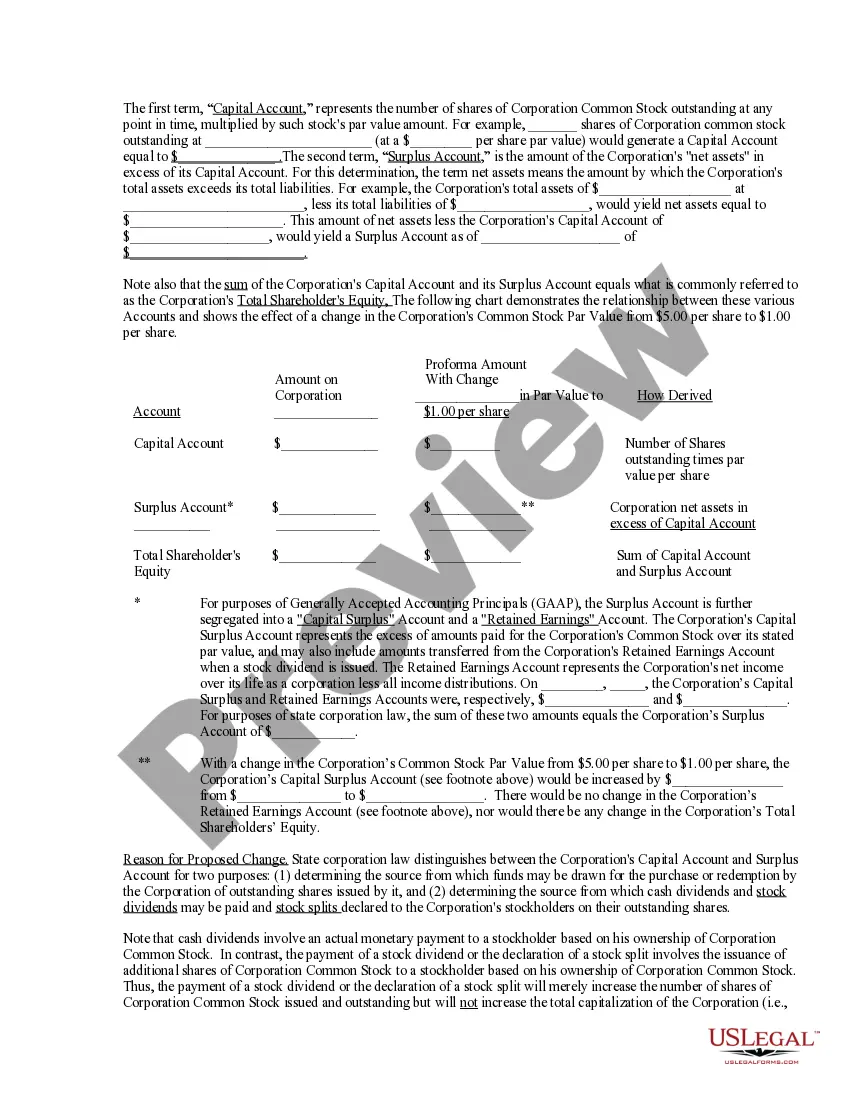

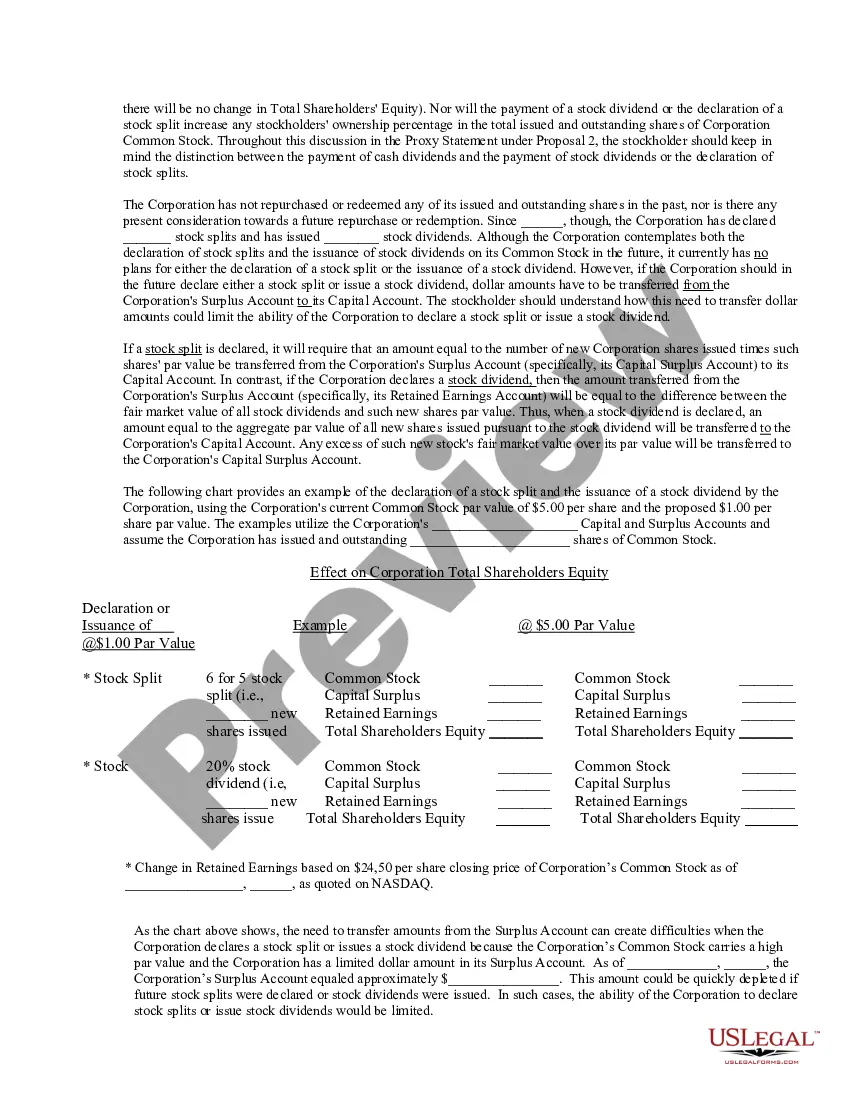

Maricopa Arizona Amendment of Common Stock Par Value: A Detailed Description The Maricopa Arizona Amendment of Common Stock Par Value refers to a legal provision that allows corporations located in Maricopa, Arizona, to modify the established par value of their common stock. Par value is the minimum price at which shares of a company's stock can be issued and represents the nominal value assigned to each share. The amendment process involves changing the par value stated in a corporation's articles of incorporation, which is a document filed with the Arizona Corporations Commission during the company's formation. By amending the par value, corporations can adjust their capital structure to better align with market conditions, shareholder expectations, or financial strategies. Keywords: Maricopa Arizona, amendment, common stock, par value, legal provision, corporation, articles of incorporation, Arizona Corporations Commission, capital structure, market conditions, shareholder expectations, financial strategies. Types of Maricopa Arizona Amendment of Common Stock Par Value: 1. Increase in Par Value: This type of amendment involves raising the par value of a company's common stock. Corporations may choose to increase the par value to enhance stockholder confidence or to deter potential hostile takeovers. It can also signal a company's improved financial position or long-term growth prospects. 2. Decrease in Par Value: Some corporations may opt to decrease the par value of their common stock through amendment. Lowering the par value can make shares more affordable and attractive to investors, potentially increasing market liquidity. It may also assist in adjusting the stock's pricing in response to changes in the company's financial situation or market conditions. 