A San Diego California Amendment to the articles of incorporation is a legal document filed by a corporation that seeks to eliminate the par value of its shares. This amendment is typically made to the initial or existing articles of incorporation and requires the approval of the corporation's shareholders and the relevant regulatory authorities. Par value refers to the designated minimum value assigned to each share of stock issued by a corporation. By eliminating the par value, the corporation relieves itself of the obligation to sell shares at a specific minimum price. This change offers several benefits to the corporation, including increased flexibility in setting share prices, easier issuance of shares, and simplified accounting procedures. When it comes to different types of San Diego California Amendments to eliminate par value within the articles of incorporation, there can be a few variations. Here are three common types: 1. Full Elimination of Par Value: This type of amendment entirely removes the par value from the corporation's articles of incorporation. After the amendment is approved and filed, the shares no longer hold any designated minimum value, allowing the corporation to determine their value based on market conditions and other factors. 2. Reduction of Par Value: In some cases, a corporation may choose to reduce the par value rather than eliminate it completely. This type of amendment involves lowering the minimum value assigned to each share of stock. The reasons for reducing par value may include accommodating a stock split, adjusting to market trends, or aligning with regulatory requirements. 3. Par Value Update: Occasionally, a corporation may decide to amend the articles of incorporation to update the par value to reflect current market conditions. This type of amendment aims to ensure that the designated minimum value of shares aligns with the corporation's economic standing, investor expectations, and regulatory guidelines. It is important to note that any amendment to the articles of incorporation, including one to eliminate or modify par value, requires compliance with relevant legal procedures and regulations. Corporations undertaking such amendments must follow San Diego California state laws and ensure proper documentation and shareholder approvals are obtained. Overall, a San Diego California Amendment to the articles of incorporation to eliminate par value is a significant legal step taken by corporations to enhance their flexibility in issuing and valuing shares. By making this change, companies can adapt to market conditions, streamline processes, and potentially attract more investors.

San Diego California Amendment to the articles of incorporation to eliminate par value

Description

How to fill out San Diego California Amendment To The Articles Of Incorporation To Eliminate Par Value?

Laws and regulations in every area vary around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the San Diego Amendment to the articles of incorporation to eliminate par value, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the San Diego Amendment to the articles of incorporation to eliminate par value from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the San Diego Amendment to the articles of incorporation to eliminate par value:

