Houston, Texas is a vibrant city known for its thriving economy, diverse culture, and numerous business opportunities. It is home to numerous corporations, including those listed on the stock exchange. One notable proposal that may arise in Houston, Texas is the amendment of articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock. A reverse stock split is a corporate action in which a company reduces the total number of outstanding shares by consolidating them into fewer shares. This can be done to increase the stock price per share, attract investors, or meet certain listing requirements. By amending the articles of incorporation, a Houston-based company can initiate this reverse stock split process. Simultaneously, a share dividend on common stock may also be authorized. Share dividends are additional shares of stock distributed by a company to its shareholders. They are typically given as a reward or bonus and are issued proportionally to existing shareholders. This can be seen as a way to enhance shareholder value and create additional liquidity. The proposed amendment to the articles of incorporation in Houston, Texas aims to effectively execute both a reverse stock split and authorize a share dividend on common stock. By combining these actions, a company can streamline its capital structure, potentially increase its stock price, and reward its shareholders simultaneously. It is essential to note that various types of proposals may arise in Houston, Texas regarding the amendment of articles of incorporation, reverse stock splits, and share dividends. Some examples include proposals specific to a particular industry, such as energy or healthcare, while others may be applicable to companies of all sectors. The specific wording and conditions of each proposal will likely vary depending on the involved corporation and its objectives. In summary, Houston, Texas serves as a hub for corporate activities, leading to proposals to amend articles of incorporation to execute a reverse stock split of common stock and authorize a share dividend on common stock. These actions can have significant implications for the company's capital structure and shareholder value.

Houston Texas Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock

Description

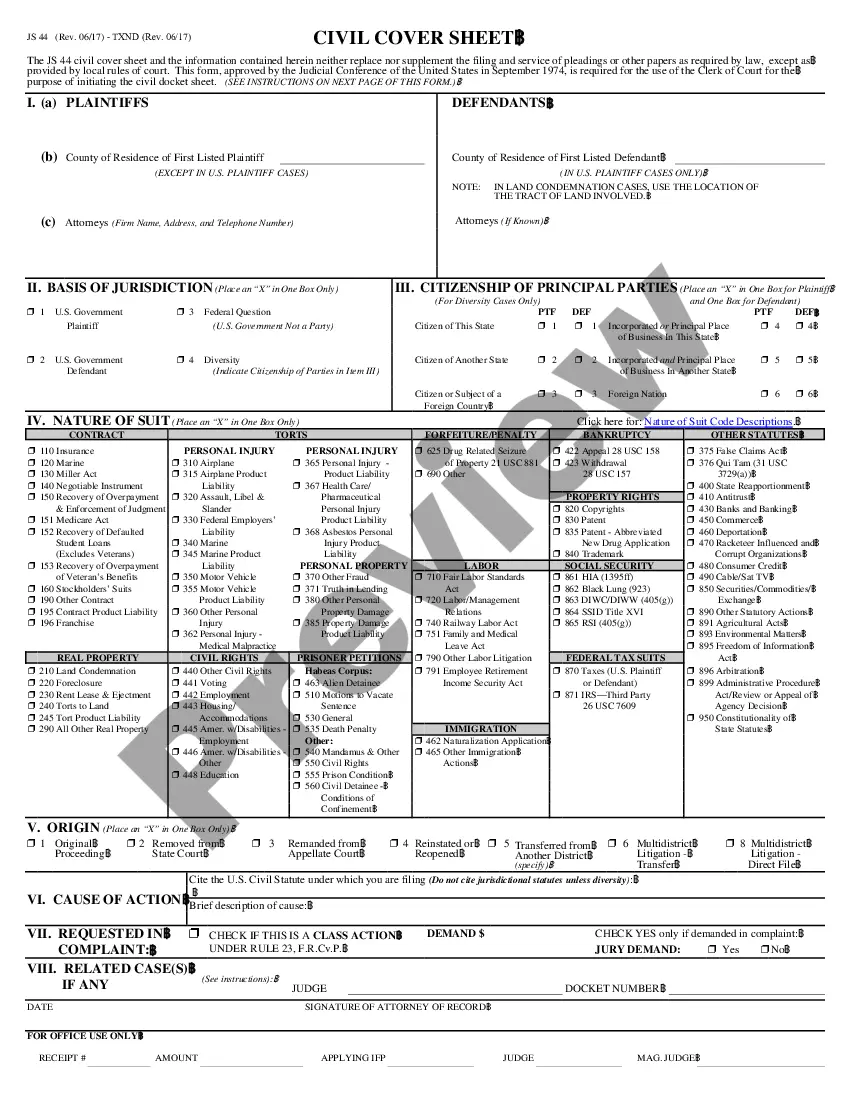

How to fill out Houston Texas Proposal To Amend Articles Of Incorporation To Effect A Reverse Stock Split Of Common Stock And Authorize A Share Dividend On Common Stock?

If you need to find a reliable legal form supplier to get the Houston Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock, consider US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can select from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support make it simple to locate and complete different papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply select to look for or browse Houston Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock, either by a keyword or by the state/county the form is created for. After locating needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Houston Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock template and take a look at the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and select a subscription plan. The template will be instantly available for download as soon as the payment is completed. Now you can complete the form.

Handling your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less costly and more reasonably priced. Set up your first business, arrange your advance care planning, create a real estate agreement, or complete the Houston Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock - all from the convenience of your sofa.

Sign up for US Legal Forms now!