3. Elimination of Par Value: Alternatively, corporations in Maricopa, Arizona, may completely eliminate the par value of their common stock. This amendment allows companies to issue shares at any price determined by the market demand, removing the minimum value restriction usually associated with par value. Eliminating par value can simplify stock transactions, enhance flexibility, and streamline capital management strategies. 4. Introduction of Different Par Value Classes: In certain cases, corporations may introduce multiple classes of common stock with distinct par values through an amendment. This allows companies to offer different share prices based on various shareholder benefits or share rights, such as voting power or dividend rights. It can provide flexibility in capital structure and cater to specific investor preferences or business strategies. When considering any amendment to the par value of common stock, corporations in Maricopa, Arizona, must adhere to legal requirements and follow prescribed procedures outlined by the Arizona Corporations Commission. Seeking legal counsel during the amendment process is advisable to ensure compliance and to navigate any potential complexities associated with the modification of stock par value. Note: The specific types of amendment may vary depending on the applicable laws and regulations within Maricopa, Arizona.

Maricopa Arizona Amendment of common stock par value

Description

How to fill out Maricopa Arizona Amendment Of Common Stock Par Value?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Maricopa Amendment of common stock par value, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used many times: once you pick a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Maricopa Amendment of common stock par value from the My Forms tab.

For new users, it's necessary to make several more steps to get the Maricopa Amendment of common stock par value:

- Analyze the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!