Montgomery County, Maryland is a vibrant and diverse county located just outside of Washington, D.C. With a population of over 1 million residents, it is the most populous county in Maryland and is known for its thriving economy, rich history, and beautiful natural landscapes. When it comes to business matters, Montgomery Maryland Amendment to the articles of incorporation to eliminate par value is an important topic to understand. In the context of company incorporation, par value refers to the nominal face value assigned to each share of stock. The Montgomery Maryland Amendment allows organizations to eliminate or modify this par value requirement in their articles of incorporation. By eliminating the par value, companies have more flexibility in determining the worth of their shares. Instead of being limited by a fixed value, corporations can adjust the price of their shares based on market demand and other factors, which can be advantageous for attracting investors and capital. There are different types of Montgomery Maryland Amendments to the articles of incorporation to eliminate par value, each tailored to specific circumstances: 1. Complete elimination of par value: This amendment removes the par value requirement entirely. It gives companies the freedom to issue shares at any price they deem appropriate, allowing for greater financial flexibility. 2. Modification of par value range: In some cases, companies may choose to retain a par value requirement but expand the allowable range. For example, they may raise the minimum par value from $0.01 to $0.10, while still maintaining the freedom to set share prices outside that range. 3. Conversion to no par value stock: This amendment converts existing par value stock into no par value stock. It may be particularly useful for old-fashioned corporations that want to modernize their corporate structure and adapt to changing market conditions. Companies considering a Montgomery Maryland Amendment to the articles of incorporation to eliminate par value should consult legal professionals experienced in corporate law and compliance. Understanding the advantages, disadvantages, and potential legal implications is crucial to making informed decisions that align with their business objectives. In summary, Montgomery County, Maryland offers an Amendment to the articles of incorporation to eliminate par value, enabling companies to tailor their stock pricing strategy to their specific needs and goals. By taking advantage of this flexibility, businesses can better adapt to market conditions and attract potential investors.

Montgomery Maryland Amendment to the articles of incorporation to eliminate par value

Description

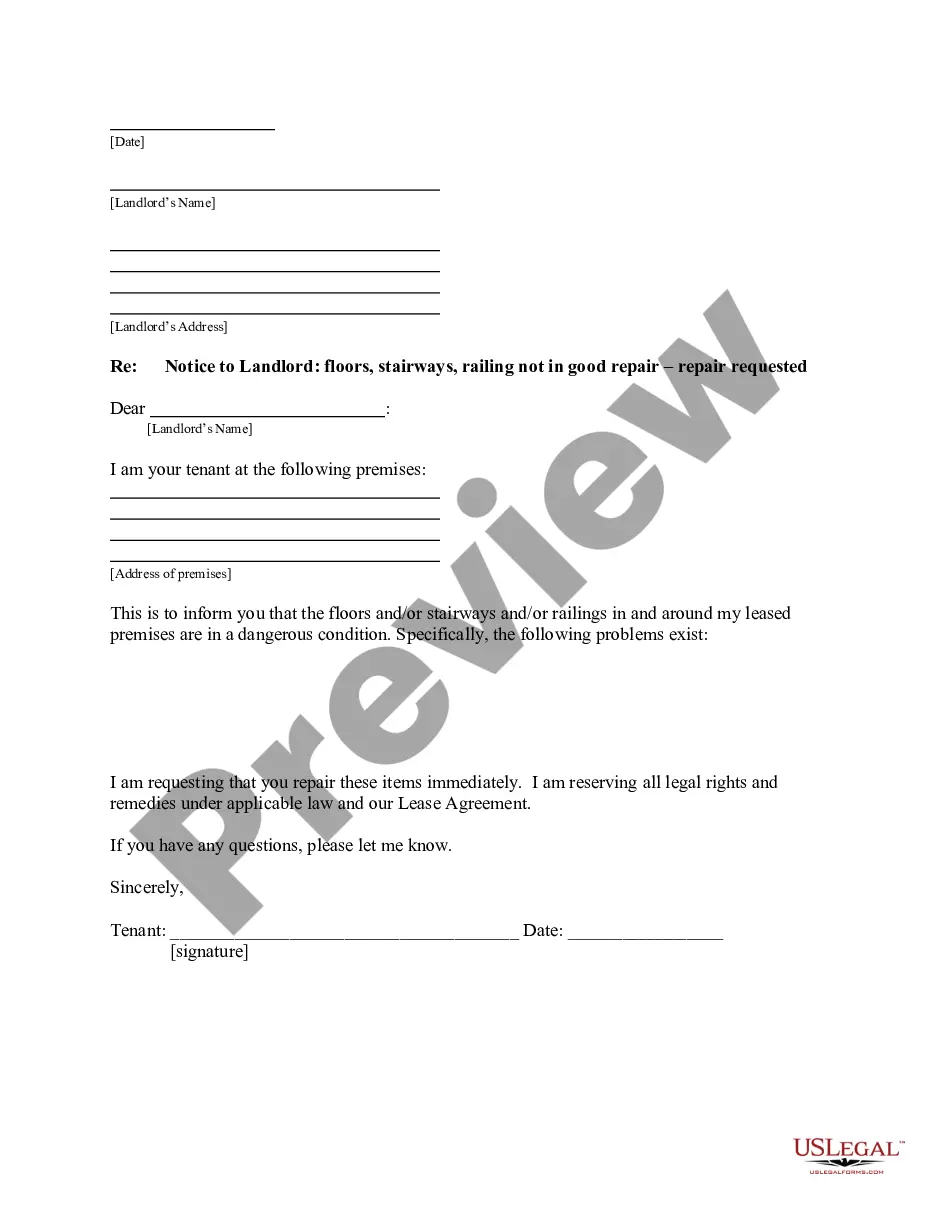

How to fill out Amendment To The Articles Of Incorporation To Eliminate Par Value?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official paperwork that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any individual or business objective utilized in your county, including the Montgomery Amendment to the articles of incorporation to eliminate par value.

Locating templates on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Montgomery Amendment to the articles of incorporation to eliminate par value will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Montgomery Amendment to the articles of incorporation to eliminate par value:

- Ensure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your requirements.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Montgomery Amendment to the articles of incorporation to eliminate par value on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

The parties certifying the certificate (usually the president and secretary of the corporation) The article being amended. A statement that the amendment has been approved by the board, and. By the required number of shareholders (if there are shareholders).

The vote usually takes place at a formal meeting of the corporation (annual meeting or other) and shareholders must be advised of the proposed change before the meeting. If the shareholders approve the change to the articles of incorporation, the amended document must be attested to by the corporate secretary.

A corporation can amend or add as many articles as necessary in one amendment. The original incorporators cannot be amended. If amending/adding officers/directors, list titles and addresses for each officer/director.

Changing articles of incorporation often means changing things like agent names, the businesses operating name, addresses, and stock information. The most common reason that businesses change the articles of incorporation is to change members' information.

The articles of incorporation of a nonstock corporation may be amended by the vote or written assent of majority of the trustees and at least two-thirds (2/3) of the members.

How to Amend Articles of Incorporation Review the bylaws of the corporation.A board of directors meeting must be scheduled.Write the proposed changes.Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

SEC. The articles of incorporation of a nonstock corporation may be amended by the vote or written assent of majority of the trustees and at least two-thirds (2/3) of the members. The original and amended articles together shall contain all provisions required by law to be set out in the articles of incorporation.

A private corporation may extend or shorten its term as stated in the articles of incorporation when approved by a majority vote of the board of directors or trustees, and ratified at a meeting by the stockholders or members representing at least two-thirds (2/3) of the outstanding capital stock or of its members.