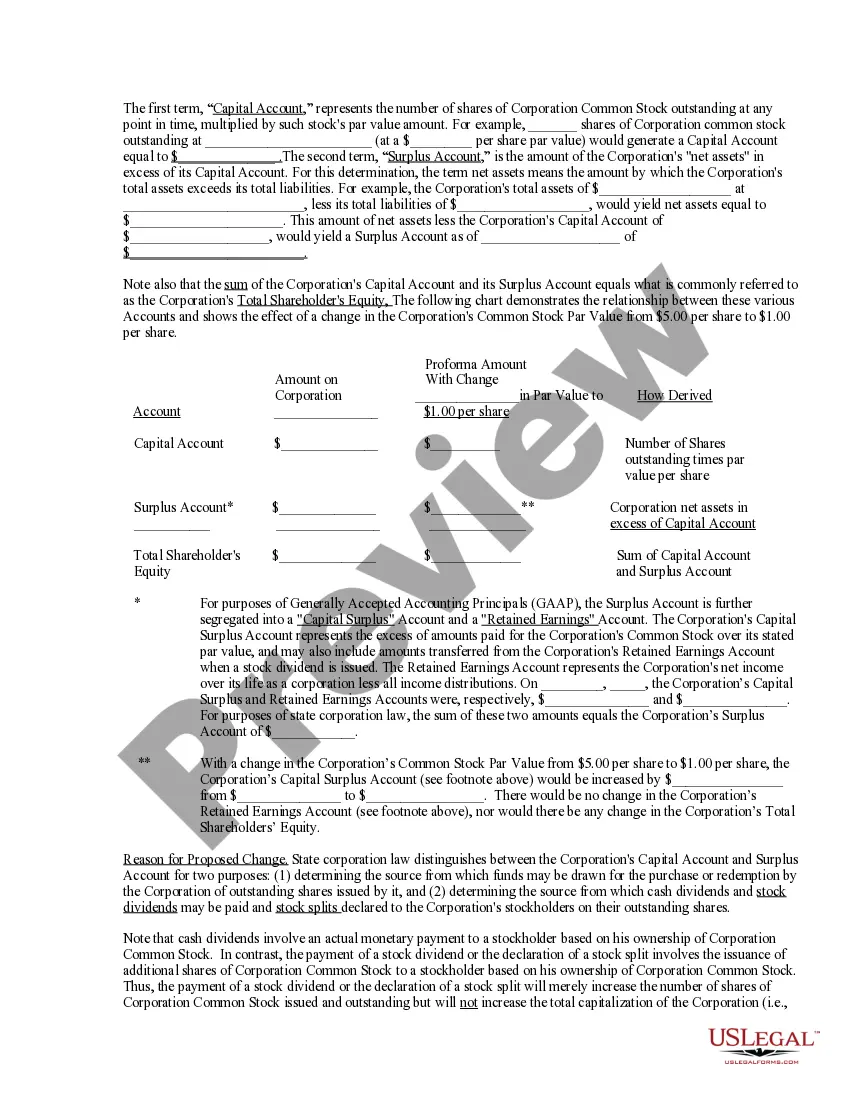

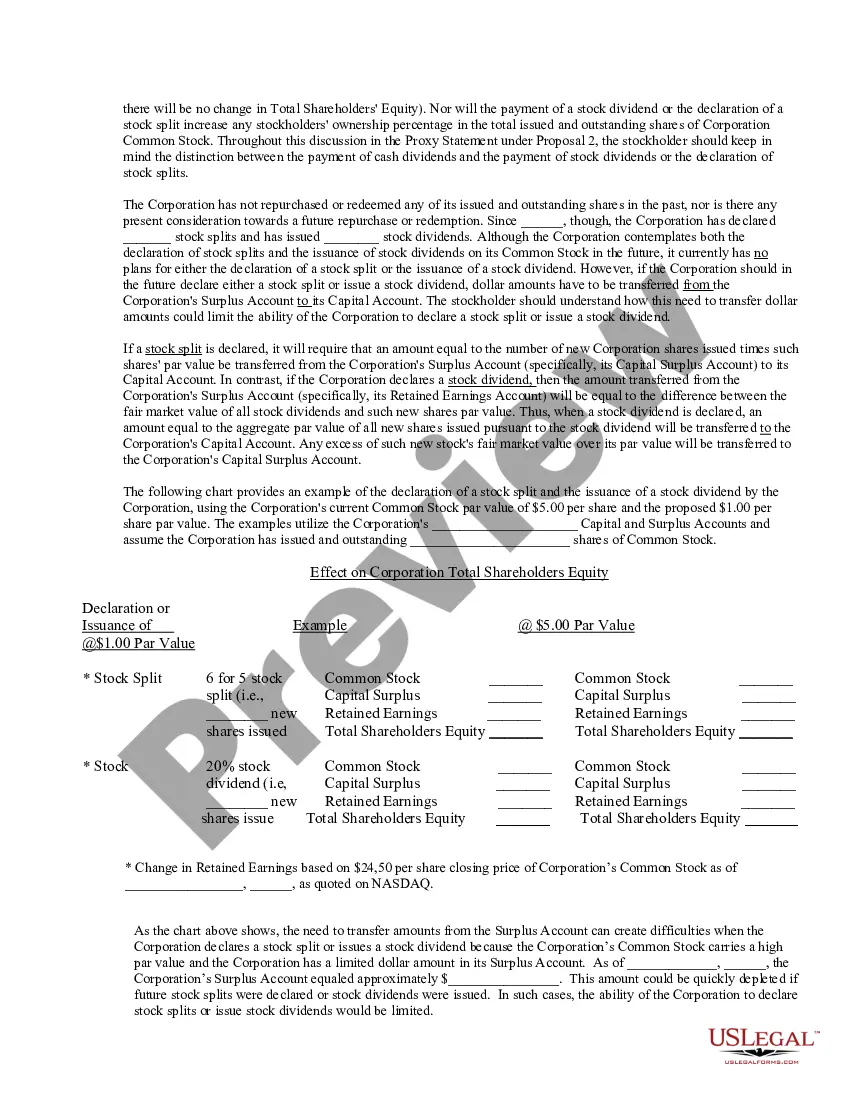

The Bexar Texas Amendment of Common Stock Par Value is a legal document that allows a corporation or business entity to alter the par value of its common stock. Par value refers to the nominal or face value assigned to shares of stock, indicating the minimum value at which the shares can be issued. This amendment is typically implemented when a company wishes to change the par value for strategic, financial, or accounting purposes. The Bexar Texas Amendment of Common Stock Par Value is crucial as it provides a clear record of the change in par value, ensuring compliance with state laws and regulations. It outlines the specific details of the amendment and may include information such as the previous par value, the new par value being proposed, the effective date of the change, and any necessary shareholder approvals. This amendment allows corporations to adjust their par value based on various factors, such as market conditions, capital structure modifications, or when issuing new shares. By modifying the par value, corporations can adjust the pricing and valuation of their common stock, influencing aspects like dividend payments, financial reporting, and shareholder rights. Different types of Bexar Texas Amendment of Common Stock Par Value may include: 1. Increase in Par Value: This type of amendment raises the par value of the common stock, increasing the minimum worth assigned to each share. It may be initiated to attract investor confidence, indicate higher company value, or meet legal or regulatory requirements. 2. Decrease in Par Value: This type of amendment reduces the par value of the common stock, lowering the minimum worth assigned to each share. Companies may implement this to enhance the liquidity of their stock, facilitate trading, or adjust their capital structure. 3. Elimination of Par Value: In some cases, corporations may opt to eliminate the concept of par value altogether. This type of amendment converts shares to no-par value or an assigned stated value per share, simplifying the stock structure and providing more flexibility in pricing and issuing shares. 4. Multiple Classes or Series: This amendment might be utilized to establish different classes or series of common stock with distinct par values. This allows companies to provide different voting rights, dividend preferences, or other privileges to specific shareholders while maintaining a consistent framework for corporate governance. It is important to consult legal professionals or business advisors to ensure compliance with Bexar Texas laws and regulations when implementing the Amendment of Common Stock Par Value. This process requires proper documentation, shareholder approvals (if applicable), and filing with relevant authorities to ensure the validity and enforceability of the change.

Bexar Texas Amendment of common stock par value

Description

How to fill out Bexar Texas Amendment Of Common Stock Par Value?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from the ground up, including Bexar Amendment of common stock par value, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various types ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find information materials and guides on the website to make any activities related to document execution simple.

Here's how to locate and download Bexar Amendment of common stock par value.

- Go over the document's preview and outline (if available) to get a basic idea of what you’ll get after getting the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can impact the legality of some documents.

- Examine the similar forms or start the search over to find the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment gateway, and purchase Bexar Amendment of common stock par value.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Bexar Amendment of common stock par value, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer completely. If you have to cope with an exceptionally complicated case, we recommend getting an attorney to review your form before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-compliant paperwork effortlessly!