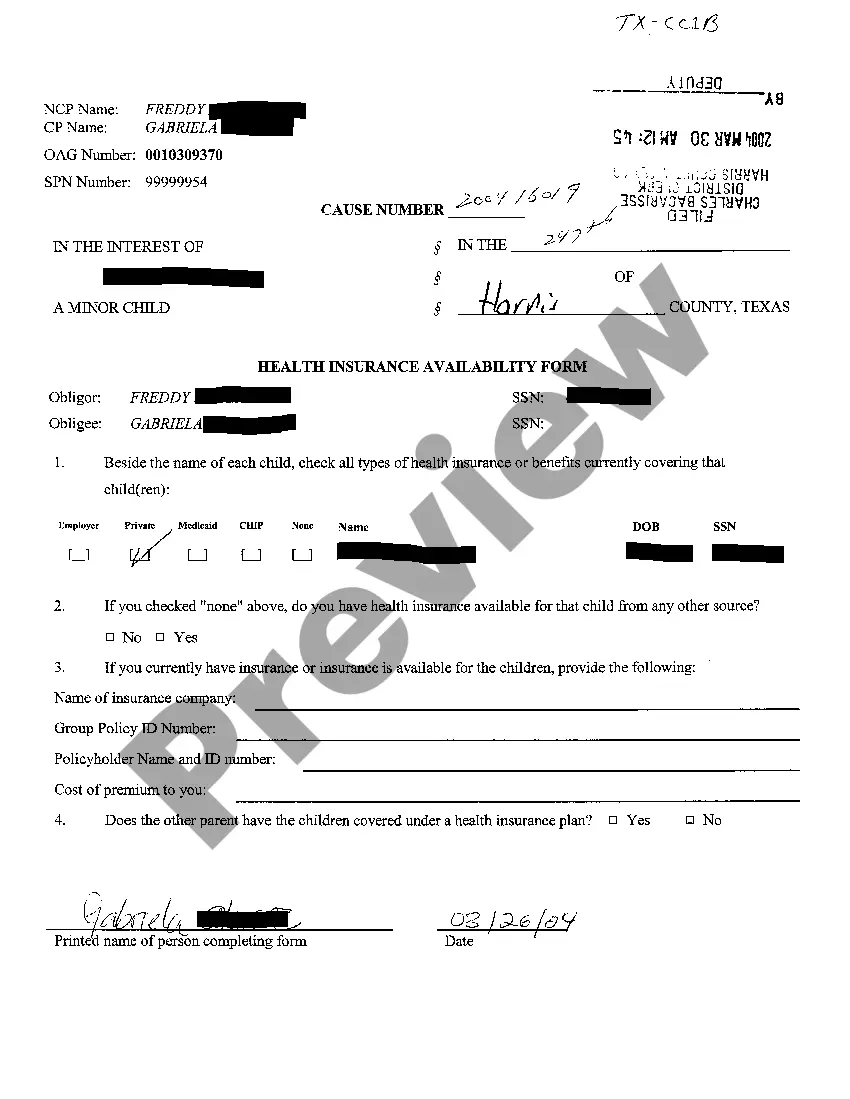

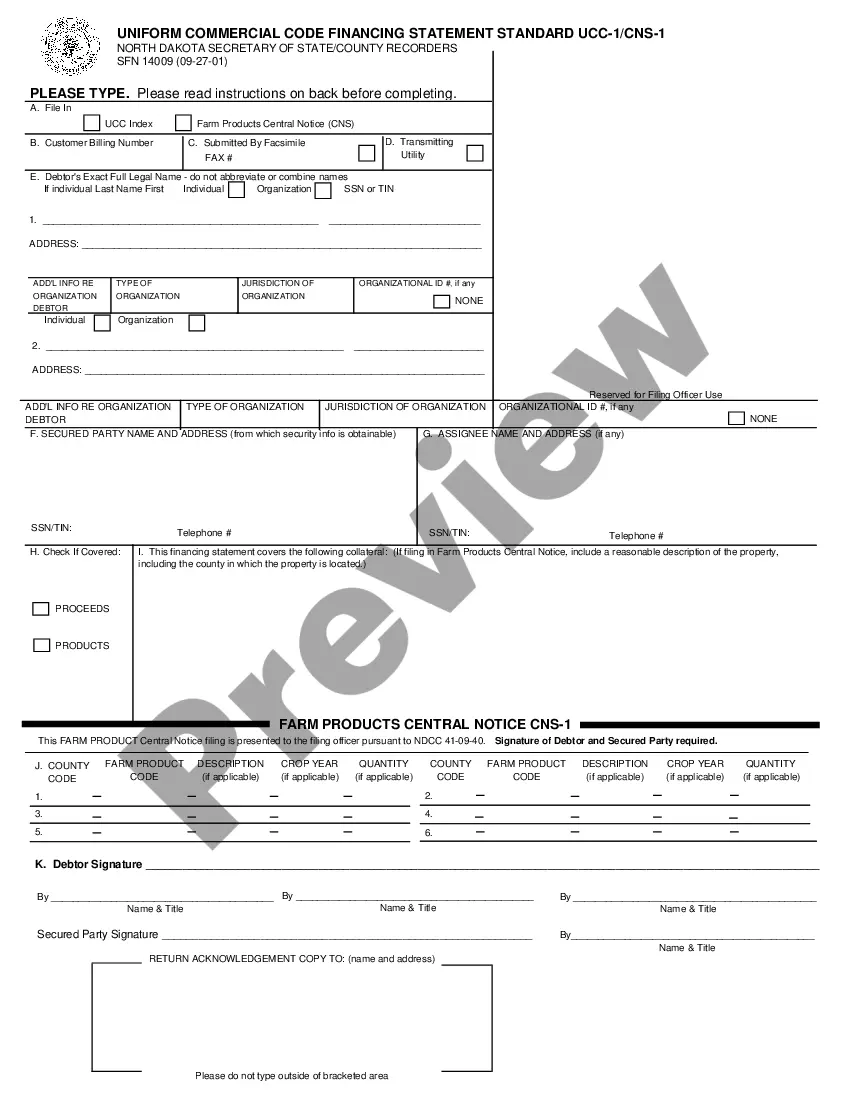

- Take a look at the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Conduct a special meeting involving all of the shareholders in the company. Vote on amending the corporation's Article of Incorporation to include the new partner. Type up the amendment, which should include the new partner's name, his financial contributions to the company and the amount of shares he is entitled to.

How to Amend Articles of Incorporation Review the bylaws of the corporation.A board of directors meeting must be scheduled.Write the proposed changes.Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

The easiest way to amend the Articles is to draft, adopt, and file a Certificate of Amendment of Articles of Incorporation. For a name change only, the Secretary of State offers a simple form that can be used. A Certificate of Amendment may be appropriate for minor other changes.

Articles of Amendment are filed when your business needs to add to, change or otherwise update the information you originally provided in your Articles of Incorporation or Articles of Organization.

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

To make any changes, the LLC must file articles of amendmentalso sometimes called a certificate of amendment or a certificate of changewith the state. The articles of amendment document is easy to prepare. Information typically required includes: the business name as it appears on the articles of organization.

Contrary to popular belief, your business entity is not set in stone. It's common to change from a simple structure, like a sole proprietorship or partnership, to an LLC or corporation. Some business owners make a change for tax purposes or because they are acquiring or merging with another company.

If you want to amend your California articles of incorporation, you must file a Certificate of Amendment of Articles of Incorporation form with the California Secretary of State (SOS) by mail or in person. Checks should be payable to the Secretary of State.

As can be gleaned from the foregoing, there are three (3) basic requirements for amending the Articles of Incorporation, namely: Majority vote of the board of directors. Written assent of the stockholders representing at least 2/3 of the outstanding capital stock. Approval by the Securities and Exchange Commission.