Chicago Illinois Amendment of common stock par value

State:

Multi-State

City:

Chicago

Control #:

US-CC-3-215A

Format:

Word;

Rich Text

Instant download

Description

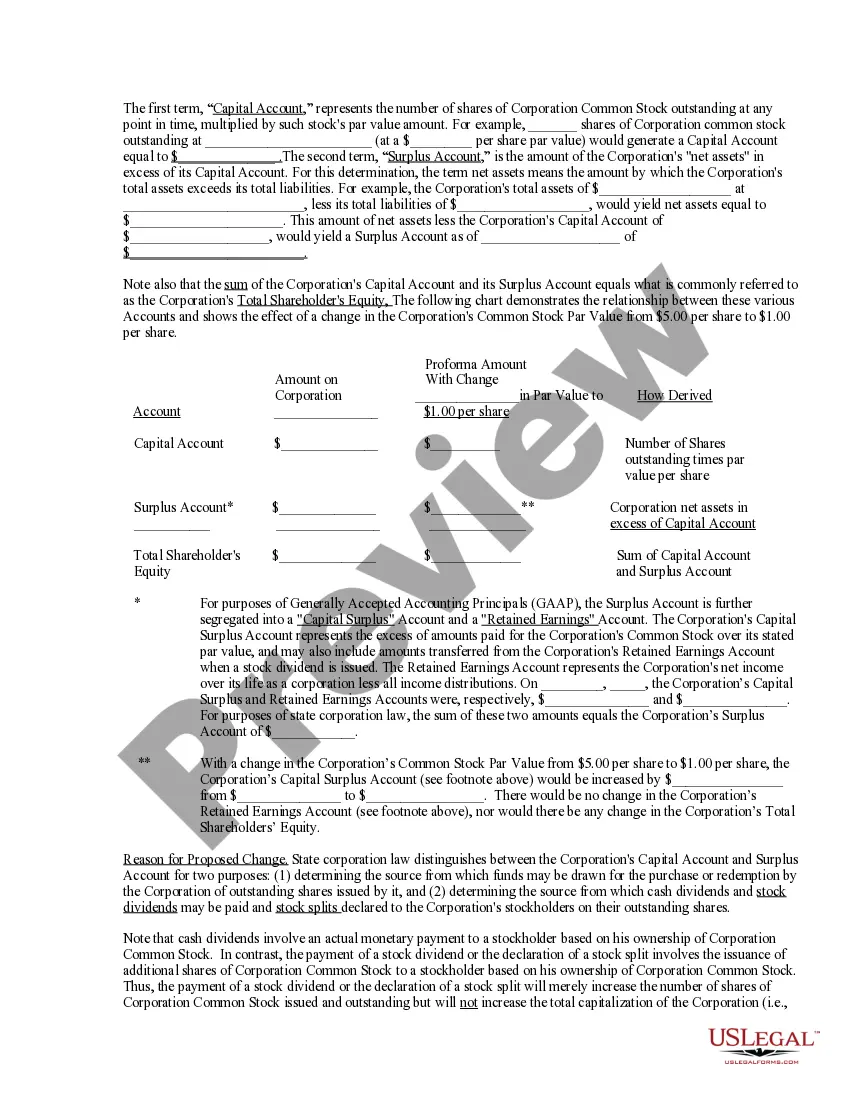

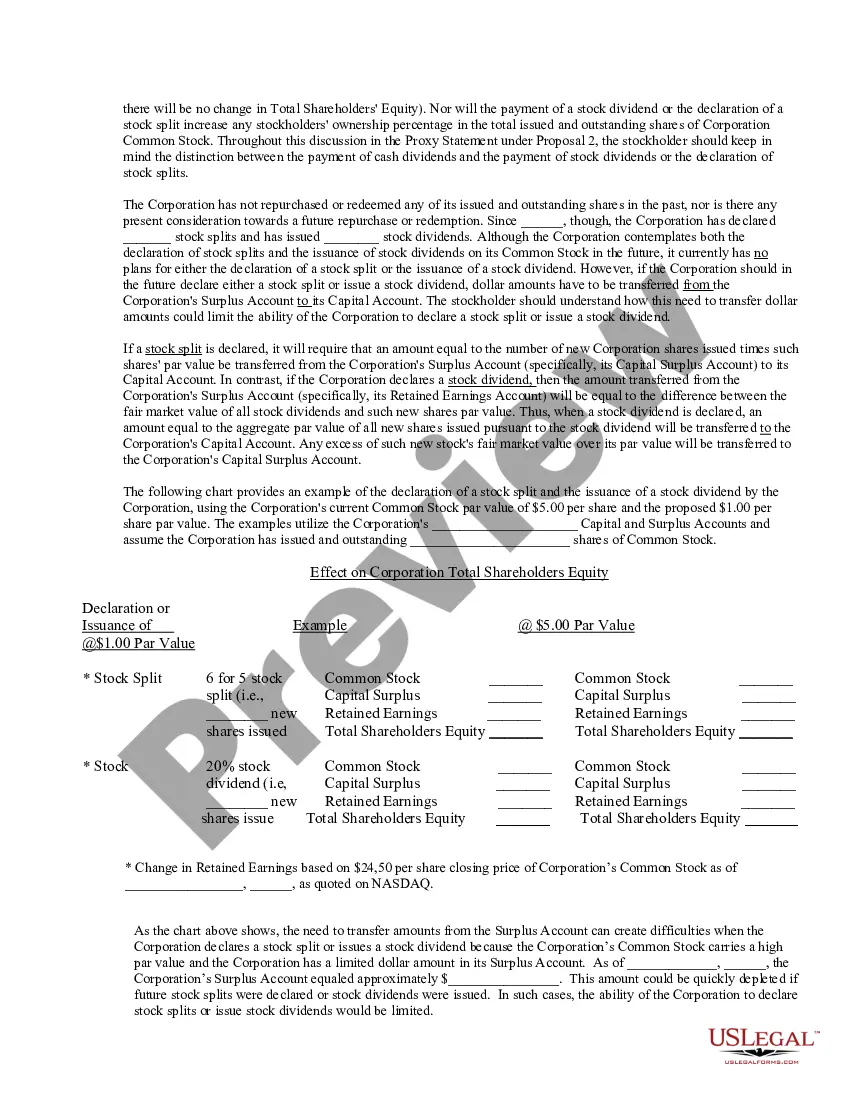

This sample form, a detailed Amendment of Common Stock Par Value document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several standard formats.

Free preview

How to fill out Amendment Of Common Stock Par Value?

Do you need to swiftly compose a legally-binding Chicago Amendment of common stock par value or perhaps any other document to manage your personal or business matters.

You can choose between two options: engage a professional to draft a legal document for you or create it entirely on your own. Fortunately, there's another alternative - US Legal Forms.

If the document includes a description, ensure to check its intended use.

If the form doesn’t match your requirements, restart the search using the header search bar.

- It will assist you in obtaining well-crafted legal documents without incurring exorbitant costs for legal services.

- US Legal Forms provides an extensive collection of over 85,000 state-specific document templates, including Chicago Amendment of common stock par value and form packages.

- We supply documents for a multitude of purposes: from divorce documentation to real estate papers.

- Having been in operation for over 25 years, we have maintained an impeccable reputation among our clients.

- Here's how to become one of them and obtain the necessary document without hassle.

- First, verify if the Chicago Amendment of common stock par value complies with your state's or county's regulations.