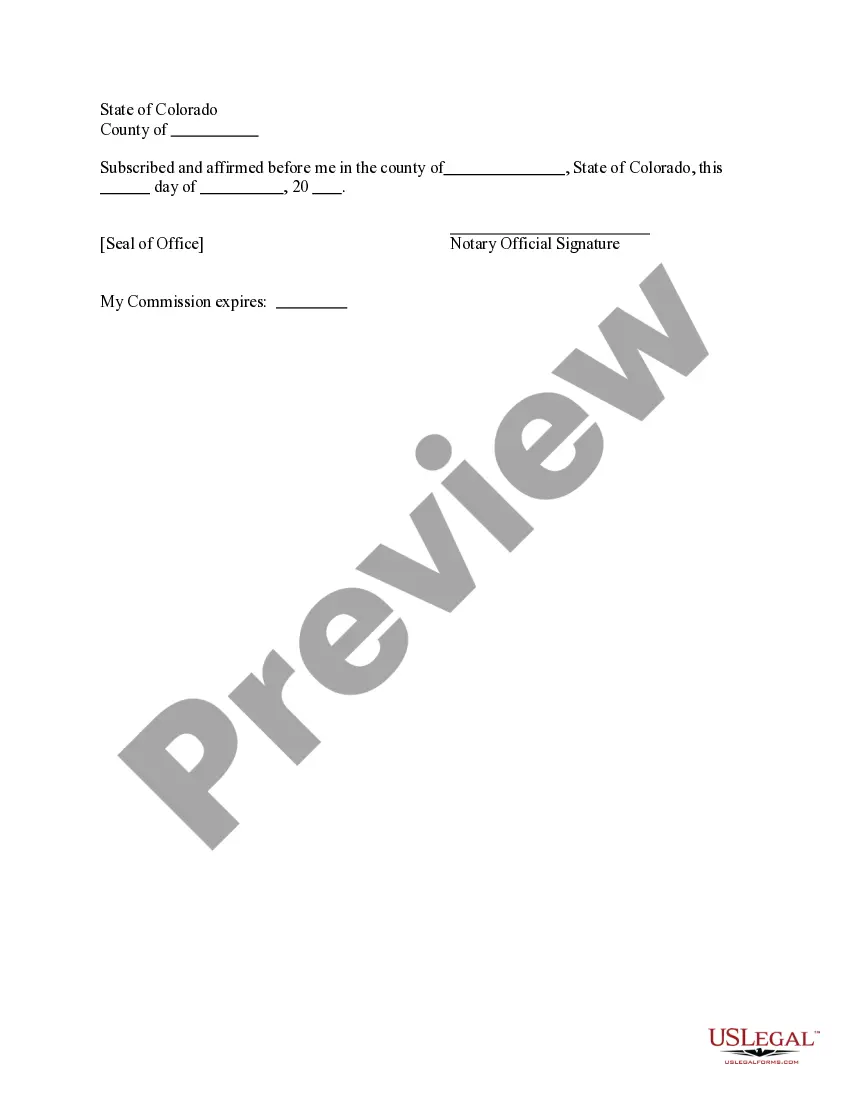

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that suits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any situation with just a few clicks!

Form popularity

FAQ

A reverse stock split has no effect on the value of what shareholders own. What is required should an issuer choose to do a reverse stock split? Generally, a public company can declare a reverse split if it obtains the approval of its board of directors. Most often shareholder approval is not required.

A company may declare a reverse stock split in an effort to increase the trading price of its shares for example, when it believes the trading price is too low to attract investors to purchase shares, or in an attempt to regain compliance with minimum bid price requirements of an exchange on which its shares trade.

A company may declare a reverse stock split in an effort to increase the trading price of its shares for example, when it believes the trading price is too low to attract investors to purchase shares, or in an attempt to regain compliance with minimum bid price requirements of an exchange on which its shares trade.

Sometimes a reverse stock split means a shareholder has fractional shares. For example, if you have 100 shares before a reverse stock split and the split is one-for-three your shares will be 33.33. In most cases, the company will enter your shares at 33 and you will get the remainder in cash.

Reverse stock splits don't affect the number of authorized shares, but a forward stock split issues new stock from the company's authorized shares. When new shares are issued by a company, it adds to the number of outstanding shares and reduces each shareholder's percentage of ownership in the company.

What is required should an issuer choose to do a reverse stock split? Generally, a public company can declare a reverse split if it obtains the approval of its board of directors. Most often shareholder approval is not required.

A reverse stock split is when a company decreases the number of shares outstanding in the market by canceling the current shares and issuing fewer new shares based on a predetermined ratio. For example, in a reverse stock split, a company would take every two shares and replace them with one share.

Announcements. The Securities and Exchange Commission, which administers securities law, does not require advance warning of a reverse stock split. A company can take this action without the approval of shareholders if its own by-laws allow it.

The number of authorized shares can be changed by way of a vote from shareholders, typically during the annual shareholder meeting. The number of shares actually available to trade is known as float. There are also restricted shares, which are set aside for employee compensation and incentives.

Generally, the split must be approved by either the board of directors or shareholders, depending on the company's bylaws and state corporate law. Public companies that file with the SEC can notify shareholders about an upcoming reverse stock split with a proxy statement on forms 8-K, 10-Q, or 10-K.