Nassau New York Amendment of Common Stock Par Value is a legal process that allows a corporation registered in Nassau County, New York, to modify the par value assigned to its common stock. Common stock represents the ownership shares held by the shareholders of a company. The amendment of common stock par value is a typical procedure undertaken by corporations when they decide to change the nominal value assigned to their common stock. This modification aims to reflect the changes in the company's financial situation, market conditions, or corporate restructuring. In Nassau County, there may be different types of amendments related to the common stock par value. These variations primarily depend on the specific changes made to the par value and the intent behind them. Some common types of Nassau New York Amendment of Common Stock Par Value include: 1. Increase in Par Value: This type of amendment involves raising the nominal value of the common stock issued by the corporation. It is often done when a company experiences favorable growth or sees potential enhancements in its market value. 2. Decrease in Par Value: When a corporation goes through financial difficulties or seeks to create more affordable shares, it may choose to reduce the par value of its common stock. This amendment allows the stock to be more accessible to potential shareholders. 3. Elimination of Par Value: In some cases, a corporation might decide to eliminate the par value altogether. This means that the company's common stock becomes "no-par" stock, and the value assigned to each share depends on market demand and investor perception. 4. Fractional Par-Value Adjustment: Occasionally, a corporation may adjust the par value to a fraction, such as splitting the stock into shares with lower denominations. This facilitates trading and allows for more flexibility in issuing new shares. 5. General Amendments: Apart from the specific types mentioned above, there may also be general amendments related to the common stock par value. These can include changes in the method of calculation or highly customized adjustments tailored to the corporation's unique needs. It's important to note that an amendment of common stock par value requires proper documentation and compliance with applicable laws, regulations, and corporate governance guidelines. Corporations seeking to undertake these amendments must adhere to the legal procedures established by Nassau County, New York, and ensure transparent communication with their shareholders. In summary, Nassau New York Amendment of Common Stock Par Value is a legal process that allows Nassau County corporations to modify the par value assigned to their common stock. Whether it involves an increase, decrease, elimination, fractional adjustment, or general amendment, these modifications play a crucial role in adjusting the value of shares to reflect a company's financial standing and market conditions.

Nassau New York Amendment of common stock par value

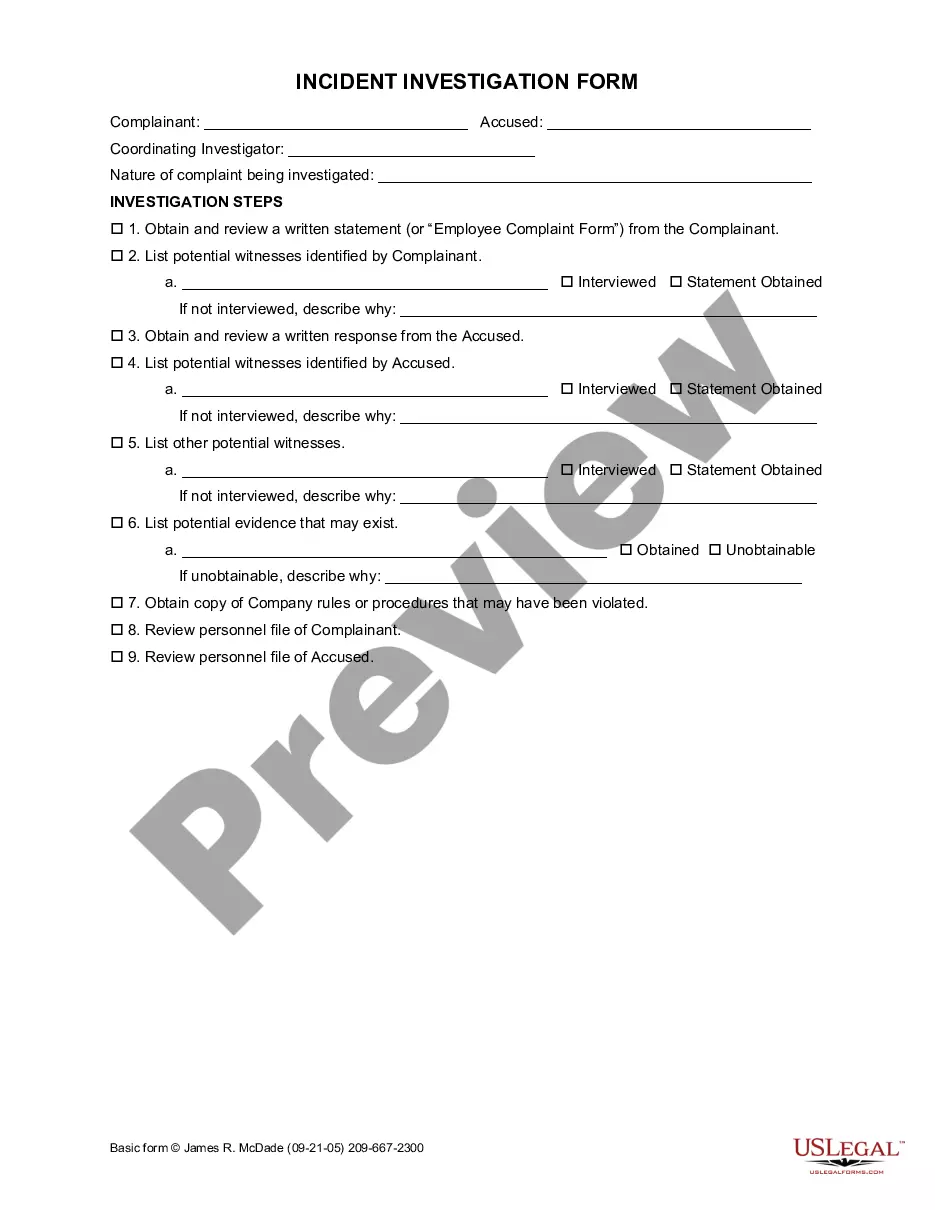

Description

How to fill out Nassau New York Amendment Of Common Stock Par Value?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare formal paperwork that varies from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any individual or business objective utilized in your region, including the Nassau Amendment of common stock par value.

Locating samples on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Nassau Amendment of common stock par value will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to get the Nassau Amendment of common stock par value:

- Make sure you have opened the proper page with your regional form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Nassau Amendment of common stock par value on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!