Queens, New York: Proposal to Amend Certificate of Incorporation for One for Ten Reverse Stock Split In the bustling city of Queens, New York, a notable proposal has emerged regarding the amendment of a company's certificate of incorporation. The proposal aims to effectuate a one for ten reverse stock splits, which holds significant implications for shareholders and the company's overall capital structure. A reverse stock split is a strategic financial maneuver that reduces the number of outstanding shares while simultaneously increasing their value. In the case of a one for ten reverse stock splits, every ten existing shares would be consolidated into a single share, leading to a decrease in the overall number of outstanding shares. This action is particularly relevant when a company's stock price has dropped significantly, as it can enhance the perceived value of each share. The motive behind the proposal is to potentially strengthen the company's equity structure, attract new investors, and increase liquidity for existing shareholders. By reducing the number of outstanding shares, this amendment can create a more appealing market perception and signal confidence in the company's future growth prospects. Understanding the potential benefits and considerations involved in this proposal is crucial. Shareholders must assess the impact of the reverse stock split on their current holdings. While the value of each share may increase, individual ownership in the company may decrease proportionally due to the consolidation process. Furthermore, any proposal to amend a certificate of incorporation requires careful evaluation to ensure compliance with laws and regulations. Legal procedures, such as shareholder approvals and filings with relevant authorities, must be diligently followed to effectuate the reverse stock split successfully. Different Types of Queens, New York Proposals for a One for Ten Reverse Stock Split: 1. Pharmaceutical Industry: A Queens-based pharmaceutical company sees an opportunity to restructure its capital base through the proposed one for ten reverse stock splits. By bolstering the perceived value of its shares, the company aims to attract potential investors and regain market confidence in its innovative drug pipeline. 2. Technology Sector: A Queens-based technology firm, facing a decline in its stock price due to market volatility, proposes a one for ten reverse stock splits. The company strategizes to enhance the attractiveness of its shares to institutional investors and amplify the potential for future capital raising opportunities. 3. Real Estate Development: A prominent Queens real estate developer contemplates a one for ten reverse stock splits to consolidate the ownership structure while still maintaining control. The proposal aims to enhance flexibility in financing options and improve the company's ability to navigate the dynamic real estate market. 4. Manufacturing Industry: A renowned Queens manufacturing company envisions a one for ten reverse stock split to achieve a better balance between price and stock market perception. By reducing the number of outstanding shares, the firm aims to present a more solid balance sheet and financial standing, attracting both potential investors and strategic partners. In conclusion, the proposal to amend a certificate of incorporation in Queens, New York, to effectuate a one for ten reverse stock splits carries immense potential for companies seeking to restructure their capital base, attract new investors, and revitalize market perception. This strategic maneuver, if properly executed and evaluated, can play a pivotal role in shaping the company's future growth trajectory and shareholder value.

Queens New York Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split

Description

How to fill out Queens New York Proposal To Amend Certificate Of Incorporation To Effectuate A One For Ten Reverse Stock Split?

