Chicago Illinois Proxy Statement of Bank of Montana System is a comprehensive document that outlines the key information regarding the bank's operations, corporate governance, and financial performance. It serves as a crucial resource for shareholders to make informed decisions during annual meetings or other voting events. The Chicago Illinois Proxy Statement of Bank of Montana System provides a detailed overview of the bank's background, including its history, mission, and values. It delves into the structure of the bank's board of directors, highlighting the qualifications, expertise, and experience of each member. This section also mentions any committees within the board, such as the Audit Committee or Compensation Committee, and describes their roles and responsibilities. The proxy statement discusses in detail the bank's executive compensation program, outlining the salaries, bonuses, stock options, and other benefits received by top-level executives. This section also explains how executive compensation is determined, taking into account the bank's performance and industry benchmarks. Furthermore, the Chicago Illinois Proxy Statement of Bank of Montana System presents information about important proposals or resolutions that may be put forth during shareholder meetings. This encompasses issues like the election of directors, approval of auditors, and any significant changes to the company's bylaws or corporate governance policies. Shareholders are encouraged to review these proposals and exercise their voting rights accordingly. Additionally, the proxy statement sheds light on the bank's financial performance, providing shareholders with financial statements, including the balance sheet, income statement, and cash flow statement. It also includes a comprehensive analysis of the bank's financial results, discussing key metrics like earnings per share, return on equity, and asset quality. Different types of Chicago Illinois Proxy Statement of Bank of Montana System may include modified versions for specific purposes, such as a special meeting or proxy statement for a merger or acquisition transaction. These modified versions would address the unique circumstances of the event and provide relevant details to shareholders. In conclusion, the Chicago Illinois Proxy Statement of Bank of Montana System is a vital document that attempts to provide transparent and comprehensive information to shareholders. It helps them understand the bank's governance structure, executive compensation program, proposed resolutions, and financial performance.

Chicago Illinois Proxy Statement of Bank of Montana System

Description

How to fill out Chicago Illinois Proxy Statement Of Bank Of Montana System?

Whether you plan to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business case. All files are collected by state and area of use, so picking a copy like Chicago Proxy Statement of Bank of Montana System is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Chicago Proxy Statement of Bank of Montana System. Adhere to the guidelines below:

- Make certain the sample meets your personal needs and state law requirements.

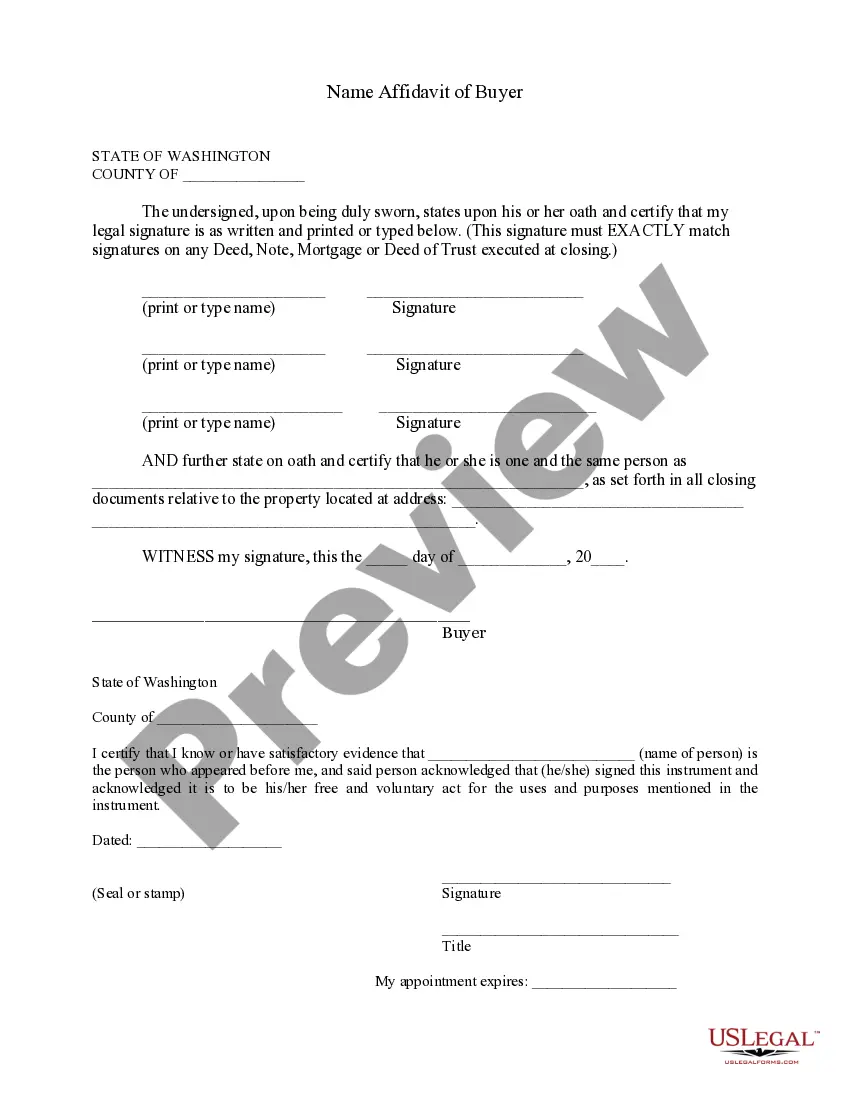

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Chicago Proxy Statement of Bank of Montana System in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!