The Fulton Georgia Amendment to the articles of incorporation refers to a specific type of amendment made to the foundational legal document that outlines the purpose, structure, and regulations of a corporation registered in Fulton, Georgia. This particular amendment focuses on the elimination of par value, which pertains to the minimum monetary value assigned to each share of stock issued by the company. By eliminating par value, the corporation is no longer restricted to assigning a specific minimum value to its shares. The elimination of par value in the articles of incorporation allows for greater flexibility in determining the worth of the company's stock. This adjustment grants the corporation the freedom to represent the true market value of its stock, enabling more accurate pricing and assessment of shares. This amendment essentially removes a fixed, arbitrary value and permits shares to have a value reflective of supply and demand dynamics, financial performance, and other relevant market factors. There are different types or variations of the Fulton Georgia Amendment to the articles of incorporation that pertain to the elimination of par value. These may include: 1. Complete elimination: This type of amendment removes par value entirely from the articles of incorporation, leaving shares without any specific minimum monetary value. The corporation is no longer obligated to assign a predetermined par value to its shares. 2. Replacement with a nominal value: In this variation, the amendment substitutes the par value with a nominal value that is significantly lower than the original par value. This nominal value serves as a formality and may hold little significance, often set at a rounded figure like $0.01. This replacement still permits the flexibility of determining the stock's worth based on market conditions. 3. Replacement with a stated value: Instead of setting a par value or nominal value, this type of amendment designates a stated value for the shares. The stated value might be determined by a formula considering factors such as net assets, earnings, or other metrics. This method offers more leeway in valuing shares, and the stated value can be adjusted over time. 4. Multiple class shares without par value: Some corporations may utilize this amendment to create multiple classes of shares, each without a par value. This allows differentiation between different types of shares, such as voting or non-voting shares, preferred or common shares, each with distinct characteristics or privileges. To conclude, the Fulton Georgia Amendment to the articles of incorporation to eliminate par value expounds on the various ways a corporation in Fulton, Georgia can modify its foundational document to remove the constraints of fixed share values. This amendment aims to enhance flexibility in valuing shares, better reflect market conditions, and adapt to the evolving needs and requirements of the corporation.

Fulton Georgia Amendment to the articles of incorporation to eliminate par value

Description

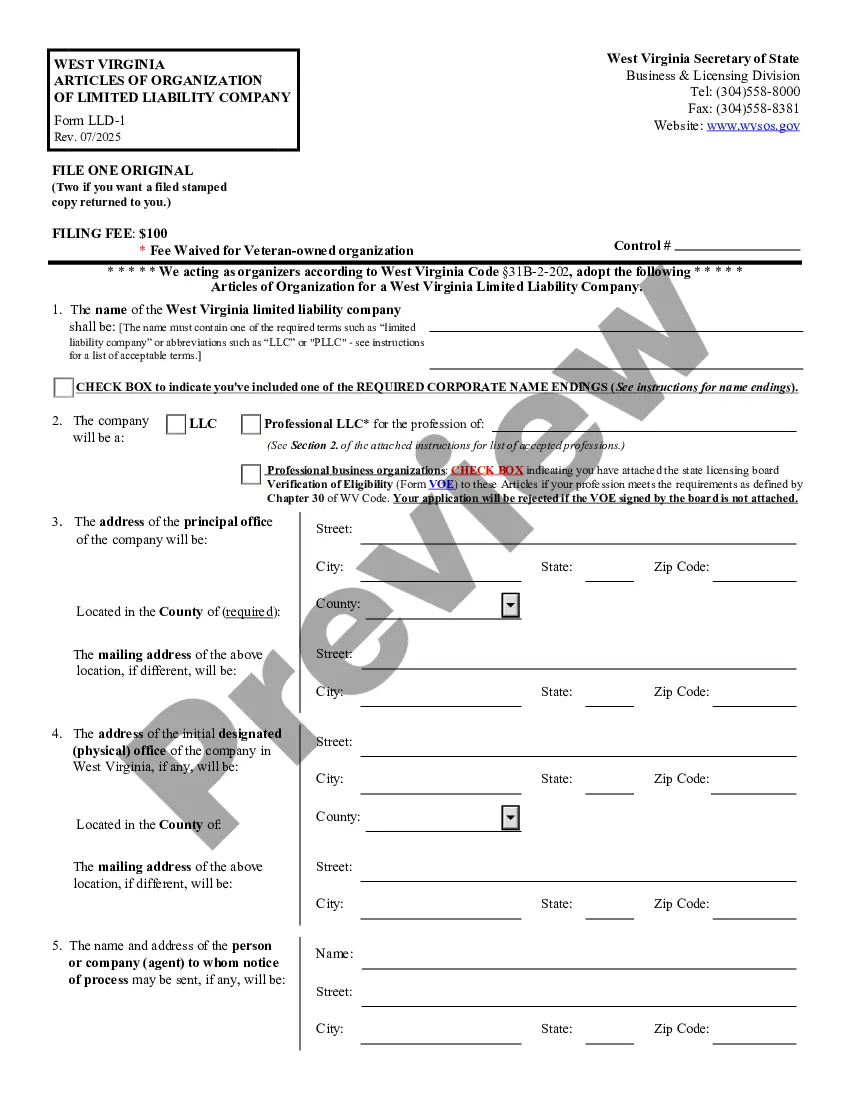

How to fill out Fulton Georgia Amendment To The Articles Of Incorporation To Eliminate Par Value?

How much time does it normally take you to create a legal document? Considering that every state has its laws and regulations for every life situation, locating a Fulton Amendment to the articles of incorporation to eliminate par value suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. In addition to the Fulton Amendment to the articles of incorporation to eliminate par value, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Specialists verify all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Fulton Amendment to the articles of incorporation to eliminate par value:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Fulton Amendment to the articles of incorporation to eliminate par value.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!