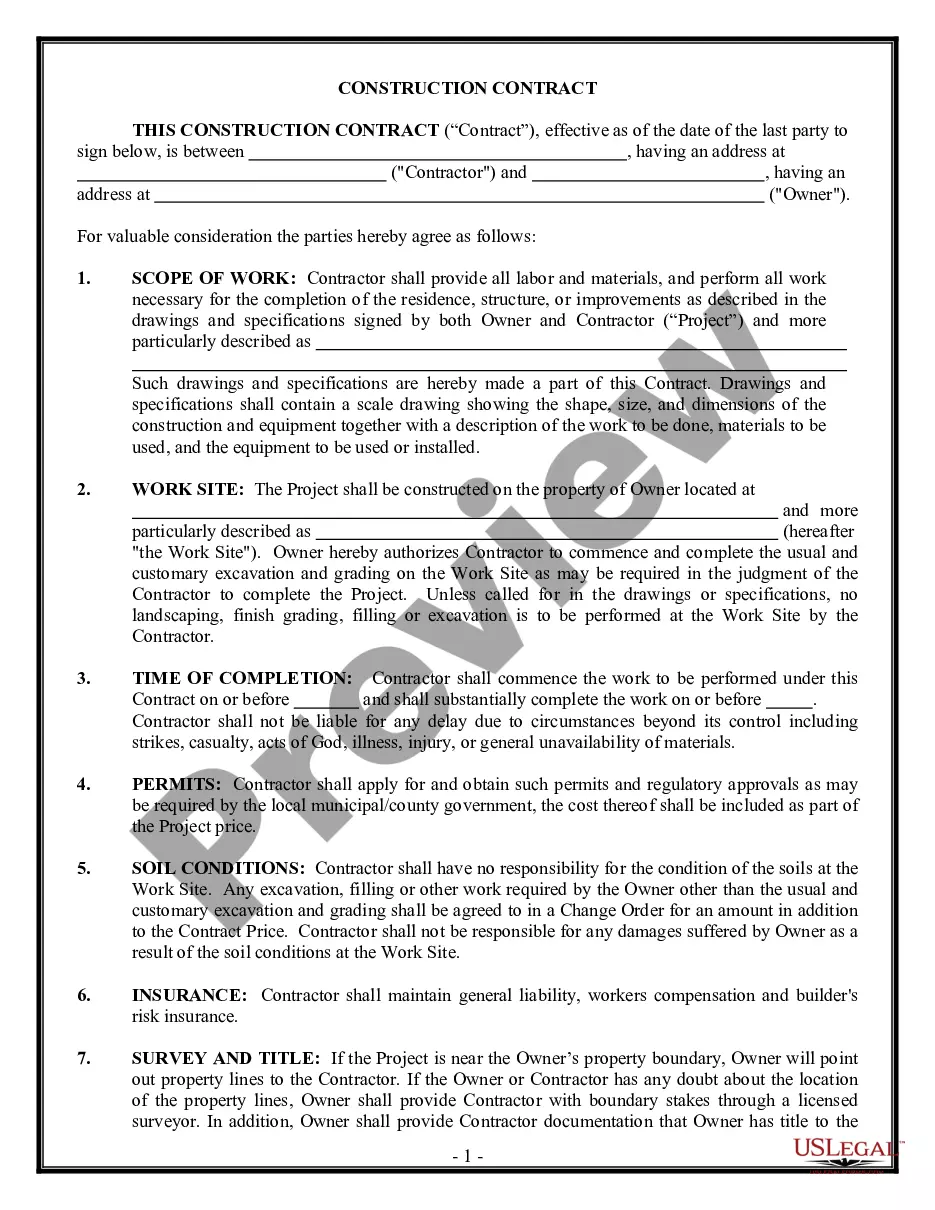

Whether you intend to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Queens Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Queens Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split. Follow the guidelines below:

- Make sure the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to get the file when you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Queens Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

Per-share price bumping is the primary reason why companies opt for reverse stock splits, and the associated ratios may range from 1-for-2 to as high as 1-for-100. Reverse stock splits do not impact a corporation's value, although they are usually a result of its stock having shed substantial value.

In some reverse stock splits, small shareholders are "cashed out" (receiving a proportionate amount of cash in lieu of partial shares) so that they no longer own the company's shares. Investors may lose money as a result of fluctuations in trading prices following reverse stock splits.

Will the reverse stock split change the par value of the share? Yes, the par value of each share will be increased proportionally to the exchange ratio, i.e. it will be multiplied by 20.

Although the SEC has authority over a broad range of corporate activity, state corporate law and a company's articles of incorporation and by-laws generally govern the company's ability to declare a reverse stock split and whether shareholder approval is required.

Initially, a reverse stock split does not hurt shareholders. Investors who have $1,000 invested in 100 shares of a stock now have $1,000 invested in fewer shares. This does not mean the price of the stock will not decline in the future; putting all or part of an investment in jeopardy.

A reverse stock split occurs when a publicly traded company divides the number of outstanding shares by a certain amount. This serves to decrease the number of outstanding shares and increase the price per share of those outstanding shares.

Stock splits are generally not taxable, as the cost basis per share is updated to reflect the new stock structure and price so that the total market value is the same. Since you did not make any gains on the stock split, no taxes are owed.

For example: For a 1-for-2 reverse stock split, enter 1 in the New Shares field and 2 in the Old Shares field. Open the account you want to use. Click Enter Transactions. In the Enter Transaction list, select Stock Split. Use this dialog to record the split. Click a link below for more information. Transaction date.

Calculating the effects of a reverse stock split is easy. Simply divide the number of shares you own by the split ratio and multiply the pre-split share price by the same amount.

No journal entry is recorded for a stock split. Instead, the company prepares a memo entry in its journal that indicates the nature of the stock split and indicates the new par value. The balance sheet will reflect the new par value and the new number of shares authorized, issued, and outstanding after the stock split.