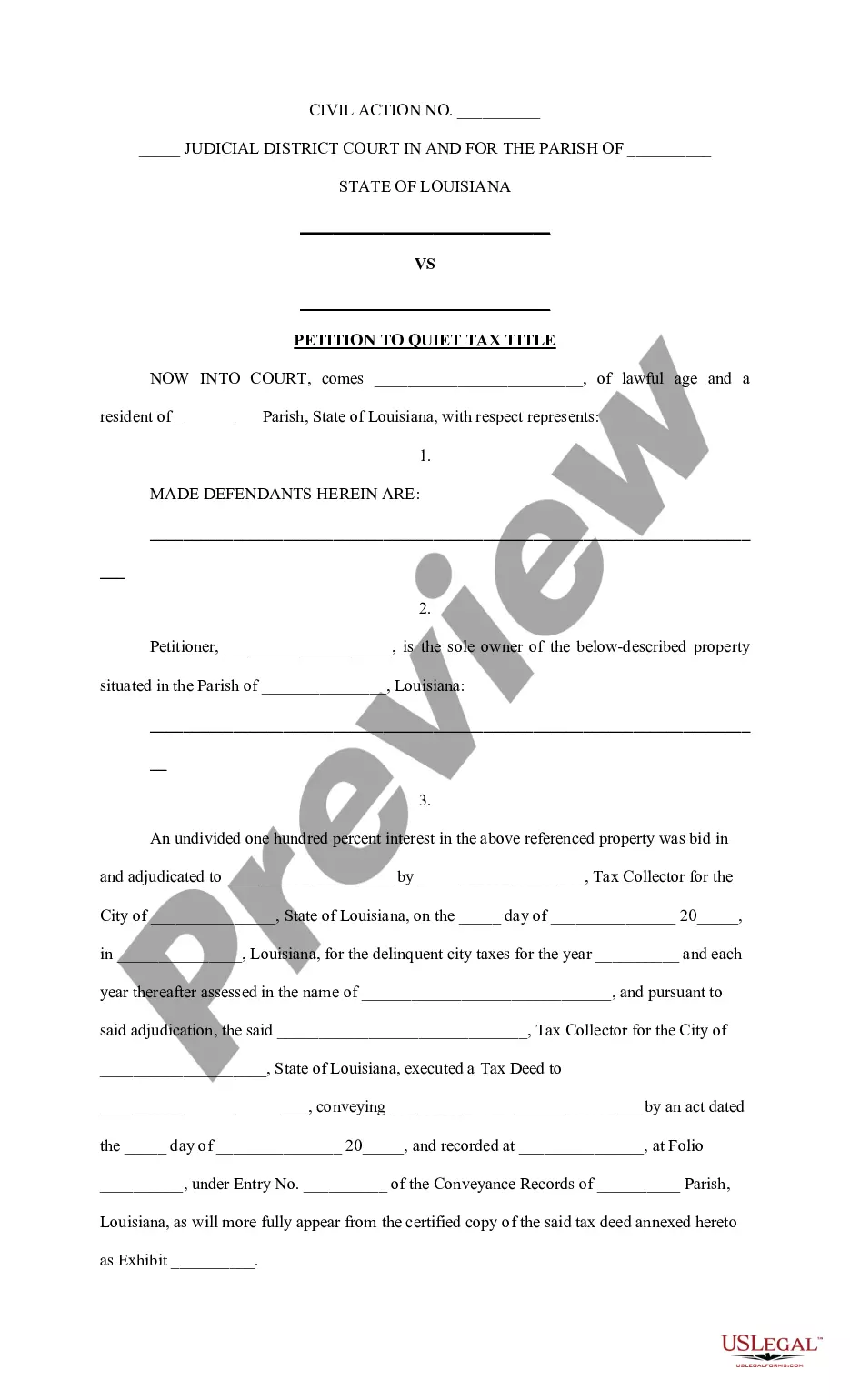

The Maricopa Arizona Proxy Statement is an essential document related to the Bank of Montana System. It provides detailed information regarding the bank's operations, governance, and upcoming initiatives. The statement serves as a communication medium between the bank's management and its shareholders, informing them about crucial matters that require their attention and voting decisions. Within the Maricopa Arizona Proxy Statement of Bank of Montana System, shareholders can find various sections that cover important topics. These comprise the summary of proposals, management's analysis, board nominee profiles, executive compensation, board structure, and voting guidelines. Additionally, the statement may contain information about the bank's financial performance, investment strategies, and risk management practices. The Maricopa Arizona Proxy Statement of Bank of Montana System plays a significant role in ensuring transparency, accountability, and effective corporate governance. It enables shareholders to make informed decisions and actively participate in the decision-making process during the annual shareholder meetings or special meetings. While there may not be different types of Maricopa Arizona Proxy Statement for Bank of Montana System, the statement is typically issued annually in preparation for the bank's shareholder meetings. The content of the Proxy Statement may vary slightly from year to year, primarily reflecting updates in the bank's operations, governance practices, and any proposed changes. Nevertheless, its fundamental purpose remains unchanged — to provide shareholders with the necessary information for making well-informed decisions regarding their investments and share ownership. In summary, the Maricopa Arizona Proxy Statement of Bank of Montana System is a comprehensive document that portrays the bank's activities, strategies, and governance structure. It serves as a vital resource for shareholders, ensuring transparency and facilitating their active participation in corporate affairs.

Maricopa Arizona Proxy Statement of Bank of Montana System

Description

How to fill out Maricopa Arizona Proxy Statement Of Bank Of Montana System?

Creating forms, like Maricopa Proxy Statement of Bank of Montana System, to manage your legal affairs is a tough and time-consumming process. A lot of circumstances require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can consider your legal issues into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents crafted for various cases and life situations. We make sure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Maricopa Proxy Statement of Bank of Montana System form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as simple! Here’s what you need to do before downloading Maricopa Proxy Statement of Bank of Montana System:

- Make sure that your form is specific to your state/county since the rules for writing legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or going through a quick description. If the Maricopa Proxy Statement of Bank of Montana System isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to begin using our website and get the document.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is ready to go. You can try and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!