Title: Broward, Florida Proposal to Amend Certificate: Reducing Par Value, Increasing Authorized Common Stock, and Implementing Reverse Stock Split with Exhibit Introduction: Broward, Florida's proposal aims to introduce significant amendments to its certificate, primarily focusing on reducing par value, increasing authorized common stock, and implementing a reverse stock split. These changes carry significant implications for the entity and its shareholders, allowing for enhanced flexibility and potential growth opportunities. This article will provide a detailed overview of this proposal, discussing its objectives, key elements, and potential benefits for Broward and its shareholders. 1. Objective of the Proposal: The primary objective of Broward, Florida's proposal to amend its certificate is to adapt to evolving market dynamics, enhance financial flexibility, and position the entity for future growth. By reducing par value, increasing authorized common stock, and implementing a reverse stock split, Broward aims to create a more favorable capital structure, attracting potential investors and boosting shareholder value. 2. Reducing Par Value: The proposed amendment seeks to decrease the nominal value assigned to individual shares of Broward's common stock. Through this reduction, shareholders would own a greater number of shares, proportionally increasing their ownership stake. This adjustment allows Broward to decrease the barriers to entry and potentially attract a broader range of interested investors. 3. Increasing Authorized Common Stock: Broward's proposal also includes an increase in its authorized common stock. This decision gives the entity the ability to issue a greater number of shares as needed for various strategic initiatives, mergers, acquisitions, or to raise additional capital. Expanding the authorized common stock enhances Broward's capacity to pursue growth opportunities and adapt to changing market conditions. 4. Reverse Stock Split: A significant aspect of the proposal is the implementation of a reverse stock split. This process consolidates a predetermined number of shares into a single share, effectively reducing the total number of outstanding shares. The reverse stock split aims to increase the market price of Broward's common stock, potentially enhancing its attractiveness to investors and securing compliance with stock exchange listing requirements. 5. Benefits and Implications: a. Enhanced Financial Flexibility: The proposed amendments grant Broward greater flexibility in managing its capital structure, facilitating potential funding arrangements and business expansion initiatives. b. Increased Shareholder Value: Decreasing the par value and implementing a reverse stock split can boost shareholder value by potentially attracting new investors, improving share liquidity, and increasing stock price. c. Improved Market Positioning: Broward's adjusted capital structure and increased authorized common stock enable the entity to adapt swiftly to market dynamics and pursue future growth opportunities. d. Compliance and Market Perception: Aligning with stock exchange listing requirements following a reverse stock split can bolster Broward's image, enhancing its visibility and potentially attracting future partnerships or investment. 6. Conclusion: Broward, Florida's proposal to amend its certificate by reducing par value, increasing authorized common stock, and implementing a reverse stock split represents a strategic move to adapt to changing market conditions and position the entity for future growth. By enhancing financial flexibility, attracting potential investors, and complying with listing requirements, Broward aims to create a favorable environment for shareholders, offering increased value and positioned for potential success.

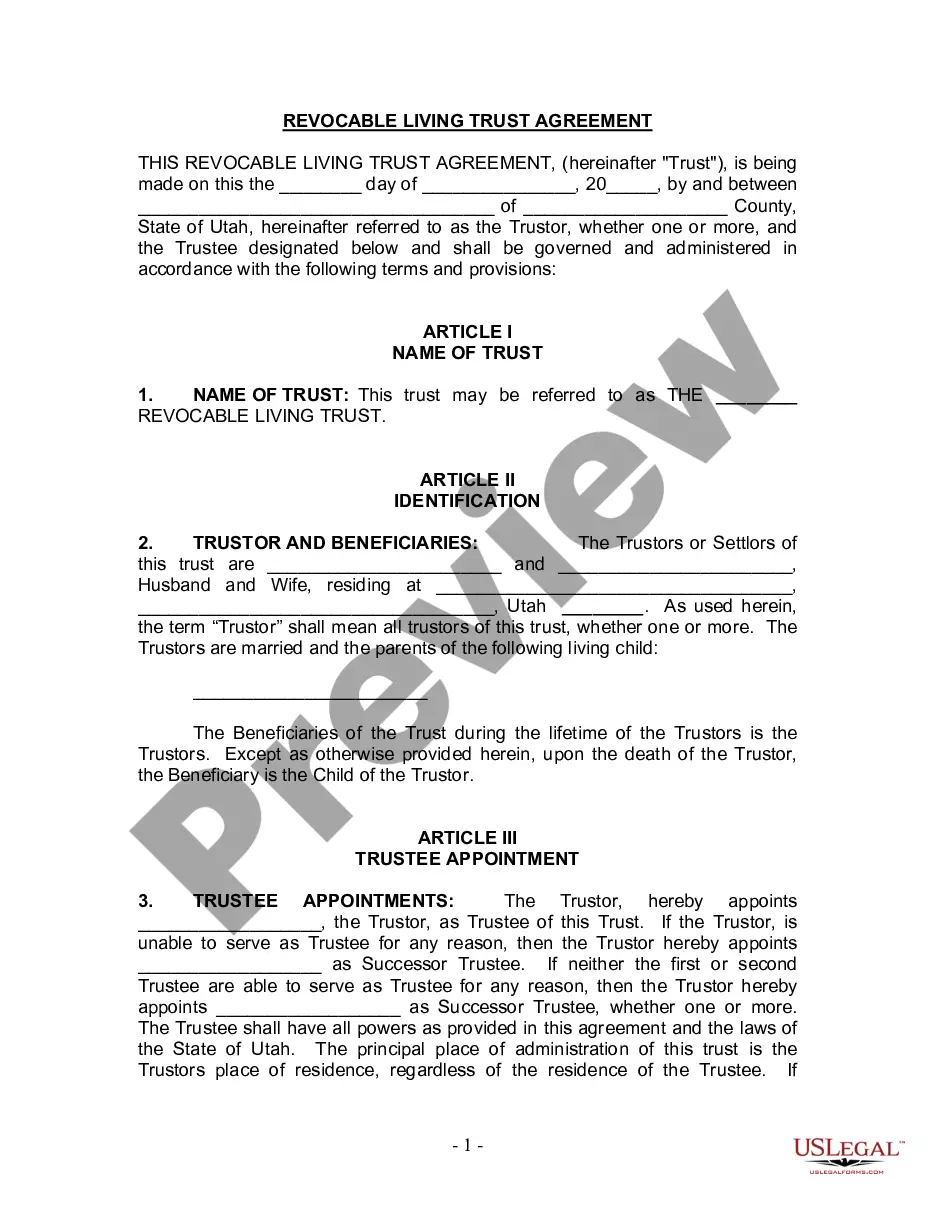

Broward Florida Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit

Description

How to fill out Broward Florida Proposal To Amend Certificate To Reduce Par Value, Increase Authorized Common Stock And Reverse Stock Split With Exhibit?

If you need to get a reliable legal document provider to obtain the Broward Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can browse from more than 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning materials, and dedicated support team make it easy to find and complete various papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to look for or browse Broward Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit, either by a keyword or by the state/county the document is intended for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Broward Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Register an account and choose a subscription option. The template will be instantly available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less pricey and more affordable. Set up your first company, arrange your advance care planning, create a real estate contract, or complete the Broward Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit - all from the comfort of your sofa.

Join US Legal Forms now!